I’m a growth guy, so it shouldn’t be a surprise that most of the stocks I go after come from the usual growth sectors: Technology infrastructure (networking and chips mostly, maybe with some storage, too), consumer-facing technology (think Google and Apple back in the day), medical (usually devices, though occasionally some drug firms) and retail (I’ve always loved cookie-cutter stories with great store economics).

And, as you’d expect, stocks from those areas pretty much make up the lion’s share of winners today—and where my focus remains.

However, there’s one group that isn’t usually thought of as a “growth” group that has a history of launching some very solid winners—and recently, my screens have turned up a bunch of names in this area that are doing great, with a bunch reacting well to earnings. And yet, as opposed to AI, Apple or other tech names, very few are noticing it.

[text_ad]

I’m talking about aerospace stocks, which might not seem growth-y, but they fill the main criteria I use when hunting for leaders: Having a long runway of both rapid and reliable growth, which I sometimes call the “3 Rs.” In terms of the first two Rs (long runway and rapid growth), following a freeze with the pandemic, it turns out demand for new aircraft and all that goes into them—mostly commercial, with newer, more efficient jets, but this also includes defense-related orders—is going wild, and short of another virus or major recession, it should continue years into the future.

As for the 3rd R—reliability—one reason aerospace names have appeal is that … there simply aren’t that many of them, which means there’s usually not a ton of competition. Combining it all, the industry outlook for increased engine and jet sales has many firms in the sector releasing bullish longer-term forecasts for sales, earnings and cash flow; again, barring a huge disruption, the writing is on the wall for strong newbuild and aftermarket demand for a long time to come.

We’ve seen a handful of aerospace names show up in Cabot Top Ten Trader recently, and here’s what we wrote about a couple of them.

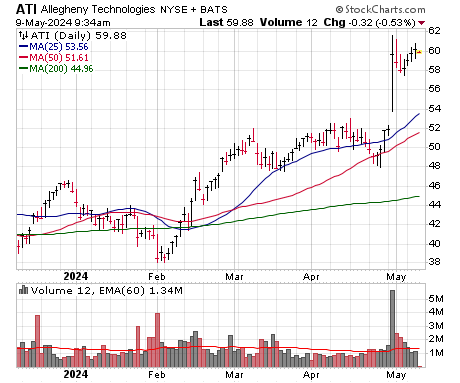

The first is ATI (ATI), which produces high-performance titanium- and nickel-based alloys, stainless steel and specialty components for a variety of sectors including oil and gas and specialty energy. But aerospace is more than 60% of revenue, and all the metrics (backlog at a record high, engine shipments up 15% in Q1, margins rising) look good. Best of all, the top brass sees EBITDA (a measure of cash flow) just beginning to ramp—for this year and next, that figure should rise 33% in total, while for 2024-2027, the goal is for a 57% EBITDA gain. ATI broke out in February and tightened up in March and early April (we recommended it April 15) before gapping up hugely on earnings last week.

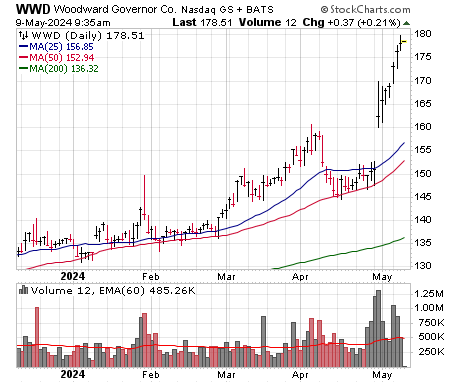

Another idea in the aerospace sector is Woodward (WWD), which just appeared in Top Ten last week. Its product line isn’t exciting—it sells a variety of energy conversion and control solutions like fuel pumps, engine and flight deck controls, air valves, fuel nozzles, injectors, actuators, integrated propulsion systems—but commercial aerospace is the driver, including big growth in aftermarket services (revenues there up 30% last year and 18% in Q1). Again, like ATI and many peers, the top brass is looking ahead to even brighter times: At last December’s Investor Day, management forecast 8% annual sales growth, 16% EBITDA growth and cumulative free cash flow of $20 or more during the next three years.

There are others, but the bigger point is that, while some traditional growth areas like chips and some AI stocks are cooling off, aerospace-centric names are doing well—and given the multi-year runway of steady, reliable growth ahead, big investors should remain interested. The stock is a bit extended here, but a near-term shakeout would be tempting.

To learn more about the market’s strongest stocks, consider subscribing to Cabot Top Ten Trader today.

[author_ad]