You’ve heard the saying “Sell In May and Go Away.” Thrown around a lot at this time of year, it references the fact that the stock market’s average return from May through October is about half its average return from November through April. It’s an interesting fact, but investing based on historical averages is a mistake. Each year is different, and plenty of May-through-October periods have seen impressive gains. Last year, the S&P 500 rose 7.7% between May 1 and October 31, and about 44% of its return for the full year occurred during the six-month period.

Of course, this year isn’t last year. Between market corrections, sector rotations and the fierce and fickle return of volatility, investors can’t be blamed for considering just selling everything and going away.

Instead, how about doing some selective buying designed to better prepare your portfolio for whatever the next six months throws at you? I’m talking about creating a core of high-quality, dependable portfolio holdings that hold up better during downturns and generate income whatever the stock market is doing. I’m talking about dividend stocks. Specifically, I’m talking about the kind of dividend stocks you can buy and ignore for six months, the kind your grandparents would have owned. I’m talking about Dividend Aristocrats.

[text_ad use_post='129632']

A Dividend Aristocrat is an S&P 500 company that has increased its dividend every year for at least 25 years. These stocks are not only a great source of reliable and gradually rising income, they’re also less volatile than other stocks. And because they lose less during drawdowns, their long-term performance is better too!

Over the past 10 years (through March 31, 2018) the average annual return of the Dividend Aristocrats index was 12.4%, versus 9.5% for the S&P 500 index. And they’re less volatile: the standard deviation of the S&P 500 during the same 10-year period was 15.1%, versus 14.1% for the Dividend Aristocrats index. These are the kind of stocks you can buy and hang on to for years (even decades!) without having to come back and check on them every few days. If that sounds like a good way to spend the next six unpredictable months, here are my top five Dividend Aristocrats to buy in May and put away:

Dividend Aristocrat #1: Aflac (AFL)

Insurance company Aflac has increased its dividend every year for 35 years, so it’s been a Dividend Aristocrat for the past decade. The stock yields about 2.3% at current prices. Aflac’s dividend payout ratio—the share of earnings paid out as dividends—is 53%.

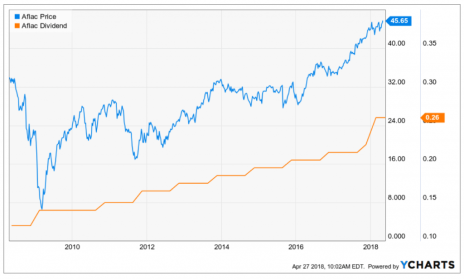

Here’s a 10-year chart of AFL along with its dividend (Which reminds me: are you investing for the long term? Then use long-term charts!)

Earnings growth expectations are good: 13% this year, 5% next year and 11% over the next five years.

Technically, AFL is at the top of its year-to-date trading range. From here, the stock could either break out or continue to trade between about 42 and 46 for a few more months. Support to the downside is strong; AFL never broke below its 200-day moving average even during the big market selloffs of February and March.

Dividend Aristocrat #2: Automatic Data Processing (ADP)

Automatic Data Processing is the biggest payroll processor in the U.S. Scale and long-term contracts mean revenues are predictable and consistent, exactly what you want from a long-term dividend investment.

The company has increased its dividend every year for 43 years, so it has qualified as a Dividend Aristocrat for almost two decades now. The stock yields 2.3%, and the company’s payout ratio is about 60%.

EPS are expected to rise 12% this year, 16% next year and about 13% per year over the next five years. The stock tends to do better when the economy is growing (and particularly when unemployment is falling) but over time, the long-term trend is firmly up.

Dividend Aristocrat #3: Consolidated Edison (ED)

Like ADP, New York-area electric utility ConEd has also increased its dividend every year for 43 years. The utility’s income is about as reliable as it gets—electricity consumption is barely affected by economic conditions or income changes, and its service area is highly populated and home to a diverse range of economic activities.

EPS are expected to rise 3% this year and 5% next year. Over the next five years, annual EPS growth is expected to average a little over 3% per year.

The stock yields 3.6%, making it one of the highest-yielding Dividend Aristocrats, and the payout ratio is 67%.

Dividend Aristocrat #4: Ecolab (ECL)

Ecolab is hard to sum up in one sentence—which might be why more investors haven’t heard of it. The 95-year-old company is typically classified as a chemical company, but it provides a wide range of products and services, many related to cleaning or water, that generally help customers be both more efficient and more environmentally friendly.

For example, Ecolab makes an antimicrobial wash for fruits and vegetables that reduces spoilage and food waste, while also preventing food-borne illnesses like E. coli and Salmonella. They developed the first environmentally-friendly solvent for cleaning automotive paint booths. They make a dry lubricant used on bottling plant conveyor belts that reduces water usage by 97%. They invented something called latex flocculants that are key to wastewater treatment. They even have a team of highly trained “Tunnel Doctors” who travel to laundries around the world to diagnose and fix problems.

Revenues are stable, and the company has paid a dividend for 32 years, and increased it every single year. The stock yields 1.1% at current prices, which are a little high. Try to wait for a pullback before buying.

EPS are expected to grow 14% this year, 12% next year, and by 13% per year (on average) over the next five years.

Dividend Aristocrat #5: S&P Global (SPGI)

Finally, another Dividend Aristocrat that may not be familiar to investors, S&P Global was formerly known as McGraw Hill. The (sort-of former) publisher acquired credit rating agency Standard & Poor’s in 1966, and after recent divestitures of its education division and other businesses, changed its name to better reflect its current focus.

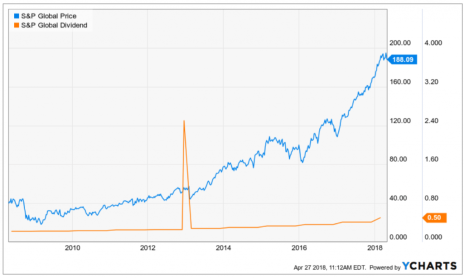

But the stock still has a strong history: 81 years of dividends, and 44 consecutive years of dividend increases (the chart below shows a large special dividend paid in 2012 as well).

Revenue has increased every year since 2011. Analysts expect EPS to grow 24% this year, 11% next year and 15% per year over the next five years (on average).

And SPGI is technically strong; the stock got nowhere near its 200-day moving average during the March and February pullbacks, and has been above its 50-day almost all year.

As always, if you want continuing coverage on these and other reliable dividend stocks that do better than non-dividend-paying stocks during downturns, you’ll find all that and more in my premium advisory, Cabot Dividend Investor. To join, click here.

[author_ad]