This Weekly Update includes summaries for the 10 Cabot Benjamin Graham Value Investor companies that reported quarterly financial results or other noteworthy news during the past week and were not reported in my March 3 Weekly Update. Reports are for the quarter ended December 31, 2016 unless otherwise stated. Prices appearing after each stock symbol are the closing prices on Friday, March 3, 2017.

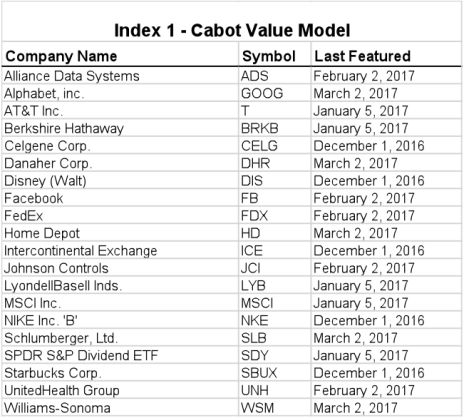

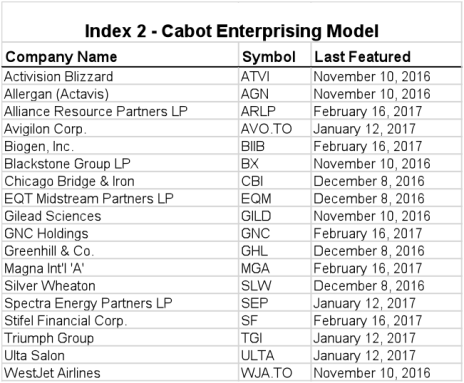

I also present two Indexes, which list companies featured in the Cabot Value Model or in the Cabot Enterprising Model during the most recent four months, so you can quickly find my recent write-ups for stocks appearing in the models.

My schedule for the next five weeks will be:

- Thursday, March 9, Cabot Enterprising Model issue 272E

- Friday, March 10, Weekly Update

- Friday, March 17, Weekly Update

- Tuesday, March 21, Wall Street’s Best Daily

- Wednesday, March 22, Wall Street’s Best Daily

- Friday, March 24, Weekly Update

- Friday, March 31, Weekly Update

- Thursday, April 6, Cabot Value Model issue 273V

- Friday, April 7, Weekly Update

Company Reports

Avigilon (Toronto Stock Exchange (AVO.TO 15.54; US OTC: AIOCF 11.68) reported good fourth-quarter results. Sales surged 25% and EPS climbed 21% after increasing 32% and 4% in the prior quarter. Management’s new focus on less expensive products is attracting new customers. Earnings were aided by lower increases in capital expenditures, marketing costs and administrative expenses. Management provided a modest outlook for 2017 sales and profits. Buy at 15.11 or below.

Berkshire Hathaway (BRKB 175.68) recorded excellent sales and earnings. Sales rose 11% and EPS advanced 14% after sales increased 8% and EPS declined 24% in the previous quarter. Cash on hand dropped 58% to $28 billion, and book value per share increased to $172.10.

Berkshire more than doubled its holdings in Apple (AAPL) after buying about 60 million shares since the beginning of 2017. Apple’s stock price has been rising steadily since mid-November. Buy at 178.50 or below.

Big Lots (BIG 54.23) reported flat sales for the quarter ended January 28, but EPS surged 18%. Same-store sales increased only 0.3% from a year ago while store count decreased slightly. Management forecast sluggish sales in 2017, but earnings could rise 12%. The company’s board of directors raised the quarterly dividend to $0.25 from $0.21. The new yield is 1.8%. Hold.

Cognizant Technology (CTSH 59.88) growth slowed in the fourth quarter. Sales advanced 7% and EPS climbed 9% after increasing 8% and 14% in the prior quarter. Sales to manufacturing, retail%, whereas sales to financial services customers increased only 5.6%. Management provided an optimistic forecast for 2017.

Under pressure from activist investor Elliott Management, Cognizant said it would replace three members of its board. The company also announced plans to expand its adjusted operating margins to 22% from the previous target range of 19% to 20%, and launch a new capital return program, delivering $3.4 billion in capital to investors over the next two years through dividends and share repurchases. Cognizant has not paid a dividend in the past.

Cognizant announced the acquisition of Brilliant Service, an intelligent products and solutions company headquartered in Osaka, Japan. Brilliant specializes in digital strategy, product design and engineering, the Internet of Things and enterprise mobility. No timetable or terms were announced. Hold.

Disney (Walt) (DIS 111.24) reported disappointing results. Sales fell 3% and EPS dropped 10% after sales declined 3% and EPS gained 16% in the previous quarter. Revenue from parks and resorts increased 6% but consumer product sales declined 23%. Year-ago product sales were inflated by successes from the movies Star Wars and Frozen.

Disney’s ESPN sports channel continued to lose subscribers causing advertising rates to fall and cable operating income to drop 11%. In response, Disney will offer a direct-to-consumer sports service in the second half of 2017. The company is also likely to sign a deal with Alphabet’s Hulu to become part of a less expensive pay-television offering, adding to Disney’s inclusion in Sony, DirectTV, Dish and Hulu cable TV packages. Hold.

IntercontinentalExchange (ICE 58.74) reported strong results. Revenue rose 30% and EPS gained 8% after increasing 32% and 10% in the prior quarter. The company’s Interactive Data unit added significant revenue. Earnings were hurt by higher expenses from several sources. ICE hiked its quarterly dividend to $0.20 from $0.17, increasing the stock’s yield to 1.4%. Management provided an upbeat forecast for 2017 revenue and earnings. Buy at 60.17 or below.

LyondellBasell Industries (LYB 92.24) reported much improved results. Sales rose 10% and EPS climbed 6% after declining 12% and 9% in the prior quarter. Moderating supply and increasing demand for Lyondell’s chemicals bodes well for 2017. The company completed a major expansion of its ethylene facilities in Texas and finished seven major plant maintenance upgrades. Management believes the company is well-positioned for solid growth in 2017. Buy at 94.83 or below.

Nissan Motor (NSANY 19.80) reported solid fourth-quarter results. Total sales fell 6% although cars and pickup trucks sold increased 8% led by double-digit increases in Japan and China. Sales were driven by the Note electric car, which outsold Toyota’s Prius. The weak Japanese yen hurt results, which will likely continue in 2017. Hold.

Stifel Financial (SF 54.21) reported another exceptional quarter. Revenue rose 11% and EPS surged 36% after increasing 10% and 15% in the previous quarter. Investment banking revenue surged 31% and management fees rose 16%. Interest income skyrocketed 87%, impacted by the growth of interest-earning assets. 2017 should be another record year for the company. Buy at 53.82 or below.

WestJet Airlines (WJA.TO 22.10) reported mixed results. Sales advanced 6% but EPS fell 8% after increases of 8% and 17% in the prior quarter. WestJet added five new aircraft to its fleet and many new routes as well. Higher fuel costs crimped results. WestJet will continue to add aircraft and new routes in 2017. Hold.

Index of Latest Summaries

Stock recommendations featured in recent issues.