Happy St. Patrick’s Day!

The stock market shrugged off an interest rate hike, weak oil prices and the unveiling of a controversial U.S. federal budget and new healthcare plan. We are in the beginning stages of sorting out which new policies, budgets, plans etc. will become enacted, what revisions will be made, and what will be discarded.

With all the uncertainty, business leaders are taking a wait-and-see approach before making new capital commitments. As prudent investors, we should take our cue from business leaders and be cautious until we see the final outcome of all of the changes ahead. Stay fully invested, but avoid placing heavy bets on what might or might not change.

This Weekly Update includes summaries for four Cabot Benjamin Graham Value Investor companies which reported quarterly financial results or other important news during the past week. I have also included questions from subscribers along with my answers. Prices appearing after each stock symbol are the closing prices on Thursday, March 16, 2017.

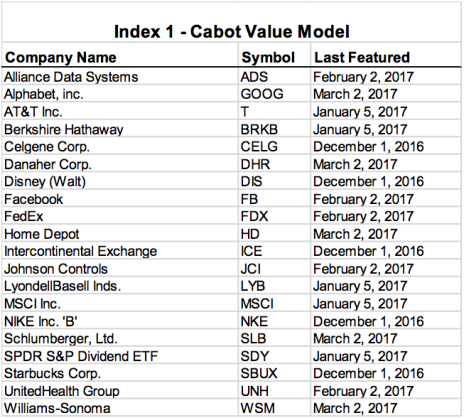

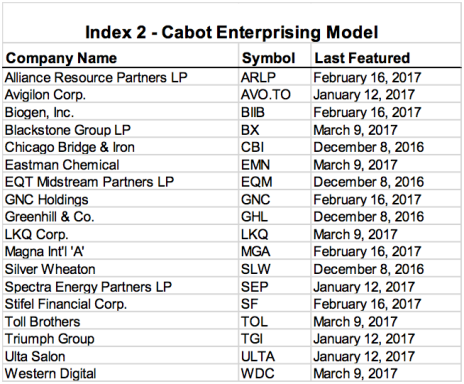

Also, in this Update, I present two indexes, which list companies featured in the Cabot Value Model or in the Cabot Enterprising Model during the most recent four months so you can quickly find my recent write-ups for stocks appearing in the models.

My schedule for the next five weeks will be:

- Tuesday, March 22, Wall Street’s Best Daily

- Wednesday, March 23, Wall Street’s Best Daily

- Friday, March 24, Weekly Update

- Friday, March 31, Weekly Update

- Thursday, April 6, Cabot Value Model issue 273V

- Friday, April 7, Weekly Update

- Thursday, April 13, Cabot Enterprising Model issue 273E

- Friday, April 14, Weekly Update

- Friday, April 21, Weekly Update

Company Reports

Biogen (BIIB 278.96) shares dropped 4.7% after President Trump’s budget proposal revealed lower spending for medical research and less funding for the Food and Drug Administration. The President previously stated that the drug approval process will be streamlined to allow companies to bring drugs to the market more quickly. I expect additional volatility in the healthcare and drug sectors as the President’s policies are debated in Congress. Buy at 285.69 or below.

MSCI Inc. (MSCI 97.67) shares jumped 13% after rumors that the company was being pursued for purchase by another company. MSCI quickly denied the rumor, which sent the shares back down 11%. I don’t expect additional rumors or offers soon. Buy at 96.88 or below.

Oracle (ORCL 45.73) reported excellent results for the quarter ended February 28 and raised its dividend. Sales advanced 2% and EPS climbed 8% after sales were flat and EPS dipped 3% in the prior quarter. Oracle’s board of directors hiked the quarterly dividend to $0.19 from $0.15 resulting in a new yield of 1.7%.

The company’s cloud revenue skyrocketed 73%, which was more than enough to offset a 15% slide in revenue from new software licenses. This is the third quarter in a row in which gains in the emerging cloud business outpaced declines in the company’s software business. As a result, earnings growth will likely accelerate in 2017 and 2018. Oracle’s heavy investment in building its cloud business is finally paying off. Hold.

Williams-Sonoma (WSM 49.25) reported strong results after one of its best holiday shopping seasons. Sales were flat for the quarter ended January 29, and EPS rose 5% after sales and EPS increased 1% in the previous quarter. Williams-Sonoma’s board of directors increased the company’s quarterly dividend to $0.39 from $0.37, raising the yield to 3.2%.

Williams-Sonoma’s West Elm division, which sells high-end home furnishings, produced strong sales and will add stores and expand into office furnishings. Management provided a modest outlook for 2017. Buy at 50.30 or below.

Questions and Answers

Question: With Kroger’s disappointing fourth quarter, should I buy, hold or possibly sell? The decline in same-store sales was unexpected I think and this may be a difficult trend to reverse now that Wal-Mart Stores is experimenting with lower grocery prices. (from subscriber G.H.)

Answer: Kroger (KR 29.32; Max Buy Price 30.39; Min Sell Price 41.01) has plummeted 21% during the past three months because of stagnant sales and earnings during the past couple of quarters, and management’s modest forecast for the next several quarters.

Competition will be the key to Kroger’s success in 2017 and beyond. As you mentioned, Wal-Mart is on a campaign to gain market share, and will lower some prices on food items and increase its e-commerce presence. Kroger is focusing on its ClickList program, which allows customers to order online and pick up their groceries at the local supermarket.

In my opinion, Kroger is better suited to gain online sales because of better customer relations, even though Wal-Mart has deeper pockets. Rumors that Amazon could become a formidable competitor don’t make sense to me, but I will be watching Amazon closely to determine if the company could undercut Kroger and Wal-Mart.

Kroger shares are selling at a bargain price, but I will continue with my Hold opinion until the company begins to show progress competing against Wal-Mart and others. Hold.

Question: What is going on with GNC? I am trying to take your advice and not sell too soon; however, this one worries me. (from subscriber B.C.)

Answer: GNC Holdings (GNC 7.26; Max Buy Price 9.52; Min Sell Price 16.30) has been in a downward spiral since November 2013, but the trend has slowed during the past month. GNC will likely form a base between 6.5 and 8 before rallying in the second half of 2017.

Declining sales and earnings have hurt GNC, and the recent omission of the quarterly dividend caused many investors to abandon the stock. On the positive side, new management is implementing new strategies for the company which will likely improve sales and earnings.

GNC holds desirable lease space in shopping malls and continues to bolster its strong balance sheet. Lastly, the company’s stock price is very cheap and could attract a buying for the entire company. The private equity firm, KKR, and others have been rumored to be interested in GNC, so a buyout at a reasonably high price is a good possibility. I recommend holding your GNC shares. Hold.

Question: I was looking for the list of ETFs. Please direct me. (from subscriber T.K.)

Answer: I currently have seven ETFs with Buy or Hold opinions; all are recommended in the Cabot Value Model Issue. March 2 is the latest Issue. The SPDR S&P Dividend ETF (SDY) is included in the Current Buy Recommendations on page 3 and the remaining six ETFs are listed in the Hold and Sell Recommendations table on page 7. Guggenheim 2020 High Yield Corp Bond ETF (BSJK) has not declined to my Max Buy Price of 23.95 yet, so it’s currently a buy recommendation that hasn’t been purchased. I have recommended ETFs sparingly in the past as defensive holdings to lower the risk in your portfolio.

Index of Latest Summaries – Recommendations featured in recent issues.