After a decade of underperformance, value stocks may be primed to overtake growth stocks in the coming years. Here are three under-the-radar value stocks to keep an eye on.

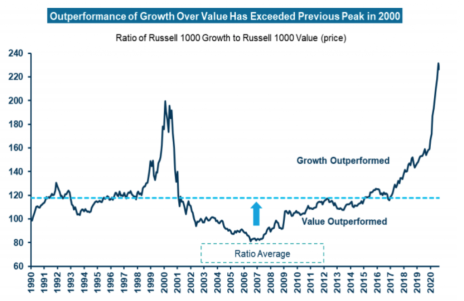

Starting in 2007, growth stocks embarked on an epic period of outperformance versus value stocks. The below chart nicely summarizes the outperformance.

The amazing run was driven by a number of factors, including:

- Declining interest rates, which were a headwind for financial stocks, which represent a large portion of value benchmarks.

- Dominance of U.S. tech businesses. Ten years ago, Google, Amazon, Apple and Microsoft looked well positioned to dominate going forward. Despite high expectations, these businesses actually exceeded expectations and as a result, their performance and representation in the growth indexes has skyrocketed.

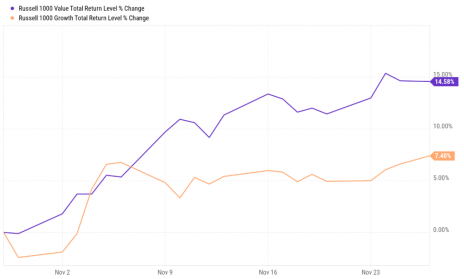

However, it looks like value stocks might finally have their long-awaited day in the sun.

Value stocks tend to be more cyclical, and thus will benefit more sharply from an improving economy.

[text_ad]

Given the news that several effective vaccines are likely to be approved over the next couple of months, we’ve seen a revival in value stocks.

It appears we are in the early innings of a value stock revival, and if I’m right, value stocks have a long way to go.

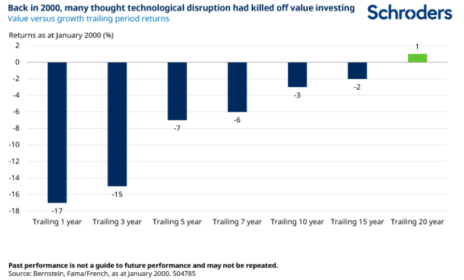

In 2000, this is what value relative performance looked like:

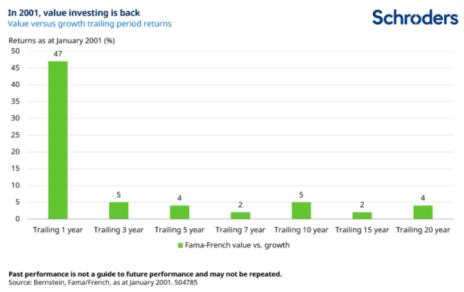

Fast forward a year to 2001, and this is what value relative performance looked like:

Given this backdrop, let’s discuss three under-the-radar value stocks that should provide attractive returns going forward.

Under-the-Radar Value Stock #1: Viatris (VTRS)

On November 16, Pfizer (PFE) successfully spun off its generic business and merged it with Mylan, to create Viatris (VTRS). Viatris is expected to have pro forma 2020 revenue of $19 billion to $20 billion, EBITDA (earnings before interest, taxes, depreciation, amortization) of $7.5 billion to $8 billion, and free cash flow of >$4 billion. On a pro forma basis, the new company is trading at 5.2x free cash flow and 5.8x EBITDA. It’s cheap because Viatris has high leverage and it (along with other generic manufacturers) is under investigation for price fixing. Nonetheless, potential liabilities are manageable, and the stock looks attractive. Especially, because it will declare a ~5% (at its current price) dividend yield in Q2 2021.

Under-the-Radar Value Stock #2: ChampionX (CHX)

ChampionX (CHX) was created when Ecolab (ECL) merged its upstream oil and gas chemicals division with Apergy, an oil field services company. Energy stocks have been a hated area of the market, but ChampionX looks attractive. Despite operating in a down-and-out industry, the company is still generated solid free cash flow. Importantly, the company generates 88% of revenue from production (wells that have already been drilled and are producing) so it doesn’t have high exposure to capex cuts. The stock is currently trading at 6.4x normalized free cash flow. Prior to the pandemic, the stock traded at 20x free cash flow. As such, if (when) energy markets recover, the stock will have explosive upside.

Under-the-Radar Value Stock #3: Nielsen Holdings (NLSN)

Nielsen (NLSN) is a global measurement and data analytics company. The company is divided into two business units. Nielsen Global Media serves media and advertising industries by providing data on media consumers (think Nielsen TV ratings) so that they can maximize their marketability to both advertisers and end consumers. This business is a virtual monopoly.

Nielsen’s other business, Nielsen Connect, provides consumer packaged goods manufacturers and retailers with information and insights that companies need to manage their brands, grow, and target customers. This is a lower quality business with lower margins. However, Nielsen recently announced that this business will be sold to Advent International, a private equity firm, for $2.7 billion.

This transaction will allow Nielsen to pay down debt and will leave behind Global Media as Nielsen’s only business. This remaining business is an idea buyout candidate due to its high margin, virtual monopoly and high free cash flow generation.

Pro forma for the Connect sale, Nielsen is trading at an EV/EBITDA multiple of 7.7x. This is too cheap. If Nielsen’s multiple expanded to just 9.0x EBITDA, the stock would be worth 22, implying significant upside.

[author_ad]