To describe the world’s recent experiences as “interesting times” would be an epic understatement. Military turmoil abounds across several regions of the globe, the results of which are threatening to undermine economies and financial markets worldwide.

With as much geopolitical instability as we’re seeing, why then has gold underperformed for much of the past year? After all, the shiny yellow metal is well known for its ability to maintain—and even increase—its value when investors are worried about war.

To answer that question, we need to look at one of gold’s biggest competitors when it comes to capturing the attention of investors: Treasury bonds. T-bonds are widely considered as a safe-haven asset among investors worldwide, with the added bonus that government bonds offer a yield. That’s an advantage that gold doesn’t offer.

[text_ad]

With Treasury yields now at levels not seen since 2007, bonds are becoming increasingly attractive to many participants. Indeed, several high-profile financial advisories and news publications are starting to tout bonds as a worthy investment now that prices are down and yields are high.

Consider, for instance, this headline from a recent issue of The Wall Street Journal: “Bonds Beckon: Here’s What to Know.” Or this one from last week’s New York Times: “Bonds Have Been Awful. It’s a Good Time to Buy.” It’s only natural, then, that as yields rise, income-oriented investors will tend to gravitate toward the high-yielding bond market vis-à-vis non-yielding gold.

Aside from the bond yield headwind, gold has also been plagued by another major factor, namely the strong dollar. As you’re likely aware, gold has a currency component since it is priced in greenbacks. As the U.S. dollar index (USD) strengthens, it therefore makes it harder for gold to appreciate due to the currency factor.

As of this writing, the dollar index is up 4% year-to-date. That might not sound like much, but given the dollar’s historically lower volatility compared to gold’s, it’s fairly significant. Thus, you can see why gold has faced some significant obstacles in recent months.

However, while the fundamental challenges facing the precious metal remain unchanged, there are key short-term factors that are shaping up in gold’s favor. One of them is the recent outbreak of war in the Middle East. War doesn’t always favor gold—particularly if the battle in question isn’t significant from a geostrategic standpoint.

But the global repercussions of an all-out war in the Mid-East region can’t be understated, especially if the U.S. becomes heavily involved. Based on those concerns, investors are right to be looking at gold right now as a hedge against financial market volatility and/or global trade uncertainties.

What’s more, a compelling argument can be made in favor of the gold bulls (on a short-term basis) from a recent development in the futures market.

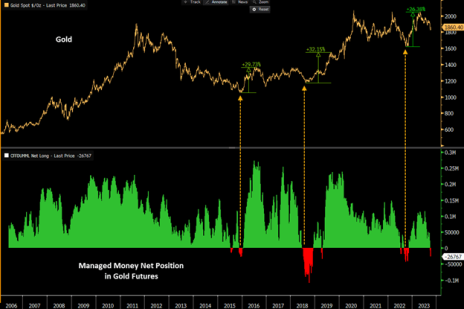

Intriguingly, managed money futures positions in gold have fallen to one of their lowest levels of the last eight years. A chart provided by financial analyst Jason Goepfert of SentimentTrader illustrates the extremity of the under-commitment to gold during the recent plunge. He points out that whenever managed money has bet like this in the past, gold has gone on to record an average gain of 23%!

Source: Jason Goepfert

More precisely, Goepfert pointed out that the only other times managed money bet like this, gold registered the following performances:

Rallied 30%

Rallied 32%

Rallied 26%

As of this writing, gold has risen by “only” 8%, so the potential for additional gains is there if this (admittedly contrarian) correlation holds true.

None of this is to say that additional short-term strength in gold is guaranteed, and much will surely depend on how the conflagration in the Middle East pans out in the coming days and weeks.

It’s a speculative risk to be sure, but if you don’t mind higher-risk trades, you might consider a conservative position in gold as a temporary hedge against the possibility of war-induced financial market volatility.

[author_ad]