Before we delve into stock spin-offs, I want to share a thought. I firmly believe that you need a niche to consistently win in the stock market.

There are too many smart, highly motivated people out there. If you dabble here and there, you are bound to underperform.

So, what are my niches?

Well, I run Cabot Micro-Cap Insider so you can probably guess one of my niches.

Why do I love micro-caps?

It boils down to three factors:

1) Performance.

- Micro-caps have significantly outperformed larger stocks over long periods of time.

2) Simplicity.

- Micro-caps are easy to understand. Generally, they have just one line of business.

3) Access to management.

- If you want to speak to a micro-cap CEO, just pick up the phone and call.

Other than micro-caps, I love special situations and my favorite special situation is the “spin-off.”

Simply defined, a spin-off is when a public company breaks up into two or more public companies.

[text_ad]

A good example is General Electric’s (GE) recent spin-off of its healthcare business, General Electric Healthcare (GEHC).

General Electric is a storied industrial conglomerate that has been around for over 100 years. It has three business lines: healthcare, power, and aerospace.

It is most well-known today for barely surviving the Great Financial Crisis of 2008 and 2009.

Ever since 2018, GE has toyed with the idea of breaking up into three separate companies to make the company easier to understand and value for Wall Street analysts.

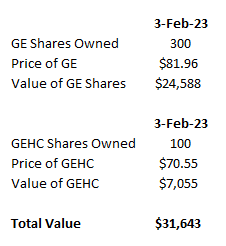

The official spin-off took place after the market close on January 3. Investors who owned 300 shares of General Electric opened up their brokerage accounts on January 4 and discovered they owned 100 shares of General Electric Healthcare (GEHC) in addition to their original 300 shares of General Electric (GE).

Why proceed with a spin-off?

Because it usually unlocks value.

I mentioned this above but it bears repeating. Investors love simplicity (this is one of the reasons why I love micro-caps so much – it’s just easier to understand and value a simple business model).

So how did the General Electric spin-off work?

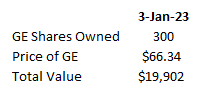

On January 3, a GE investor’s 300 shares were worth $19,902.

A month later, the investor’s 300 shares of GE and 100 shares of GE Healthcare were worth $31,643.

A total return of +59% in a single month. Not bad.

Even factoring in the S&P 500’s strong performance over the same period (+8%), GE’s performance was remarkable.

Now you can see why I like spin-offs!

At the beginning of this article, I mentioned that my two favorite niches are micro-caps and stock spin-offs.

The magic really happens when you combine these two niches.

For example, let’s take a quick look at BBX Capital (BBXIA).

In October 2020, I recommended CMCI subscribers buy BBX Capital shares at 3.17.

At the time, BBX Capital was a recent spin-off that was selling at 50% of the value of cash on its balance sheet.

A year and a half later, I closed the recommendation for a +133% return.

Turns out I should have held on as the stock now trades at 9.20.

Interested in learning when the next attractive micro-cap spin-off hits the market?

Join the Cabot Micro-cap Insider community and you will be the first to know.

[author_ad]