Productivity Drives Stock Market Growth

Since Cabot was founded in 1970, our belief that, in the long run, the stop market goes up, has served us and our customers well. Individual stocks rise and fall based on a variety of causes (the subject of a future post).

And, in the short run, the stock market can be affected by macroeconomic factors and world events. But, in the long run, it’s pretty simple: the market goes up.

The Stock Market Goes Up: Dow Jones Industrial Average, 1900 to Present

The stock market’s bumpy but continued rise has experienced only a few interruptions since 1900 – the Great Depression of the early 1930s, a prolonged sideways market for most of the 1970s and early 80s, and it got somewhat overheated in the early 2000s concluding with Great Recession of 2009.

Why does the stock market go up in the long run? In a word – productivity.

Increasing productivity means that for the same amount of inputs, we produce greater output.

If it used to take $100 of inputs to produce $200 of final goods and now you can produce the same $200 of goods for just $80, you have increased productivity.

The increased productivity has increased the margin on that product by $20. That $20 can be “spent” in a number of ways – reducing the price of the product, increasing the wages of the workers, increasing the “profit” of the owner – or a combination of them. The profit of the owner can be invested into further productivity enhancements and product developments in a virtuous circle.

Importantly, because productivity reduces the cost of producing a product or service it reduces inflationary pressure.

Productivity can get a bad rap at times when people think about, for instance, installing robots and reducing jobs. While it is true that productivity can cause displacement of employees in the short run, in the long run, it enables labor to move to higher-value-added activities.

Since owners and governments benefit from increased productivity, they can provide funding through public and/or private initiatives for retraining and relocation when employees are displaced. From a long-term, macroeconomic perspective, such programs set the stage for further productivity enhancement.

The efficient redeployment of labor displaced by productivity gains is challenging not just because there isn’t always the political or economic will to provide retraining. Often times the displaced themselves have emotional attachments to a job and the way of life that went along with it and don’t want to be retrained or relocated.

These can all cause temporary disruptions, but again in the long run, the workforce gravitates to more secure, better-paying jobs. So it may take time, but the economy will get more productive.

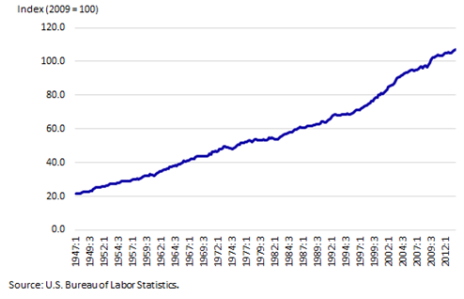

Productivity Goes Up: U.S. Productivity Since 1947

Productivity has increased steadily since World War II. Note the acceleration in productivity gains from the late 1990s through 2009, largely driven by the Internet.

So, what enables us to improve productivity?

Productivity is driven by many factors:

Innovation: To provide a certain level of light in a room, we used to need a 100-watt incandescent lightbulb. Through innovation, we created compact fluorescent lightbulbs that could provide the same level of light for about 20 watts. Further innovation brought LED bulbs which provide the same level of light for about 8 watts – a twelve-fold improvement in energy cost for the same light output.

Technology: Technology has a seemingly limitless ability to improve productivity. As mentioned above, robots have enabled many industries to be far more productive, handling heavy and repetitive tasks without the need for breaks or risking injury. Inexpensive drones enable inspection of buildings, bridges, and towers without a person having to take their feet off the ground. AI enables better and faster review of x-rays and detection of tumors, and the impact of generative AI is just starting to be felt in many industries. And today’s low-cost video conferencing now enables people to do almost face-to-face meetings without the time and expense of traveling.

Raw Materials: Substituting an inexpensive, widely available input for a more expensive input reduces costs and therefore increases productivity. There was a period in history when whale oil was the state-of-the-art fuel for lamps, but the risk and expense of hunting whales, rendering the oil, and transporting it back for consumption were quickly made obsolete when we discovered how to produce and refine petroleum with far less risk and cost.

Financing: In recent years crowdfunding has enabled many businesses to get started that would otherwise not have qualified for more traditional capital from bank loans, stock offerings or even private equity or venture capitalists. While many such companies will not succeed, those that do may develop new technology or other innovations that would not have been possible if those businesses couldn’t get funded.

Business Processes: The first semiconductors were a huge step forward in terms of increased computing power and energy efficiency. But, since that time semiconductors have gotten smaller, more powerful and even more energy efficient due to changes in business processes. At the same time, the energy to produce them and the waste from the production process has also fallen dramatically. Taxis and hotels have been around for a long time, but Uber and Airbnb brought new business processes to these industries enabling lower costs and a higher level of service.

Work Environments: A safer, more comfortable, well-lit workplace contributes to increased productivity by reducing the chances of accidents as well as causes of illness or errors. In addition, a workplace that supports higher employee engagement has been found to increase productivity to some extent. This is the justification for the fabled Silicon Valley office perks of ping pong tables, free snacks and the like.

Training: I’m not sure whether I should have listed this first or last. Training is probably the easiest and least expensive factor that can be applied to drive up productivity. With proper training, employees can work faster, more efficiently, and with fewer errors and waste.

All of these factors taken together produce steady forward progress in productivity. That is the biggest single driver behind the stock market continually rising.

Really the only time productivity dips is during times of economic disruption, for instance, as we saw early in the pandemic in 2020. When that occurs it is almost always the case that output falls with demand but adjustments to labor inputs are a little slower, either out of management caution about not cutting back too quickly, or due to contractual obligations or other reasons. That produces a passing dip in productivity.

In case you missed it …

Each January Cabot’s growth investing expert and Chief Investment Strategist, Mike Cintolo provides his outlook on the market for the coming year. It’s a must-watch and best of all, it’s available to you and shareable with friends for free – view it on demand here.

Noteworthy in January

Our value investing expert Bruce Kaser had a nice win this past month in his Cabot Turnaround Letter when news broke that Kaman (KAMN) had accepted a takeover offer from Arcline Investment Management to take the company private. Shares jumped 105% the next day, generating market-beating gains for patient investors.

On the options trading side, Jacob Mintz delivered a +218% profit to his Cabot Options Trader subscribers in less than 7 months, when he closed his Intel (INTC) calls.

New Best Stocks Report – Get it Free Now

We have just released 5 Best Stocks to Buy in February, featuring five strong momentum stocks to buy right now. This concise report is by Mike Cintolo, our Chief Investment Strategist and Chief Analyst of Cabot Top Ten Trader. You can download the report for free.

For your investing success,

Ed