After a multi-month correction, fuel prices are on the rise again with gasoline pump prices surging 17% in the last couple of months, while crude oil is up by the same amount year-to-date. For investors, that means it’s time to take a closer look at oil stocks in an energy sector that is starting to heat up.

Several factors account for the recent energy price increases, beginning with supply issues. Ukraine’s recent attacks on refineries in Russia are one reason for the latest oil price strength, a move likely to negatively impact global fuel supplies.

At least seven major refineries were targeted by Ukrainian drones in the past month, resulting in a shutdown of at least 7% (about 370,500 barrels a day) of Russian refinery capacity, according to Reuters. And with Russia facing storage problems, analysts believe further production cuts are possible in the coming months.

[text_ad]

Gasoline prices, meanwhile, just hit a year-over-year high for the first time since December 2023, and industry experts see the uptrend continuing into summer when the U.S. “driving season” peaks.

Per analyst Carl Surran, “Total U.S. refinery utilization rates have remained below 87% for eight straight weeks, the longest such stretch in three years.” Indeed, the upward pressure in pump prices is creating headaches for central bankers who are trying to extinguish the flames of inflation.

For investors, however, increased energy prices will mean abundant opportunities to buy petroleum-focused stocks that were discarded, or largely ignored, during the sector-wide correction of the last few months.

Another factor worth mentioning is that average short interest across energy components in the S&P 500 index jumped 13 basis points, to about 2.5% of floating shares, on a month-over-month basis in February, according to Seeking Alpha News. The fact that many oil stocks are heavily sold short potentially adds fuel to an already bullish energy sector landscape and intriguingly sets the stage for possible short-covering rallies in the coming weeks.

A couple of standout oil stocks within the sector are worth highlighting. Both of them stand to benefit from short covering, with one of them also having the additional benefit of being a potential momentum play. Let’s take a closer look at both of them.

Oil Stock #1: PBF Energy (PBF)

One of the more attractive oil stocks right now is PBF Energy (PBF), which is one of the largest independent petroleum refiners and suppliers of unbranded transportation fuels, heating oil, lubricants, petrochemical feedstocks and other petroleum products. The company’s Logistics segment includes owning, leasing and acquisition of crude oil and refined petroleum products terminals, pipelines and storage facilities.

Last year, PBF entered a 50/50 joint venture with global integrated energy giant ENI for a biorefinery in Louisiana—the St. Bernard Renewables (SRB) biorefinery—which will produce hydrotreated vegetable oil (renewable diesel) with a production capacity of over 300 million gallons per year. SRB started commercial production in June and sold the first products in July, and ENI has committed to providing capital contributions of $846 million to PBF for the project, of which just over half was paid in the second quarter and the rest in Q3.

On the financial front, PBF posted its second-best financial year ever in 2023, and for the first time in its history, now owns and controls all its inventory, which management called a “milestone event.” Looking ahead, PBF expects a “tight” balance between global refining capacity and refined product demand, which it sees generating “long-term value” for investors. In terms of short interest, nearly 10% of the float is currently sold short, which is well above the stock’s long-term average.

Oil Stock #2: Delek U.S. Holdings (DK)

Improving demand and margins for downstream companies that refine crude oil into usable products like fuels, asphalt and lubricants has prompted a major Wall Street to call it a new “Golden Age” for refiners in the wake of global underinvestment across the broader energy sector. Delek (DK) is a diversified downstream energy company with assets in petroleum transportation and storage, asphalt, renewable fuels and convenience store retailing.

Refining is Delek’s specialty, and the firm can process 302,000 barrels per day of crude from its four U.S. refineries (two in Texas and the others in Arkansas and Louisiana). Dramatic improvement in the refining landscape has prompted a number of Wall Street institutions to boost their outlook for refining margins in 2024, while Delek has expressed optimism going forward for what it calls a “robust macro environment” with plans to “explore opportunities in the energy transition space.”

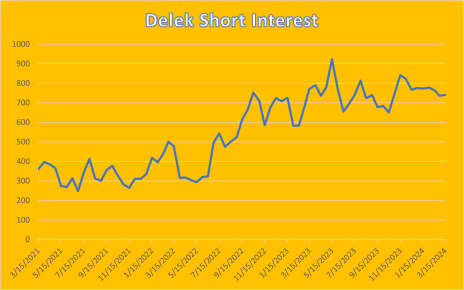

In terms of short interest, 12% of Delek’s float is currently sold short—well above the long-term norm—with a short interest ratio of 4.4 days to cover.

Here at Cabot, we can help you navigate the market by selecting the most promising candidates in retail and many other sectors via Mike Cintolo’s weekly Top Ten Trader. Expert stock picking is paramount for navigating the market’s current challenges, which is why Top Ten Trader is ideal for participants who want to focus mainly on the strongest companies with the best short-to-intermediate-term growth potential.

[author_ad]