President Biden is proposing much higher tax rates for the rich, which caused a very brief sell-off last week. But are tax hikes truly bad for stocks?

Investors were abuzz last week about the prospect of tax hikes from the Biden administration as the White House plan takes shape. In fact, news of the initial trial-balloon tax plan floated out last Thursday quickly, but only briefly, tanked the markets. The commonly held wisdom, of course, is that higher tax rates are bad for stocks.

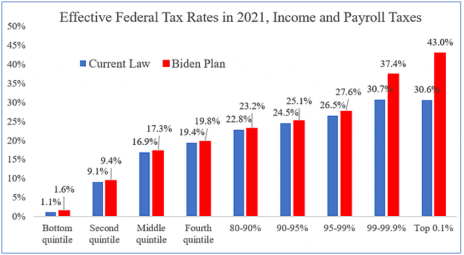

According to various media reports, President Biden is proposing higher taxes on the rich. That shouldn’t really come as a surprise, since “wealth inequality” in America was a central plank of Candidate Biden’s campaign platform last year. The initial plan, which is likely to be subjected to wholesale changes to get through Congress, proposes a top marginal income tax rate of 39.6% for the “rich.”

There is also a new “Old-Age, Survivors, and Disability Insurance” (Social Security) payroll tax imposed on income earned above $400,000, evenly split between employers and employees.

[text_ad]

Corporate income tax rates would increase to 28%, up from 21% now, which were just lowered four years ago by the Tax Cuts and Jobs Act in 2017 under former President Trump. Big businesses with profits of $100 million or more would also face a new alternative minimum tax to close corporate loopholes. The below chart, courtesy of the Cato Institute, shows the higher tax rates being proposed (red bars).

But what really got the stock market’s attention, and not in a good way, was the part of President Biden’s plan to nearly double the capital gains tax on folks making $1 million or more.

And when you add in the 3.8% surtax on investment income that helps pay for the Affordable Care Act it would raise the total capital gains tax on seven-figure income-earners to 43.6%!

According to estimates from the American Enterprise Institute on the plan’s likely impact, the top 1% of income earners (the target group for income inequality) would see their after-tax income decline by nearly 18%.

But Do Higher Tax Rates Really Affect Stock Prices?

Overall, the first draft of Biden’s tax plan aims to raise tax revenue by $3.3 trillion over the next decade. But are higher taxes really the nightmare scenario for the stock market that some believe they are?

Historically speaking, the answer is no.

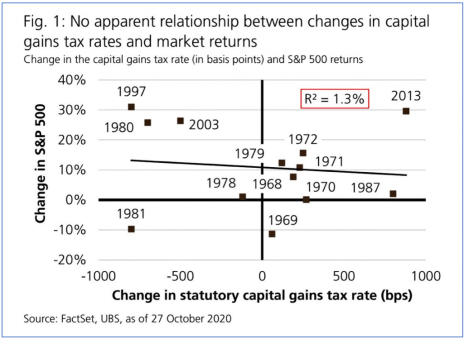

In fact, a timely Tweet last week from Schwab chief investment strategist Liz Ann Sonders (see chart above) shows that there is virtually no relationship between changes in the capital gains tax rate and S&P 500 Index performance. This is based on many tax law changes dating back to the 1960s and up through the present.

The lack of correlation between higher taxes and lower stock prices holds true in both the year the tax change takes effect and the year before it happens, in anticipation of possible tax hikes (the stock market tends to be forward-looking, after all). In fact, Sonders goes on to note, “The last time cap gains went up (in 2013), the S&P had a stellar year (up 30%).”

There are, of course, still plenty of unknowns about what the final tax plan will look like. But investors should be able to take some comfort in the fact that, according to the historical record at least, higher tax rates are not automatically bad for stock prices.

[author_ad]