In an increasingly frothy market, it can pay to have a few undervalued micro-cap stocks in your portfolio. Here are three that I like.

There is no shortage of signs that there is froth in the market.

The S&P 500 is trading at an all-time high price-to-sales multiple.

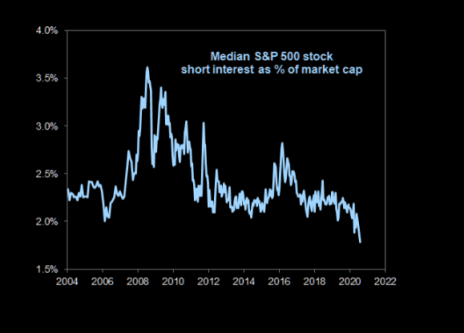

Short interest is at an all-time low.

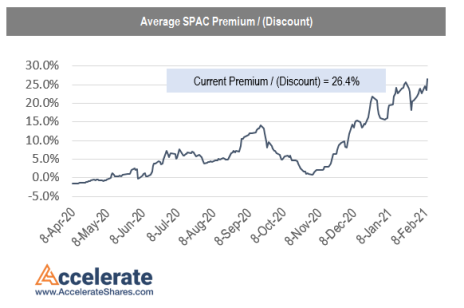

SPACs (Special Purpose Acquisition Companies) are trading at an average premium to net asset value (NAV) of 26.4% as more investors pile in to take advantage of the “pop” once a deal is announced.

But the great thing about investing in micro-cap stocks is there is always something to do no matter the market conditions.

Between Canada and the United States, there are about 10,000 public companies.

[text_ad]

If I can’t find at least a handful of undervalued micro-cap stocks even in a frothy market, then I’m not a very good analyst.

I’ve recently added three names to my watch list in the past week alone, and I want to share how I found the stocks and why they are interesting to me.

Undervalued Micro-Cap Stock #1: Meridian Corp (MRBK)

I found Meridian Corp (MRBK) today courtesy of a Google alert. Google alerts are a great free resource that I use to monitor certain keywords. “Special dividend” is one of the terms that I monitor and today’s alert notified me that Meridian, a bank, will be paying a special dividend.

I’m always interested in companies returning cash to shareholders whether it’s through share buybacks or special dividends.

After a preliminary review, the stock looks interesting.

It is paying a special dividend of $1.00 per share for shareholders of record on March 1. The $1.00 per share dividend works out to a one-time yield of 4.2% – not a crazy large special dividend, but still attractive.

The stock is close to a 52 week high so momentum looks good. Finally, the stock is incredibly cheap trading at a P/E of 5.5, and there has been aggressive insider buying.

Undervalued Micro-Cap Stock #2: Stabilis Solutions (SLNG)

I found Stabilis Solutions (SLNG) today courtesy of another Google alert keyword term: “pre-announcement.” When a company pre-announces good results, it can be a nice buy signal.

I started to dig into Stabilis, and although I need to do more work, it looks like an interesting situation. The company is focused on providing solutions for liquid natural gas fueling, production, and distribution.

The company pre-announced revenue that is 170% higher than second-quarter 2020 revenue (the low point for the year). On a year-over-year basis, Q4 revenue is expected to be up at least 8%. It’s pretty impressive that an energy company is already back to peak revenue generation.

Meanwhile, the company’s valuation (1.4x revenue) seems reasonable and there has been insider buying right around the current share price.

Undervalued Micro-Cap Stock #3: CCUR Holdings (CCUR)

One great way to find new ideas is to follow professional managers who share their ideas in quarterly letters. I found out about CCUR Holdings (CCUR) through Cedar Creek Partners’ latest quarterly letter.

CCUR trades at a huge discount to book value per share of 6.91. Further, the company is sponsoring a SPAC and its founders’ shares could be worth an additional $3 to $4 per share if a successful acquisition is consummated. Finally, the company is doing a reverse stock split to effectively squeeze out small shareholders at less than 50% of book value. This is great for the shareholders who aren’t squeezed out!

Micro-caps stocks like Meridian, Stabilis, and CCUR tend to outperform. From 1927 to 2016, micro caps generated a compound annual return of 17.4%.

Interested in adding micro-cap stocks like these to your portfolio?

Join Cabot Micro-Cap Insider and we will find interesting opportunities together—no matter how frothy the market gets.

[author_ad]