While small-cap stocks continue to trade at a discount to large caps, there is more than just a valuation argument to be made for the asset class. During periods when small caps trade at a discount they are also attractive acquisition targets.

To be clear, buying a small-cap stock – or any stock for that matter – because it may be an acquisition target is a tough strategy to pull off.

But if a company is doing well, the stock is in an uptrend and it ticks several boxes in the plus column as an M&A target, well then maybe it’s worth taking a closer look.

The key here is that the stock should look good even if you don’t expect it to get acquired at a nice premium. And if it does, well then that’s just the icing on the cake.

Here are three stocks that could be acquisition targets in 2023.

[text_ad]

To compile this list, I started by digging into a recent screen from Bank of America that pulled out potential small-cap M&A targets from the Russell 2000 index.

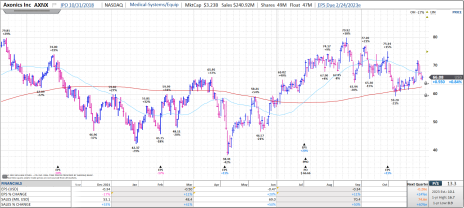

Potential Small-Cap Acquisition Target #1: Axonics (AXNX)

Axonics (AXNX) is a small-cap MedTech company with solutions for patients that suffer from overactive bladder (OAB), Urinary Retention (UR) and Fecal Incontinence (FI). It was on Bank of America’s “growth-at-any-price” M&A screen and has a market cap of $3.2 billion.

The treatment market has traditionally been led by Medtronic (MDT) and sacral neuromodulation (SNM) treatments. SNM involves implanting a programmable stimulator in the body to send low-amplitude electrical stimulation to the sacral nerve, thereby restoring normal control of the bladder and bowel.

Then Axonics came along and built a better range of devices.

The Axonics R15 System is a miniaturized, long-lived rechargeable neurostimulator that works for up to 15 years. It is MRI-compatible. Charging is required after one to two months.

The company also released the F15 in early 2022. The F15 is the only truly recharge-free SNM therapy option and works for ten to twenty years. The F15 has been a home run, and there are reports of practices completely switching over their entire SNM volume to the F15.

Finally, Axonics has enjoyed success with the acquired (in 2021) Bulkamid urethral bulking agent, a solution for women with stress urinary incontinence (SUI). Bulkamid is synergistic with both the R15 and F15 solutions and may become a front-line option (replacing sling /mesh surgeries) for patients, some of whom may later progress on to an implanted SNM solution.

Axonics grew 2021 revenue by 62% to $180 million and is seen growing by 44% in 2022 and by 27% in 2023. While the company is not profitable (expected EPS this year is -$1.56) it is trending in the right direction. Expected EPS loss in 2023 is -$0.99, a nearly 40% improvement over this year.

This is what the chart looks like.

Potential Small-Cap Acquisition Target #2: Halozyme Therapeutics (HALO)

Halozyme Therapeutics (HALO) is a biotechnology company that has developed a drug delivery platform called ENHANZE that is used to deliver injected drugs and fluids. It has a market cap of $7.9 billion and was on Bank of America’s “growth-at-any-price” M&A screen.

The key part of ENHANZE is Halozyme’s proprietary recombinant human hyaluronidase enzyme, rHuPH20. This enzyme works by breaking down a naturally occurring carbohydrate in the extracellular matrix in tissues (such as skin and cartilage) to improve the absorption and dispersion of injectable biologics, small molecules and fluids.

This means drugs that were required to be delivered via IV can now be delivered just under the skin (subcutaneous injection) with ENHANZE. The technology can cut delivery time by hours, reduce adverse reactions, simplify dosing requirements and allow more flexible treatment options, such as dosing at home by nurses, or even the patient.

Halozyme makes money by licensing its technology to biopharmaceutical companies and collaborating with them to develop products that combine ENHANZE with their own compounds.

This gives the company a much lower risk profile than many other small and mid-cap biotech companies because its revenue streams are diversified.

I won’t get into all the treatments Halozyme has licensed ENHANZE out for. But suffice it to say, with agreements with Roche, Baxalta, Pfizer (PFE), Janssen, AbbVie (ABBV), Lilly (LLY), Bristol-Myers Squibb (BMY), Alexion, Argenx (ARGX), and Horizon Therapeutics (HZNP), among others, there are a lot of irons in the fire.

Halozyme has also recently completed the acquisition of Anteres Pharma, which brought in an autoinjector technology with a 5 mL autoinjector currently in development. This product appears to be well-suited for patients that want to self-administer treatments.

Halozyme’s revenue is a mix of product sales, collaboration revenue and license revenue. In aggregate, the trend is strong. Halozyme grew revenue by 66% to $443 million in 2021. Revenue is seen up 53% this year and up another 31% in 2023. The company is profitable. EPS in 2022 is expected to be $1.35 (down versus 2021) and $2.63 in 2023 (up 95%).

This is what the chart looks like.

Potential Small Cap Acquisition Target #3: Catalyst Pharmaceuticals (CPRX)

Catalyst Pharmaceuticals (CPRX) is a small-cap biopharma company focused on in-licensing, developing and commercializing novel medicines to treat rare diseases. It has a market cap of $1.7 billion and was on Bank of America’s “value” M&A screen.

While the company came public in 2006, the company’s current success is more closely aligned with a collaboration it struck with BioMarin (BMRN) in 2012 when Catalyst obtained the North American rights to amifampridine.

At the time, amifampridine was being developed to treat Lambert-Eaton Myasthenic Syndrome (LEMS), a neuromuscular disorder that often causes severe and progressive muscle weakness and fatigue. It happens when the immune system disrupts communication between nerves and muscles and disrupts the release of an important chemical called acetylcholine (ACh). Lacking proper release of Ach, muscles don’t fully function. LEMS impacts about 3,000 people in the U.S. and many more worldwide.

In 2018 Catalyst obtained FDA approval for amifampridine tablets (the commercial name is Firdapse) for adults with LEMS. The commercial launch was in early 2019, and it is now available for adults and children ages six to seventeen. Canada has also approved the treatment for adults.

The growth profile is impressive, especially in recent quarters. Sales were up 18% in 2021 but are on target to rise almost 50% in 2022, to $210 million. Third-quarter sales were up 59%.

Analysts expect revenue growth of around 20% in 2023. Catalyst is profitable as well, with 2022 EPS trending toward $0.73 (+33%).

This is what the chart looks like.

To learn more about Cabot’s favorite stocks this month, click here to download your free report. Or, to learn more about Tyler’s best small-cap stocks, subscribe to Cabot Small-Cap Confidential today!

[author_ad]