When investing in micro-cap stocks, you need to be especially diligent because the story can change very quickly.

Further, sometimes the market doesn’t react to good or bad news.

With large-cap stocks, the market digests good or bad news almost instantaneously thanks to trading algorithms.

But it’s different in the micro-cap world.

Sometimes, a company will announce terrible news and the stock will just sit there.

In other words, it pays to pay attention.

And while I pay close attention to the latest earnings reports for all the micro-cap stocks that I recommend for CMCI subscribers, there are three in particular that I don’t have to watch as closely.

They are micro-cap stocks that I recommend for the long term.

Why?

A combination of factors:

- High insider ownership (aligned incentives).

- Strong fundamentals.

- Cheap valuation on an absolute basis.

[text_ad]

3 Long-Term Micro-Cap Stocks

IDT Corporation (IDT)

Let’s start with IDT.

This company was founded in the 1990s by entrepreneur, Howard Jonas. It is a value-creating machine.

IDT’s DNA is to use its legacy telecom business to generate cash flow and then to use that cash flow to incubate new businesses.

The strategy is time-tested and has created billions of dollars of value over the decades.

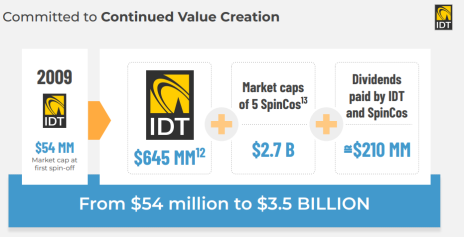

Since 2009, IDT has spun off five separate businesses.

Today, IDT is continuing with the same strategy. Its legacy telecommunications business is in secular decline (as it has been for years), but it is incubating three fast-growing segments:

National Retail Solutions or NRS is a point-of-sale terminal business that caters to bodegas and convenience stores. Think a Square (or Block) terminal but for convenience stores. NRS owns the market and is growing like crazy (+157% y/y in the most recent quarter).

Net2phone is IDT’s UCaaS provider and serves small and medium enterprises. The business is also growing very well (+37% in the most recent quarter).

Finally, IDT has a mobile money transfer business called BOSS Money. It is growing 56% y/y.

On a sum-of-the-part basis, I think IDT is probably worth $55 per share.

And we know that ultimately, the value will be realized. The slide below, from a recent investor presentation, does a nice job of showing how much value has been created by IDT since 2009.

Esquire Financial (ESQ)

Esquire Financial is a niche bank focused on lawyers and the litigation industry.

Due to its specialty and expertise, it has been able to grow very well. Lawyers are low credit risk, and consequently, losses have been low.

Results have been and continue to be excellent.

Revenue in the most recent quarter grew 23% while EPS grew 37%. Despite rapid growth, credit losses are minuscule.

Despite strong historical growth, Esquire trades at just 11x forward earnings.

In many ways, Esquire reminds me of Silicon Value Bank (SVB). Silicon Value Bank has focused on a market niche – technology companies and start-ups. Esquire is focusing on another niche – lawyers.

Silicon Valley Bank has a market cap of $13BN. Esquire’s market cap is $300MM. I’m not suggesting that Esquire will eventually have a market cap of $13BN, but I do think there is significant room for growth.

Truxton Corporation (TRUX)

Truxton is another bank. It’s based in Nashville, Tennessee, and has been a star performer.

Revenue has grown every year since its IPO and is up 163% since 2012.

Strong growth has continued in 2022 with revenue up 9% and EPS up 33% in the most recent quarter.

Meanwhile, credit metrics remain strong ($0 in non-performing loans).

Despite strong growth, share buybacks and high insider ownership, the stock trades at just 11x earnings.

If you’re looking for micro-cap stocks to own for the long term, look no further than IDT Corp, Esquire Financial and Truxton Corporation. To learn which other stocks I’m investing in, subscribe to Cabot Micro-Cap Insider today.

[author_ad]