One of the most fascinating things about the stock market is that there are always opportunities out there. Especially in small-cap stocks, fortunately for me.

It doesn’t always feel that way. Not when we’re bombarded with doomsday headlines about wars, surging interest rates, political dysfunction and the number of S&P 500 companies trading below their 200-day moving average lines.

Given all the noise, it can be very, very easy to get lulled into a sense of thinking everything is going wrong – and that stocks are for suckers.

But for a lot of us it is the hunt for opportunities that helps keep us engaged in the market.

[text_ad]

Whether we choose to buy a stock, and if so how much, is a very different stage of the investing process. That’s when things get more complicated since we need to (or at least should) factor in position sizing, diversification and all the nitty-gritty details of portfolio management.

In contrast, the search for compelling stocks to buy is comparatively simple. Find a compelling story and follow it as far as you want.

Here are three small-cap stocks with compelling stories that have continued to attract my attention lately, even while the broad market has acted iffy.

3 Small-Cap Stocks Holding Up Well

Cellebrite (CLBT)

Cellebrite (CLBT) provides Digital Intelligence software solutions for the public and private sectors. The technology is used to help convict bad actors and bring justice for a wide variety of crimes, from drug and human trafficking to fraud to homicide.

This software is typically used by large organizations, including all 50 U.S. states, the country’s biggest police departments, leading accounting, pharma, telecom, and software companies, the biggest banks, and numerous federal offices, including 14 of the 15 U.S. Cabinet Executive Departments.

These customers use Cellebrite’s software platform to help them navigate the complexities of legally sanctioned digital investigations, collecting, reviewing, analyzing and managing data.

Beyond having a good product, Cellebrite is also reaping the rewards of an ongoing transition to a subscription software-based pricing model. This is more dependable, efficient and aligned with growth-driven strategies than the old on-premise software model.

Two years ago, subscription was 70% of total revenue. In the recently completed second quarter of 2023 it was 88% (the remaining 13% is split 10% professional services and just 3% for perpetual licenses and hardware).

On the second quarter 2023 conference call management raised full-year revenue growth guidance from a range of 12% to 16% to a range of 15% to 18%. Analysts see that pace of growth continuing into 2024 as well, when Cellebrite is seen returning to a full year of profitability after a slight dip in EPS in 2023.

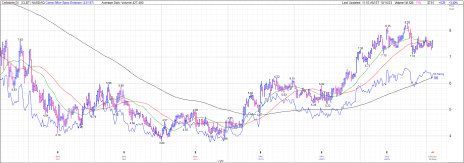

This is what the chart looks like.

LSI Industries (LYTS)

LSI Industries (LYTS) is an innovative small industrial company that makes and installs integrated lighting and display solutions for large commercial and industrial applications.

Major end markets include sports complexes, quick service restaurants, car dealerships, gas stations, parking garages, retail and grocery outlets and warehouses. Next time you’re at one of these locations just take note of how many signs and lights there are and consider the importance of energy efficiency solutions. It’ll become relatively clear why this is a stable, modest growth market.

The company has been rolling out new solutions to meet the evolving needs in the marketplace. More than 40 new products are being launched every year, driving around 30% of sales. Given that contracts can range from hundreds to thousands of locations, depending on the client, LSI has developed a relatively stable business, albeit with some quarter-to-quarter fluctuations.

In fiscal 2023, which ended in June, revenue was up 9.2% to $497 million. With operational improvements and debt payments, LSI enjoyed massive profit growth. EPS rose 55% to $0.99.

Looking into fiscal 2024 (the first quarter of the fiscal year just ended in September) management has called for a flattish first half then stronger growth in the second half. This is partly because first-half growth in 2023 was in the high teens, and that makes for tough comparisons this year.

The bottom line is that fiscal 2024 revenue growth should net out to 4% to 5%, with EPS growth of around 12% (to $1.19).

If your interest is piqued, visit LSI Industries’ investor relations page and listen to the webcast of the August 17 earnings conference call. It’s especially important with these smaller companies that lack analyst coverage to do at least a little legwork if you’re going to invest. Listening to the conference call is by far the most efficient way.

This is what the chart looks like.

Duolingo (DUOL)

Duolingo (DUOL) is an educational software company that’s developed a gamified mobile app that helps people learn over 40 languages. It has also developed a math-learning application.

The company’s reach is undeniable. Duolingo has over 20 million daily average users (DAUs) and more than 70 million monthly average users (MAUs). These users complete over 1 billion learning exercises every day.

That activity fuels a massive dataset that Duolingo’s artificial intelligence (AI) team uses to build proprietary systems and continually improve the platform.

To keep things fun, Duolingo’s apps feature art and animation and a relatively straightforward user interface. This all helps engage learners and keep them motivated.

Revenue comes from four sources: subscriptions (74%), advertising (12%), Duolingo English Test (9%) and In-App purchases (5%). Roughly 45% of revenue comes from the U.S., 10% comes from the U.K. and the balance comes from the rest of the world.

While there are premium subscription offerings (Super Duolingo, Duolingo English Test, and the new Duolingo Max, for example) a lot of content is free. Learners who use the platform for free see advertisements at the end of each lesson.

Duolingo grew 2022 revenue by 47% (to $369.5 million). EPS in 2022 was -$1.51 (7% improvement). In 2023, revenue is expected to grow around 40% while EPS is expected to improve to a loss of just -$0.14. That implies Duolingo will deliver its first full year of profitability in 2024.

This is what the chart looks like.

[author_ad]