While researching medical device stocks to buy for an article last week I came across a screening tool in our research platform that allowed me to dig into initial public offerings (IPOs). I took the bait, tweaked my search criteria, and downloaded the results. They confirmed what I suspected: the IPO market is warming up, health care IPOs are leading the charge, and small-cap biotech IPOs are red hot.

I’ll get to the best small-cap biotech IPOs of 2017 in just a minute. But first, let’s take a quick look at the state of the IPO market in 2017, and the performance of this year’s IPOs since they hit the big board.

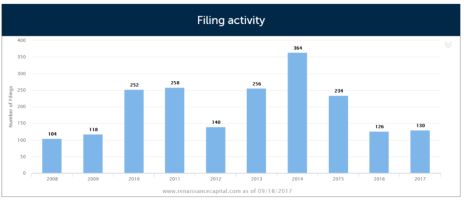

There have been 93 IPOs so far this year (with market caps over $50 million). According to Renaissance Capital, that’s an increase of 48% since the same time last year, when there was a total of 105 IPOs.

That means we only need 12 more to beat last year’s number, which seems likely given that there are three months left in the year, and that there have been 130 IPOs filed this year, up 43% over last year.

That said, the IPO market is still depressed relative to recent history, as the two charts above clearly show.

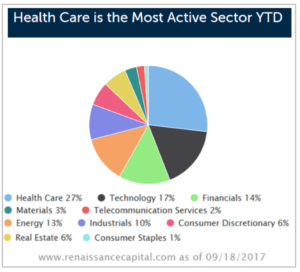

Health Care Leads the Market

Depressed though IPOs might be, two sectors are leading the charge in 2017. And, probably not coincidentally, they are the two sectors that are posting the best performance in Cabot Small-Cap Confidential, where our average stock is beating the small-cap index by an average of 22%. Those two sectors are health care and technology, which represent 27% and 20%, respectively, of year-to-date IPOs.

According to my data, the average gain of these 2017 healthcare IPOs is 38%. Interestingly, only seven of them were posting losses, and only three had double-digit losses (all three were -40% or more).

[text_ad use_post='129618']

This performance supports what I’ve been finding while research stocks for inclusion in Cabot Small-Cap Confidential—namely that small-cap health care stocks are extremely strong performers. To put it in relative performance terms, small-cap health care is the best performing sector in 2017, and is up 24% year-to-date. That’s 20% better than the small-cap index, and no doubt the returns are being pushed by the biotech sub-sector, which is up 26% so far this year (including biotech stocks across all market cap classes).

So which are the best performing small-cap biotech stocks of 2017? Here they are. Interestingly, almost all of them are biopharmaceutical stocks.

5 Best Small-Cap Biotech IPOs of 2017

Biohaven Pharma Holding (BHVN) is a clinical-stage biopharmaceutical company with a market cap of $1.4 billion. Its drug candidates are small molecules based on two platforms; calcitonin gene-related peptide (CGRP) receptor antagonists, and glutamate modulation. The most advanced candidate from the CGRP receptor antagonist platform targets treatment of migraine, and management should release Phase 3 data in the first quarter of 2018. The most advanced candidate from the glutamate modulation platform is trigriluzole, which is being developed for treatment of spinocerebellar ataxia (SCA). Phase 2/3 data from this trial should be released late in 2017. Shares are up 123% since going public in May.

Urogen Pharma (URGN) is another small-cap clinical-stage biopharmaceutical company. It has developed a pipeline of products targeting the uro-oncology market. It has two advanced candidates, MitoGel (Phase 3) and VesiGel, both of which are proprietary formulations based on the chemotherapy drug Mitomycin C (MMC), a generic drug used off-label for urothelial cancer treatment. The stock surged in late-August when the FDA designated MitoGel for Fast Track review for treatment of low-grade upper urinary tract urothelial carcinoma (UTUC). The primary advantage of the treatment is that it might control cancer without requiring kidney and upper tract removal. Shares of the $418 million market cap company are up 148% since going public in early May.

AnaptysBio (ANAB) has a market cap of $760 million and is a clinical-stage company developing antibody products for inflammation and immune-oncology. Its platform is based on somatic hypermutation, which is the key biological process used to generate antibodies. The most compelling candidate (at the moment) is ANB-020, which targets allergic diseases, including adult atopic dermatitis (AD), peanut allergy and eosinophilic asthma. If successful, this candidate could have a significant market size of roughly $2 billion worldwide, and proof-of-concept data is due before the end of the year. Collaborations with Tesaro (immune-oncology) and Celgene (inflammation) also represent potential hits. Shares of the small-cap biotech stock are up 148% since going public in January.

BeyondSpring (BYSI) went public in March. The 126% rally in shares since going public means the company now has a market cap of $868 million. It owns a portfolio of novel immune-oncology candidates, the most advanced of which is Plinabulin. Plinabulin is indicated for prevention of Neutropenia caused by chemotherapy regimens, as well as Non-Small Cell Lung Cancer (NSCLC) in patients with measurable lesions. The company is advancing the candidate in both the U.S. and China. Investors should keep an eye out for the first Phase 2 data readout for Neutropenia before the end of 2017, with another coming in the first half of 2018. An interim Phase 3 data readout for NSCLC should hit the wires in the first quarter of 2018.

G1 Therapeutics (GTHX) is the underperformer of the group, but it’s all relative. The small-cap biotech stock is still up 65% since going public in May! G1 is another biopharmaceutical company; it’s developing novel therapies for treating cancer. It has two clinical-stage candidates, trilaciclib and G1T38. Both were designed to treat most forms of cancer by being combined with current therapies. A third candidate, G1T48, is being developed as an oral selective estrogen receptor degrader (SERD) for treating breast cancer. The company is earlier stage than the others on this list. Both trilaciclib and G1T38 are in proof of concept trials. While initial data will start rolling in in the first half of 2018 investors will clearly have to be patient with this one. G1 Therapeutics has a market cap of $700 million.

Clearly, small-cap biotech IPOs are doing well this year. But it’s a fickle business, and the fortunes of these companies will rise and fall based on FDA approvals.

In Cabot Small-Cap Confidential we’ve opted to get our health care exposure through medical device stocks, several of which are growing revenue above 30%. While I like the biotech stocks too, the companies we’re covering right now have more stable business models, are likely to deliver consistent gains to investors over the years, and have less downside risk. To find out which stocks are helping us beat the market, click here.

[author_ad]