Lost in the shuffle of the steady stream of Russia/Ukraine headlines is a series of developments that point to a new gold bull market. The evidence we’ll discuss suggests demand is increasing for gold as a safe-haven investment for individual investors, as well as a stabilizing instrument for major countries.

The main reasons for gold’s return to favor are easy to discern. For one, rising uncertainty surrounding the geopolitical outlook and the global economy has sent investors scurrying to buy the yellow metal as a hedge against possible financial market fallout.

Then there’s the inflation threat which has dominated the news for the last several months. With the official U.S. inflation rate hovering around 8%, the Reuters/Jefferies CRB Index (the benchmark for broad commodity futures prices) is underscoring this threat and is up an eye-opening 60% since last April!

[text_ad]

And it doesn’t end there, as the bond market apparently foresees even higher inflation ahead, as the Fed’s implied inflation rate indicator (below) attests. Moreover, with the latest Covid-related lockdowns in China creating even more supply-chain bottlenecks for the global economy, the new inflation cycle that began in 2020 has another major support in the foreseeable future.

Some of the world’s biggest central banks are clearly concerned by these trends. They bought 463 tons of gold in 2021, an astounding 82% increase from the prior year. This continued a trend of rising central bank gold purchases going back 12 years and amounting to the largest total gold reserves for central banks since 1992, according to the International Monetary Fund (IMF).

But an even bigger development has taken place in recent weeks, namely the return of Russia as a gold buyer after suspending purchases in 2020. Of even greater significance, Russia even made a serious move toward putting its ruble currency on a gold basis.

Russia and the New Gold Bull Market

On March 25, the Bank of Russia announced it would immediately commence gold purchases from banks, paying a fixed price of 5,000 rubles ($52) per gram. Russia’s central bank had suspended gold purchases from banks last month in order to fulfill exploding gold demand from individual buyers. But the central bank’s shocking move was based on being able to “ensure sustainable supply and the uninterrupted functioning of gold producers,” according to Reuters.

(Note: Because Russian gold is sanctioned by the U.S. and other nations, the price Russians pay for gold internally is far less than the international gold price, hence the steep discount which Russia’s central bank offered to pay for gold from member banks.)

The End Game Investor (EGI) newsletter opined that Russia’s bank could be building up gold reserves for the purpose of making the ruble a gold substitute at a fixed exchange rate (i.e. a gold standard). A growing number of gold market commentators voiced a similar conclusion.

Further supporting the narrative of Russia moving toward a de facto gold standard were comments by Pavel Zavalny, head of Russia’s parliament. At a press conference, Zavalny raised some eyebrows among economists when he said, “The dollar ceases to be a means of payment for us, it has lost all interest for us,” further referring to greenbacks as mere “candy wrappers.”

He went on to say that if other countries want to purchase his country’s natural resources (including oil and gas) they may be forced to “pay either in hard currency, and this is gold for us, or pay as it is convenient for us, this is the national currency.”

Commenting on this astonishing (if underreported) statement, MarketWatch writer Brett Arends observed that if Russia’s lead was to be followed by countries such as China, India and others, “countries that may not welcome Washington’s ability to control the global financial system through its monopoly power over the global reserve currency,” it could prove disastrous for the dollar but quite bullish for gold.

The shockwaves from Russia’s gold purchase announcement quickly reverberated around the world and, as it turned out, had the intended effect: Russia’s battered ruble currency quickly strengthened and returned to pre-invasion levels. And so, on April 7, Russia’s central bank announced that it would scrap its original plan of purchasing gold at a fixed price from local banks, but instead would continue buying at a “negotiated price” due to a “significant change in market conditions.”

The takeaway from this politically charged incident is that even the mere threat of a return to a gold standard is still capable of restoring order to a chaotic currency market. It further underscores the elevated role that gold continues to play in the modern world, despite being often maligned as an antiquated, “barbarous relic” from a bygone era.

Meanwhile, smaller banks around the world are feverishly accumulating gold in an apparent attempt to protect against future economic volatility. Financial analyst David K. Barker, editor of Market Cycle Dynamics, has observed that the Bank of International Settlements’ Basel III regulations (which are designed to promote the stability of the international financial system) “appear to finally be forcing banks to buy more gold to back up their paper positions and trading activities,” adding that the war in Ukraine is playing an important role in further bolstering gold’s appeal as an international monetary stabilizer.

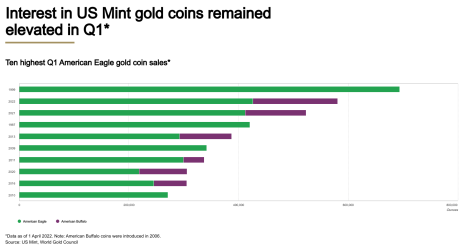

Major countries and banks aren’t the only ones interested in gold right now, however. Individuals are getting in on the action, too. The latest U.S. Mint data shows that gold coin sales (American Eagle and Buffalo coins) totaled 220,000 ounces in March. Commenting on this, the World Gold Council points out that this pushed first-quarter total U.S. gold coin sales to over $1 billion, the second-highest Q1 sales total in volume terms since 1999! This sanguine performance underscores the growing hunger for owning physical gold among retail investors.

How to Play the Gold Rush

Going forward, the bull market in gold should continue to enjoy support from not only the continuing buildup of global inflationary pressures, but from all the additional factors mentioned here. That especially includes war, as the last major war during the turbulent 2000s taught us, which saw gold prices double from 2003 to 2007.

All told, I expect gold to continue benefiting from the ongoing inflationary cycle, and in order to hedge against inflation, I suggest investors own a conservative position in the metal via physical bullion or through an actively traded gold-tracking ETF.

[author_ad]

*This post has been updated from an original version.