Have you wanted to dip your toes into the world of options but are hesitant? If so, I might have the options strategy for you: a covered strangle.

A covered strangle is simply a covered call strategy coupled with a short put–or just buying a stock and wrapping a short strangle around it. Either way, it’s a covered strangle and it’s a favorite income strategy amongst options professionals.

Investors use covered strangles when they wish to enhance the returns on a long position (stock or ETF) by roughly two to four times, while also having the opportunity to buy even more shares at a price of their choosing. It’s a great income strategy to use on stocks you already own or wish to acquire.

Let’s go through an example that I shared with my readers two weeks ago to really get down to the nitty-gritty of how a covered strangle works.

Covered Strangle in Apple (AAPL)

I’m going to keep it simple by using tech behemoth Apple (AAPL) for our covered strangle example.

[text_ad use_post='262603']

With AAPL trading for 152.95 as of this writing, we are going to buy 100 shares for $15,295.

Once we’ve purchased at least 100 shares we begin the process of selling a short strangle around our newly acquired shares. Since AAPL is trading for roughly 153, we will look to sell a short strangle that has a delta of roughly 0.10 to 0.30 for both the call and put. Moreover, I will look to go with an expiration cycle between 20 to 60 days. My preference is to go with a shorter duration for my short strangle, but the amount of premium I can bring in will define my choice of expiration cycle.

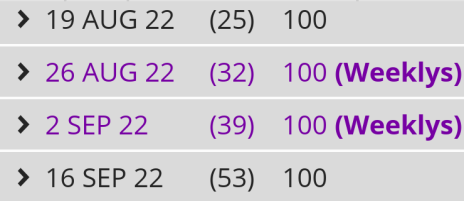

Here are our choices for AAPL’s expiration cycles between 20 to 60 days. I’m going to use the September 16, 2022 expiration cycle with 53 days left until expiration.

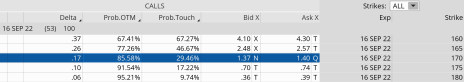

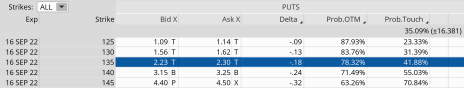

Once I’ve chosen my expiration cycle, I then must decide which strikes I wish to use for my short strangle.

In most cases, I want to sell a short strangle that has an 80%+ probability of success, or a delta of roughly 0.20 or less.

On the call side:

We can sell the 170 call strike for roughly $1.37. The 170 call strike has a probability of success of 85.58%, or a delta of 0.17.

On the put side:

We can sell the 135 put strike for roughly $2.25. The 135 put strike has a probability of success of 78.32%, or a delta of 0.18.

The Trade

Simultaneously:

- Sell out-of-the-money call

- Sell out-of-the-money put

Sell to open AAPL September 16, 2022 170 call

Sell to open AAPL September 16, 2022 135 call for a total credit of $3.62

Premium Return: $3.62 ($1.37 for the call + $2.25 for the put)

Breakeven Price: 149.33

Maximum Profit Potential: $2,067 ($170 short call strike – $149.33 breakeven)*100 for a 13.5% return over 53 days.

A Few Possible Outcomes

Stock Pushes Above Short Call Strike

If Apple pushes above the 170 short call strike, no worries, we get to keep the put premium of $2.25, the call premium of $1.37 and we make roughly $17 on the stock. Overall our gain would be $2.067, or 13.5% over 53 days.

Stock Stays Within the Range of 135 to 170

If Apple stays between our short put and short call we get to keep the entire premium of $3.62, or 2.4% over 53 days. We can use the covered strangle strategy roughly six more times over the course of the year for a total annual return (just options premium) of approximately 14.4%.

Stock Pushes Below our Short Put Strike

If Apple pushes below our short put strike of 135 we still get to keep our overall premium of $3.62. But we would be issued 100 shares of stock for every put sold. Our breakeven on the newly issued shares would be $131.38, a discount of 14.1%.

In Summary…

To sum up a covered strangle options strategy, if you wish to enhance a stock position, like AAPL, consider this often overlooked but highly flexible strategy. You start with the same exposure as a long stock and have protection if the stock moves above or below the stock price. And again, if the stock stays between the short put and short call, you will be rewarded with significantly more premium than with a standard covered call.

If you want more income-boosting trades like this, subscribe to my brand new Cabot Options Institute Income Trader advisory, where we put out income-enhancing options trades several times a week!

[author_ad]