Let me underline a big economic and investment trend that is being completely missed by the mainstream financial media.

Events in Europe during these past weeks, this year – and over the last decade for that matter – highlight that the European Community, with a population of 450 million and shrinking, is facing steep challenges. Ukraine symbolizes the pressure it faces without cheap Russian energy and getting caught in the middle of the U.S.-China rivalry.

[text_ad]

Anemic economic growth, stubbornly high unemployment, sporadic terrorism, big government, aging demographics, crushing debt, and a lack of dynamism are all part of the cocktail that shadows Europe’s future. Great Britain’s exit from the European Community is just the tip of the iceberg, as Europe becomes less unified and less important to investors.

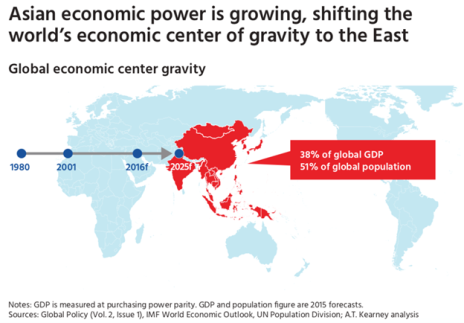

Meanwhile, way on the other side of the world, there is a group of dynamic surging countries. With a combined population approaching 700 million and a GDP of $4 trillion by 2025– these ten Southeast Asian nations have launched an ambitious initiative to join their economies together in a common market.

The goal of this ASEAN Economic Community is to increase their common influence, form a counterweight to China, and boost growth and prosperity.

This diverse group of countries shares more than geography. Malaysia, Indonesia, Malaysia, Thailand and the Philippines have a young tech-savvy population with a rising middle class fueling booming consumer markets. Indonesia, the fourth largest country in the world, boasts consumer spending that has more than doubled in the last decade as it becomes a $2 trillion economy. Singapore has become the most important financial and trading nexus in Asia and already is the world’s richest nation on a per capita basis.

Vietnam has the fastest-growing and the most youthful economy in the world. Myanmar, which is just beginning to open to the world marketplace, has plenty of room for catch-up growth.

These countries have in spades what Europe sorely lacks: strong economic and job growth, a young ambitious population, a rising middle class, optimism about the future, low debt, and an attractive destination for new capital and investment. One fact sums all this up: over the past few years, Southeast Asia has attracted more foreign direct investment than China.

You need to capture some of this growth in your portfolio. There are country-specific ETFs for almost all these countries but for one-stop shopping, consider Global X’s Southeast Asia ETF (ASEA).

My top country pick and ETF in this region right now would be the iShares Vietnam (VNM). This country is packed with talented, well-educated, ambitious people with a great faith in their future, low real wages for a decisive competitive advantage, opportunities for market reforms, low valuations and robust foreign investment to drive its stock market forward.

Get your head around this statistic. America now trades more on an annual basis with Vietnam than it does with the United Kingdom.

Now let’s turn to an even bigger idea. Why America and investors need to turn toward the Pacific region for higher growth and bigger profits.

The new dynamic Asia economic community I just described above is not a threat to America’s future – it is an opportunity. Much like Europe in the late 19th and early 20th centuries, the Asia-Pacific of the early 21st century is home to several rising, contending powers. Instead of the American-shaped order that enabled China’s tremendous growth, new strategic balances are emerging, creating friction, tension and disputes. American diplomacy can play a critical role as leader, balancer and mediator.

For America to play this role effectively requires two steps. First, the right market reforms at home and, second, a persistent shift of attention and resources toward the Pacific region.

And keep the theme of Pacific America at the core of your growth portfolio. You won’t regret it.

[author_ad]