Housing stocks have been on a tear despite the pandemic. Can the momentum last?

Don’t look now, but the housing market is (perhaps inexplicably) on the comeback trail. In spite of widespread predictions of another real estate collapse in the pandemic’s wake, new home sales in several areas of the country are surging as buyers flee virus-plagued major cities in favor of less crowded suburban areas.

And while economists and industry experts debate the staying power of the real estate rebound, the market for real estate stocks is just starting to heat up. Here we’ll look at some companies that should be able to benefit from a continuation of the pandemic-inspired home sales surge.

[text_ad]

Underscoring the increased demand for housing even as the coronavirus runs rampant is the recent improvement reported in the U.S. residential real estate market. Pending home sales soared by a record 44% in May, according to National Association of Realtors (NAR) data. Commenting on the latest data, Lawrence Yun, NAR’s chief economist, observed: “This bounce back also speaks to how the housing sector could lead the way for a broader economic recovery.” (The pending home sales report for June is due on July 29).

Source: Census Bureau

Another indication of just how remarkably strong the domestic real estate market has been, existing-home sales rebounded at a record pace in June (+21%), according to the NAR, which observed that housing is “showing strong signs of a market turnaround after three straight months of sales declines caused by the ongoing pandemic.”

Each of the four major U.S. regions covered by NAR recorded monthly growth, with the Western region seeing the biggest sales recovery. NAR further observed that home prices rose during lockdowns this spring and “could rise even further due to heavy buyer competition and a significant shortage of supply.” Real estate market timer Robert Campbell, of The Campbell Real Estate Timing Letter, points out that existing-home sales are an excellent leading indicator for the future direction of housing prices.

Also worth mentioning is that monthly new home sales in the U.S. surged 14% (both sequentially and annually) in June to a seasonally adjusted rate of 776,000, according to the latest Census Bureau report. This was some 9% above the consensus expectation and represents the best pace of home sales in 13 years. The implication of this report is that the new home market is surprisingly strong, with low inventories and huge pent-up demand from potential homebuyers—many of whom are looking to escape big cities for suburban or rural areas.

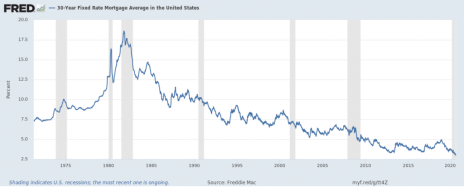

Further undergirding the increased housing demand are record low mortgage rates. The 30-year fixed rate mortgage average recently hit a record low of 3%. This is one of the most important considerations when evaluating the real estate outlook, for whenever rates are declining, it typically stimulates home demand as prospective buyers rush to lock in the attractive rates.

Source: St. Louis Fed

Yet another reflection of the strong housing demand is that home construction and improvement stocks are performing quite well and are showing signs of increasing strength as we head further into the summer. Below is the iShares U.S. Home Construction ETF (ITB), one of my favorite proxies for the homebuilding industry. The chart looks constructive (no pun intended), and it’s just possible that real estate stocks will take the lead from the current high-flyers like healthcare and big tech in the coming months.

Now let’s turn our attention to some of the stocks which stand to benefit from continued strength in the residential real estate market.

Real Estate Stock #1: PulteGroup (PHM)

PulteGroup (PHM) is the nation’s third-largest home construction company and should be able to benefit from continued housing demand. It recently reported Q2 earnings of $1.15 per share, besting expected earnings of $0.87. Led by strong demand from first-time buyers, net new orders rose 50% for the month of June, year-over-year.

Among the other features of its Q2 earnings report was a homebuilding gross margin increase of 80 basis points (to 23.9%) and a backlog of 13,214 homes (+12%), with a backlog value of nearly $6 billion. Pulte’s president and CEO noted that the recovery in new home demand the firm saw during the second quarter “was nothing short of outstanding.”

As an aside, it should be noted that real estate stocks in general have often been treated as safe havens during periods of falling interest rates. I think Pulte will benefit from the recent rush to safety, as well as from continued low interest rates in the coming months.

Real Estate Stock #2: Toll Brothers (TOL)

Toll Brothers (TOL) is a leading home construction firm specializing in building, marketing and arranging financing for single-family and condominium homes in the luxury market. In the second quarter, Toll Brothers boasted a net signed contract increase of 43% through the six weeks ended March 15 before the nationwide lockdowns began. Even with the COVID-related backlog, the company’s deposits (a leading indicator of market demand) in May were at the highest level since 2005 on both a same-store and a gross basis.

Toll’s work teams also delivered 1,923 homes and produced revenues of $1.52 billion in Q2, and its balance sheet remains strong (it ended Q2 with $2 billion in liquidity, including $741 million cash and $1.3 billion available under a $2 billion revolving bank credit facility). It’s a strong story with a bright outlook as long as interest rates remain low.

Real Estate Stock #3: Meritage Homes (MTH)

Meritage Homes (MTH) builds single-family detached homes across the U.S., as well as active adult communities and luxury real estate in Arizona. It also has begun to focus on building entry-level communities as a way to address the housing affordability issue for first-time home buyers, which is creating some big interest among investors. Meritage boasts a compound annual revenue growth rate of 14% over the last decade, and in its latest quarter ended June 30, it saw 3,597 total orders—an all-time record for Meritage and 32% higher than the year-ago quarter.

It also set an all-time record in May for single-month orders (a total of 1,320 homes), which was surpassed in June with another new record of more than 1,500 orders. This performance strongly suggests that a very large pent-up demand for homes is now being unleashed after this year’s lockdowns. Meritage has a solid long-term story that’s being additionally supported by the low-interest-rate climate.

While there is risk in going all in on any one sector these days, the stocks discussed here are supported by the dual tailwinds of record-low mortgage rates and rebounding home sales. If you want the best-performing growth stocks right now regardless of sector, I highly recommend subscribing to our Cabot Top Ten Trader advisory, where every week chief analyst Mike Cintolo provides you with some of the market’s strongest growth stocks from both a technical and a fundamental perspective.

To learn more, click here.

[author_ad]