A decision to suspend fertilizer exports by Russia, one of the world’s leading producers of nitrogen and potash, has fueled fears of a global shortage of these important crop inputs.

Add to that soaring fertilizer costs due to rising natural gas prices, tight global inventories (“as low as we’ve ever seen,” according to one major producer), plus transportation bottlenecks, and suddenly the once-stodgy fertilizer industry has become red hot. Here are three fertilizer stocks that are making a big move.

While the companies that produce the inputs needed to ensure a steady food supply are often overlooked by investors, they offer some attractive opportunities for those with longer time frames looking to hedge against a softening U.S. currency. Here we’ll examine three companies that are starting to benefit from inflation and war-related sanctions.

[text_ad]

Fertilizer producers admittedly aren’t among the sexiest segments of the market. But they produce a product which is vital to ensure our high standard of living. For without modern farm chemicals, high-production agriculture would be impossible and our grocery bills would be considerably higher. While farmers are among America’s unsung heroes, agrichemical producers are equally under-appreciated.

To understand what drives the fertilizer industry, it’s first important to know what the main fertilizers are used for. For those of you who don’t garden, the three macro nutrients essential for healthy plant growth are nitrogen (N), phosphate (P) and potash/potassium (K). Sulfur (S) is needed in smaller amounts than the other three, but is often used as a soil amendment. Fertilizer producers often specialize in just one of these three nutrients, or sometimes all three.

Nitrogen fertilizer is made through a combination of natural gas and air, while phosphate and potash are typically mined from the earth, although some commonly used fertilizers—such as monoammonium phosphate (MAP) and diammonium phosphate (DAP)—combine nitrogen with phosphate rock.

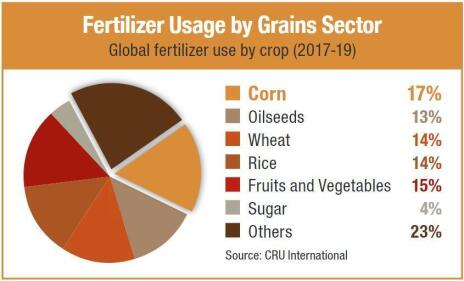

It’s also useful to know that nitrogen is the most widely used nutrient, especially in corn and grain crop production, while phosphates and potassium are mostly used in legumes, fruits and vegetables. The following pie graph breaks down fertilizer usage by grains sector.

Source: CropLife

Fertilizer companies ultimately profit from buoyant N-P-K prices, and rising nutrient prices are determined by three key variables: 1. rising crop prices (and thus rising fertilizer demand), 2. input costs (e.g. natural gas prices) and 3. currency factors (e.g. inflation).

The current inflationary backdrop is particularly worth mentioning. In fact, some of the strongest bull markets in fertilizer stocks have occurred when the inflation rate was increasing at a sustained fashion over a period of several months to years.

Today’s inflationary trend is a prime reason why fertilizer stocks are strengthening, for dollar weakness—plus supply constraints—typically translates into commodity price strength.

With this in mind, let’s take a look at three fertilizer stocks which should be able to benefit from continued inflation.

3 Fertilizer Stocks to Consider

As the world’s leading producer of the widely-used fertilizer anhydrous ammonia, CF Industries (CF) is making hay from soaring nitrogen prices. Although the company expects crop nutrient supply tightness in the foreseeable future, it believes positive industry fundamentals will persist for a long time to come, underpinned by the need to replenish global grain stocks. Also driving CF’s strength is recent speculation from a widely read deal-making site the firm is a potential acquisition target (no buyer was named). It’s just a rumor at this point, but fertilizer makers are coming under increasing scrutiny as takeover targets as volumes and revenues increase, and CF management expects the global economic factors behind this to support elevated nitrogen prices until at least 2023. And while CF warned that “global nitrogen supply will remain constrained,” it also believes farm industry fundamentals are strong enough to counteract this. Analysts apparently agree and see the company’s bottom line exploding 50% and 120%, respectively, for full-year 2022.

Sociedad Química y Minera de Chile S.A. (SQM) is a Chilean supplier of iodine and, as one of the world’s largest lithium producers, is benefiting from the lithium battery-based electric vehicle (EV) boom. But SQM also producers crop inputs—mainly potash and potassium nitrate—with the company’s fertilizer business comprising 33% of total gross profits. SQM is better positioned than most pure-play fertilizer companies since it is diversified. But with fertilizer prices soaring (potash alone is up over 100% from a year ago!), and supplies for the three main crop nutrients expected to be harder to obtain in the coming months (due partly to sanctions on top producers Russia and Belarus), SQM stands to benefit from both trends and could step in to fill the gap left by Russia’s potash exports, with management projecting a 10% increase in potash sales volumes for 2022. In 2021, the firm’s revenue jumped 58% from the prior year, driven by strong lithium demand and higher potassium prices. For 2022, Wall Street expects sales and earnings increases of 80% and 180%, respectively, while management sees stronger results driven by continued fertilizer and lithium sector strength.

Aside from being a global leader in the production of bromine (used in agricultural chemicals, pharmaceuticals and chemical intermediates), Israeli-based ICL Group (ICL) is also one of the world’s largest potash producers, as well as a major supplier of phosphate and specialty fertilizers. (The company uses a unique evaporation process to extract potash and other minerals from the Dead Sea.) For full-year 2021, ICL’s revenue increased 38% from the prior year while net income improved substantially, rising 219%. Like the other companies discussed here, ICL is expected to benefit from the sanctions on Russian fertilizer exports, as well as from runaway potassium and phosphorus prices. Analysts, meanwhile, project sales to increase 25% this year, with earnings forecast to leap 53%.

What else would you like to know about up-and-coming fertilizer stocks? Leave a question below in the comments.

[author_ad]

*This post has been updated from an original version, published in 2020.