Real estate investment trusts (REITs) started 2018 off on the wrong foot. Treasury yields rose to four-year highs in February, after then-new Fed Chair Jerome Powell suggested four rate hikes were possible this year. (So far the Fed has raised the benchmark rate three times, in March, June and September, but one more hike is likely next week.) REITs, and high-yield REITs in particular, sold off sharply as investors adjusted their expectations, then bottomed in early February.

But the sector has been beating the market since, as REIT investors look forward to the end of the monetary tightening in 2019. REIT investors have long expected the Fed to slow the pace of rate hikes next year. Then last week, Powell said rates are “just below” neutral, suggesting that the current cycle of rate hikes could end even more abruptly than anticipated—perhaps after just one or two more.

REITs often have very high yields, but you shouldn’t select them based on yield alone: extremely high yields can be a sign of unsustainable leverage or other dangerous financial maneuvering. Instead, look for REITs with a steady track record of cash flow growth and a long history of distributions, and gravitate toward REITs in profitable niches.

[text_ad]

Whether you already love REITs for the income or are just looking to diversify your portfolio, here are 3 high-yield REITs to own in 2019.

High-Yield REIT #1: STAG Industrial (STAG)

Current Yield: 5.3%

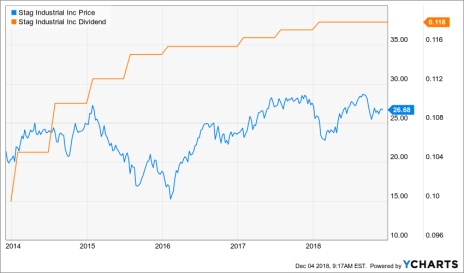

I recommended STAG Industrial (STAG) in Cabot Dividend Investor back in March, shortly after the REIT index bottomed. STAG specializes in industrial properties, the majority of which are used as distribution centers by logistics and e-commerce companies. The Federal government is also a major tenant. Funds from operations (or FFO, a widely-used measure of REIT cash flow) have increased every year since the REIT came public in 2011. In 2019, analysts expect STAG to report FFO growth of nearly 6%, and revenue growth of 12%.

STAG has paid distributions for seven years, and currently yields 5.3%. Best of all, the company pays distributions monthly, so you receive a little income every 30 days or so.

After advancing from March to September, STAG traced out a normal correction, pulling back about 14%. The stock found support in mid-October and has been trading sideways since, and looks like a good buy heading into 2019.

High-Yield REIT #2: Omega Healthcare Investors (OHI)

Current Yield: 6.9%

Healthcare REITs are one of the largest REIT subsectors—owning healthcare-related properties and leasing them to operators under long-term contracts works well for everyone in this capital-intensive industry. Omega Healthcare Investors (OHI) specializes in assisted living facilities and nursing homes. Omega currently owns over 900 long-term care facilities, spread across 41 states.

The industry is growing steadily as the U.S. population ages, but declining Medicare reimbursement rates presented a challenge in recent years. That plus other factors (rising labor costs and changing hospital referral practices among them) contributed to big declines in Omega’s FFO last year. FFO is expected to decline again this year, as are revenues.

But in 2019, revenues and FFO are both expected to grow again, by about 3% each. The stock has been looking ahead for most of the year—OHI bottomed back in April, after first-quarter results beat expectations, and has been advancing since. The stock’s yield has come down from north of 10% earlier this year but is still unusually high, at 6.9%. And Omega has a strong dividend history: the company paid dividends since 1992 and has increased the dividend every year since 2003, often multiple times per year.

High-Yield REIT #3: Community Healthcare Trust (CHCT)

Current Yield: 5.2%

Another healthcare REIT, Community Healthcare Trust owns all sorts of healthcare facilities in non-urban areas, mostly in the Midwest, the South and Texas. The company’s buildings include clinics, medical offices, mental health facilities, ambulatory surgery centers and specialty properties like dialysis and endoscopy centers. The company currently has investments in 89 properties, and is adding a few new properties to its portfolio every quarter, mostly through acquisitions. Management chooses to focus on non-urban markets in part because there’s less competition there, so acquisition prices are lower.

While the future is bright, the past is short: Community Healthcare Trust is a new company, founded in March 2014 by industry veteran Timothy Wallace. The REIT came public in May 2015 and paid its first dividend that August. So the company’s dividend history—and all other types of history—are thin. However, what track record CHCT has is good.

FFO has increased nearly every quarter since the IPO. In the latest quarter, FFO per share rose by 26%. And in 2019, analysts expect FFO growth of about 17% and revenue growth of 30%. In part because the company is relatively new, CHCT has very low debt levels relative to other healthcare REITs. And since August 2015, the company has increased its dividend by $0.25 per quarter every quarter, or by about 3% per year, to a current yield of about 5.2%.

[author_ad]