The S&P 500 has almost officially entered a bear market. The somewhat arbitrary definition of a bear market is a 20% decline. The S&P 500 peaked on January 3, 2022 at 4,797. Therefore, if the Index closes at or below 3,837, we will officially be in a bear market.

Currently, the market is in a “correction,” which is defined (also arbitrarily) as a decline between 10% and 20%.

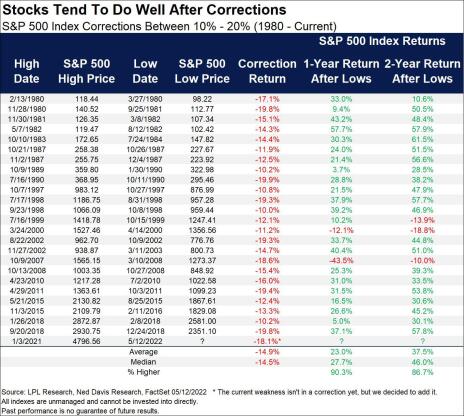

If the S&P 500 somehow manages to avoid the 20% drawdown, returns historically have been quite strong.

There have been 24 corrections in the S&P 500 and on average the index is up 23% in one year following the correction.

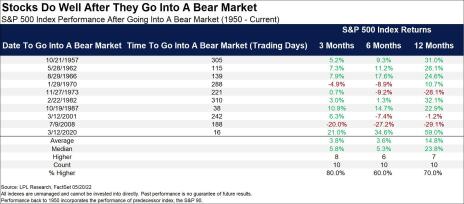

If the market does close below 3,837, triggering a “bear market,” the returns looking out 12 months still look pretty good.

On average, the S&P 500 is up 14.8% after entering a bear market.

While we aren’t trying to time the market, I find these statistics to be reassuring. They help me keep my head down to try to find the next great idea.

This week, we had a few items of note that I wanted to highlight (full updates below).

- Cipher Pharmaceuticals (CPHRF) reported solid earnings. Revenue was flat but earnings shot higher due to great cost cutting.

- Zedge (ZDGE) saw more insider buying. The stock is only trading at 3x EBITDA.

Changes This Week

None

Updates

Aptevo (APVO) reported earnings in early May. The company disclosed that it earned $10MM in milestone payments related to 2021 sales of RUXIENCE. It is optimistic that it will receive an additional $22.5MM in capital over the next two years. As of March 31, 2022, Aptevo has $30MM of net cash and, as detailed above, expects to receive an additional $22.5MM over the next few years. Aptevo’s cash burn over the past year was $22MM. As such, it can probably make it another two years without raising cash. However, the company probably does want to raise capital at some point. From a fundamental perspective, Aptevo continues to report good data for its lead compound APVO436 in patients with acute myeloid leukemia (AML). This biotech bear market is no fun, but Aptevo continues to be an asymmetric bet. Original Write-up. Buy under 7.50

Atento S.A. (ATTO) reported earnings and has gotten absolutely crushed. This market is punishing stocks that miss expectations. Revenue came in at $1.45BN, up 5.7%, but missed consensus expectations slightly. The bigger issue is EBITDA decreased 10% to $35MM. The EBITDA shortfall was driven by lingering issues related to the cyber hack, higher inflation and the Omicron surge. Despite the weak quarter, management maintained its guidance for mid-single-digit constant currency revenue growth and 13.5% EBITDA margins. This may be optimistic, but the share price drop is an overreaction. At the end of the day, the stock is trading at just 3x EBITDA while peers trade at closer to 12x EBITDA. Original Write-up. Buy under 20.00

BBX Capital (BBXIA) reported earnings last week. They were rather weak, driven by weak results at Renin due to inflation and supply chain issues. IT’SUGAR, the company’s confectionary store, had its seasonally weakest quarter but expects growth to accelerate throughout the remaining year. The real estate business is still benefiting from strong demand in Florida despite inflationary pressures. From a valuation perspective, BBX is very cheap. It has net cash of $6.71 per share. The share repurchase authorization is $15MM, and I would expect the company to continue to repurchase shares aggressively going forward. Original Write-up. Buy under 11.00

Cipher Pharma (CPHRF) reported earnings this week. They were great. Revenue was flat year over year, but EPS increased from $0.05 last year to $0.08 this year. The EPS increase was driven by cost cutting (operating expenses decreased 25%). Meanwhile, ~2% of shares were repurchased during the quarter. Cipher currently has $22MM of net cash on its balance sheet, representing 48% of the company’s market cap. Cash flow should be stable for at least the next 4/5 years which will provide time for the pipeline to emerge. The company continues to move its pipeline forward and evaluate accretive acquisition opportunities. Original Write-up. Buy under 2.00

Cogstate Ltd (COGZF) had no news this week. It is a profitable, rapidly growing Australian company that is the market leader in computerized cognition testing. The biggest use case is Alzheimer’s Disease, which is a massive and growing market. Cogstate is benefiting from a boom in Alzheimer’s R&D spending which is driving 20%+ revenue growth. Longer term, Cogstate’s direct-to-consumer Alzheimer’s test could accelerate growth even further. Despite a terrific outlook, Cogstate trades at just 25x current earnings. Looking out a few years, this stock could easily double or more. Original Write-up. Buy under 1.80

Crossroads Systems (CRSS) reported earnings results in April. PPP has ended, but Crossroads continues to process the forgiveness of loans. In addition, the company continues to focus on funding impact loans across the country. Book value currently sits at $11.68, slightly below the current stock price. The management team and board of directors have a track record of creating shareholder value (the company paid a special dividend of $40/per share in 2021 due to windfalls from the PPP program). As such, the current valuation looks attractive. Original Write-up. Buy under 15.00

Currency Exchange International (CURN) is my newest recommendation. The company is benefitting from the post-pandemic travel boom yet only trades at 6x EBITDA. It is growing revenue by 100% and is expanding margins rapidly. Insider ownership is high, and the company has a rock-solid balance sheet. Finally, Currency Exchange has a hidden asset (payments business) which is highly valuable. I see 100% upside. Original Write-up. Buy under 15.00

Dorchester Minerals LP (DMLP) continues to look good. Dorchester recently announced its Q2 distribution of $0.75, which annualizes to a 10.3% yield. The company is benefiting from high commodity prices. While commodity prices will continue to be volatile, I expect them to remain elevated for the foreseeable future. Dorchester will pay out all windfall profits to shareholders. Original Write-up. Buy under 25.00

Epsilon Energy (EPSN) continues to perform well given rocketing natural gas prices. Last year, the company produced tremendous free cash flow and will likely do so again this year. The company currently has $27.1MM of cash (18% of its market cap) and no debt. Epsilon recently committed to paying a quarterly dividend of $0.0625 per share starting on March 31. This works out to a 3.3% dividend yield. In addition, the company approved a share repurchase authorization to buy 1.1MM shares. Original Write-up. Buy under 8.00

Esquire Financial Holdings (ESQ) initiated a 9-cent quarterly dividend recently. This works out to a 1% yield. The company reported earnings in late March. Results were excellent, and the investment case remains on track. The company reported Q2 EPS of $0.66, a penny ahead of consensus. Return on equity increased y/y from 13.3% to 15.0%. Esquire remains well capitalized with excellent credit metrics. The company has a long runway for growth, as articulated by CEO Andrew Sagliocca, “There is tremendous potential in both the litigation and payment markets primarily due to the limited number of players and fragmented and inefficient approach to coupling financing, payment processing, and technology. We believe Esquire will be a leader in all three categories in both industries.” Despite its strong outlook, the stock trades at just 12x earnings. Original Write-up. Buy under 35.00

IDT Corporation (IDT) announced recently that it is delaying its net2phone spin-off. While this is disappointing, it makes sense given the market environment for high-growth stocks. Eventually the spin-off will happen. In March, IDT reported Q2 earnings. The headline number didn’t look great, but the investment case remains on track. Revenue was down slightly year over year, but IDT’s two key segments, NRS and net2phone, generated excellent results. NRS revenue grew 104% to $10.6MM while net2phone subscription revenue increased 32.5% to $12.5MM. The investment case remains on track and my price target is 55 based on an updated sum-of-the-parts analysis. Original Write-up. Buy under 45.00

Liberated Syndication (LSYN) stopped trading on April 15 (the 14th was the last day of trading) because the SEC revoked the company registration. This sounds like horrible news, but I think it’s actually the opposite. Let me explain. Libsyn has been working with the SEC for ~2 years to restate its financials. Long story short, the prior CEO and CFO did a bad job managing the business and didn’t properly account for state sales tax. As a result, the company had to go back through its financials and restate them all. This process has taken longer than anyone anticipated. However, it appears that we are close to the end of the process. I recently spoke to the current CEO of Libsyn, and he told me that the SEC had advised that it would be a more efficient path forward to de-register the stock and then re-file financials rather than restate all previous financials. This makes intuitive sense to me. As such, this de-registration is step one. I don’t have a sense for when the financials will be re-filed, but I believe it could happen within a few weeks. Once the financials are filed, I believe we will see a fast-growing, profitable company trading at less than 3x revenue. While Libsyn has been a frustrating stock, I think (and hope!) our patience will be rewarded in short order. Original Write-up. Buy under 5.00

Medexus Pharma (MEDXF) announced in April that it has completed its resubmission of Treosulfan to the FDA. The company expects a decision within six months. In March, Medexus announced that it has acquired exclusive rights to sell Gleolan in the United States. The company estimates that this is a $14MM USD opportunity. Medexus currently sells Gleolan in Canada and is familiar with the product. This is a big positive as it increases the company’s revenue run rate by ~16%. In February, Medexus posted their Q3 earnings results and reported sales of $21.3MM, beating consensus of $18.8MM. They also posted positive EBITDA of $1.9MM, which was expected to be negative $1.6MM. Revenue was $17.9MM last quarter. So sequential improvement of 18% is excellent from my perspective. Looks like IXINITY is getting back on track (Medexus noted IXINITY drove the sequential improvement). Key things to note from the earnings call: The company received a $2MM order for IXINITY late in the quarter so it was a little higher than expected. Next quarter might be a little lower revenue but should be breakeven EBITDA. But remember, the company is carrying costs for Treo so excluding that spend, the company would be profitable. I continue to believe that the risk/reward for Medexus looks attractive heading into the second half of the year. Original Write-up. Buy under 3.50

NexPoint Diversified REIT (NXDT) had no news this week. In its proxy statement in late March, the company disclosed that “the Conversion process is nearly complete.” This is a major positive as it will enable many new shareholders to invest in the stock (most professional investors don’t invest in closed end funds). The company also recently announced that it made a major realization on its MGM investment. The company disclosed that it received $45MM in cash due to Amazon’s acquisition of MGM. However, what is more interesting is the company disclosed that it expects to receive an additional $81MM from indirect investments in MGM. I spoke to the company and the indirect investments are attributed to the company’s CLO (collateralized loan obligation) holdings. I believe the CLOs are heavily discounted due to liquidity. As such, once they are realized, NAV (net asset value) should increase. Given the positive news, I’m increasing my buy limit to 16.00. Original Write-Up. Buy under 16.00

P10 Holdings (PX) reported another great quarter recently. Revenue increased 32% to $43.3MM while adjusted EBITDA increased 31% to $22.5MM. Assets under management increased 34% to $17.6BN. Higher assets under management will drive continued revenue and earnings growth. The company also announced a $20MM share repurchase. P10 is currently trading at 15x 2022 adjusted EBITDA which is a very reasonable valuation for such a stable business with strong organic growth potential. Original Write-up. Buy under 15.00

Truxton (TRUX) reported another great quarter in April with the company reporting its best quarterly earnings ever. The private banking team continues to grow assets in the Nashville area and rising rates are benefiting the portfolio’s net interest margin. Asset quality remains sound with $0 in non-performing loans and $0 in net charge-offs (that’s pretty good!). The Truxton investment case remains on track. The bank will continue to grow loans and earnings prudently while returning excess cash to shareholders through dividends and share buybacks. The stock is trading at just 12.3x annualized earnings. This isn’t the most exciting stock, but it’s a slow and steady winner. Original Write-up. Buy under 75.00

Zedge Inc (ZDGE) continues to see more insider buying. In total, three different insiders have purchased shares on the open market over the past three weeks. Zedge announced a transformative acquisition in April. It has acquired GuruShots, a company that combines photography with mobile gaming for $18MM up front and an additional potential earnout of $16.8MM in cash or stock. GuruShots is an Israel-based company whose app allows amateur photographers to compete in a wide variety of contests, showcasing their photos. The app generates an impressive ARPMAU of $3.50 (compared to Zedge at $0.06). I had a chance to talk to Zedge’s investor relations and am optimistic about the opportunity for the Zedge team to scale up GuruShots and cross-sell to its existing Zedge app users. Pro-forma for the acquisition, Zedge is trading at 3.0x EBITDA and looks very attractive. Original Write-up. Buy under 6.00

The next issue of Cabot Micro-Cap Insider will be published on Wednesday, June 9. As always, if you have any questions, please email me at rich@cabotwealth.com.

| Stock | Price Bought | Date Bought | Price on 5/24/22 | Profit | Rating |

| Aptevo Therapeutics (APVO) | 32.01 | 3/10/21 | 4.60 | -86% | Buy under 7.50 |

| Atento SA (ATTO) | 21.57 | 8/24/21 | 9.58 | -56% | Buy under 20.00 |

| BBX Capital (BBXIA) | 3.17 | 10/5/20 | 7.39 | 133% | Buy under 11.00 |

| Cipher Pharma (CPHRF) | 1.80 | 9/8/21 | 1.80 | 0% | Buy under 2.00 |

| Cogstate Ltd (COGZF) | 1.70 | 4/13/22 | 1.25 | -26% | Buy under 1.80 |

| Crossroad Systems (CRSS) | 14.10 | 2/9/22 | 12.50 | -11% | Buy under 15.00 |

| Currency Exchange (CURN) | 14.10 | 05/12/22 | 14.17 | 0% | Buy under 15.00 |

| Dorchester Minerals LP (DMLP)* | 10.49 | 10/14/20 | 29.96 | 186% | Buy under 25.00 |

| Epsilon Energy (EPSN) | 5.00 | 8/11/21 | 6.97 | 39% | Buy under 8.00 |

| Esquire Financial Holdings (ESQ) | 34.11 | 11/10/21 | 36.31 | 6% | Buy under 35.00 |

| IDT Corporation (IDT) | 19.37 | 2/10/21 | 26.89 | 39% | Buy under 45.00 |

| Liberated Syndication (LSYN) | 3.06 | 6/10/20 | 3.75 | 23% | Buy under 5.00 |

| Medexus Pharma (MEDXF) | 1.78 | 5/13/20 | 2.05 | 15% | Buy under 3.50 |

| NexPoint Diversified Real Estate Trust (NXDT) | 13.67 | 1/12/22 | 14.96 | 9% | Buy under 16.00 |

| P10 Holdings (PX)** | 2.98 | 4/28/20 | 11.29 | 279% | Buy under 15.00 |

| Truxton Corp (TRUX)* | 72.25 | 12/8/21 | 69.00 | -3% | Buy under 75.00 |

| Zedge (ZDGE) | 5.73 | 3/9/22 | 4.66 | -19% | Buy under 6.00 |

Disclosure: Rich Howe owns shares in BBXIA, LSYN, MEDXF, PIOE, IDT, APVO, DMLP, and NXDT. Rich will only buy shares after he has shared his recommendation with Cabot Micro-Cap Insider members.

Buy means accumulate shares at or around the current price.*Includes dividends received

Hold means just that; hold what you have. Don’t buy, or sell, shares.

Sell means the original reasons for buying the stock no longer apply, and I recommend exiting the position.

Sell a Half means it’s time to take partial profits. Sell half (or whatever portion feels right to you) to lock in a gain and hold on to the rest until another ratings change is issued.