Welcome to Cabot Micro-Cap Insider!

This inaugural issue is a little different than future editions.

In this issue, I’ve profiled my initial five recommendations. In future issues, I will profile one new idea in depth, and provide updates on all open recommendations.

Because I’m including five new ideas today, the write-ups are more concise than you can expect going forward.

Before you read this issue, I recommend that you read my Cabot Micro-Cap Insider Guide. It will help you get the most out of your Cabot Micro-Cap Insider membership, and make your investing decisions easier and more profitable. It will also explain much of the shorthand we use in Cabot Micro-Cap Insider, and explain our ratings.

If you have any questions about any of my recommendations, I encourage you to reach out to me directly at rich@cabotwealth.com.

Now let’s get into the stocks that you should start buying today.

Cabot Micro-Cap Insider 420

[premium_html_toc post_id="203818"]

Welcome to Cabot Micro-Cap Insider

Welcome to Cabot Micro-Cap Insider!

This inaugural issue is a little different than future editions.

In this issue, I’ve profiled my initial five recommendations. In future issues, I will profile one new idea in depth, and provide updates on all open recommendations.

Because I’m including five new ideas today, the write-ups are more concise than you can expect going forward.

Before you read this issue, I recommend that you read my Cabot Micro-Cap Insider Guide. It will help you get the most out of your Cabot Micro-Cap Insider membership, and make your investing decisions easier and more profitable. It will also explain much of the shorthand we use in Cabot Micro-Cap Insider, and explain our ratings.

If you have any questions about any of my recommendations, I encourage you to reach out to me directly at rich@cabotwealth.com.

Now let’s get into the stocks that you should start buying today.

Current Recommendations

P10 Holdings: A Private Equity Management Company with Over 100% Upside

Company: P10 Holding

Ticker: PIOE

Price: 1.98

Market Cap: $177 million

Enterprise Value: $374 million

Price Target: 4.75

Upside: 140%

Recommendation: Buy Under 2.25

Recommendation Type: Rocket

Executive Summary

P10 Holdings (PIOE) is an under-the-radar growing company operating in an extremely stable and profitable industry (private equity), yet trades at just 7.0x cash low. Over the next several years, I expect the company to grow free cash flow significantly as its private equity business grows. My one-year price target is 4.75, implying 140% upside. Looking out three years, I believe this stock could easily trade at 10 per share or higher.

Background

P10 Holdings used to be called Active Power. Active Power went bankrupt and was recapitalized by a team of investors in Texas in 2017. Importantly, the team preserved the net operating losses of the business. At the time of the recapitalization, the business had Net Operating Losses (NOLs), which could be used to offset future taxable income but no revenues and earnings. The management team has changed that by acquiring various stakes in private equity companies.

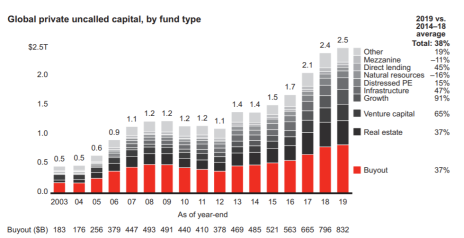

PIOE has made two acquisitions, acquiring RCP Advisors LLC and Five Points Capital, Inc. In the investment management industry, there has been fast-growing interest in private equity for more than 10 years. P10 is poised to benefit from that enduring trend of growth in private equity assets under management. See the historical growth of private equity below.

The other really attractive aspect about the private equity business is that assets under management (and fees) are sticky. When an investor commits to a private equity strategy, he is committing to pay fees on that investment for a minimum of 10 years (most private equity funds have a 10-year life). This results in a very attractive, stable, annuity-like fee stream to the private equity owner.

PIOE’s structure is designed to offer the sellers of each investment management firm a more diversified participation in the alternative investment management business. Moreover, the company owns valuable patents and net operating losses from its predecessor that can shield taxable income. Sellers of acquired investment management companies are given P10 common or preferred stock, notes, and cash for their firms. The recurring management fees go to P10, but the sellers retain the right to performance fees (carried interest), allowing the principals of each selling firm to benefit from their own skill, yet own stock in a more diversified business.

Business Outlook

PIOE’s business outlook is very strong.

In 2019, revenue grew 36% to $45 million as RCP Advisors grew assets under management by $800 million during the year by raising additional private equity funds. RCP earns management fees on capital that it has raised and PIOE will benefit as those fees flow through to the company.

The outlook for 2020 is robust as RCP expects to close its latest fund-of-fund, Fund XIV, shortly with close to $400 million of additional commitments. RCP has additional funds that it expects to launch in 2020 as well, which will increase RCP’s assets under management.

As revenue grows so does PIOE’s free cash flow.

PIOE’s 2019 free cash flow of $16.8 million has increased 16-fold since 2017.

And it will continue to grow in 2020 due to organic growth at RCP and because PIOE recently made an acquisition.

In April 2020, PIOE closed on the acquisition of Five Points Capital, a private credit manager in April 2020. Five Points Capital manages $1.7 billion in assets under management, and PIOE expects this acquisition to contribute $10 million of EBITDA in 2020. The deal was funded with cash on hand and by issuing the owners of Five Point Capital $60 million of convertible debt. The beauty of the convertible debt is that it only pays 1% interest and converts to PIOE common stock at $3.00, almost 50% higher than the current share price.

Almost all of the $10 million of incremental EBITDA from the Five Points acquisition drops to the bottom line as PIOE doesn’t pay taxes due to its substantial net operating losses.

As a result, I conservatively expect PIOE to generate $24.3 million of free cash flow in 2020. I believe this is a conservative estimate because it gives no credit for additional capital that RCP and Five Points will raise in 2020.

PIOE should experience strong revenue and free cash flow growth in 2021 as the company will benefit from a full-year contribution from Five Points and additional capital commitments raised by RCP and Five Points in 2020.

Valuation and Price Target

The best comparable company for P10 Holdings is Hamilton Lane (HLNE). Hamilton Lane is a company that I know well from days on the private equity research team at Citi Private Bank. It is a diversified private equity manager that focused primarily on fund-of-funds and co-investments. It is similar to P10 Holdings but larger.

Currently, Hamilton Lane trades at an EV/2019 EBITDA multiple of 23.3x and a price to 2019 free cash flow multiple of 14.4x. PIOE trades at an EV/2019 EBITDA multiple of 15.4x and a price to 2019 free cash flow multiple of 7.4x.

If PIOE trades in line with Hamilton Lane at 23.3x 2019 EBITDA, it would trade at 4.20 per share. If PIOE sold at a price to 2019 free cash flow multiple of 14.4x, it would trade at 5.15.

My initial price target of 4.75 implies 140% upside, but longer term I see significant additional upside.

Let me explain.

PIOE’s free cash flow increased by a factor of 14 from 2017 to 2019. Let’s assume it grows by ”only” ~100% to $50 million by 2023, driven by high assets under management and another acquisition. If PIOE trades at 14.3x (Hamilton Lane’s current multiple) by then, it would be worth over 8.00, almost 300% higher that it currently trades.

Risks

This biggest risk is that RCP’s performance declines. If RCP’s performance declines, investors may not commit to RCP’s future funds. As a result, the annuity-like management fee that PIOE earns will decline.

While this is certainly a risk, RCP’s performance has been consistently good and as a result, investors continue to allocate additional capital to their funds.

Recro Pharma: A Defensive Company with Takeout Potential

Company: Recro Pharma

Ticker: REPH

Price: 8.16

Market Cap: $191 million

Enterprise Value: $281 million

Price Target: 21

Upside: 157%

Recommendation: Buy Under 10

Recommendation Type: Rocket

Executive Summary

Recro Pharma (REPH) is outsourced pharmaceutical contract development and manufacturing organization (CDMO). It has grown revenue 13% per year over the past four years and has strong 40% EBITDA margins. It has signed long-term contracts with its pharmaceutical clients and so revenue is very sticky. Despite robust fundamentals, REPH trades at 8.3x 2020 EBITDA and 16.4x 2020 EPS, a massive discount to peers. Finally, there has been tremendous consolidation in the CDMO industry and REPH is a prime acquisition candidate. I believe a sale of REPH in 2020 is likely, but even if that doesn’t materialize, Recro Pharma is a high quality business that I would want to own for many years.

Background

Today, Recro Pharma consists of an outsourced pharmaceutical drug contract development and manufacturing organization (CDMO). Many biotechnology and pharmaceutical companies outsource their manufacturing to CDMO companies. The logic goes that biotech and pharma companies want to focus on their core competencies (R&D, sales and marketing) and outsource everything else including manufacturing. As a result, the CDMO industry has been growing like gangbusters.

And REPH has participated in that growth. Over the past four years, REPH has grown revenue at 13% a year. In 2019, that revenue growth accelerated to 28%. And the company is profitable, with expected EPS in 2020 of $0.59

Until this year, Recro Pharma’s strong growth and profitability was masked as the company was pouring millions of dollars into R&D to develop a new pain pharmaceutical drug. As a result, despite strong revenue growth, the company was losing money year after year. That changed in November 2019, when the division that was working to develop the new pain drug was spun off, and all the costs to develop and launch that drug were spun off with it.

As a result, the remaining company (Recro Pharma) is a pure play CDMO and its growth and profitability will no longer be hidden.

Business Outlook

Recro Pharma’s outlook is very strong.

As discussed above, from 2016 to 2019, revenue has grown at a compound annual growth rate of 13%. In 2019, that revenue growth accelerated to 28%.

On its recent earnings call, management guided that revenue growth is expected to be flat in 2020, which was surprising considering the company’s strong historic growth.

As a result, the stock traded down sharply. However, management has a track record of under-promising and over-delivering. In fact, in each of the past four years, annual revenue has exceeded initial guidance by 10% to 25%.

Further, the outlook in 2021 and beyond is very strong, as discussed by REPH’s CEO during the most recent quarterly call.

Jacob Johnson -- Stephens Inc. -- Analyst

Hey, thanks for taking the questions. Maybe following up on that last answer, Gerri, if we think out longer term it sounds like 2019 really strong year. It makes for a tough comp in 2020. How should we think about the long-term revenue growth profile of the business sort of beyond the 2020 time frame?

Gerri A. Henwood -- President and Chief Executive Officer

Yeah. Good question. Thanks, Jacob, for asking. So I think as we look at the macro of the business, we know that some of the mature products will have a very modest, at least as we’ve seen in the past, change year-over-year other than this rebalancing associated with Mylan’s possible reentry into the market. We think that we’ve taken that into account in our current guidance at some rational levels. And I think that the new business will sop up a lot of that gap that would have existed and then some -- I think as we look out further, we have the potential for a very substantial growth new business wise year-over-year as we get through the end of ’20 and beyond because we’ve been building and investing and what we see in proposal volume and win rates and things like that, which we’re not ready to give total granularity on, I’m sure you understand because it’s still -- the mix is still shaking out but very positive signals. I think we see a very strong business ahead of us.

Valuation and Price Target

Recro Pharma is a company that is extremely attractive in the current environment because it is defensive. It manufactures pharmaceutical drugs that patients will consume regardless of the macro environment.

Further, it historically has been a strong grower with 13% compound annual revenue growth and over 20% compound annual EBITDA growth.

Nonetheless, it currently trades at a price to 2020 earnings multiple of 13.7x and an enterprise value to 2020 EBITDA multiple of 7.2x.

Its closest peer is a company called Catalent (CTLT), which trades at 33x 2020 earnings and 16.8x 2020 EBITDA.

At the same multiples, Recro Pharma would trade at 20 and 23.75 per share, respectively.

Lastly, Recro Pharma is an acquisition candidate. The company lists seven competitors in its annual report, and five out of those competitors have recently been acquired. The average takeout multiple is 16x, significantly above where REPH trades.

My price target of 21 implies 157% upside.

Risks

- Revenue is concentrated.

- REPH is dependent on a small number of commercial partners, with its four largest customers (Novartis Pharma AG, Teva Pharmaceutical Industries, Inc., Pernix Therapeutics, Inc., or Pernix, and Lannett Company, Inc.) having generated 99% of the company’s revenues in 2018, of which Teva Pharmaceutical Industries, Inc. generated 48% of revenue under one customer agreement, and Novartis Pharma AG, generated 38% of revenue combined under two separate customer agreements.

- If REPH were to lose the Teva or Novartis contract, it would be a major headwind.

- REPH is very dependent on one manufacturing facility which it owns. REPH owns a 97,000 square foot property in Gainesville, Georgia where it does almost all of its manufacturing. If this facility were to have operational issues it would negatively impact REPH’s stock price and prospects. However, REPH could transition manufacturing to its second plant, which it leases. Further, REPH does have insurance to cover any loss of income in the case that property and equipment is damaged.

Riviera Resources: A Cheap Energy Company with No Debt and Hidden Assets

Company: Riviera Resources

Ticker: RVRA

Price: 2.60

Market Cap: $151 million

Enterprise Value: $105 million

Price Target: 7.00

Upside: 169%

Recommendation: Buy Under 3

Recommendation Type: Rocket

Executive Summary

Riviera Resources is the rare energy company with no debt and valuable hidden assets that will grow in value over time. The company has been methodically selling assets and returning cash to shareholders through special dividends and share buybacks. Over the past three years, RVRA has invested over $300 million to build an impressive midstream asset that consists of a natural gas processing plant as well as crude, natural gas, and water gathering pipelines. I believe this asset will ultimately be worth $1 billion. If I’m right, RVRA will ultimately be worth 19 per share. If I’m wrong, downside is limited as the company has no debt, $54 million of cash and will generate positive free cash flow for the foreseeable future.

Background

Riviera Resources was a spin-off from post-bankruptcy Lynn Energy. At the time of the spin-off in 2018, it consisted of legacy mainly natural gas wells and acreage and a burgeoning midstream operation named Blue Mountain.

Since 2018, the management team has methodically sold assets and returned cash to shareholders through share buybacks and special dividends. In total, RVRA has generated $548 million through asset sales and has returned $550 million cash to shareholders through share repurchases and special dividends.

Currently, RVRA has upstream oil and gas assets, which it values at $88 million. Its most valuable asset is Blue Mountain, its midstream operation.

Blue Mountain, is centered in the core of the Merge play in the Anadarko Basin. The Blue Mountain reporting segment consists of a state of the art cryogenic natural gas processing facility, a network of gathering pipelines and compressors and produced water services and a crude oil gathering system located in the Merge/SCOOP/STACK play.

Since 2017, Riviera Resources has invested $328 million to build the Blue Mountain assets.

Business Outlook

Today, the outlook for oil and gas markets looks terrible.

The Covid-19 shutdown of the global economy has created an unprecedented economic demand drop that has resulted in a large oversupply of oil.

As a result, oil has plunged and actually went negative in April 2020 as there is so much oil being produced and nowhere to store it.

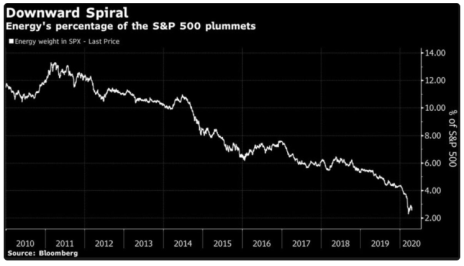

Negative oil prices are not lost on investors as Energy’s percentage of the S&P 500 has plunged to an all-time low.

But there’s a saying in the energy business: “The best cure for low oil prices is low oil prices.”

When prices are low, many energy companies will go bankrupt. The survivors will have zero incentive to explore for new oil leading to a shrinking supply.

Eventually when economic growth recovers, oil demand will increase and will exceed oil supply, leading to sharply higher prices.

The boom can last for some time as there will be fewer oil companies due to bankruptcies, and it will take the survivors time and investment to discover and produce enough oil to meet surging demand.

Eventually, “This too shall pass.” When it does the energy companies that survive will be particularly attractive.

Riviera management has given guidance that its Blue Mountain assets will be able to produce up to $145 million of EBITDA at full capacity. Because Blue Mountain has net cash on its balance sheet, it can be patient and wait out the downturn in energy markets.

Once the market turns (and it always does), Riviera will be well positioned to benefit.

Valuation and Price Target

The easiest way to value RVRA is on an asset by asset basis.

First, it has oil and gas properties that it values at $88 million. That value has probably dipped in the near term due to the fall in oil prices, but it will recover with time. To be conservative we can assume the properties are only worth $44 million.

Second and most importantly, Riviera Resources’ midstream business (Blue Mountain) has considerable value. On an annualized basis, it is generating $30.6 million of EBITDA. Its peers trade at an average EV/EBITDA multiple of 5.6x.

Using the same EV/EBITDA multiple, Blue Mountain is worth $171 million.

Finally, Riviera has $54 million of net cash on its balance sheet.

Adding up all of Riviera’s assets yields, a fair value is $270 million, or 4.50 per share, 73% higher than RVRA’s current share price.

I think a 4.65 fair value is conservative mainly because it significantly undervalues Blue Mountain.

Over the past three years, Riviera Resources has spent $328 million building Blue Mountain’s assets (pipelines, natural gas processing facility, and water gathering facility).

If we value Blue Mountain at its replacement cost, Riviera Resources is worth 7.35 per share.

If we give Blue Mountain credit for its expected future growth (management ultimately expects it to generate $145 million of EBITDA), it is worth $812 million (assuming the same 5.6x EV/EBITDA multiple). In this scenario, Riviera Resources is worth 15.70.

I think this scenario is likely within the next few years. After all, when I personally met with the CEO of Riviera Resources last year, he told me that “a $1 billion valuation for Blue Mountain is not unreasonable.”

I’m starting with a price target of 7.00, which implies 169% upside.

Risks

Continued low oil and natural gas prices will negatively impact RVRA’s valuation. Nonetheless, I believe downside is limited as an exceptionally bleak outlook is factored into RVRA’s current valuation. Further, I believe oil and gas prices will ultimately recover; again, the best cure for low oil prices is low oil prices.

HopTo Inc: A Fast-Growing Software Company Trading at a Dirt Cheap Valuation

Company: HopTo Inc.

Ticker: HPTO

Price: 0.39

Market Cap: $7.5 million

Enterprise Value: $3.3 million

Price Target: 0.70

Upside: 79%

Recommendation: Buy Under 0.45

Recommendation Type: Rocket

Executive Summary

HopTo is an incredibly small, profitable and growing, micro-cap software company that is completely under investors’ radar. Due to a recent offering which management and insiders backstopped, the company has $4.1 million of net cash on its balance sheet (55% of market cap), which provides a nice measure of downside protection. The company became profitable in 2019 and margins have significant room to increase over time. At its current valuation, the company is trading at an EV/EBIT multiple of 6.1x. Publicly traded peers in the Software industry trade at an average EV/EBIT multiple of 39.8x. My price target of 0.70 implies 79% upside.

Background

HopTo Inc. is a developer of application software, which includes application virtualization and cloud computing software for multiple computer operating systems. The company’s products are sold under the brand name GO-Global and are sold to small- to medium-sized companies, departments within large corporations, governmental and educational institutions, independent software vendors (ISVs) and value-added resellers (VARs). Its GO-Global includes different product families that include GO-Global for Windows, UNIX, and Client. The company generates revenue mainly through sales in the United States, Brazil, and other countries.

GO-Global enables office workers to work remotely, which is especially attractive in the current environment.

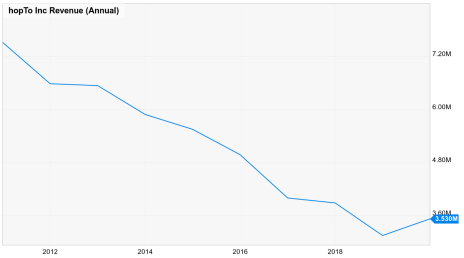

For years, hopTo was badly managed and revenue declined every year as shown in the chart below.

However, that changed in 2018, when an activist investor, Jonathan Skeels of Novelty Capital, started to buy stock in the company. Since then, he has taken control of the company.

As shown in the chart above, he has successfully turned around the revenue trajectory of the business as revenue grew 12% in 2019 and HopTo became profitable after years of losses.

Business Outlook

HopTo’s business outlook is quite strong.

In 2019, revenue grew 12%, and the business generated $0.5 million of operating income and $0.6 million of free cash flow. Commentary from management is sparse (no guidance), but the company is positioned well as its revenue is largely recurring and focused on enabling employees to work from home, an area which should continue to grow given the social distancing that is required by the Covid-19 pandemic.

I’m assuming revenue grows 10% in 2020 and that free cash flow grows by 31% to $0.9 million.

The other interesting aspect of hopTo’s business is that it has $70 million of net operating losses—quite a substantial amount for a $7.5 million market cap company with $3.5 million in revenue. As a result, hopTo will not be paying taxes for quite some time!

In addition, hopTo has a substantial (39) patent portfolio, which it is trying to sell.

Meanwhile, Skeels used to work at Davenport as an analyst focusing on intellectual property and subsequently worked at IP Navigation, a notorious patent troll.

He seems like the perfect candidate to try to monetize the company’s patents.

Finally, management just completed a rights offering. The rights offering was announced when the stock was trading at $0.59. The offering enabled existing investors to buy more of hopTo’s stock at a price of $0.30. For investors that didn’t participate, this rights offering diluted their stake in the company. But it was a positive event for investors that believe the company is undervalued and wanted to acquire shares at a discount.

Interestingly, there was a backstop provision that enabled a group of accredited investors led by Novelty Capital Partners (firm of CEO Jonathan Skeels).

What does this mean?

Through the rights offering, the CEO and his group of accredited investors were able to massively increase their stake in the company at a bargain basement price. Effectively, it was a massive insider buy and bodes well for the outlook of the stock.

Valuation and Price Target

In 2019, hopTo generated $0.65 million of free cash flow. I believe a 10x multiple is fair/conservative given the recurring nature of revenue. Pro forma for the rights offering, hopTo has $4.1 million of cash on its balance sheet. I value hopTo’s 39 patents at $2.8 million based on the rate at which hopTo has previously been able to monetize its patents. This could be very conservative given Skeels’ IP expertise. Add it all up and hopTo is worth 0.70, 79% higher than where it’s currently trading.

I believe this estimate is conservative as there is an upside scenario in which the company is able to monetize its patents for considerably more than $2.8 million. Management’s recent massive insider buy through the rights offering suggests this may be the case. Further, I expect free cash flow to grow by 27% in 2020. A 10x multiple on free cash flow is arguable too conservative. Finally, I believe downside is limited given the company has no debt and $4.1 million of cash on its balance sheet.

Risks

HopTo is an incredibly small company that has a history prior to 2019 of generating losses. If there were to be a hiccup in hopTo’s business it could return to losses.

- Since CEO Jonathan Skeels has taken over, the business has quickly turned around and become profitable. Given that the CEO and his accredited investor group recently participated heavily in a rights offering to buy more HPTO shares, I think it’s unlikely that we will see a reversal in revenue growth.

- HopTo’s business enables office workers to work remotely, which is especially attractive in the current environment. As such, I don’t think Covid-19 will have a negative impact on the business. It may even have a positive impact.

U.S. Neurological: A Tiny Net Net That is Worth Multiples of its Current Share Price

Company: U.S. Neurological

Ticker: USNU

Price: 0.14

Market Cap: $1.1 million

Enterprise Value: -$0.16 million

Price Target: 0.53

Upside: 278%

Recommendation: Buy Under 0.20

Recommendation Type: Slow and Steady

Executive Summary

U.S. Neurological Holdings (USNU) is a tiny, profitable company that is trading at a negative enterprise value. This means that company’s net cash on its balance sheet is worth more than the company’s market cap. This doesn’t make sense. Most negative enterprise companies are burning cash, but USNU is has generated $0.56 million of free cash flow on average over the past two years. Any reasonable estimate of fair value indicates this company is worth multiples of its current share price. However, the company is extremely illiquid and there are many days where no shares trade. Be patient and use limits to establish a position below $0.20.

Background and Business Outlook

U.S. Neurosurgical Holdings operates as a holding company in the United States. It is engaged in providing medical treatment and diagnostic services that include stereotactic radiosurgery centers, utilizing gamma knife technology, and holds interests in radiological treatment facilities. The company is focusing on establishing cancer centers using intensity-modulated radiation therapy. Its gamma knife is a stereotactic radiosurgical device used to treat brain tumors and other malformations of the brain without invasive surgery.

USNU’s business outlook is not positive as it experienced negative revenue growth of 11% in 2019 primarily driven by a lower average rate per procedure.

Nonetheless, the business has generated $0.56 million of free cash flow on average over the past two years. At the current valuation, the company is priced as if its operations have negative value. Again, that doesn’t make sense.

Valuation and Price Target

Given declining revenue, I’m only assuming a 5x free cash flow multiple on USNU’s average annual free cash flow generation of $0.56 million. Add in $1.3 million of net cash and I arrive at my fair value estimate of 0.53, significantly above USNU’s current share price.

Risk

The main risk is illiquidity. This is an extremely illiquid stock. As such, investors that establish a position need to recognize that they may not be able to sell their position in a timely fashion.

Nonetheless, I believe USNU is a compelling investment for an investor who can buy a position and “forget” about it. I think it’s likely that the company will eventually be sold for a significant premium to its current price. However, that sale could take years to materialize.

Updates on Current Recommendations

| Stock Name | Date Bought | Price Bought | Price on 4/27/20 | Profit | Rating |

| P10 Holdings | PIOE | 1.98 | 1.98 | 0.00% | Buy under 2.25 |

| Recro Pharma | REPH | 8.16 | 8.16 | 0.00% | Buy under 10.00 |

| Riviera Resources | RVRA | 2.60 | 2.60 | 0.00% | Buy under 3.00 |

| Hopto | HPTO | 0.39 | 0.39 | 0.00% | Buy under 0.45 |

| U.S. Neurological Holdings | USNU | 0.14 | 0.14 | 0.00% | Buy under 0.20 |

Glossary

Buy means accumulate shares at or around the current price.

Hold means just that; hold what you have. Don’t buy, or sell, shares.

Sell means the original reasons for buying the stock no longer apply, and I recommend exiting the position.

Sell a Half means it’s time to take partial profits. Sell half (or whatever portion feels right to you) to lock in a gain, and hold on to the rest until another ratings change is issued.

Please email me at rich@cabotwealth.com with any questions or comments about any of our stocks, or anything else on your mind.

The next Cabot Micro-Cap Insider issue will be published May 13, 2020.

Cabot Wealth Network

Publishing independent investment advice since 1970.

CEO & Chief Investment Strategist: Timothy Lutts

President & Publisher: Ed Coburn

176 North Street, PO Box 2049, Salem, MA 01970 USA

800-326-8826 | support@cabotwealth.com | CabotWealth.com

Copyright © 2020. All rights reserved. Copying or electronic transmission of this information is a violation of copyright law. For the protection of our subscribers, copyright violations will result in immediate termination of all subscriptions without refund. No Conflicts: Cabot Wealth Network exists to serve you, our readers. We derive 100% of our revenue, or close to it, from selling subscriptions to its publications. Neither Cabot Wealth Network nor our employees are compensated in any way by the companies whose stocks we recommend or providers of associated financial services. Disclaimer: Sources of information are believed to be reliable but they are not guaranteed to be complete or error-free. Recommendations, opinions or suggestions are given with the understanding that subscribers acting on information assume all risks involved. Buy/Sell Recommendations: All recommendations are made in regular issues or email alerts or updates and posted on the private subscriber web page. Performance: The performance of this portfolio is determined using the midpoint of the high and low on the day following the recommendation. Cabot’s policy is to sell any stock that shows a loss of 20% in a bull market or 15% in a bear market from the original purchase price, calculated using the current closing price. Subscribers should apply loss limits based on their own personal purchase prices.