Today, we are being a little contrarian and recommending an investment in a company that operates in a down and out industry. Nonetheless, we believe there is significant upside over the next couple of years.

This company’s characteristics include:

- High margins

- No capex requirements

- An 8% dividend yield

- A cheap valuation

All the details are inside this month’s Issue. Enjoy!

Cabot Micro-Cap Insider 1020

[premium_html_toc post_id="217687"]

Going Contrarian

Ideally, I like to look for companies that are operating in industries with secular tailwinds and long runways for growth (think Liberated Syndication or P10 Holdings).

I usually don’t like to invest in overly cyclical industries because a lot is out of the company’s control.

However, in certain circumstances it makes sense to invest in cyclical industries. The time to invest is when the industry has become hated and nobody thinks it will ever get better.

Such is the case with the energy industry right now, and I think it will ultimately pay to be a contrarian.

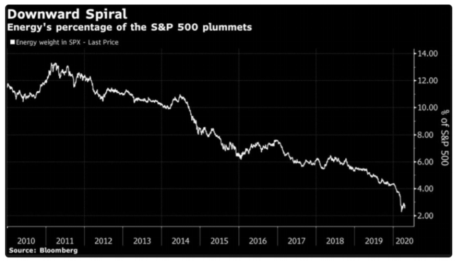

Energy used to represent over 10% of the S&P 500. Now, the industry accounts for less than 3% of the index.

While the world is moving away from fossil fuels, experts believe fossil fuels will remain an important source of energy for many decades to come.

As such, it’s appropriate to selectively invest in energy companies with good business models that are well capitalized.

I can’t tell you when (my guess is within three years) it will happen, but I’m highly confident that the energy markets eventually will turn.

This week, I’m recommending an energy name that has no debt, high margins and strong free cash flow generation. I’m highly confident it will be around in three years and believe it will be trading significantly higher.

This week, our monthly webinar will take place on Thursday, October 15 at 2 p.m. ET. We will review all open recommendations and answer subscriber questions. Feel free to email questions to me ahead of time at rich@cabotwealth.com and I can answer them during the webinar.

Now let’s get into my newest recommendation: Dorchester Minerals LP.

New Recommendation

Dorchester Minerals LP: An Energy Company with no Debt, High Margins, and a Low Valuation

Company: Dorchester Minerals LP

Ticker: DMLP

Price: 10.45

Market Cap: $362 million

Enterprise Value: $339 million

Price Target: 20

Upside: 91%

Recommendation: Buy Under 11

Recommendation Type: Rocket

Executive Summary

Dorchester Minerals LP (Dorchester) is the rare energy company with high margins and no capital expenditures. It generates tons of free cash flow and pays a dividend. Insiders have been gobbling up shares, and I believe the stock is a great long-term holding which will be trading significantly higher in three years. While waiting for the stock to appreciate, investors get to collect an ~8% dividend yield.

Background

Dorchester Minerals LP is an oil and gas royalty firm. This company has been on my watch list for several months, and I’m finally ready to pull the trigger. It owns land and offers oil and gas companies the ability to drill on its land in exchange for a royalty or a profit share.

It is the rare oil and gas company with a good business model. As a result of its business model, it has very low operating costs and generates very high margins (net income margin of 69% in 2019).

The company has no debt and pays out all its income to unit holders. Its unit price is depressed (similar to all other oil and gas companies), but zero debt means there’s no risk of bankruptcy, and it will thus rebound strongly once the energy industry rebounds. In the meantime, we get paid to wait with an attractive dividend.

Dorchester Minerals LP Overview

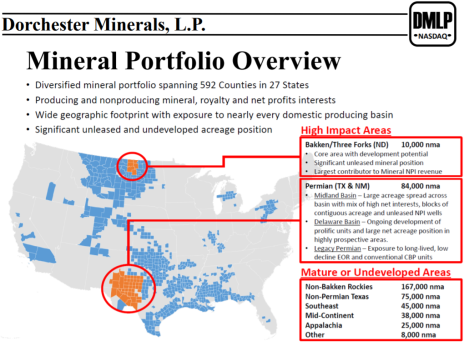

Dorchester is an oil and gas royalty firm. As shown below, it owns producing and nonproducing mineral, royalty, and net profit interests throughout the continental United States.

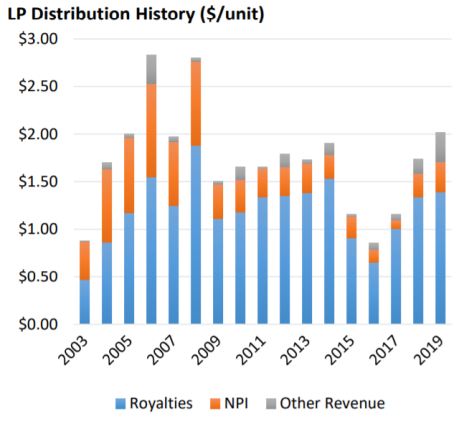

The company’s partnership agreement requires that it distributes all proceeds received from the royalty properties and net profit interests less certain expenses quarterly.

Historical distributions are listed here on the company’s investor relations webpage.

From 2003 through 2019, $29.54 has been paid out to unit holders.

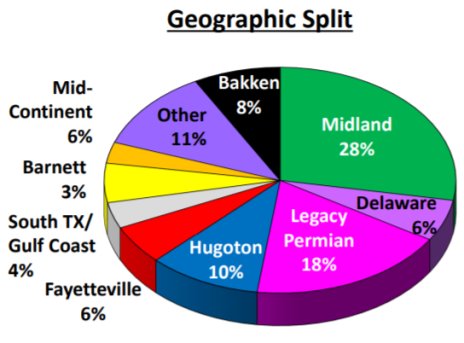

Dorchester is diversified from a geographic perspective, as shown below.

Business Outlook

The immediate outlook for Dorchester is quite poor, but counterintuitively, the best time to buy DMLP is when the outlook for the company is poor.

As they say in the energy business, “The best cure for low oil prices is low oil prices.”

When prices are low, there is little incentive to drill for new oil.

Further, many energy companies have gone bankrupt and many more will go bankrupt, taking additional capacity out of the market.

Eventually, when economic growth recovers, oil demand will increase and will exceed oil supply, leading to sharply higher prices.

The boom can last for some time as there will be fewer oil companies due to all the bankruptcies, and it will take time and investment to discover and produce enough oil to meet surging demand.

Currently, oil and gas companies are preserving capital in order to survive.

As a result, drilling is down substantially.

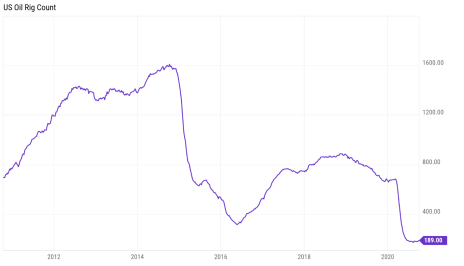

In fact, there are only 189 rigs in the United States drilling for oil currently, down 88% from 1,609 rigs in 2014, the last peak.

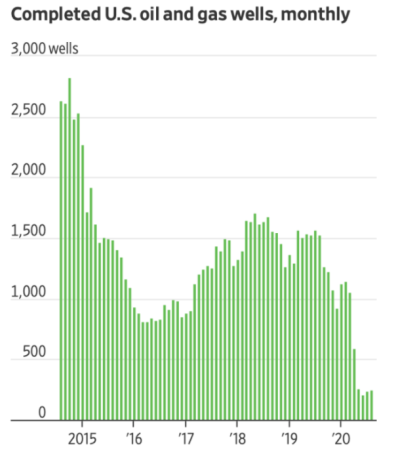

With sharply reduced drilling, very few new wells are being completed, as shown below.

Eventually, once global economies have completely recovered from the pandemic, oil demand will start to steadily increase and will inevitably outstrip oil supply, driving prices sharply higher.

The nice thing about Dorchester is it has no debt so investors can be patient as we wait for the recovery. And investors will get paid to wait.

During the last downturn in energy markets (2016), Dorchester made distributions to investors of $0.85. At its current stock price, that works out to a yield of 8.1%. Dorchester’s most recent distribution was $0.226, or $0.904 annualized (an implied 8.6% yield).

Famed investor Carl Icahn recently suggested that in three years, investors may regret not buying energy companies when they were a bargain. I 100% agree.

The company discloses the following in its latest annual report:

“Because certain expenses vary directly with oil and natural gas sales prices and volumes, we anticipate that sufficient funds will be available at all times for payment of these expenses.”

This statement gives me confidence that Dorchester will be able to survive the downturn, no matter how long it lasts.

One other appealing aspect of Dorchester Minerals is that it can be owned in tax free investment accounts (although I’m definitely not an expert in taxes or a tax advisor!).

Investors who hold limited partnerships inside an individual retirement account (IRA) can create tax liabilities even for tax-deferred accounts due to the generation of unrelated business taxable income, or UBTI.

However, Dorchester has a stated objective of being “UBTI free.”

As such, this stock appears to be a great candidate to tuck away in a retirement account and forget about until energy markets turn.

Insider Buying

Insiders have been aggressive buyers of DMLP over the past six months, as shown below. That is usually a good sign. Insiders own ~9% of shares outstanding. I would prefer to see higher insider ownership, but am satisfied with ~9% given insiders have consistently bough additional shares in the open market.

Valuation and Price Target

Dorchester Minerals is cheap any way you look at it.

The stock is currently yielding 14.99% based on its last four distributions. On a forward looking basis, it’s yielding ~8.0%.

On a trailing twelve-month basis, the stock is trading at 6.3x free cash flow. Its 10-year median price to free cash flow multiple is 12.9x. As such, the stock is trading at a 50%+ discount to its typical valuation.

This valuation is very cheap for any company, but especially so for a company that has 57% operating margins and no capex!

DMLP is more liquid than the typical micro cap, but it still makes sense to use limits. Be patient buying DMLP as I consider this a longer-term investment than my typical recommendation.

My rating for DMLP is Buy Under 11.

Risks

- Energy markets remain in the doldrums for the long term.

- While this is certainly a risk, Dorchester Minerals has no debt and can withstand a prolonged downturn.

- Counter-party risk.

- If the driller that operates the land on which Dorchester owns mineral rights goes bankrupt, there is a chance that Dorchester’s interests could be at risk. My understanding is that Dorchester’s interests would remain intact, but I’m doing my due diligence to limit this risk further.

Recommendation Updates

Changes This Week

Moving RVRA to Hold.

Updates

BBX Capital (BBXIA) has come down since spiking after my initial recommendation last week. BBX Capital is an obscure micro-cap spin-off that is trading too cheaply. Factoring in a note receivable due within five years, it is trading at 40% of its cash and notes receivable. Further, the company has valuable operating assets that generate positive free cash flow. Despite poor historical corporate governance, BBXIA shares trade far too cheaply. I see 100%+ upside. Buy under 5.00.

Greystone Logistics (GLGI) was flat on the week. In September, CEO and President Warren Kruger disclosed that he purchased an additional 1,000 shares of GLGI in the open market at a price of $1.02. In total, Kruger owns over 30% of the company. As such, we are well aligned as we both will benefit from continued strong operational performance and stock price increases. Greystone reported earnings recently for its fiscal year ended May 31. Quarterly revenue was $18.3 million, down 13% from a year ago. In its press release, the company noted that demand from customers continues to grow. Its biggest challenge is maintaining an adequate workforce as many employees have opted to stay at home for protection from COVID-19. The company reported $0.06 of GAAP EPS that was helped by an unusual tax benefit. On a normalized basis, the company generated $0.03 in EPS, consistent with my expectations. Thus, in the last fiscal year, the company generated $0.12 of EPS and is trading at 7.8x earnings. This is too cheap for a company that has historically grown revenue at a 20%+ CAGR and just grew EPS 140%. Buy under 1.10.

HopTo Inc (HPTO) was flat on the week. In the company’s most recent quarter, revenue grew 49%. Quarterly revenue growth is very lumpy so I’m not going to get too excited, but it’s good to see that year-to-date revenue is up 7%. Here’s my current thinking on hopTo’s valuation. In the first six months of 2019, hopTo generated $389.9k of earnings before interest and taxes (EBIT), or $779.8k annualized. I think a 12x multiple is fair, which works out to a $9.4MM enterprise value for these cash flows. This arguably is a cheap multiple for a software company, but the company is tiny and I’m not convinced it really has a sustainable competitive advantage. Next, we can add the value of hopTo’s 39 patents, which I value at $2.8MM based on where hopTo has sold other patents. Finally, we can add hopTo’s cash balance of $4.5MM (pro forma for the rights offering). Add it all up and you get a fair market cap of $16.65MM, or $0.89 per share. HopTo is currently trading at an EV/EBIT multiple of 8.3x. This is too cheap. To put it in perspective, the software and internet industry trades at an average EV/EBIT multiple of 55.8x. Buy under 0.55.

Liberated Syndication (LSYN) was flat on the week. Recently, LSYN announced that it has partnered with Player FM to distribute its podcasts on the Player FM podcast app. This is just another example of Libsyn partnering with all podcast distributors to ensure that podcast hosted episodes are available everywhere. Recently, there have been several insider purchases. New CFO Richard Heyse has purchased 40,000 shares through several different transactions, while Eric Shahinian (the activist investor) bought an additional ~15,000 shares. In total, Shahinian owns almost 7% of the company. Libsyn recently reported an excellent quarter and hosted a helpful and transparent conference call. In the second quarter, revenue grew by 11.4%. Podcast hosting grew 11.1% while website hosting grew 14.3%. I was a little surprised that podcast revenue didn’t grow more strongly, but management commented that podcast listening has been down due to less commuting time. Nonetheless, I expect podcast listening and Libsyn podcast revenue to reaccelerate over time. Buy under 3.75.

MamaMancini’s Holdings (MMMB) was flat on the week. In the most recent quarter, revenue growth of 28% was very impressive. Even more impressive, EPS grew 104% to $0.02 as the company continues to leverage its fixed costs. One area of weakness was in gross margins, which were lower than expected due to higher beef prices, but management commentary in the press release suggests that this pressure is starting to dissipate. MamaMancini’s continues to execute well and the investment case remains on track. It has historically grown revenue at a 24% CAGR yet only trades at a P/E of 16.0x. Management owns over 50% of the stock, ensuring that incentives are aligned. Further, the company has a clean balance sheet. Buy under 2.00.

Medexus Pharma (MEDXF) was flat on the week and continues to look attractive. In its most recent quarter, Medexus reported revenue growth of 71%. The company generated $4.1 million of free cash flow in the quarter, or $16.4 million annualized. As such, MEDXF is currently trading at a price to free cash flow multiple of 3.4x. On an EV/Revenue basis, MEDXF trades at 0.9x while slower growing peers trade at 3.7x. This is a good stock to average up in as the company continues to execute yet remains undervalued by the market. Buy under 3.50.

NamSys Inc. (NMYSF) recently reported fiscal Q3 earnings (quarter ended July 31). Revenue grew 11.8%, which is pretty impressive given pandemic related headwinds. Gross margins were under pressure due to an accrual of management bonuses as well as increased staffing related costs. I’m not concerned with the management bonus as it is based on continued strong execution. The increased staffing costs relate to the high demand and required salary for software engineers/programmers. I will monitor this going forward. The most important factor for NamSys is continued revenue growth. Despite historically growing revenue and earnings at a compound annual growth rate of 20%+, the stock only trades at 19.7x 2019 earnings. It has a pristine balance sheet with significant cash and no debt, and insiders own over 40% of the company, ensuring strong alignment. Buy under 0.80.

P10 Holdings (PIOE) was flat on the week. In August, the company announced a transformative acquisition, and the stock has rallied sharply. It will be acquiring TrueBridge Capital Partners, a venture capital firm with $3.3BN in assets under management. TrueBridge’s strategy is to invest in micro and venture funds. P10 holdings is paying $159MM for the acquisition. To pay for the deal, P10 is issuing convertible preferred debt that will yield 1% and has the right to convert into P10 stock at a conversion price of 3.30 (PIOE’s share price was 2.58 before the deal was announced). Pro forma for this deal, P10 expects to generate $55MM in EBITDA on a run rate basis by the end of 2020. As such, the stock is trading at 13.0x EBITDA. This isn’t a dirt-cheap valuation, but it remains reasonable. P10’s most comparable company is Hamilton Lane, which trades at 30x forward EBITDA. Nonetheless, given the stock’s sharp increase, I recently moved my rating to Hold. Hold.

Riviera Resources (RVRA) Riviera Resources recently published a press release that it will make a $1.35 distribution on October 27. It will make an additional distribution of $0MM to $40MM ($0.00 to $0.69 per share) at a later date. This is disappointing news. I had expected proceeds of closer to $2.48, but Riviera’s estimate implies total distributions of only $2.04 at the high end and $1.69 at the midpoint. Clearly the dissolution process will be more expensive than I had estimated. Management tends to be pretty conservative in its guidance, thus, I think it’s likely that ultimate distributions will be closer to the high end of the estimated range. As such, I’m estimating the remaining proceeds (after the first transaction) will be $30MM. If this is accurate, there will be $1.87 of total distributions.

My best guess is there will be a second distribution made in November or December and then a small amount of capital will be kept on the balance sheet as the dissolution is completed (sometimes it can take a year or longer). Given the recent news, I’m downgrading Riviera to Hold. Hold.

U.S. Neurological Holdings (USNU) was flat on the week. The company recently reported a solid quarter. While revenue declined by 28% due to hospital procedures being delayed, the company continued to generate strong cash flow, and expects operations to return to normal soon. Currently, the company has $2.0 million ($0.26 per share) of cash and no debt on its balance sheet. U.S. Neurological Holdings operates as a holding company in the United States. It is engaged in providing medical treatment and diagnostic services that include stereotactic radiosurgery centers, utilizing gamma knife technology, and it holds interests in radiological treatment facilities. Buy under 0.25.

Watch List

This month, SOFO remain on my watch list.

Sonic Foundry (SOFO) is a video software company that specializes in solutions that cater to the education market. The company has struggled over the past three years but appears to be very well positioned to increase sales in the COVID-19 world as many schools will be embracing remote classes. Further, Sonic’s chairman recently tried to take the company private at $5.00 per share but relented when minority shareholders complained that this price was too low.

Recommendation RATINGS

| Stock | Price Bought | Date Bought | Price 10/14/20 | Profit | Rating |

| BBX Capital (BBXIA) | 3.17 | 10/5/20 | 3.40 | 7% | Buy under 5.00 |

| Dorchester Minerals LP (DMLP) | 10.45 | 10/14/20 | 10.45 | 0% | Buy under 11.00 |

| Greystone Logistics (GLGI) | 0.81 | 7/8/20 | 0.90 | 11% | Buy under 1.10 |

| Hopto Inc (HPTO) | 0.39 | 4/28/20 | 0.52 | 33% | Buy under 0.55 |

| Liberated Syndication (LSYN) | 3.06 | 6/10/20 | 3.72 | 22% | Buy under 3.75 |

| MamaMancini’s Holding (MMMB) | 1.76 | 8/12/20 | 2.05 | 16% | Buy under 2.00 |

| Medexus Pharma (MEDXF) | 1.78 | 5/13/20 | 2.93 | 65% | Buy under 3.50 |

| NamSys Inc (NMYSF) | 0.65 | 9/9/20 | 0.73 | 12% | Buy under 0.80 |

| P10 Holdings (PIOE) | 1.98 | 4/28/20 | 4.10 | 107% | Hold |

| Riviera Resources (RVRA) | 2.60 | 4/28/20 | 1.60 | -10%* | Hold |

| U.S. Neurological Holdings (USNU) | 0.14 | 4/28/20 | 0.25 | 79% | Buy under 0.25 |

*Includes 0.75 distribution

Glossary

Buy means accumulate shares at or around the current price.

Hold means just that; hold what you have. Don’t buy, or sell, shares.

Sell means the original reasons for buying the stock no longer apply, and I recommend exiting the position.

Sell a Half means it’s time to take partial profits. Sell half (or whatever portion feels right to you) to lock in a gain, and hold on to the rest until another ratings change is issued.

Disclosure: Rich Howe owns shares in BBXIA, HPTO, PIOE, MEDXF, LSYN, GLGI, and RVRA. Rich will only buy shares after he has shared his recommendation with Cabot Micro-Cap Insider members and will follow his rating guidelines.

The next Cabot Micro-Cap Insider issue will be published on November 11, 2020.

Cabot Wealth Network

Publishing independent investment advice since 1970.

CEO & Chief Investment Strategist: Timothy Lutts

President & Publisher: Ed Coburn

176 North Street, PO Box 2049, Salem, MA 01970 USA

800-326-8826 | support@cabotwealth.com | CabotWealth.com

Copyright © 2020. All rights reserved. Copying or electronic transmission of this information is a violation of copyright law. For the protection of our subscribers, copyright violations will result in immediate termination of all subscriptions without refund. No Conflicts: Cabot Wealth Network exists to serve you, our readers. We derive 100% of our revenue, or close to it, from selling subscriptions to its publications. Neither Cabot Wealth Network nor our employees are compensated in any way by the companies whose stocks we recommend or providers of associated financial services. Disclaimer: Sources of information are believed to be reliable but they are not guaranteed to be complete or error-free. Recommendations, opinions or suggestions are given with the understanding that subscribers acting on information assume all risks involved. Buy/Sell Recommendations: All recommendations are made in regular issues or email alerts or updates and posted on the private subscriber web page. Performance: The performance of this portfolio is determined using the midpoint of the high and low on the day following the recommendation. Cabot’s policy is to sell any stock that shows a loss of 20% in a bull market or 15% in a bear market from the original purchase price, calculated using the current closing price. Subscribers should apply loss limits based on their own personal purchase prices.