I usually wait until the second Wednesday of the month to share my latest micro-cap recommendation with you, but in this case, I couldn’t wait.

I closely follow stock spin-offs and occasionally, they present incredible opportunities.

I believe the recent spin-off of New BBX Capital (BBXIA) from Bluegreen Vacation Holdings (BVH) represents one such opportunity.

Oftentimes spin-offs are priced very cheaply in initial trading, and so I wanted to share this recommendation now in case the opportunity has disappeared by next week.

Next week, I will publish my next issue of Cabot Micro-Cap Insider, and with it, a new recommendation.

So consider this recommendation a “bonus” stock idea.

New BBX Capital: A Micro-cap Spin-off Trading at a Negative Enterprise Value

October 5, 2020

Ticker: BBXIA

Price: 2.73

Market Cap: $52.2MM

Enterprise Value: -$2.7MM

Recommendation: Buy under 5.00

Price Target: 7.52 (+178%)

Recommendation Type: Quick Trade

Summary

New BBX is an obscure micro-cap spin-off that is trading at a negative enterprise value. Factoring in a note receivable due within 5 years, it is trading at 40% of its cash and notes receivable. Further, the company has valuable operating assets that generate positive free cash flow. Despite poor historical corporate governance, New BBX trades far too cheaply. I see 100%+ upside.

Background

On June 17, 2020, BBX Capital announced that it would spin-off all non-Bluegreen related businesses into a new public company.

At the time of the spin-off announcement, BBX Capital owned the following assets:

- 93% of Bluegreen Vacation Corp (BXG), a public timeshare company

- BBX Capital Real Estate LLC, which owns various real estate properties and joint venture investments

- BBX Sweet Holdings, LLC, which owns various businesses in the confectionary (candy) industry

- Renin Holdings, LLC, manufactures sliding doors and other home products

The idea behind the spin-off was that BBX Capital was trading at a huge discount to its net asset value and a separation would close that discount.

The spin-off took place on October 1, 2020, and BBX Capital spun off all non Bluegreen assets into a new company called New BBX Capital which trades under the ticker BBXIA.

The remaining company changed its name to Bluegreen Vacation Holding Company (BVH) as it’s only asset (besides cash and debt) is its 93% ownership stake in Bluegreen Vacation (BXG).

New BBX Capital’s Market Value is Dislocated with Underlying Assets

I initially hadn’t spent too much time on this spin-off transaction due some corporate governance concerns which I will discuss later.

But after seeing where BBXIA started to trade, it is clear the stock is being valued at a small fraction of any reasonable estimate of fair value, even assuming a large discount for corporate governance concerns.

Valuation

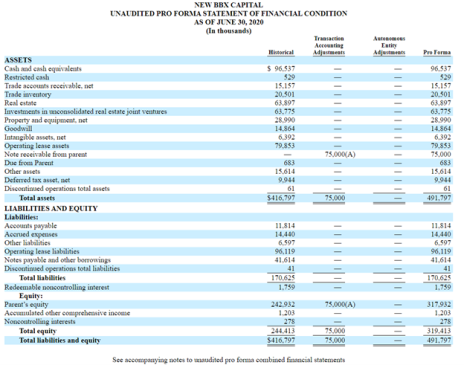

As disclosed in the spin-off’s Information Statement, New BXX Capital has a strong balance sheet as shown below.

If we just consider cash and cash equivalents ($96.5MM) and other borrowings ($41.6MM), we can see that the company has net cash of $54.9MM. At Friday’s closing price, New BBX Capital has a market cap of $52.2MM (19.28MM shares outstanding). Thus, the company is trading at a negative enterprise value before considering its other assets.

The next most important asset to consider is a $75MM note receivable from its parent company, Bluegreen Vacation Holding Company (BVH). This note pays 6% interest per year and is due in 5 years. Bluegreen Vacation Holding Company is reliant on dividend payments from Bluegreen Vacation. If Bluegreen Vacation goes bankrupt, New BBX Capital would not be able to collect its $75MM note receivable. While anything is possible, Bluegreen Vacation generated $4.4MM in free cash flow in the first half of 2020 despite the pandemic. In normal times, Bluegreen Vacation is an incredibly cash generative business. In the past five years, Bluegreen has paid out $257MM in dividends (it currently has a $382MM market cap).

Besides cash and the note receivable, New BBX Capital has three businesses:

BBX Capital Real Estate LLC

BBX Real Estate acquires, develops, constructs and manages real estate.

BBX Capital originally got into the real estate business after it sold its banking business to BB&T Corporation in 2012, but retained certain real estate assets and non-performing loans that it worked out.

In addition, BBX Capital Real Estate owns a 50% equity interest in The Altman Companies, a developer and manager of multifamily apartment communities. BBX Capital Real Estate had total assets of $161.9 million as of June 30, 2020.

BBX Sweet Holdings, LLC

BBX Capital has acquired many companies in the confectionery (candy) industry, including IT’SUGAR, Hoffman’s Chocolates and Las Olas Confections and Snacks. IT’SUGAR is a specialty candy retailer which operates in retail locations throughout the United States. Its products include bulk candy, candy in giant packaging, and novelty items that are sold at its retail locations, which include a mix of high-traffic resort and entertainment, lifestyle, mall/outlet, and urban locations across the United States.

Hoffman’s Chocolates is a retailer of gourmet chocolates with retail locations in South Florida. Las Olas Confections and Snacks is a manufacturer and wholesaler of chocolates and other confectionery products.

BBX Sweet Holdings had total assets of $133.2 million as of June 30, 2020.

It was recently disclosed that IT’SUGAR has filed for reorganization. Thus, I’m assuming that the entire confectionary division is worth $0. This is probably conservative.

Renin Holdings, LLC

Renin is engaged in the design, manufacture, and distribution of sliding doors, door systems and hardware, and home décor products. It operates through its headquarters in Canada and two manufacturing and distribution facilities in the United States and Canada. Renin had total assets of $35.9 million as of June 30, 2020.

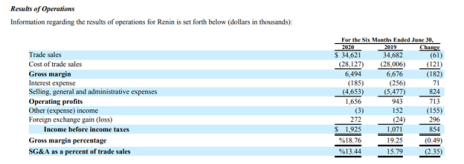

In 2020, Renin’s profitability has spiked due to lower spend on travel and trade show costs.

I assume Renin is worth $14.4MM (8x 2019 EBIT of $1.8MM).

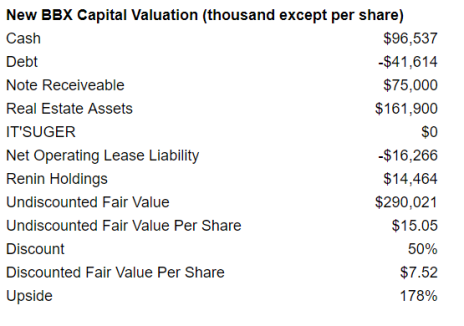

What’s it Worth

New BBX also has operating lease assets and liabilities that net to an operating lease liability of $16.2MM. I will subtract this from my fair value estimate.

If you add it all up, you get a fair value of $15.05 per share versus BBXIA’s current share price of $2.71.

Even if you apply a 50% discount, you still reach a fair value of $7.52.

Will This Business Generate or Consume Cash Going Forward?

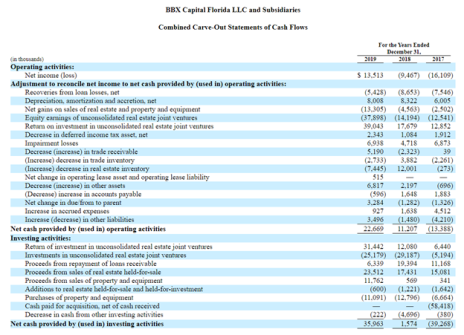

In 2018 and 2019, New BBX Capital generated positive free cash flow as shown below. Further, historically real estate activity has been a net generator of cash.

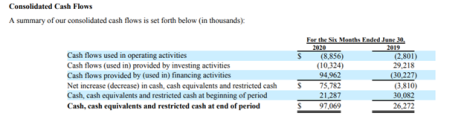

Through the first 6 months of 2020, New BBX Capital has consumed ~$19MM of free cash flow (as shown below), but in a normalized environment, New BBX Capital should generate cash or at least be breakeven.

Why Does This Opportunity Exist?

First, it’s a spin-off. Oftentimes, dislocations are associated with spin-offs—especially with micro-cap spin-offs with no when-issued trading.

Second, corporate governance issues.

Initially, I didn’t spend much time on this spin-off because corporate governance left a bad taste in my mouth.

In the Information Statement for the spin-off, it reads:

As described in further detail in the Information Statement, in contemplation of the Spin-Off, the Parent’s Compensation Committee approved the acceleration of vesting of all unvested restricted stock awards that were previously granted by the Parent, all of which were held by the Parent’s executive officers. In connection with such vesting acceleration, the Parent will recognize compensation expense during the quarter ending September 30, 2020 of approximately $19.8 million (which represents the unrecognized compensation expenses associated with the restricted stock awards as of June 30, 2020). In addition, the Parent’s Compensation Committee approved the payment, prior to the consummation of the Spin-Off, of a total of approximately $19.5 million in cash to the Parent’s executives for 2020 services and the payout of cash to settle the Parent’s long-term incentive program for 2020 (which, in previous years, was generally paid primarily in stock awards).

This looks pretty egregious to me.

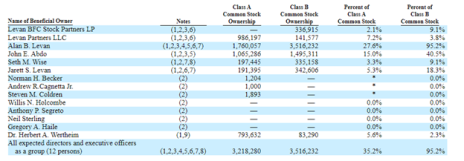

As shown below, Alan Levin controls the stock based on his class B share ownership and basically dictates executive compensation.

However, New BBX Capital is trading at such a discount to any reasonable estimate of fair value, that I’m willing to hold my nose and buy the stock.

Further, Mr. Levan owns 27.6% of the common stock, and as such, is incentivized to increase value at the company. Also, the BBX Capital team strikes me as relatively savvy capital allocators. The company sold BankAtlantic Bancorp, Inc to BB&T in 2012, but retained certain real estate which it was able to monetize effectively.

This article explains how they took advantage of weakness in Bluegreen Vacation to acquire shares in the company and ultimately take it private before taking the company public again.

If New BBX Capital trades at a big discount to fair value, I would be surprised if management didn’t try to take the company private.

Conclusion

While corporate governance and executive compensation issues at New BBX Capital are concerning, the stock is trading at a completely dislocated price relative to the value of the company’s assets. It’s hard to estimate exactly what the stock is worth, but I’m confident it’s worth significantly more than its current share price.

Risks

? Real estate value is overestimated.

? I’m not a real estate expert, and it’s difficult to estimate the company’s real estate value with precision. However, the company has historically generated significant proceeds from its real estate activities. Further, one can discount my real estate fair value estimate by 50% or more and still be in good shape

? Value is destroyed by poor acquisitions.

? While the company’s acquisitions in the confectionery industry have not worked out, it has been successful in the real estate industry and with its Bluegreen Vacations investment.

? Continued poor corporate governance.

? Unfortunately, I think this is likely to continue. Nonetheless, this risk is well established, and the stock’s current price reflects it fully.