Today, we are recommending a biotech company.

The company is trading well below an offer to take it private and has numerous other catalysts on the horizon.

This company’s characteristics include:

- Insiders own over 40% of the company.

- A proxy fight - A hedge fund is lobbying to have the company sold to the highest bidder.

- Royalty income streams which provide downside protection.

- Much, much more.

All the details are inside this month’s Issue. Enjoy!

Cabot Micro-Cap Insider 321

[premium_html_toc post_id="226849"]

Value is Pulling Away From Growth

Value investors have waited a long time for this.

After suffering through one of the worst periods of relative underperformance ever, value is outperforming.

Not only is value outperforming, but it feels like some of the froth is being sucked out of the market.

Tesla (TSLA) is down 36% from its all-time highs. Nikola (NKLA) is down 49%. Many SPACs are suddenly trading for less than their cash holdings.

However, in a few instances, the baby is getting thrown out with the bath water.

In the case of Tesla, it was inevitable that the stock would have a significant correction. Yes, Tesla is the leader in the rapidly growing electric vehicle market, but even with the pullback, it’s trading at 16.9x sales. That’s an expensive valuation …for a software company! Perhaps, ultimately, Tesla will actually become a software company. But for now, it’s an automobile manufacturer. Nikola is even worse. It trades for a market cap of $5.7BN but has $0 in sales.

But consider companies like Medexus Pharma (MEDXF).

The only thing going against Medexus is it’s up 200% since the pandemic lows. So perhaps investors thought it was due for a pullback. But the company just announced a transformative licensing deal that will enable it to double sales.

In the first nine months of its fiscal year, sales are up 70%. Yet the stock is only trading at 1.3x sales.

This fiscal year, Medexus should generate ~$110MM in sales. But with its current portfolio of drugs, it should be able to generate $350MM to $400MM of sales within a few years.

Just last week, I spent an hour on the phone with the CEO and CFO of Medexus to ensure I wasn’t missing anything. It was a great conversation and increased my conviction level in the outlook.

This week, our monthly webinar will take place on Thursday, March 11 at 2 p.m. ET. We will review all open recommendations and answer subscriber questions. Feel free to email questions to me ahead of time at rich@cabotwealth.com and I can answer them during the webinar.

Now let’s get into my newest recommendation: Aptevo Therapeutics (APVO).

New Recommendation

Aptevo Therapeutics: Merger Arbitrage with Material Upside

Company: Aptevo Therapeutics

Ticker: APVO

Price: 32.01

Market Cap: $140 million

Enterprise Value: $140 million

Price Target: 50.00

Upside: 56%

Recommendation: Buy Under 40.00

Recommendation Type: Quick Trade

Executive Summary

Aptevo is a biotech company with a promising pipeline yet a very low valuation. Tang Capital has an offer outstanding to purchase the company for 50 per share, significantly above where the stock currently trades. Tang is also undertaking a proxy contest to get two board seats and to run a sales process to sell the company to the highest bidder. Downside is limited given Aptevo’s strong balance sheet and royalty income streams yet upside potential is substantial given the blockbuster potential of its pipeline. Aptevo looks like a great asymmetric bet.

Aptevo Corporation Overview

Aptevo Therapeutics is a 2016 spin-off from Emergent BioSolutions (EBS). At the time of the spin-off, Aptevo consisted of several revenue producing drugs and a pipeline of other drugs in development.

Over time, Aptevo has sold off its revenue producing drugs to fund its R&D in its pipeline. Aptevo does receive royalties on the sales of two drugs (Medexus and Ruxience), which is quite valuable (more on this below).

Right now, Aptevo has a pipeline of drugs that are focused on bispecific therapeutics. Bispecific therapeutics are antibody-based molecules that are able to bind to multiple targets of therapeutic interest. What does this mean? Well, to take a cancer as an example, a bispecific therapy could attack and destroy a cancer tumor while simultaneously stimulating the patient’s immune system to recognize and attack the cancer tumor. Thus, the drug could attack the cancer from two different angles.

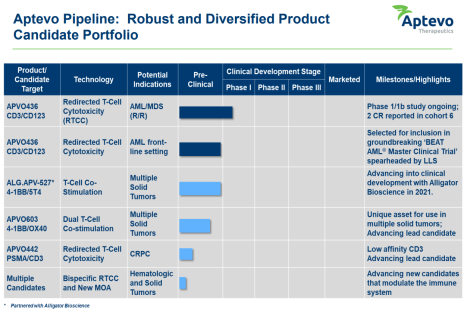

Aptevo has a sizeable number of drugs in development.

While I don’t claim to be a biotech expert, bispecific therapeutics appear to be a hot market.

Recently large pharma and biotech companies have shelled out large amounts of capital to partner with up-and-coming bispecific companies.

Example #1:

Eli Lilly recently agreed to pay Merus NV (MRUS) $40MM in upfront cash, invest $20MM into the company and pay the company up to a total of $1.6BN based on certain milestones being achieved in its bispecific pipeline.

Example #2:

Novartis (NVS) paid Xencor (XNCR) $150MM up front, plus up to $2.5BN in milestone payments in a partnership on the Xencor bispecific pipeline.

Example #3:

Johnson & Johnson (JNJ) paid Macrogenics (MGNX) $75MM upfront and up to $750MM in total if it hits certain milestone targets.

This all seems very exciting.

The only problem is Aptevo has been touting its pipeline and pursuing partnerships with large pharma since the time of its spin-off five years ago, with very little to show for it.

But it looks like that is all about to change.

Business Outlook

Aptevo’s most promising drug in development is called APVO436. It is currently being tested in preclinical and Phase I trials for patients with Acute Myeloid Leukemia (AML) and Myelodysplastic syndromes (MDS). AML is a type of cancer of the blood and bone marrow with excess immature white blood cells. Myelodysplastic syndromes (MDS) are an often unrecognized, under-diagnosed rare group of bone marrow failure disorders, where the body no longer makes enough healthy, normal blood cells in the bone marrow. MDS is also known as a form of blood cancer.

In November 2020, Aptevo announced excellent early results from a trial of APVO436.

Two patients out of eight who were given the drug in a cohort of the trial demonstrated a complete response. A complete response basically means that signs of cancer went away. This is incredibly promising!

When the first complete response was announced, the stock started to skyrocket. It became apparent later why.

A hedge fund named Tang Capital was buying the stock indiscriminately.

By the time Tang Capital was done buying shares, the hedge fund owned 42.5% of the company’s shares.

The company scrambled to adopt a “poison pill,” which prevented Tang from acquiring any more shares of the company. A poison pill is a tool that companies can use to prevent an unsolicited acquisition at too low of a price.

When Tang was effectively banned from buying any more shares due to the poison pill, it offered 50 per share for the remaining shares of the company.

The stock initially rallied to the mid-40 range, but has since declined as management has failed to engage with Tang about a potential acquisition.

Tang decided to run a proxy contest and is hoping to achieve the following:

- Two seats on Aptevo’s board of directors

- To add a question at the annual meeting on whether shareholders want management to run a process to sell the company to the highest bidder.

Given that Tang owns over 40% of shares outstanding, I believe it’s highly likely (it only needs 10.1% of shareholders to support its proposals) that it wins its proxy contest.

Further, management does not have much control as they own less than 10% of shares outstanding.

Let’s take a step back. Who is Tang Capital?

To be honest, I didn’t know much about Tang Capital prior to this news. But I did some digging and here is what I found.

Tang Capital is run by Kevin Tang. Prior to founding his hedge fund, he was most recently the managing director and head of Life Sciences research group at Deutsche Banc Alex Brown.

It’s hard to get a sense of Tang Capital’s returns, but from what I can tell, they are excellent.

This article is dated, but it claims that Tang Capital delivered annual returns of 26% from 2002 to 2012.

I’m not a biotech expert, but I’m essentially riding Kevin Tang’s coattails here.

It’s reassuring to know that another healthcare focused hedge fund (RTW Investments) recently bought shares of Aptevo (6.6% of shares outstanding). RTW Investments also appears to be a very good biotech investor as it claims to have generated a 370% IRR and 3.1x multiple of invested capital on its private investments.

Downside Protection

The other attractive aspect about Aptevo is there is significant downside protection as the company is currently exploring monetizing its two royalty streams.

Aptevo receives 2% of IXINITY sales, but starting on June 30, 2022 its royalty on IXINITY will increase to 5%. I estimate sales of IXINITY are currently $40MM per year and growing quickly. Aptevo will receive its royalty through the year 2035. By my estimate, Aptevo will receive $43MM in total royalties from IXINITY, or $19MM in present value (discount rate is 10%).

Further, Aptevo will receive royalty payments from Pfizer for sales of biosimilar rituximab for seven years. By my estimate, Aptevo should receive $49MM of royalty payments for rituximab, or $33MM in present value (discount rate is 10%).

The present value of Aptevo’s royalty streams add up to $52MM. So assuming Aptevo’s pipeline is worth zero (despite incredibly promising results), the company should be worth $52MM, or 11.89 per share.

Insider Ownership

While management doesn’t own much stock, Tang Capital owns more than 40% of shares outstanding and will do everything it can to ensure that shareholder value is maximized.

Strong Balance Sheet

Aptevo has cash on its balance sheet of $44MM, which provides financial runway until 2022 when it may have to raise additional capital.

Valuation and Price Target

It’s hard to value Aptevo with certainty, but I like the setup.

There is a current offer to purchase the company for 50 per share by an expert biotech investor who controls over 40% of shares outstanding.

Given that Tang Capital owns over 40% of shares outstanding, I think it’s probable that it wins its proxy contest and shareholders vote to sell the company to the highest bidder.

Selling the company for 50 per share would be a win for shareholders who buy today, but there is the potential that another bidder comes in and pays multiples of 50 per share.

APVO436 is being tested in MDS and AML. Assuming ~25,000 new patients per year at a price of $50,000 per treatment implies $1.3BN of revenue for APVO436. Generally biotech companies can sell for 2x to 3x peak sales. Thus, there is a possibility that Aptevo is eventually sold for several billion dollars.

This setup looks like an attractive asymmetric opportunity, with limited downside given strong clinical data and valuable royalty streams and potentially massive upside.

As always, use limits when buying micro-caps.

My official rating is Buy under 40.00.

Risks

- Acquisition fails. Tang Capital could withdraw its bid for the company. If this were to occur, shares would likely fall. Nonetheless, given that Tang controls so many shares, I think it’s highly likely that it wins its proxy context and the company is sold to the highest bidder.

- Management Raises Equity. Management could raise equity to dilute Tang Capital’s ownership stake. While this is possible, Aptevo currently has $44MM of cash on its balance sheet so there is no need to raise additional capital. Further, the company is exploring monetizing its royalty streams, which would further increase cash on the balance sheet.

Recommendation Updates

Changes This Week

Increase limit on MMMB to Buy under 2.50

Updates

BBX Capital (BBXIA) had another quiet week. In February, Angelo Gordon filed a 13D to disclose that it owns 6.4% of shares outstanding. I view this as bullish given: 1) Angelo Gordon is a sophisticated investor and sees significant value, and 2) management was open to taking on outside investment (the company will allow Angelo Gordon to own up to 9.9% of shares outstanding). I recently spent considerable time reviewing my investment thesis for BBX Capital. All in all, the investment case remains on track. Despite strong performance, the company trades at just 39% of book value. It should generate significant earnings and free cash flow in 2021. In October 2020, the company announced that it had authorized a $10 million share repurchase, representing 8% of its market cap. The company also recently announced that it has purchased Colonial Elegance, a supplier and distributor of building products, including barn doors, closet doors, and stair parts for 5.6x EBITDA, an attractive price. Despite poor historical corporate governance, we are aligned with management as the Levin family (controlling shareholders) own 42% of shares outstanding. I see 20%+ upside. Original Write-up. Buy under 5.00.

Donnelley Financial Solutions (DFIN) recently reported excellent earnings, and the stock has responded as you would expect. In the quarter, revenue increased 10.5%, beating consensus expectations considerably. The revenue upside was driven by strong capital markets activity (IPOs and SPAC issuance) as well as continued growth of software and tech enabled solutions. Software solutions revenue increased 8% y/y to $54.2MM and now represent 25.8% of total sales. The company also announced the launch of a new software solution for SEC filing and announced a $50MM share repurchase authorization that will replace its current $25MM authorization. All in all, an excellent quarter. And better yet the stock is still cheap trading at 8.0x free cash flow and 7.2x forward EBITDA. Given the stock is up 30% since reporting earnings, I wouldn’t be surprised if it took a breather. Nonetheless, I recently increased my buy limit to 25 given its excellent performance and strong outlook. Original Write-up. Buy under 25.00.

Dorchester Minerals LP (DMLP) continue to look attractive. While the stock is up ~42% (including dividends) since we recommended it, it still appears undervalued given that oil prices are back above $60/barrel. In 2020, the company generated $39.4MM of free cash flow. Given the pandemic, we can view this free cash flow generation as a trough. As such, DMLP is trading at 12.8x trough free cash flow. This is an extraordinarily cheap multiple for such a high-quality royalty business. Original Write-up. Buy under 15.00.

FlexShopper (FPAY) has pulled back in the past couple of weeks but reported an excellent quarter this week. In the quarter, revenue increased by 25.3%, beating consensus by 4%. Adjusted EBITDA increased by 136% to $2.6MM. And better yet, new originations increased 26.5%, which implies that revenue and earnings growth for 2021 should be very strong. I continue to like FlexShopper. It is a rapidly growing company in the virtual lease-to-own market. Despite rapid growth and margin expansion, it is only trading at 8.9x 2021 earnings. Importantly, the Chairman of FlexShopper owns over 20% of the company and has recently been buying in the open market. My 12-month price target for FlexShopper is 4.70. Original Write-up. Buy under 3.00.

Greystone Logistics (GLGI) had a quiet week. The stock has been pretty weak since the company reported earnings in January. Nevertheless, I still have long-term conviction in it. Revenue declined by 20% in the quarter. The biggest challenge that Greystone currently has is meeting demand from its customer base. As a result, one of the company’s customers (a major beer company) gave notice that it will be diversifying purchases of case pallets between Greystone and another vendor. Greystone will continue to be the sole provider for the keg pallets. Greystone believes that it will not have a material impact on its financials. On the one hand, a 20% decline in revenue is worse than I had anticipated. But on the positive side, net income increased by 187%. How is that possible? The big driver was a strong improvement in the company’s gross margin. It increased from 11.0% last year to 19.9% in the most recent. Greystone has been investing in improving its manufacturing efficiency and clearly that has paid off. The gross margin expansion is even more impressive given that revenue declined. Usually, gross margins shrink as revenue shrinks given diseconomies of scale. The key question in my mind is: Will revenue ever start growing again? I have high conviction that it will. From 2016 to 2020, revenue grew at a compound annual growth rate of 30.4%. Once vaccines are broadly distributed and Greystone has its workforce back up to full capacity, the company should start growing quickly again. In the most recent quarter, the company generated $0.03 of EPS or $0.12 on an annualized basis. Thus, the stock is trading at a P/E of 7.5x. This represents a good value for a company with such a strong long-term growth outlook. Original Write-up. Buy under 1.10.

HopTo Inc (HPTO) had another quiet week with no news, but the stock has generally been weak since reporting earnings in November. In the quarter, sales declined by 6%. However, just as we didn’t get too excited last quarter when sales jumped 49%, we aren’t going to get too down this quarter. On a quarterly basis, sales are lumpy. Year to date, revenue is up 3% and operating profit is up 5%. The stock has pulled back and looks attractive. I believe HTPO is worth ~0.86 per share. The stock is currently trading at an EV/EBIT multiple of 4.8x. This is way too cheap. To put it in perspective, the software and Internet industry trades at an average EV/EBIT multiple of over 50x. Original Write-up. Buy under 0.55.

IDT Corporation (IDT) had pulled back sharply prior to reporting earnings. Following excellent results, the stock has rallied just as sharply. The company reported a strong quarter yesterday, with consolidated revenue growth of 5%. National Retail Solutions (NRS), BOSS Revolution Money Transfer, and net2phone-UCaaS subscription revenues increased by 151%, 73% and 36%, respectively. In particular, NRS’ growth of 151% was incredibly impressive. NRS deployed 1,300 billable POS terminals during the quarter, increasing its network to 13,700 terminals, and had 3,800 active payment processing merchant accounts at January 31, 2021. IDT believes that the market for NRS’ point of sale terminals is 100,000. On a sum-of-the-parts basis (which I think is the right way to view this name given IDT’s propensity to sell and spin off its assets), the stock is worth 34. Original Write-up. Buy under 23.50.

Liberated Syndication (LSYN) has been weak over the past week, but I view it as a buying opportunity. The company is extremely well positioned in a secular basis at 13.6x normalized free cash flow and 4.1x revenue. There are many catalysts on the horizon including: 1) a reacceleration of the business due to an improved user interface, 2) progress on monetization of advertising, 3) a Nasdaq uplisting and 4) the resolution of a lawsuit by Libsyn against some of its largest shareholders, which could reduce shares outstanding by 27%. Original Write-up. Buy under 4.25.

MamaMancini’s Holdings (MMMB) recently announced that it is looking to make small acquisitions. It is targeting companies with $12MM to $20MM of sales and positive EBITDA. Any acquisition will be complementary to the company’s current portfolio of products and will be immediately accretive. The stock has reacted well to this news, and I think tuck in acquisitions would make a lot of sense. MamaMancini looks attractive in 2021. I expect nice growth. Further, the company has submitted an application to uplist to the Nasdaq in order to increase the number of investors that can invest in the stock. Additionally, the company is currently running a strategic review which could result in the company being sold. Whether or not the company is sold, I believe returns should be strong going forward given the company will continue to grow and generate strong earnings growth. It has historically grown revenue at a 24% CAGR yet only trades at 11.6x forward earnings. Management owns over 50% of the stock, ensuring that incentives are aligned. Further, the company has a clean balance sheet. Given strong performance and a cheap valuation, I’m increasing my buy limit to 2.50. My 12-month price target is 3.80, which is driven by an estimated price to earnings multiple of 20x on expected fiscal 2021 earnings of $0.19. Original Write-up. Buy under 2.50.

Medexus Pharma (MEDXF) has been weak despite announcing terrific earnings recently. Revenue increased 70% y/y to $31.5MM in the quarter. The top line benefitted from ~$3MM of sales that slipped from last quarter to this quarter. Adjusted EBITDA increased to $5.1MM from $700,000 a year ago. The bigger news with Medexus is the licensing deal that it announced last month. In February, Medexus announced that it has entered into a licensing agreement with medac, a German company. Medexus agreed to pay $5MM up front, up to $55MM in regulatory milestone payments, and up to $40MM in sales-based milestone payments. Medexus recently announced that it closed its equity offering to fund the deal. For those payments, Medexus will have the right to sell a drug called Treosulfan which is given to patients with acute myeloid leukemia (“AML”) and myelodysplastic syndrome (“MDS”) prior to stem cell transplantation. Patients who received Treosulfan lived longer and had fewer side effects than patients treated with the generic alternative. Medexus believes the drug will ultimately generate more than $126MM in sales. Medexus’ current drug portfolio (including Treosulfan) has peak sales potential of $275MM to $325MM CAD. Assuming the company can trade at 3x this revenue estimate (the company will execute additional licensing deals so I expect revenue to ultimately grow even higher) in line with slower-growing peers, MEDXF would trade at ~30 per share, implying significant upside from here. Buy under 8.00.

NamSys Inc. (NMYSF) recently reported positive full-year results. In the fiscal year, revenue increased 15% to $4.7MM. Free cash flow increased 34% to $1.9MM. Namsys is attractively valued, trading at 15.3x free cash flow. The biggest news remains that the company recently announced that it has terminated its long-term incentive plan. The plan was originally put in place in the mid-2010s to incentivize the team to help transition NamSys’ software from on-premise to a cloud-based offering. However, the long-term incentive plan had no limit as participants in the bonus plan are entitled to 15% of the value of the company, no matter how high it’s valued. The payout for the termination of the bonus plan will be made in cash and stock. This is a major positive as it will increase the company’s earnings growth rate going forward. Further, it’s possible that this announcement could be a prelude to a sale of the company. Despite historically growing revenue and earnings at a compound annual growth rate of 20%+, the stock only trades at 15.3x free cash flow. It has a pristine balance sheet with significant cash and no debt, and insiders own more than 40% of the company, ensuring strong alignment. Original Write-up. Buy under 0.80.

P10 Holdings (PIOE) has been quiet since it closed its acquisition of Enhanced Capital Group, a premier impact investment platform, in December. Since its inception, Enhanced has deployed over $2BN of capital into impact credit and impact equity investments. Areas of focus include small business lending in impact areas and to women and minority-owned businesses, renewable energy, and historic building rehabilitation. My estimate is that this transaction will increase run rate EBITDA to ~$75MM. As such, P10 is trading at an EV/EBITDA multiple of 14.6x. As I have said before, the stock is no longer dirt cheap. Yet, it still trades at a sharp discount to its closest peer, Hamilton Lane (HLNE), which trades at an EV/forward EBITDA multiple of 30.6x. Catalysts for P10 Holdings going forward include: 1) additional deals and 2) a potential up-listing to a major exchange. Given the stock is not dirt cheap anymore, I recommend holding a half position. I want to keep exposure to the name but think it’s prudent to book some profits. Original Write-up. Hold Half.

U.S. Neurological Holdings (USNU) had another quiet week. It last reported earnings in November. Revenue grew 0.6% y/y and 11% q/q as procedures and price per procedure both rebounded. Year to date, the company has generated EPS of $0.05, or $0.067 on an annualized basis. As such the company is trading at just 5.2x earnings. In addition, the company has $1.5 million ($0.19 per share) of cash and no debt on its balance sheet. It also has $1.1MM (due from related parties) and has generated over $500,000 in free cash flow year to date. U.S. Neurological Holdings operates as a holding company in the United States. It is engaged in providing medical treatment and diagnostic services that include stereotactic radiosurgery centers, utilizing gamma knife technology, and it holds interests in radiological treatment facilities. Original Write-up. Buy under 0.25.

Watch List

FitLife Brands (FTLF) sells nutritional products for health-conscious consumers. It has been growing quickly and trades at 5x earnings. The one area of concern is that 75% of sales go to GNC, which recently declared bankruptcy. Nonetheless, FitLife somehow has been able to grow sales slightly in 2020. This is a name that I will continue to track.

Truxton Corp (TRUX) is a Nashville-based private bank and trust business. It recently announced it is paying a $2 special dividend and initiating a $5MM share repurchase authorization. The company has grown very nicely yet only trades at a P/E of 12.5x.

Meridian Corp (MRBK) is a Pennsylvania-based commercial bank that has performed very well. It has benefitted from refinancing activity and will see earnings decline in 2021. However, the stock trades at just 5x earnings and has consistently generated a positive ROE. Financials are looking increasingly attractive in a world with rising interest rates, especially given cheap valuations.

Waitr Holdings (WTRH) has been on my watch list for a while now, but I haven’t had the conviction to pull the trigger. Waitr recently announced Q4 earnings and revenue declined by about 11% from Q3. Q4 revenue was down 23% from peak levels in Q2, which benefitted from the fiscal stimulus. Waitr is profitable but is growing much slower than larger competitors, UberEats and GrubHub. This name will stay on my watch list, but I’m not tempted to invest just yet

Recommendation RATINGS

| Stock | Price Bought | Date Bought | Price 3/10/21 | Profit | Rating |

| BBX Capital (BBXIA) | 3.17 | 10/5/20 | 6.25 | 97% | Buy under 5.00 |

| Donnelley Financial Solutions (DFIN) | 14.54 | 11/11/20 | 28.58 | 97% | Buy under 25.00 |

| Dorchester Minerals LP (DMLP) | 10.45 | 10/14/20 | 14.50 | 42%* | Buy under 15.00 |

| FlexShopper (FPAY) | 2.13 | 12/9/20 | 2.87 | 35% | Buy under 3.00 |

| Greystone Logistics (GLGI) | 0.81 | 7/8/20 | 0.88 | 9% | Buy under 1.10 |

| Hopto Inc (HPTO) | 0.39 | 4/28/20 | 0.47 | 21% | Buy under 0.55 |

| IDT Corporation | 19.37 | 2/9/21 | 20.66 | 7% | Buy Under 23.50 |

| Liberated Syndication (LSYN) | 3.06 | 6/10/20 | 4.12 | 35% | Buy under 4.25 |

| MamaMancini’s Holding (MMMB) | 1.76 | 8/12/20 | 2.28 | 30% | Buy under 2.50 |

| Medexus Pharma (MEDXF) | 1.78 | 5/13/20 | 5.36 | 201% | Buy under 8.00 |

| NamSys Inc (NMYSF) | 0.65 | 9/9/20 | 0.81 | 25% | Buy under 0.80 |

| P10 Holdings (PIOE) | 1.98 | 4/28/20 | 6.75 | 241% | Hold Half |

| U.S. Neurological Holdings (USNU) | 0.14 | 4/28/20 | 0.35 | 150% | Buy under 0.25 |

*Includes dividends received.

Glossary

Buy means accumulate shares at or around the current price.

Hold means just that; hold what you have. Don’t buy, or sell, shares.

Sell means the original reasons for buying the stock no longer apply, and I recommend exiting the position.

Sell a Half means it’s time to take partial profits. Sell half (or whatever portion feels right to you) to lock in a gain, and hold on to the rest until another ratings change is issued.

Disclosure: Rich Howe owns shares in BBXIA, HPTO, PIOE, MEDXF, LSYN, GLGI, and FPAY. Rich will only buy shares after he has shared his recommendation with Cabot Micro-Cap Insider members and will follow his rating guidelines.

The next Cabot Micro-Cap Insider issue will be published on April 14, 2021.

Cabot Wealth Network

Publishing independent investment advice since 1970.

President & CEO: Ed Coburn

Chairman & Chief Investment Strategist: Timothy Lutts

176 North Street, PO Box 2049, Salem, MA 01970 USA

800-326-8826 | support@cabotwealth.com | CabotWealth.com

Copyright © 2021. All rights reserved. Copying or electronic transmission of this information is a violation of copyright law. For the protection of our subscribers, copyright violations will result in immediate termination of all subscriptions without refund. No Conflicts: Cabot Wealth Network exists to serve you, our readers. We derive 100% of our revenue, or close to it, from selling subscriptions to its publications. Neither Cabot Wealth Network nor our employees are compensated in any way by the companies whose stocks we recommend or providers of associated financial services. Disclaimer: Sources of information are believed to be reliable but they are not guaranteed to be complete or error-free. Recommendations, opinions or suggestions are given with the understanding that subscribers acting on information assume all risks involved. Buy/Sell Recommendations: All recommendations are made in regular issues or email alerts or updates and posted on the private subscriber web page. Performance: The performance of this portfolio is determined using the midpoint of the high and low on the day following the recommendation. Cabot’s policy is to sell any stock that shows a loss of 20% in a bull market or 15% in a bear market from the original purchase price, calculated using the current closing price. Subscribers should apply loss limits based on their own personal purchase prices.