Today, we are recommending a mini conglomerate.

The stock is near a 52 week high, but there is at least 50% upside for the stock.

This company’s characteristics include:

- A cheap valuation (0.3x revenue)

- One of the best value creators of all time on the management team

- Several hidden assets that will be spun off in the next year to unlock value

- High insider ownership.

All the details are inside this month’s Issue. Enjoy!

Cabot Micro-Cap Insider 221

[premium_html_toc post_id="225273"]

The Market is Expensive But Don’t Fight the Tape

Depending on who you follow to get your financial news, you may be aware that the U.S. stock market is quite expensive and there are several warning signs that prospective returns could be weak.

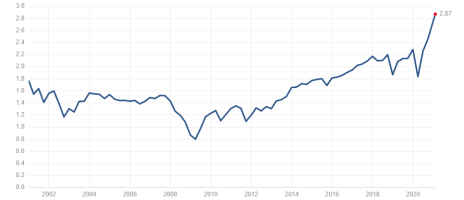

For example, the S&P 500 Index recently hit an all-time high Price to Sales multiple at 2.9x, as shown below.

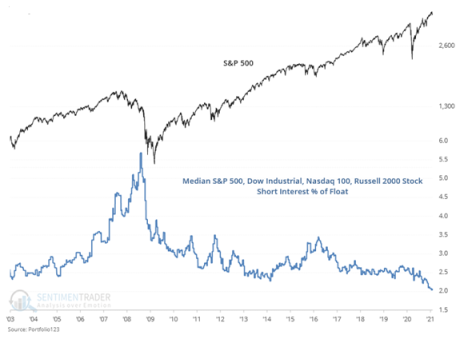

Short interest in the stock market is at a 17-year low.

But it’s important to remember that stocks in motion tend to stay in motion.

The market “feels” like it wants to go higher.

Momentum is a real thing.

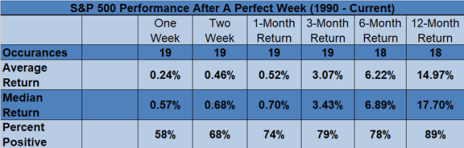

The first week of February was a “perfect” week in the market—the S&P 500 was up all five trading days.

LPL Financial crunched the numbers and found that when the S&P 500 has a perfect week, it is up an average of 14.97% over the subsequent 12 months.

As Jesse Livermore would say, “Don’t fight the tape.”

And remember we aren’t just blindly investing in the market. We are investing in stocks that have strong fundamentals and momentum yet are undervalued.

While there are certainly areas of the market that appear to be a bit “bubbly” – SPACs, electric vehicle stocks, high short interest companies come to mind – there are many companies with cheap stock prices that will benefit from a recovering economy in 2021.

Our recommendation today, IDT Corporation (IDT), is a perfect example.

It is cheap on an absolute and relative basis, trading at an EV/EBITDA multiple of 6.5x and an EV/Revenue multiple of 0.26x.

Meanwhile, it has no debt and $119MM of net cash on its balance sheet.

Its fundamentals are terrific and its chart is a thing of beauty (remember not to be afraid of buying a stock at a 52-week high!).

If I couldn’t find any cheap stocks and the market in aggregate looked expensive, I would be worried.

But we aren’t there yet.

Don’t fight the tape!

This week, our monthly webinar will take place on Thursday, February 11 at 2 p.m. ET. We will review all open recommendations and answer subscriber questions. Feel free to email questions to me ahead of time at rich@cabotwealth.com and I can answer them during the webinar.

Now let’s dig a bit deeper into my newest recommendation: IDT Corporation (IDT).

New Recommendation

IDT Corporation: Mini Conglomerate with Significant Upside

Company: IDT Corporation

Ticker: IDT

Price: 19.37

Market Cap: $468 million

Enterprise Value: $327 million

Price Target: 33.00

Upside: 70%

Recommendation: Buy Under 23.50

Recommendation Type: Rocket

Executive Summary

IDT Corporation is a mini-conglomerate run by Howard Jonas, one of the best value creators in the world. The stock is trading at a big discount to its sum-of-the-parts valuation, but the imminent spin-off of one or more of its high growth technology subsidiaries will unlock that value. Insiders own 25% of shares outstanding ensuring we are well aligned with management. My price target implies over 50% upside.

IDT Corporation Overview

As I mentioned, IDT Corporation is run by Howard Jonas.

Here is a great Wall Street Journal article that provides some background on his entrepreneurial career.

The 60-year-old cut his teeth selling hot dogs in the Bronx, N.Y., at the age of 14, studied economics at Harvard and eventually moved into the phone business with the founding of long-distance provider IDT Corp. in 1990. He used the windfall from his Net2Phone deal to fund an array of ventures including looking for shale oil in Mongolia, publishing “Star Trek” comic books and trying to cure cancer.

Jonas started IDT Corporation in 1990 and by 1996, when the business went public, it was one of the largest Internet and alternative telecommunications companies in the world.

The business has morphed over time, but for the past 10 years, the legacy telecommunications business has been shrinking but generating significant free cash flow.

And that cash flow has been used to fund investment into new businesses that are eventually spun off to IDT shareholders.

If you looked at IDT Corporation’s stock price, you wouldn’t think there was anything special.

But the stock chart only tells 10% of the story.

Because since 2010, IDT has spun four different businesses into independent public companies.

- IDW Media (IDWM): $29MM market cap.

- Straight Path Communications: This business was ultimately sold to Verizon for over $3BN.

- Zedge Inc (ZDGE): $145MM market cap (my recommendation from last month)

- Rafael Holdings (RFL): $486MM market cap.

If you include all the value that has come from IDT in the form of tax free spin-offs, the stock has generated a compound annual return of ~50% since 2010.

Simply put, Howard Jonas is a money maker.

IDT Corporation hasn’t spun out any assets since 2018 (Rafael Holdings), but I believe that will change shortly.

Business Outlook

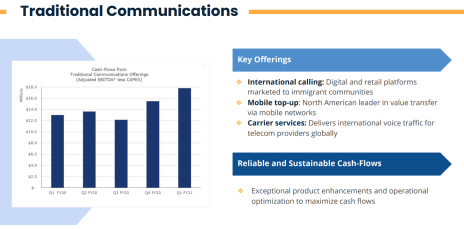

IDT’s cash cow is its traditional communications business, which participates in the paid minute voice communications market. The business is subject to revenue and margin pressure as consumers migrate to low-cost or free messaging services and other non-voice communications technologies.

IDT works diligently to maximize cash flows from its core offerings in part by introducing new features and enhancements to prolong their longevity and utility while reducing their overhead costs and operating expenditures.

IDT’s strategy is to harvest cash flows that are generated from its legacy telecommunications business to fund innovative and high-margin technology focused businesses.

In its fiscal year, IDT was able to harvest $30MM from its mature business to invest into its high-margin, high-growth tech businesses. What are those businesses?

They can be broken down into two buckets:

- Fintech

- Unified Communications as a Service

Fintech

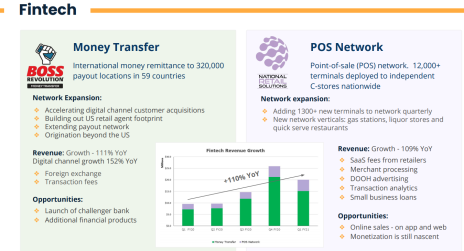

The Fintech assets consist of BOSS Revolution and National Retail Solutions.

The BOSS Revolution money transfer app allows customers to transfer money safely and quickly back to friends and family in other countries. Here is an excellent video that helps explain how it works.

The app appears to be well liked based on over 25,000 reviews on Google with an average rating of 4.7/5.

Growth has been incredibly strong. For example, in the last quarter revenue grew 111%. Ultimately, this business will be spun off to IDT shareholders.

National Retail Solutions is a point-of-sale network with 12,000+ terminals.

The target customer for the point-of-sale terminals is the owner of a convenience store. The terminal will help the customer more efficiently manager his/her store.

Here is a great video that shows the typical use cases for the terminals.

The reviews for the National Retail Solutions are mediocre (2.9/5), but the product has significant potential and is growing incredibly well (109% in the last quarter).

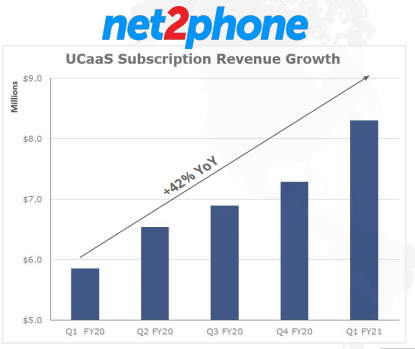

Unified Communications as a Service (Net2phone)

Net2phone is a worldwide leader in the voice-over-IP industry. It enables companies to move their voice-over-IPO systems to the cloud and get rid of wires and machinery that is usually needed for a phone system. Net2phone is a communications system that integrates desk phone, PC, and mobile via its platform. It is also backed up client management tools and analytics.

This is great explainer video.

It takes advantage of cloud technology. It’s able to take voice-over IP phone systems and move them to the cloud. This gets rid of wires and services to back-up phone system.

Growth (only 7%) last year was negatively impacted by the pandemic but growth has since reaccelerated, driven by Unified Communications as a Service (UCaaS) subscription revenue growth.

Insider Ownership and Insider Buying

As you know, I always look for high insider ownership to ensure that we are aligned with the people running the business. In the case if IDT, insiders own ~25% of shares outstanding.

Strong Balance Sheet

IDT has an incredibly strong balance sheet with $119MM of cash and no debt.

Valuation and Price Target

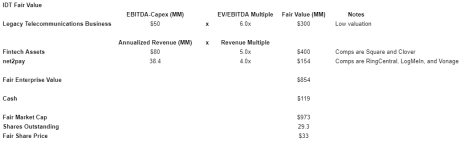

The best way to value IDT is on a sum-of-the-parts basis as I believe it’s highly likely that IDT spins off its fintech assets and Net2phone into two separate independent companies within the next year or so.

I’m valuing IDT’s legacy business at a draconian multiple (6.0x free cash flow). For IDT’s fintech assets, I believe Square and Clover (Australian company) are the best comps. For Net2pay, the best comps are RingCentral, LogMeIn, and Vonage.

Adding up the value, I arrive at my fair value estimate of 33 per share.

My rating is Buy under 23.50.

Risks

- Business growth slows. I’m ascribing significant value to IDT’s growth assets. If growth slows or reverses, it will have a negative impact on IDT’s outlook.

- Decline of legacy business. IDT faces fierce competition in its legacy telecommunications business. Historically, IDT has done a good job of maximizing cash flows given secular challenges. However, if revenue declines accelerate, my fair value estimate would decline.

Recommendation Updates

Changes This Week

Moving ZDGE to Hold

Increase limit on MEDXF to Buy under 8.00

Updates

BBX Capital (BBXIA) filed an 8-k in January which disclosed that investment firm Angelo Gordon owns 4.9% of the company and that BBX Capital had granted it permission to buy up to 10% of the company. This week, Angelo Gordon filed a 13D to disclose that it owns 6.4% of shares outstanding. I view this as bullish given: 1) Angelo Gordon is a sophisticated investor and sees significant value, and 2) management was open to taking on outside investment. I recently spent considerable time reviewing my investment thesis for BBX Capital. All in all, the investment case remains on track. Despite strong performance, the company trades at just 37% of book value. It should generate significant earnings and free cash flow in 2021. In October 2020, the company announced that it had authorized a $10 million share repurchase, representing 9% of its market cap. The company also recently announced that it has purchased Colonial Elegance, a supplier and distributor of building products, including barn doors, closet doors, and stair parts for 5.6x EBITDA, an attractive price. Despite poor historical corporate governance, we are aligned with management as the Levin family (controlling shareholders) own 42% of shares outstanding. I see 24%+ upside. Original Write-up. Buy under 5.00.

Donnelley Financial Solutions (DFIN) announced that it will report earnings on February 25. It will be good to get an update on the company’s progress with its turnaround. Donnelley Financial Solutions (DFin) is a 2016 spin-off that has successfully executed a turnaround, transitioning from a mainly print focused business to a software/tech-enabled services business. Despite strong cash flow generation and debt paydown, the stock still trades at a draconian valuation. Simcoe Capital, an activist investor, owns 10% of the stock, ensuring we are well aligned with insiders. With modest earnings growth and multiple expansion, coupled with significant debt paydown, the stock should hit 40 by 2024, implying over 90% upside. The stock has performed well but still only trades at 9.3x free cash flow and 6.7x forward EBITDA. Original Write-up. Buy under 22.50.

Dorchester Minerals LP (DMLP) will make its next dividend payment of $0.24 this Thursday, February 11. While the stock is up ~30% since we recommended it, it appears still very undervalued given that oil prices are back above $50/barrel. Through last September, the company generated $32MM of free cash flow, or $43MM on an annualized basis. As such, it is trading at 10.9x annualized free cash flow. This is an incredibly cheap valuation for a debt-free royalty business that pays out all its income in dividends and will skyrocket if (when) energy markets recover. Original Write-up. Buy under 14.00.

FlexShopper (FPAY) has performed well despite recent volatility even though there has been no news. I continue to like the stock. It is a rapidly growing company in the virtual lease-to-own market. Despite rapid growth and margin expansion, it is only trading at 12.0x 2021 earnings. Importantly, the chairman of FlexShopper owns over 20% of the company and has been buying more stock as fast as he can in the open market. Recently, H.C. Wainwright published an initiation report on the company with a 4.00 price target. Also, I recently had a chance to talk to management (both the CEO and CFO), which increased my conviction in the idea. My 12-month price target for FlexShopper is 4.70. Original Write-up. Buy under 3.00.

Greystone Logistics (GLGI) reported earnings recently. The stock has been a little volatile, but I still have long-term conviction in it. Revenue declined by 20% in the quarter. The biggest challenge that Greystone currently faces is meeting demand from its customer base. As a result, one of the company’s customers (a major beer company) gave notice that it will be diversifying purchases of case pallets between Greystone and another vender. Greystone will continue to be the sole provider for the keg pallets. Greystone believes that it will not have a material impact on its financials. On the one hand, a 20% decline in revenue is worse than I had anticipated. But on the positive side, net income increased by 187%. How is that possible? The big driver was a strong improvement in the company’s gross margin. It increased from 11% last year to 19.9% in the most recent quarter. Greystone has been investing in improving its manufacturing efficiency and clearly that has paid off. The gross margin expansion is all the more impressive given that revenue declined. Usually, gross margins shrink as revenue shrinks given diseconomies of scale. The key question in my mind is, Will revenue ever start growing again? I have high conviction that it will. From 2016 to 2020, revenue grew at a compound annual growth rate of 30.4%. Once vaccines are broadly distributed and Greystone has its workforce back up to full capacity, the company should start growing quickly again. In the most recent quarter, the company generated $0.03 of EPS, or $0.12 on an annualized basis. Thus, the stock is trading at a P/E of 6.7x. This represents a good value for a company with such a strong long-term growth outlook. Original Write-up. Buy under 1.10.

HopTo Inc (HPTO) had no news this week, but the stock has generally been weak since reporting earnings in November. In the quarter, sales declined by 6%. However, just as we didn’t get too excited last quarter when sales jumped 49%, we aren’t going to get too down this quarter. On a quarterly basis, sales are lumpy. Year to date, revenue is up 3% and operating profit is up 5%. The stock has pulled back and looks attractive. I believe HTPO is worth ~0.86 per share. HopTo is currently trading at an EV/EBIT multiple of 6.2x. This is too cheap. To put it in perspective, the software and internet industry trades at an average EV/EBIT multiple of over 50x. Original Write-up. Buy under 0.55.

Liberated Syndication (LSYN) was quiet this week. Over the past couple of months there has been significant insider buying among the CEO, CFO, and directors including activist investor Eric Shahinian of Camac Partners. Camac Partners currently owns 7.9% of shares outstanding ensuring strong alignment. Libsyn recently reported earnings. As expected, the quarter was a little messy due to compensation expenses related to the former CEO, Chris Spencer, leaving. Nonetheless, the long-term outlook looks great. Another interest thing to monitor is that Libsyn recently filed an 8-k disclosing that it is suing several of its largest shareholders to force them to forfeit their shares. The backstory is a little complicated but here is a good article that summarizes it. The key takeaway is it would be a huge positive for us if Libsyn won its lawsuit as shares outstanding would decline from 26.6MM to 19.4MM, a 27% reduction. Original Write-up. Buy under 4.25.

MamaMancini’s Holdings (MMMB) reported earnings in early December. Revenue grew 6.8% while EPS grew 100% to $0.02 as the company continues to leverage its fixed cost base. Sales growth decelerated slightly due to COVID headwinds, but I’m confident sales will reaccelerate in 2021 and beyond. Additionally, the company is currently running a strategic review which could result in the company being sold. Whether or not the company is sold, I believe returns should be strong going forward given the company will continue to grow and generate strong earnings growth. It has historically grown revenue at a 24% CAGR yet only trades at 9.7x forward earnings. Management owns over 50% of the stock, ensuring that incentives are aligned. Further, the company has a clean balance sheet. Original Write-up. Buy under 2.00.

Medexus Pharma (MEDXF) recently announced that it has entered into a licensing agreement with medac Gesellschaft für klinische Spezialpräparate m.b.H. (“medac”). Medac has granted Medexus the right to sell treosulfan in the United States. Treosulfan is given to acute myeloid leukemia (“AML”) and myelodysplastic syndrome (“MDS”) patients prior to stem cell transplantation. Patients who received treosulfan lived longer and had fewer side effects than patients treated with the generic alternative. Medexus believes the drug will ultimately generate sales in excess of $126MM. To secure the licensing agreement, Medexus will pay medac $5MM up front followed by up to $55MM in regulatory milestone payments and $40MM in sales based milestones. Including triosulphan, Medexus has line of sight to generating $250MM to $300MM in high margin revenue. As such, the stock looks incredibly attractive. Year to date, Medexus has generated $4.0MM of free cash flow or $8.0MM annualized. As such, the stock is trading at 15.1x free cash flow, an cheap valuation for a rapidly growing company. On an EV/Revenue basis, MEDXF trades at 1.5x while slower growing peers trade at 3.6x. Medexus recently gave a great presentation which is available on YouTube. Medexus remains my highest conviction idea. Given the recently announced deal, I’m increasing my buy limit to 8.00. Original Write-up. Buy under 8.00.

NamSys Inc. (NMYSF) Recently, Namsys announced that it has terminated its long-term incentive plan. The plan was originally put in place in the mid-2010s to incentivize the team to help transition Namsys’s software from on-premise to a cloud-based offering. However, the long-term incentive plan had no limit as participants in the bonus plan are entitled to 15% of the value of the company, no matter how high it’s valued. The payout for the termination of the bonus plan will be made in cash and stock. This is a major positive as it will increase the company’s earnings growth rate going forward. Further, it’s possible that this announcement could be a prelude to a sale of the company. Despite historically growing revenue and earnings at a compound annual growth rate of 20%+, the stock only trades at 22x 2019 earnings. It has a pristine balance sheet with significant cash and no debt, and insiders own over 40% of the company, ensuring strong alignment. Original Write-up. Buy under 0.80.

P10 Holdings (PIOE) closed its acquisition of Enhanced Capital Group, a premier impact investment platform, in December. Since its inception, Enhanced has deployed over $2BN of capital into impact credit and impact equity investments. Areas of focus include small business lending in impact areas and to women and minority-owned businesses, renewable energy, and historic building rehabilitation. My estimate is that this transaction will increase run rate EBITDA to ~$75MM. As such, P10 is trading at an EV/EBITDA multiple of 13.1x. As I have said before, the stock is no longer dirt cheap. Nonetheless, it still trades at a sharp discount to its closest peer, Hamilton Lane (HLNE), which trades at an EV/forward EBITDA multiple of 28.3x. Catalysts for P10 Holdings going forward include: 1) additional deals and 2) a potential up-listing to a major exchange. Given the stock is not dirt cheap anymore, I recommend holding a half position. I want to keep exposure to the name but think it’s prudent to book some profits. Original Write-up. Hold Half.

U.S. Neurological Holdings (USNU) reported earnings in November. Revenue grew 0.6% y/y and 11% q/q as procedures and price per procedure both rebounded. Year to date, the company has generated EPS of $0.05 or $0.067 on an annualized basis. As such the company is trading at just 4.9x earnings. In addition, the company has $1.5 million ($0.19 per share) of cash and no debt on its balance sheet. It also has $1.1MM (due from related parties) and has generated over $500,000 in free cash flow year to date. U.S. Neurological Holdings operates as a holding company in the United States. It is engaged in providing medical treatment and diagnostic services that include stereotactic radiosurgery centers, utilizing gamma knife technology, and it holds interests in radiological treatment facilities. Original Write-up. Buy under 0.25.

Zedge (ZDGE) has been on fire since I recommended it last month. Recently the company announced that premium annual subscriptions grew 158% in 2020. While this is very impressive, it wasn’t really news (growth was similar in the last quarter), and so I was a little surprised that the stock moved so much. Currently, the stock is trading at 43x my estimate for 2021 earnings. Given it’s moved so far so fast and is probably due for a breather, I’m going change my rating to hold. Original Write-up. Hold.

Watch List

FitLife Brands (FTLF) sells nutritional products for health-conscious consumers. It has been growing quickly and trades at 5x earnings. The one area of concern is that 75% of sales go to GNC, which recently declared bankruptcy. Nonetheless, FitLife somehow has been able to grow sales slightly in 2020. This is a name that I will continue to track.

Truxton Corp (TRUX) is a Nashville-based private bank and trust business. It just announced it is paying a $2 special dividend and initiating a $5MM share repurchase authorization. The company has grown very nicely yet only trades at a P/E of 12.5x.

Waitr Holdings (WTRH) has been on my watch list for a while now, but I haven’t had the conviction to pull the trigger. Waitr recently announced Q3 earnings and revenue declined by about 20% from Q2. However, there has been insider buying by two insiders, which bodes well.

Recommendation RATINGS

| Stock | Price Bought | Date Bought | Price 2/9/21 | Profit | Rating |

| BBX Capital (BBXIA) | 3.17 | 10/5/20 | 6.10 | 92% | Buy under 5.00 |

| Donnelly Financial Solutions (DFIN) | 14.54 | 11/11/20 | 21.46 | 48% | Buy under 22.50 |

| Dorchester Minerals LP (DMLP) | 10.49 | 10/14/20 | 13.02 | 27% | Buy under 14.00 |

| FlexShopper (FPAY) | 2.13 | 12/9/20 | 3.40 | 60% | Buy under 3.00 |

| Greystone Logistics (GLGI) | 0.81 | 7/8/20 | 0.87 | 7% | Buy under 1.10 |

| Hopto Inc (HPTO) | 0.39 | 4/28/20 | 0.45 | 15% | Buy under 0.55 |

| IDT Corporation (IDT) | 19.37 | 2/9/21 | 19.37 | 0% | Buy Under 23.50 |

| Liberated Syndication (LSYN) | 3.06 | 6/10/20 | 4.87 | 59% | Buy under 4.25 |

| MamaMancini’s Holding (MMMB) | 1.76 | 8/12/20 | 1.90 | 8% | Buy under 2.00 |

| Medexus Pharma (MEDXF) | 1.78 | 5/13/20 | 6.87 | 286% | Buy under 8.00 |

| NamSys Inc (NMYSF) | 0.65 | 9/9/20 | 0.83 | 28% | Buy under 0.80 |

| P10 Holdings (PIOE) | 1.98 | 4/28/20 | 6.12 | 209% | Hold Half |

| U.S. Neurological Holdings (USNU) | 0.14 | 4/28/20 | 0.36 | 157% | Buy under 0.25 |

| Zedge (ZDGE) | 6.01 | 1/13/21 | 13.90 | 131% | Buy under 6.50 |

*Includes 0.75 distribution and 1.35 distribution.

Glossary

Buy means accumulate shares at or around the current price.

Hold means just that; hold what you have. Don’t buy, or sell, shares.

Sell means the original reasons for buying the stock no longer apply, and I recommend exiting the position.

Sell a Half means it’s time to take partial profits. Sell half (or whatever portion feels right to you) to lock in a gain, and hold on to the rest until another ratings change is issued.

Disclosure: Rich Howe owns shares in BBXIA, HPTO, PIOE, MEDXF, LSYN, GLGI, and FPAY. Rich will only buy shares after he has shared his recommendation with Cabot Micro-Cap Insider members and will follow his rating guidelines.

The next Cabot Micro-Cap Insider issue will be published on March 10, 2021.

Cabot Wealth Network

Publishing independent investment advice since 1970.

President & CEO: Ed Coburn

Chairman & Chief Investment Strategist: Timothy Lutts

176 North Street, PO Box 2049, Salem, MA 01970 USA

800-326-8826 | support@cabotwealth.com | CabotWealth.com

Copyright © 2021. All rights reserved. Copying or electronic transmission of this information is a violation of copyright law. For the protection of our subscribers, copyright violations will result in immediate termination of all subscriptions without refund. No Conflicts: Cabot Wealth Network exists to serve you, our readers. We derive 100% of our revenue, or close to it, from selling subscriptions to its publications. Neither Cabot Wealth Network nor our employees are compensated in any way by the companies whose stocks we recommend or providers of associated financial services. Disclaimer: Sources of information are believed to be reliable but they are not guaranteed to be complete or error-free. Recommendations, opinions or suggestions are given with the understanding that subscribers acting on information assume all risks involved. Buy/Sell Recommendations: All recommendations are made in regular issues or email alerts or updates and posted on the private subscriber web page. Performance: The performance of this portfolio is determined using the midpoint of the high and low on the day following the recommendation. Cabot’s policy is to sell any stock that shows a loss of 20% in a bull market or 15% in a bear market from the original purchase price, calculated using the current closing price. Subscribers should apply loss limits based on their own personal purchase prices.