The bull market lasted from March 2020 to June 13, 2022.

But now, we are officially in a bear market.

In other words, the market (S&P 500) has declined by 20% or more from its peak.

What happens next?

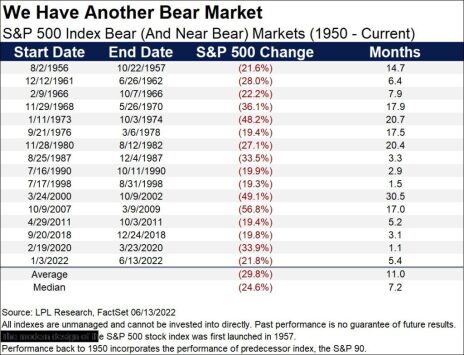

Typically, bear markets last about 11 months and average a peak to trough drop of 29.8%.

The current bear market has lasted for seven months with a drawdown of 21.8%.

So, it looks like we could see some further downside to the market.

And to add insult to injury, the Celtics have lost two straight and are on the brink of losing to the Golden State Warriors.

What should we do next?

I’m just going to continue to focus on what I can control which is identifying undervalued stocks with positive and improving fundamentals.

This week, I bought more NexPoint Diversified (NXDT).

Unfortunately, NexPoint hasn’t sold off as sharply as the rest of the market, but it’s my highest-conviction idea at the moment.

Here’s why I bought more:

- The stock is cheap on an absolute and relative basis. NAV is ~$26 vs. the stock price of 15.

- James Dondero (CEO) continues to buy like a madman (his last buy was last Thursday).

- Reclassification to REIT seems imminent. It’s been “imminent” for a while, but now, it really feels imminent.

This week, we had a few items of note that I wanted to highlight (full updates below).

- Aptevo (APVO) announced positive data from its lead drug APVO436.

- Atento (ATTO) announced a settlement with the activist. The activist will get a board seat and will focus on enhancing shareholder value.

- Crossroads (CRSS) reported earnings. It was relatively uneventful, and the investment case remains on track.

- Currency Exchange (CURN) reported earnings. Results were strong as expected.

- Zedge (ZDGE) reported weak earnings, and the stock fell. Nonetheless, I’m optimistic about next quarter given it will include a full contribution from the recent acquisition of GuruShots.

The next issue of Cabot Micro-Cap Insider will be published on Wednesday, July 13. As always, if you have any questions, please email me at rich@cabotwealth.com.

Changes This Week

None

Updates

Aptevo (APVO) announced positive data from its phase 1b trial in MDS patients treated with APVO436. 36% of patients achieved a remission. As of March 31, 2022, Aptevo has $30MM of net cash and, as detailed above, expects to receive an additional $22.5MM over the next few years. Aptevo’s cash burn over the past year was $22MM. As such, it can probably make it another two years without raising cash. However, the company probably does want to raise capital at some point. From a fundamental perspective, Aptevo continues to report good data for its lead compound APVO436 in patients with acute myeloid leukemia (AML). This biotech bear market is no fun, but Aptevo continues to be an asymmetric bet. Original Write-up. Buy under 7.50

Atento S.A. (ATTO) reached a settlement with an activist investor, Kyma Capital, which owns 8.5% of the company. Under the terms of the agreement, Kyma will get a board seat and will work with the Board of Directors to evaluate all options to increase shareholder value. Kyma also has permission to increase its position to 19.9%. While the most recent quarter was weak, the stock looks very cheap. And this news is a positive. Atento is trading at just 3x EBITDA while peers trade at closer to 12x EBITDA. Original Write-up. Buy under 20.00

Cipher Pharma (CPHRF) reported earnings in May. They were great. Revenue was flat year over year, but EPS increased from $0.05 last year to $0.08 this year. The EPS increase was driven by cost cutting (operating expenses decreased 25%). Meanwhile, ~2% of shares were repurchased during the quarter. Currently has $22MM of net cash on its balance sheet, representing 48% of the company’s market cap. Cash flow should be stable for at least the next 4-5 years which will provide time for the pipeline to emerge. The company continues to move its pipeline forward and evaluate accretive acquisition opportunities. Original Write-up. Buy under 2.00

Cogstate Ltd (COGZF) had no news this week. It is a profitable, rapidly growing Australian company that is the market leader in computerized cognition testing. The biggest use case is Alzheimer’s Disease, which is a massive and growing market. Cogstate is benefiting from a boom in Alzheimer’s R&D spending which is driving 20%+ revenue growth. Longer term, Cogstate’s direct-to-consumer Alzheimer’s test could accelerate growth even further. Despite a terrific outlook, Cogstate trades at just 25x current earnings. Looking out a few years, this stock could easily double or more. Original Write-up. Buy under 1.80

Crossroads Systems (CRSS) reported earnings this week. The company doesn’t share too much information when it reports earnings, but the key takeaways for me was the following: 1) impact loan generated $1.5MM of net income in the quarter or $6MM on an annualized basis 2) the impact loan portfolio continues to grow the company’s recently announced partnership with Enhanced Capital. The stock is trading at ~12x annualized net income (from impact loans) which seems far too cheap given 1) strong growth potential in the impact loan market and 2) the management team and board of directors have a track record of creating shareholder value (the company paid a special dividend of $40/per share in 2021 due to windfalls from the PPP program). Original Write-up. Buy under 15.00

Currency Exchange International (CURN) reported earnings last night. Revenue increased 109% y/y to $13.3MM. Net operating income increased to $2.9MM up from a loss of $0.6MM last year. Both Banknotes (+103%) and Payments (+127%) grew very strongly. Importantly, management noted that it expects a strong summer travel season which should drive (my opinion) record results. The stock continues to look very cheap. Original Write-up. Buy under 16.00

Dorchester Minerals LP (DMLP) continues to perform well. Dorchester’s latest distribution was $0.75, which annualizes to a 9.8% yield. The company is benefiting from high commodity prices. While commodity prices will continue to be volatile, I expect them to remain elevated for the foreseeable future. Dorchester will pay out all windfall profits to shareholders. Original Write-up. Buy under 25.00

Epsilon Energy (EPSN) continues to perform well although it’s pulled back recently in line with a pullback in natural gas prices. Last year, the company produced tremendous free cash flow and will likely do so again this year. The company currently has $30MM of cash (20% of its market cap) and no debt. Epsilon recently committed to paying a quarterly dividend of $0.0625 per share starting on March 31. This works out to a 3.0% dividend yield. In addition, the company is actively buying back shares (1.1MM share repurchase authorization). Original Write-up. Buy under 8.00

Esquire Financial Holdings (ESQ) initiated a 9-cent quarterly dividend recently. This works out to a 1% yield. The company reported earnings in late March. Results were excellent, and the investment case remains on track. The company reported Q2 EPS of $0.66, a penny ahead of consensus. Return on equity increased y/y from 13.3% to 15.0%. Esquire remains well capitalized with excellent credit metrics. The company has a long runway for growth, as articulated by CEO Andrew Sagliocca: “There is tremendous potential in both the litigation and payment markets primarily due to the limited number of players and fragmented and inefficient approach to coupling financing, payment processing, and technology. We believe Esquire will be a leader in all three categories in both industries.” Despite its strong outlook, the stock trades at just 12x earnings. Original Write-up. Buy under 35.00

IDT Corporation (IDT) announced quarterly results, and the stock sold off. On a high level, the quarter didn’t look great. Revenue decreased 12% y/y which was driven by a 17% decline in traditional communications revenue. This segment benefitted from the boom in paid calling during the pandemic, but that surge is normalizing. Most importantly, IDT’s high-growth segments continue to grow well. National Retail Solutions (NRS), IDT’s payment terminal business, grew 102% y/y. Net2phone, IDT’s other highly valuable subsidiary, grew recurring revenue by 42%. Further, IDT expects subsidiary growth to contribute to consolidated profitability in the second half of this year. While the spin-off of net2phone has been temporarily delayed, we know that it and NRS will ultimately be monetized. The investment case remains on track and my price target is 55 based on an updated sum-of-the-parts analysis. Original Write-up. Buy under 45.00

Liberated Syndication (LSYN) has had no news recently. It stopped trading on April 14 because the SEC revoked the company registration. This sounds like horrible news, but I think it’s actually the opposite. Let me explain. Libsyn has been working with the SEC for ~2 years to restate its financials. Long story short, the prior CEO and CFO did a bad job managing the business and didn’t properly account for state sales tax. As a result, the company had to go back through its financials and restate them all. This process has taken longer than anyone anticipated. However, it appears that we are close to the end of the process. I recently spoke to the CEO, and he told me that the SEC had advised that it would be a more efficient path forward to de-register the stock and then refile financials rather than restate all previous financials. This makes intuitive sense to me. As such, this de-registration is step one. I don’t have a sense for when the financials will be refiled, but I believe it could happen within a few weeks. Once the financials are filed, I believe we will see a fast-growing, profitable company trading at less than 3x revenue. While Libsyn has been a frustrating stock, I think (and hope!) our patience will be rewarded in short order. Original Write-up. Buy under 5.00

Medexus Pharma (MEDXF) had no news this week. Recently, Medexus announced that the FDA has requested additional data and analysis related to its New Drug Application for Treosulfan. Medac (Medexus’ partner) believes it will be able to provide all the data and analysis by July 2022 (the original 12-month deadline). However, in the case that Medac can’t make the deadline, it can request an extension. In response to the news, the stock has gotten whacked, but I think it is a good buying opportunity. I think the stock is undervalued even if Treosulfan isn’t ultimately approved. I continue to believe that the risk/reward for Medexus looks attractive heading into the second half of the year. Original Write-up. Buy under 3.50

NexPoint Diversified REIT (NXDT) filed an SEC document last week. My take is the SEC should approve NexPoint’s application to deregister unless someone requests a hearing by June 27. As such, the company could get approval as soon as the end of the month. The investment case is on track for NexPoint. It continues to trade at a large discount to NAV, and I expect that gap to close quickly once the REIT transition is complete. Original Write-Up. Buy under 16.00

P10 Holdings (PX) reported another great quarter in May. Revenue increased 32% to $43.3MM while adjusted EBITDA increased 31% to $22.5MM. Assets under management increased 34% to $17.6BN. Higher assets under management will drive continued revenue and earnings growth. The company also announced a $20MM share repurchase. P10 is currently trading at 15x 2022 adjusted EBITDA which is a very reasonable valuation for such a stable business with strong organic growth potential. Original Write-up. Buy under 15.00

RediShred (RDCPF) is my latest recommendation. It’s a Canada-based, leading document destruction services company. Insiders own more than 30% of the company. It has grown revenue at a 31% CAGR and EBITDA at an 80% CAGR over the past 10 years through organic and inorganic growth. Future growth is poised to continue yet the stock trades at just 5x forward EBITDA. I see 100% upside over the next 12 months and significantly more upside looking out a few years. Original Write-up. Buy under 0.70

Truxton (TRUX) reported another great quarter in April with the company reporting its best quarterly earnings ever. The private banking team continues to grow assets in the Nashville area, and rising rates are benefiting the portfolio’s net interest margin. Asset quality remains sound with $0 in non-performing loans and $0 in net charge-offs (that’s pretty good!). The Truxton investment case remains on track. The bank will continue to grow loans and earnings prudently while returning excess cash to shareholders through dividends and share buybacks. The stock is trading at just 12.3x annualized earnings. This isn’t the most exciting stock, but it’s a slow and steady winner. Original Write-up. Buy under 75.00

Zedge Inc (ZDGE) reported earnings this week. The stock fell as revenue grew by 18% but declined sequentially. Monthly active users (MAUs) in both developing and developed countries fell sequentially. However, management noted that MAUs are growing again and that they are cautiously optimistic that these trends will continue. Further, the recent quarter included no contribution from the recent acquisition of GuruShots. Given strong recent insider buying, I’m expecting positive news when we hear more details about the integration of GuruShots. The stock remains very cheap trading at 3.4x EBITDA. Original Write-up. Buy under 6.00

| Stock | Price Bought | Date Bought | Price on 6/14/22 | Profit | Rating |

| Aptevo Therapeutics (APVO) | 32.01 | 3/10/21 | 3.32 | -90% | Buy under 7.50 |

| Atento SA (ATTO) | 21.57 | 8/24/21 | 12.01 | -44% | Buy under 20.00 |

| Cipher Pharma (CPHRF) | 1.80 | 10/11/21 | 1.80 | 0% | Buy under 2.00 |

| Cogstate Ltd (COGZF) | 1.70 | 4/13/22 | 1.02 | -40% | Buy under 1.80 |

| Crossroad Systems (CRSS) | 14.10 | 2/9/22 | 12.26 | -13% | Buy under 15.00 |

| Currency Exchange (CURN) | 14.10 | 05/11/22 | 14.36 | 2% | Buy under 16.00 |

| Dorchester Minerals LP (DMLP)* | 10.45 | 10/14/20 | 29.43 | 182% | Buy under 25.00 |

| Epsilon Energy (EPSN) | 5.00 | 8/11/21 | 6.31 | 26% | Buy under 8.00 |

| Esquire Financial Holdings (ESQ) | 34.11 | 10/10/21 | 33.40 | -2% | Buy under 35.00 |

| IDT Corporation (IDT) | 19.37 | 2/10/21 | 22.66 | 17% | Buy under 45.00 |

| Liberated Syndication (LSYN) | 3.06 | 6/10/20 | 3.75 | 23% | Buy under 5.00 |

| Medexus Pharma (MEDXF) | 1.78 | 5/13/20 | 1.52 | -15% | Buy under 3.50 |

| NexPoint Diversified Real Estate Trust (NXDT) | 14.15 | 1/12/22 | 14.73 | 4% | Buy under 16.00 |

| P10 Holdings (PX)** | 2.98 | 4/28/20 | 10.43 | 250% | Buy under 15.00 |

| Truxton Corp (TRUX)* | 72.25 | 12/8/21 | 67.85 | -5% | Buy under 75.00 |

| Zedge (ZDGE) | 5.73 | 3/9/22 | 3.77 | -34% | Buy under 6.00 |

Disclosure: Rich Howe owns shares in BBXIA, LSYN, MEDXF, PIOE, IDT, APVO, DMLP, and NXDT. Rich will only buy shares after he has shared his recommendation with Cabot Micro-Cap Insider members.

Buy means accumulate shares at or around the current price.*Includes dividends received

Hold means just that; hold what you have. Don’t buy, or sell, shares.

Sell means the original reasons for buying the stock no longer apply, and I recommend exiting the position.

Sell a Half means it’s time to take partial profits. Sell half (or whatever portion feels right to you) to lock in a gain and hold on to the rest until another ratings change is issued.