Today, I’m recommending an app developer that I previously recommended (we exited for a 114% gain last year). The business is growing like crazy yet trades at a dirt-cheap valuation.

Other key points:

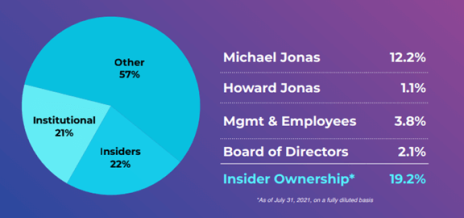

- High insider ownership (19% of the company).

- 25%+ revenue growth this year.

- 34% of its market cap in cash and no debt.

All the details are inside this month’s Issue. Enjoy!

New Recommendation

My Ideal Setup

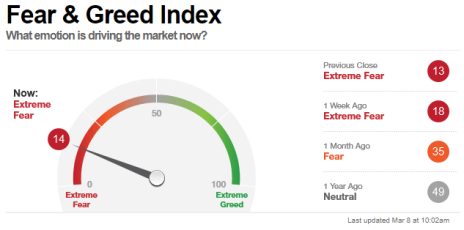

I’ve gotten a few questions from subscribers who are feeling sick given the situation in Ukraine and elevated stock market volatility. But I think that’s probably a good bullish sign for stocks. While it’s never fun buying new stocks, only to see them trade down shortly thereafter, I think it is probably the right thing to do.

Investor sentiment, understandably, is quite weak right now. And usually that is a good time to invest.

Further, usually the market manages to look through geopolitical troubles.

When evaluating micro-caps, my ideal setup is a company with the follow attributes

- Growing

- Cheap (absolute/relative)

- Positive momentum

- Not over extended (near or below 50-day moving avg.)

- Illiquid

This month’s recommendation has all five attributes except number three, positive momentum.

In this market, it’s hard to find a micro-cap with positive momentum. Most small and micro names have been taken behind the woodshed.

Nonetheless, I’m confident recommending this month’s idea, Zedge Inc. (ZDGE), despite a horrible looking stock chart.

Why?

The stock has downside protection with significant cash on its balances sheet and no debt. Further, it will grow revenue at least 25% this year and insiders are strongly aligned (they own 19% of the company) to create value.

To me, Zedge’s stock price looks completely disconnected from its fundamentals. If that were happening in a bull market, I would be concerned that I’m missing something. But in the current market environment, where most micro-cap stocks are getting crushed, I think it represents an opportunity.

With that, let’s dive deeper into my latest idea, Zedge Inc. (ZDGE).

New Recommendation

Zedge: An App Developer with 70% Upside

Company: Zedge Inc.

Ticker: ZDGE

Price: 5.38

Market Cap: $75 million

Price Target: 9.00

Upside: 67%

Recommendation: Buy under 6.00

Recommendation Type: Rocket

Executive Summary

Zedge Inc. (ZDGE) is an app developer that we’ve previously recommended (we exited for a 114% gain last year). The business is growing like crazy and generated gobs of cash. Insiders own a significant stake in the business. Yet the stock is trading at a P/E of 9x. Zedge’s price is truly dislocated from its fundamentals. I expect strong upside in the next 12 months as the Zedge’s stock price reconnects with its fundamentals.

Company Overview

Background

I recommended Zedge (ZDGE) in January 2021 and ultimately exited the recommendation just a month later as the stock appreciated over 114%. Here is the write up from last year.

At the time, I was attracted to Zedge because it was growing revenue at 84% yet only trading at 19x annualized earnings.

Today, I’m attracted to Zedge because its growing revenue at 60% (growth has decelerated slightly) yet is only trading at 9.3x earnings!

Usually, I wouldn’t be interested in recommending a stock like Zedge given its chart looks horrible (it’s under its 50-day moving average and 200-day moving average).

However, I’m comfortable recommending Zedge as many micro-caps are in a bear market and market participants are panicking about geopolitics (Russia/Ukraine).

Further, I have confidence that the downside is protected given a large cash balance ($1.88 per share) and strong free cash flow generation.

Alright, with that out of the way, let’s talk about Zedge, the business.

Zedge was a 2016 spin-off from IDT Corporation (IDT), another Cabot Micro-cap Insider recommendation.

The company is a leading app developer focusing on the mobile phone personalization and entertainment verticals. Specifically, the app allows users to customize their phones’ wallpaper and ringtones.

What exactly is phone wallpaper? It is the background to your phone’s main screen.

Amazingly, over 500 million people have downloaded the Zedge app to help customize their wallpaper and ringtones and ~43 million people use the app every month.

Ninety percent of its users are on the Android platform, which is easier to customize, while 10% of users are on the iOS (Apple) platform.

At the time of the spin-off in 2016, the company generated all its revenue from advertising (it gave its wallpaper and ringtones away for free).

However, the company launched Zedge Paid Subscriptions in 2019, and that has been a smashing success.

Customers who sign up for a Zedge Paid Subscription get to access all Zedge’s content without any advertisements. Google retains 30% of the fee charged for the initial subscription and 15% of any annual renewal fees.

Paid subscriptions have grown rapidly and now account for 17% of revenue.

Zedge’s main revenue generator – paid advertising – has been performing incredibly well too with 53% growth in the most recent quarter.

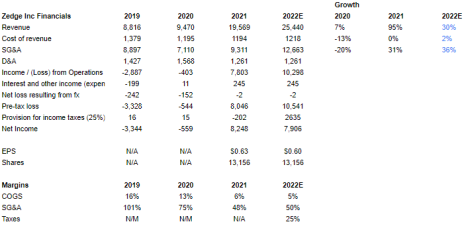

All in all, Zedge has been executing well and it’s resulted in strong revenue and operating income growth as shown below.

The big driver behind the improvement in advertising has been the company reconfiguring its advertising stack which has optimized advertising and resulted in accelerating revenue growth.

In addition, Zedge has a number of additional initiatives such as Zedge Shortz, a short-form, chat fiction app, and the continued maturation of Zedge Premium, a marketplace for artists to sell their digital content.

Most recently, Zedge launched NFTs Made Easy on its premium marketplace which allows artists to monetize their creations. Here’s a recent interview with Zedge CEO which gives an overview of the company and its most recent launch of NFTs.

Business Outlook

The outlook for Zedge is strong. Last year, revenue grew 107%. Guidance for revenue growth for this year is 25% to 30%. In the first quarter of this fiscal year, revenue grew 60%, implying that guidance for the full year is conservative.

Typically, the second quarter is Zedge’s strongest so we could see a strong sequential bump later this month when the company reports its earnings.

Further, Zedge typically updates its guidance in conjunction with second-quarter results.

To be conservative I’m assuming that Zedge grows revenue by 30% this year.

Operating income should grow ~31% but EPS will be relatively flat.

The reason?

Zedge has historically benefitted from net operating losses, but the NOLs have all been used. As such, Zedge will pay taxes in 2022 (I assume a 25% tax rate).

As such, I expect EPS growth to be relatively flat in 2022.

For now, I’m going to refrain from projecting beyond 2022, but my sense is that Zedge should be able to continue to grow revenue and EPS at 20%+ for the foreseeable future given the company’s many initiatives (Zedge Shortz, Zedge Premium, NFTs Made Easy) and its ability to increase monetization.

Insider Ownership

As Cabot Micro-Cap Insider subscribers know, insider ownership is high on my checklist and is critical when investing in micro-caps.

Insiders, the board of directors, and employees own ~19% of shares outstanding as shown below. This ensures that we are well aligned.

Valuation and Price Target

Zedge currently has $27MM of net cash ($1.73 per share). This provides some nice downside protection. It’s hard to go bankrupt when you have no debt and a big pile of cash on your balance sheet!

What is the company worth?

Internet companies have pulled back drastically in the past 6 months and now trade at a P/E of ~19x.

As Zedge is a smaller company, we can assume a 20% discount is appropriate. If Zedge traded at 15x 2022 earnings of $0.60, it would be a $9 stock. I think this is an appropriate initial price target and implies significant upside.

My official rating is Buy under 6.00.

As is always the case with micro-caps, use limits as volume is quite low.

Risks

It’s Dependent on Google Play and Apple App Store for Downloads.

- While Zedge is reliant on Google Play and, to a lesser extent, the Apple App Store, the company has historically done a good job of staying compliant. Nonetheless, suspension of the Zedge app would have a serious negative impact on revenue generation.

Updates, Watch List and Ratings

Recommendation Updates

Changes This Week

Increase buy limit for DMLP to Buy under 25.00

Updates

Aptevo (APVO) had no news but recently announced that it received a $10MM milestone payment from Ruxience. With this the company is optimistic that Ruxience will lead to additional earnings of $22.5MM over the next two years. This $10MM will be used to pay down their MidCap Financial debt, reducing their principal on the debt to $5MM, overall strengthening their balance sheet. Aptevo continues to suffer in the biotech bear market. Nonetheless, I think there are many positive catalysts on the horizon. Aptevo will report additional data from its ongoing trials in 2022 and any positive news will move the stock upwards. Original Write-up. Buy under 15.00

Atento S.A. (ATTO) had no news this week. The most recent development is that an activist investor, Kyma Capital, now owns 5% of the company, and is engaging with the management team to unlock value. This is a strong positive, given healthy fundamentals and an incredibly cheap valuation. 2022 could be the year that Atento gets sold. Original Write-up. Buy under 30.00

BBX Capital (BBXIA) recently announced yet another share repurchase authorization, this time for an additional $15MM. I’m looking forward to BBX reporting its annual results so that I can add up all the shares that have been repurchased since the initial spin-off. Well over 20% of shares outstanding have been retired. While BBX has performed very well since our initial recommendation, it remains a high-conviction idea, given 1) positive fundamentals (real estate in Florida is hot) and 2) a very cheap valuation (the stock is still trading at a 50% discount to book value). Original Write-up. Buy under 11.00

Cipher Pharma (CPHRF) has started to trend back up after selling off in November and December. The stock is currently dirt cheap, has no debt, and significant optionality. Finally, insiders own a significant portfolio of shares outstanding and are incentivized to maximize value. The company is buying back shares aggressively. Original Write-up. Buy under 2.00

Crossroads Systems (CRSS) had no news this week. I continue to think it looks attractive. The stock is trading slightly above book value ($12.70) yet has significant optionality. The management team and board of directors have a track record of creating shareholder value (company paid a special dividend of $40/per share in 2021 due to windfalls from the PPP program).Original Write-up. Buy under 15.00

Dorchester Minerals LP (DMLP) will benefit from soaring commodity prices due to the geopolitical conflict in Ukraine. Dorchester will pay out all windfall profits to shareholders. The company paid out its latest dividend of $0.639 per unit on February 10, 2022. On an annualized basis, Dorchester is yielding 10.3%. The stock continues to look attractive. Given higher commodity prices which will drive the dividend yield higher, I’m increasing my buy limit to 25.00. Original Write-up. Buy under 25.00

Epsilon Energy (EPSN) recently announced a new capital return policy (as was hinted at in its last earnings release). It will start paying a quarterly dividend of $0.0625 per share on March 31, 2022. This works out to a 3.9% dividend yield. In addition, the company approved a share repurchase authorization to buy 1.1MM shares at an average price of no more than $6.76 per share. I look forward to the company’s quarterly report which should be released later in March. Original Write-up. Buy under 6.00

Esquire Financial Holdings (ESQ) had no news this week. The company reported a great quarter in January. For the year, the company generated $2.26 of EPS, up 37% from last year. Asset quality remains high as the company’s allowance for bad loans is just 1.7% of total loans. Esquire dominates its niche, the liquidation industry. Due to its specialty and expertise, it has been able to grow very well, and I expect that growth to continue. Importantly, the company’s investment in digital marketing and sales is paying off as digital accounted for half of commercial loan originations in 2021. This expertise will enable Esquire to grow beyond its current New York and New Jersey focus. Despite strong historical growth (~20% per year), the stock trades at ~10x forward earnings. Looking out a couple of years, Esquire should be trading significantly higher. Original Write-up. Buy under 35.00

IDT Corporation (IDT) reported earnings this week. The headline number didn’t look great, but the investment case remains on track. Revenue was down slightly year over year, but IDT’s two key segments, NRS and net2phone, generated excellent results. NRS revenue grew 104% to $10.6MM while net2phone subscription revenue increased 32.5% to $12.5MM. IDT announced its goal is to spin net2phone off before the end of its fiscal year (July 31 year-end). The investment case remains on track and my price target is $55 based on an updated sum-of-the-parts analysis. Original Write-up. Buy under 45.00

Liberated Syndication (LSYN) recently announced that it has acquired Podcast Ad Reps (PAR), a podcast advertising company. I view this acquisition positively as Libsyn continues to build increased scale in the podcast advertising space. I expect Libsyn to re-file its financials by the middle of this year and once it does, I think it will look quite attractive. I estimate that it’s trading at 3.0x (EV/revenue) with high-teens revenue growth. Original Write-up. Buy under 5.00

Medexus Pharma (MEDXF) recently announced that it has acquired exclusive rights to sell Gleolan in the United States. Medexus estimates that this is a $14MM USD opportunity. Medexus currently sells Gleolan in Canada and is very familiar with the product. This is a big positive as it increases the company’s revenue run rate by ~16%. In February, Medexus posted their Q3 earnings results, and reported sales of $21.3MM, beating consensus of $18.8MM. They also posted positive EBITDA of $1.9MM, which was expected to be negative $1.6MM. Revenue was $17.9MM last quarter. So sequential improvement of 18% is excellent from my perspective. Looks like IXINITY is getting back on track (Medexus noted IXINITY drove the sequential improvement). Key things to note from the earnings call, the company received a $2MM order for IXINITY late in the quarter so it was a little higher than expected. Next quarter might be a little lower revenue but should be breakeven EBITDA. But remember, the company is carrying costs for Treo so excluding that spend, the company would be profitable. I continue to believe that the risk/reward for Medexus looks attractive heading into the second half of the year. Original Write-up. Buy under 3.50

NexPoint Diversified REIT (NXDT) had no news this week. It is a closed end fund that is transitioning into a real estate investment trust (REIT). It trades at a 40% discount to NAV and is significantly below where it traded pre-pandemic. Once the transition to a REIT is complete, it will be eligible for many more investors to own including funds and ETFs. This will likely drive indiscriminate buying pressure. The CEO owns 14% of the company and has been buying the stock in the open market relentlessly. A near-term re-rate to NAV could drive 50%+ upside, but longer term, a bigger opportunity could materialize as the REIT is repositioned to capture value. Original Write-Up. Buy under 15.00

P10 Holdings (PX) reported excellent year-end results last week. Revenue increased 123% y/y. Adjusted EBITDA increased 162% y/y to $83MM. P10 Holdings has equity stakes in six private equity focused strategies: 1) RCP Advisors, 2) TrueBridge Capital Partners, 3) Enhanced Capital, 4) Five Points Capital, 5) Hark Capital, and 6) Bonaccord Capital Partners. All of these managers have strong track records which will enable them to continue to raise additional assets under management. This drives continued revenue and earnings growth. P10 is currently trading at 19x 2021 adjusted EBITDA which is a very reasonable valuation for such a stable business with strong organic growth potential. Original Write-up. Buy under 15.00

Truxton (TRUX) reported a great quarter in January and announced a $1 per share special dividend and $5MM share repurchase authorization. For the full year, EPS increased 29% to $5.02. Meanwhile, the stock trades at just 14.3x earnings. Loan quality remains excellent as the company wrote off just $2k in loan losses. Allowance for loan losses remains very low at 0.9% of all loans. I expect strong performance to continue in the future and anticipate significant upside in the years ahead. Original Write-up. Buy under 75.00

Watch List

BNCCORP (BNCC) remains on my watch list. It is a cheap bank that is returning all excess cash to shareholders via special dividends. Last year, it paid out $14/share in special dividends (32% of current share price). It looks like an attractive low-risk idea. The stock has faded a bit. In 2022, it should generate EPS of $5 and will likely dividend it all out to shareholders.

Currency Exchange International Corp (CURN) remains on my watch list. It is a new name on my watch list. It is a Canadian company with a legacy business and a hidden high-growth software business. Downside appears limited given cash on its balance sheet, but upside is considerable given impressive software growth.

Fortitude Gold (FTCO) is a new name on my watch list. It is a Nevada-based gold producer that is generating tremendous cash flow from its Isabella Pearl mine. The mine only has 3 more years of remaining life, but the company is aggressively looking to develop an adjacent property. It also pays a nice dividend.

Recommendation RATINGS

| Stock | Price Bought | Date Bought | Price on 3/9/22 | Profit | Rating |

| Aptevo Therapeutics (APVO) | 32.01 | 3/10/21 | 4.86 | -85% | Buy under 15.00 |

| Atento SA (ATTO) | 21.57 | 8/24/21 | 23.76 | 10% | Buy under 30.00 |

| BBX Capital (BBXIA) | 3.17 | 10/5/20 | 10.51 | 232% | Buy under 11.00 |

| Cipher Pharma (CPHRF) | 1.80 | 9/8/21 | 1.50 | -17% | Buy under 2.00 |

| Crossroad Systems (CRSS) | 14.38 | 2/9/22 | 13.10 | -9% | Buy under 15.00 |

| Dorchester Minerals LP (DMLP)* | 10.45 | 10/14/20 | 24.61 | 136% | Buy under 25.00 |

| Epsilon Energy (EPSN) | 5.00 | 8/11/21 | 6.25 | 25% | Buy under 6.00 |

| Esquire Financial Holdings (ESQ) | 34.10 | 11/10/21 | 32.10 | -6% | Buy under 35.00 |

| IDT Corporation (IDT) | 19.37 | 2/10/21 | 32.22 | 66% | Buy under 45.00 |

| Liberated Syndication (LSYN) | 3.06 | 6/10/20 | 3.25 | 6% | Buy under 5.00 |

| Medexus Pharma (MEDXF) | 1.78 | 5/13/20 | 2.47 | 39% | Buy under 3.50 |

| NexPoint Diversified Real Estate Trust (NXDT) | 14.15 | 1/12/22 | 14.06 | -1% | Buy under 15.00 |

| P10 Holdings (PX)** | 2.98 | 4/28/20 | 11.80 | 296% | Buy under 15.00 |

| Truxton Corp (TRUX) | 69.50 | 12/8/21 | 75.00 | 8% | Buy under 75.00 |

* Return calculation includes dividends

**Original Price Bought adjusted for reverse split.

Hold means just that; hold what you have. Don’t buy, or sell, shares.

Sell means the original reasons for buying the stock no longer apply, and I recommend exiting the position.

Sell a Half means it’s time to take partial profits. Sell half (or whatever portion feels right to you) to lock in a gain, and hold on to the rest until another ratings change is issued.

Disclosure: Rich Howe owns shares in BBXIA, PX, MEDXF, LSYN, IDT, FPAY, DMLP, LEAT, and NXDT. Rich will only buy shares after he has shared his recommendation with Cabot Micro-Cap Insider members and will follow his rating guidelines.

The next Cabot Micro-Cap Insider issue will be published on April 13, 2022.