Today, I’m recommending a company that will benefit from the post-pandemic travel boom.

Other key points:

•145% quarterly revenue growth

•Cheap valuation: 5.7x EBITDA

•Hidden high-growth payments division

•High insider ownership (21% of the company).

All the details are inside this month’s Issue. Enjoy!

Cabot Micro-Cap Insider Issue: May 11, 2022

It Feels Scary Out There

With elevated volatility, market conditions feel a bit precarious.

It doesn’t feel good.

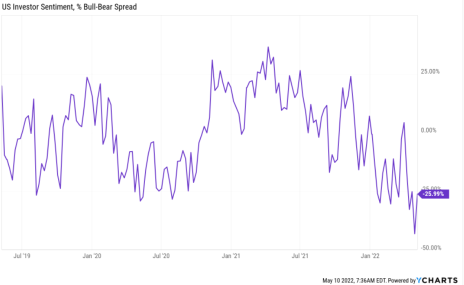

Sentiment remains depressed.

But that usually means it’s a good time to buy.

Warren Buffett famously said, “Be fearful when others are greedy and greedy when others are fearful.”

People are fearful.

While Buffett’s quote is reassuring, it’s also helpful to look at the data.

LPL Financial crunched the numbers and turns out the S&P 500 is off to one of its worst starts to a year ever.

But the good news is that the market usually finishes strong.

During the nine previous worst starts to the year through April, the S&P 500 finished the year up 10% on average.

While these statistics are encouraging, what is more exciting to me is I’m personally seeing many compelling opportunities, not just in the micro-cap world but in large-cap stocks as well.

In previous issues, I recommended a new stock with 25% to 40% upside. In this issue, I can easily see 100% upside over the next 12 months.

With that, let’s move on to my newest recommendation: Currency Exchange International (CURN).

New Recommendation

Currency Exchange (CURN): 100% Upside in This Travel Recovery Play

Company: Currency Exchange International

Ticker: CURN

Price: 13.70

Market Cap: $88 million

Price Target: 27.50

Upside: 100%

Recommendation: Buy under 16

Recommendation Type: Rocket

Executive Summary

Currency Exchange International (CURN) is benefitting from the post-pandemic travel boom yet only trades at 6x EBITDA. It is growing revenue by 100% and is expanding margins rapidly. Insider ownership is high and the company has a rock solid balance sheet. Finally, Currency Exchange has a hidden asset (payments business) which is highly valuable. I see 100% upside.

Company Overview

Background

In 1987, Randolph Pinna founded Currency Exchange, the predecessor to Currency Exchange International.

Eventually, Bank of Ireland bought the business but was forced to sell it in 2007 as the financial crisis began. Mr. Pinna bought back several forex (foreign exchange) retail locations and created the current company.

Currency Exchange specializes in selling foreign banknotes through their retail and wholesale channels while also offering payments solutions to integrated banking customers.

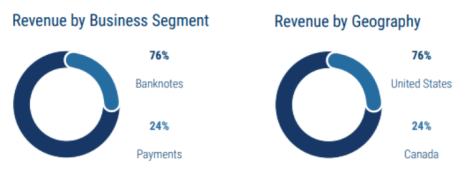

Source: Currency Exchange Annual Report

Seventy-six percent of revenue comes from banknotes and 24% of revenue comes from payments.

What are banknotes?

Think physical dollar bills.

Currency Exchange makes money both through retail stores and wholesale agreements.

On the retail side, tourists come to the U.S. and exchange foreign currency for U.S. dollars. The company has 35 stores in high tourist areas (like New York City) where foreigners can exchange international currency for U.S. dollars (or vice versa). Currency Exchange makes a margin on each transaction.

The company’s wholesale business supplies banks and third-party FX retailers with currency to sell.

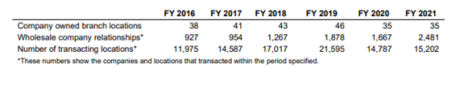

Growth has been strongest as the number of wholesale relations has increased from 927 in 2016 to 2,481 in 2021. The number of retail branch locations has decreased from a peak of 46 in 2019 to 35 in 2021.

Source: Currency Exchange Annual Report

Selling banknotes is a slow-growth (1-4%), high-gross margin business (30-50% EBIT margin) that captures the spread between the spot purchase price of foreign currency and the final sale price. This business is analogous to a financing division at a car dealership. The financing department gets a spot interest rate from their bank and sells it to the customer for a spread.

The traditional banknote sourcing business is a slow- to no-growth business. Because of the oligopolistic nature of the industry, an entrant’s success hinges on achieving the scale necessary to combat large incumbents. These barriers to scale are typically experienced through favorable buy rates received by doing bulk banknote transactions. Since TravelX’s bankruptcy and subsequent departure from the Americas, the industry has consolidated even further into three names: Wells Fargo, Bank of America, and Currency Exchange International.

Using this opportunistic industry consolidation, Currency Exchange took over TravelX kiosks in high density airports with no incremental capital needs. This is because the kiosks will be operated by individual owners under a partnership agreement with the company – leading to no incremental capex required to build out kiosks and less risk tied to a decline in miles traveled.

This high-margin, recurring franchise revenue is similar in nature to an individual franchise agreement, where the operator is responsible for day-to-day working capital needs, uses the franchisors name and IP but kicks back a fee per transaction to the franchisor. While only a small portion of overall revenues, this is high quality annuity-like income that should be valued as such.

Twenty-four percent of revenue comes from the rapidly growing payments business. In 2021, payments revenue increased 117% to $7.4MM. The company’s payments system is integrated through banks and bank branches. Using Currency Exchange’s proprietary payments infrastructure allows banks to send out foreign payments, allowing Currency Exchange to collect transaction fees. This segment continues to grow more than 30% and at maturity should generate 20-25% EBIT margins. Additionally, the company offers an online solution for home currency delivery and has a nominal retail presence in airports.

Management estimates that over the next five years revenue will be split 50/50 between banknotes and payments.

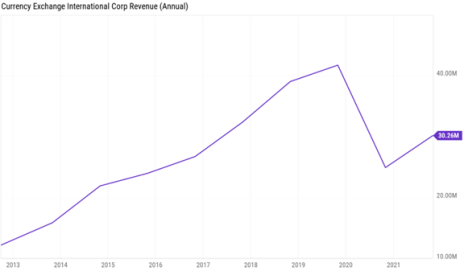

While revenue took a large hit during the pandemic due to the decline in travel, the top line has bounced back as the company generated $12MM in sales in the most recent quarter, its highest level ever, despite it being a historically weak quarter.

Business Outlook

As a proxy, hospitality and leisure occupancy rates are higher right now than 2019 during weekends, yet still trending relatively in line/underperforming 2019 numbers during weekdays. Because international travel has been disproportionately affected by travel bans, there’s still more upside to the reopening trade for CURN’s end market. According to TSA checkpoint data, travelers were still down approximately 10% vs. the same period in 2019.

I subscribe to a newsletter called The Transcript, which monitors company transcripts to pick up key themes.

The key theme recently has been an acceleration in travel.

Increased travel is going to flow through to Currency Exchange’s financial results. I expect increased travel activity to drive 100% growth in 2022 (Q1 revenue grew 145%).

Insider Ownership

As Cabot Micro-Cap Insider subscribers know, insider ownership is high on my checklist and is critical when investing in micro-caps.

Currency Exchange’s CEO, Randolph Pinna, owns 21% of shares outstanding, ensuring minority shareholders are well aligned with management.

Further, Randolph is a proven operator who has been in the business since the 1980s.

Valuation and Price Target

Currency Exchange has 6.5MM shares outstanding and a market cap of $88MM. It has $86MM of net cash on its balance sheet, which provides nice downside protection.

Per management’s comments from the Q3 2020 earnings call, not all cash on the balance sheet is excess cash. On a normalized basis, about 80% of the cash build goes towards inventories while the additional cash can truly be considered “excess cash.”

Assuming 20% of the $86mm in net cash is “excess,” $17MM should be used for purposes of the enterprise value calculation.

As such, the current enterprise value of Currency Exchange is $71MM.

In the most recent quarter (which is seasonally weak), the company generated $3.1MM of EBITDA, or $12.4MM on an annualized basis. As such, the company is trading at 5.7x annualized EBITDA. This seems far too cheap.

Given a booming travel market and additional growth opportunities, I expect the company to generate ~$60MM of revenue in 2022 and $18MM of EBITDA.

A target valuation of 9x EBITDA seems reasonable/conservative, but that would yield a 27.50 price target.

Currency Exchange is a low-risk/high-reward way to play an international reopening, with an unencumbered balance sheet, net cash position, multiple near-term catalysts, and an aligned management team.

My official rating is Buy under 16.00.

As is always the case with micro-caps, use limits as volume is quite low.

Risks

Recession risk

- If a recession occurs in the near future it will reduce consumer disposable income and negatively impact international travel. Nonetheless, Currency Exchange has a strong balance sheet and should be able to withstand the macroeconomic challenges.

Further COVID Lockdown

- While I think it’s unlikely to occur, there could be further travel restrictions which would negatively impact Currency Exchange’s business. Given the company was able to successfully navigate 2020 and 2021, I have confidence it will be able to manage any pandemic-related challenges in 2022.

Recommendation Updates

Changes This Week

None

Updates

Aptevo (APVO) continues to perform poorly. It recently filed an 8-K disclosing that it is at risk of being delisted from the NASDAQ exchange because its stockholders’ equity balance of $1.2MM is below the minimum threshold of $2.5MM. The company could easily meet this threshold by raising equity although it would be dilutive. The stock continues to look incredibly cheap, but the entire biotech sector is in a bear market. What could get the stock going again? It’s tough to say with certainty, but Aptevo will report additional data from its ongoing trials this year, and any positive news will move the stock upwards. Aptevo has cash on its balance sheet of $46MM which is enough for the next 12 months Original Write-up. Buy under 7.50

Atento S.A. (ATTO) reported earnings in late March. Revenue increased 5% but EBITDA declined by 7%. Results missed consensus expectations, but the miss was due to a cyber hack which had been previously disclosed and resolved. Nonetheless, the investment thesis is intact. To summarize, the company is trading at a massive discount to peers and will likely be sold in the near term (the company has hired Goldman Sachs to review strategic alternatives, according to Bloomberg). Another positive is the Brazilian Real has appreciated recently and that will be a tailwind for the company. Original Write-up. Buy under 35.00

BBX Capital (BBXIA) reported earnings in March. They were excellent. Book value per share now stands at $20.79, up over a dollar since last quarter. The aggressive buybacks are really paying off. Since the spin-off, shares outstanding have declined by 16%. The company has a market cap of $162MM. Meanwhile, it has net cash + notes receivable of $113MM ($6.96 per share). In 2021 it generated $29MM in free cash flow and that is set to continue given the real estate market is booming in Florida. My new price target is 12.50 (60% of book value). Original Write-up. Buy under 11.00

Cipher Pharma (CPHRF) reported earnings in March. The results were great. On the year, revenue was up 1% to $21.9MM. SG&A decreased 18.3% to $5.1MM and this drove a dramatic increase in EBITDA, which increased 46% to $11.8MM. The company bought back ~5% of shares during the year. The company has no debt and $20.5MM ($0.79 per share) of cash on its balance sheet. Meanwhile, the company continues to move its pipeline forward and evaluate accretive acquisition opportunities. Original Write-up. Buy under 2.00

Cogstate Ltd (COGZF) had no news this week. It is a profitable, rapidly growing Australian company that is the market leader in computerized cognition testing. The biggest use case is Alzheimer’s Disease, which is a massive and growing market. Cogstate is benefiting from a boom in Alzheimer’s R&D spending which is driving 20%+ revenue growth. Longer term, Cogstate’s direct-to-consumer Alzheimer’s test could accelerate growth even further. Despite a terrific outlook, Cogstate trades at just 28x current earnings. Looking out a few years, this stock could easily double or more. Original Write-up. Buy under 1.80

Crossroads Systems (CRSS) reported earnings results recently. PPP has ended, but Crossroads continues to process the forgiveness of loans. In addition, the company continues to focus on funding impact loans across the country. Book value currently sits at $11.68, slightly below the current stock price. The management team and board of directors have a track record of creating shareholder value (the company paid a special dividend of $40/per share in 2021 due to windfalls from the PPP program). As such, the current valuation looks attractive. Original Write-up. Buy under 15.00

Dorchester Minerals LP (DMLP) continues to look good. Dorchester recently announced its Q2 distribution of $0.75, which annualizes to an 11.5% yield. The company is benefiting from high commodity prices. While commodity prices will continue to be volatile, I expect them to remain elevated for the foreseeable future. Dorchester will pay out all windfall profits to shareholders. Original Write-up. Buy under 25.00

Epsilon Energy (EPSN) continues to perform well given rocketing natural gas prices. Last year, the company produced tremendous free cash flow and will likely do so again this year. The company currently has $27.1MM of cash (18% of its market cap) and no debt. Epsilon recently committed to paying a quarterly dividend of $0.0625 per share starting on March 31. This works out to a 3.3% dividend yield. In addition, the company approved a share repurchase authorization to buy 1.1MM shares at an average price of no more than $6.76 per share. Original Write-up. Buy under 6.00

Esquire Financial Holdings (ESQ) initiated a 9-cent quarterly dividend last week. This works out to a 1% yield. The company reported earnings in late March. Results were excellent, and the investment case remains on track. The company reported Q2 EPS of $0.66, a penny ahead of consensus. Return on equity increased y/y from 13.3% to 15.0%. Esquire remains well capitalized with excellent credit metrics. The company has a long runway for growth, as articulated by CEO Andrew Sagliocca, “There is tremendous potential in both the litigation and payment markets primarily due to the limited number of players and fragmented and inefficient approach to coupling financing, payment processing, and technology. We believe Esquire will be a leader in all three categories in both industries.” Despite its strong outlook, the stock trades at just 12x earnings. Original Write-up. Buy under 35.00

IDT Corporation (IDT) announced that it is delaying its net2phone spin-off. While this is disappointing, it makes sense given the market environment for high-growth stocks. Eventually the spin-off will happen. In March, IDT reported Q2 earnings. The headline number didn’t look great but the investment case remains on track. Revenue was down slightly year over year, but IDT’s two key segments, NRS and net2phone, generated excellent results. NRS revenue grew 104% to $10.6MM while net2phone subscription revenue increased 32.5% to $12.5MM. The investment case remains on track and my price target is 55 based on an updated sum-of-the-parts analysis. Original Write-up. Buy under 45.00

Liberated Syndication (LSYN) stopped trading on April 15 (the 14th was the last day of trading) because the SEC revoked the company registration. This sounds like horrible news but I think it’s actually the opposite. Let me explain. Libsyn has been working with the SEC for ~2 years to re-state its financials. Long story short, the prior CEO and CFO did a bad job managing the business and didn’t properly account for state sales tax. As a result, the company had to go back through its financials and re-state them all. This process has taken longer than anyone anticipated. However, it appears that we are close to the end of the process. I recently spoke to the CEO of Libsyn, and he told me that the SEC had advised that it would be a more efficient path forward to de-register the stock and then re-file financials rather than re-state all previous financials. This makes intuitive sense to me. As such, this de-registration is step 1. I don’t have a sense for when the financials will be re-filed, but I believe it could happen within a few weeks. Once the financials are filed, I believe we will see a fast-growing, profitable company trading at less than 3x revenue. While Libsyn has been a frustrating stock, I think (and hope!) our patience will be rewarded in short order. Original Write-up. Buy under 5.00

Medexus Pharma (MEDXF) recently announced that it has completed its resubmission of Treosulfan to the FDA. The company expects a decision within six months. In March, Medexus announced that it has acquired exclusive rights to sell Gleolan in the United States. The company estimates that this is a $14MM USD opportunity. Medexus currently sells Gleolan in Canada and is familiar with the product. This is a big positive as it increases the company’s revenue run rate by ~16%. In February, Medexus posted their Q3 earnings results, and reported sales of $21.3MM, beating consensus of $18.8MM. They also posted positive EBITDA of $1.9MM, which was expected to be negative-$1.6MM. Revenue was $17.9MM last quarter. So sequential improvement of 18% is excellent from my perspective. Looks like IXINITY is getting back on track (Medexus noted IXINITY drove the sequential improvement). Key things to note from the earnings call: The company received a $2MM order for IXINITY late in the quarter so it was a little higher than expected. Next quarter might be a little lower revenue but should be breakeven EBITDA. But remember, the company is carrying costs for Treo so excluding that spend, the company would be profitable. I continue to believe that the risk/reward for Medexus looks attractive heading into the second half of the year. Original Write-up. Buy under 3.50

NexPoint Diversified REIT (NXDT) filed its proxy statement in late March and disclosed that “the Conversion process is nearly complete.” This is a major positive as it will enable many new shareholders to invest in the stock (most professional investors don’t invest in closed end funds). The company also recently announced that it made a major realization on its MGM investment. The company disclosed that it received $45MM in cash due to Amazon’s acquisition of MGM. However, what is more interesting is the company disclosed that it expects to receive an additional $81MM from indirect investments in MGM. I spoke to the company and the indirect investments are attributed to the company’s CLO (collateralized loan obligation) holdings. I believe the CLOs are heavily discounted due to liquidity. As such, once they are realized, NAV (net asset value) should increase. Given the positive news, I’m increasing my buy limit to 16.00. Original Write-Up. Buy under 16.00

P10 Holdings (PX) reported excellent year-end results in early March. Revenue increased 123% y/y. Adjusted EBITDA increased 162% y/y to $83MM. P10 Holdings has equity stakes in six private equity-focused strategies: 1) RCP Advisors, 2) TrueBridge Capital Partners, 3) Enhanced Capital, 4) Five Points Capital, 5) Hark Capital, and 6) Bonaccord Capital Partners. These managers have strong track records which will enable them to continue to raise additional assets under management. Higher assets under management will drive continued revenue and earnings growth. P10 is currently trading at 14x 2022 adjusted EBITDA which is a very reasonable valuation for such a stable business with strong organic growth potential. Original Write-up. Buy under 15.00

Truxton (TRUX) reported another great quarter in April with the company reporting its best quarterly earnings ever. The private banking team continues to grow assets in the Nashville area and rising rates are benefiting the portfolio’s net interest margin. Asset quality remains sound with $0 in non-performing loans and $0 in net charge-offs (that’s pretty good!). The Truxton investment case remains on track. The bank will continue to grow loans and earnings prudently while returning excess cash to shareholders through dividends and share buybacks. The stock is trading at just 12.3x annualized earnings. This isn’t the most exciting stock, but it’s a slow and steady winner. Original Write-up. Buy under 75.00

Zedge Inc (ZDGE) announced a transformative acquisition in April. It has acquired GuruShots, a company that combines photography with mobile gaming for $18MM up front and an additional potential earnout of $16.8MM in cash or stock. GuruShots is an Israel-based company whose app allows amateur photographers to compete in a wide variety of contests, showcasing their photos. The app generates an impressive ARPMAU of $3.50 (compared to Zedge at $0.06). The app generated $8MM of revenue but is growing rapidly. I had a chance to talk to Zedge investor relations and am optimistic about the opportunity for the Zedge team to scale up GuruShots and cross-sell to its existing Zedge app users. Original Write-up. Buy under 6.00

Watch List

BNCCORP (BNCC) remains on my watch list. It is a cheap bank that is returning all excess cash to shareholders via special dividends. The bank has benefitted from the mortgage refinancing boom which is fading given rising interest rates. Nonetheless, the company earned $0.41 in EPS in the most recent quarter, or $1.64 on an annualized basis. The company’s policy is to dividend out all excess earnings. In fact, the bank just announced a special dividend of $1.75 which will be paid out on June 21.

Fortitude Gold (FTCO) continues to look attractive. It is a Nevada-based gold producer that is generating tremendous cash flow from its Isabella Pearl mine. The mine only has three more years of remaining life, but the company is aggressively looking to develop an adjacent property. It also pays a nice dividend.

SWK Holdings (SWKH) is an interesting idea which was recently flagged by Chris DeMuth Jr. on Seeking Alpha. The thesis is simple (my favorite kind of thesis). The company is a specialty finance company that specializes in small pharmaceutical and health care financing. The company trades at book value yet has valuable hidden assets. Carlson Capital is the company’s largest shareholder and has tried to buy the company twice outright (the board rejected Carlson’s acquisition offers). Finally, SWK could be added to the Russell 2000 Index in June which would drive “forced buying” from index funds.

Unit Corp (UNTC) is a post-bankruptcy re-org energy company that looks interesting. The business is made up of an upstream oil and gas business that is for sale, a contract drilling business, and a midstream business. The press reported that Unit is seeking up to $1BN for its upstream assets. However, the company currently has unprofitable hedges that it would have to cover in the event of a sale. Nonetheless, the potential sale proceeds compare favorably to the company’s current market cap of $582MM and enterprise value of $750MM. Besides the upstream business that is listed for sale, Unit has a valuable contract drilling business and midstream business.

Recommendation RATINGS

| Stock | Price Bought | Date Bought | Price on 5/10/22 | Profit | Rating |

| Aptevo Therapeutics (APVO) | 32.01 | 3/10/21 | 3.89 | -88% | Buy under 7.50 |

| Atento SA (ATTO) | 21.57 | 8/24/21 | 22.83 | 6% | Buy under 35.00 |

| BBX Capital (BBXIA) | 3.17 | 10/5/20 | 8.99 | 184% | Buy under 11.00 |

| Cipher Pharma (CPHRF) | 1.80 | 9/8/21 | 1.77 | -2% | Buy under 2.00 |

| Cogstate Ltd (COGZF) | 1.70 | 4/13/22 | 1.18 | -31% | Buy under 1.80 |

| Crossroad Systems (CRSS) | 14.10 | 2/9/22 | 12.50 | -11% | Buy under 15.00 |

| Currency Exchange (CURN) | New | - | - | - | Buy under 16.00 |

| Dorchester Minerals LP (DMLP)* | 10.49 | 10/14/20 | 24.50 | 134% | Buy under 25.00 |

| Epsilon Energy (EPSN) | 5.00 | 8/11/21 | 6.94 | 39% | Buy under 6.00 |

| Esquire Financial Holdings (ESQ) | 34.11 | 11/10/21 | 34.10 | 0% | Buy under 35.00 |

| IDT Corporation (IDT) | 19.37 | 2/10/21 | 26.50 | 37% | Buy under 45.00 |

| Liberated Syndication (LSYN) | 3.06 | 6/10/20 | 3.75 | 23% | Buy under 5.00 |

| Medexus Pharma (MEDXF) | 1.78 | 5/13/20 | 2.09 | 17% | Buy under 3.50 |

| NexPoint Diversified Real Estate Trust (NXDT) | 13.67 | 1/12/22 | 15.00 | 10% | Buy under 16.00 |

| P10 Holdings (PX)** | 2.98 | 4/28/20 | 10.75 | 261% | Buy under 15.00 |

| Truxton Corp (TRUX)* | 72.25 | 12/8/21 | 67.00 | -6% | Buy under 75.00 |

| Zedge (ZDGE) | 5.73 | 3/9/22 | 4.53 | -21% | Buy under 6.00 |

* Return calculation includes dividends

**Original Price Bought adjusted for reverse split.

Buy means accumulate shares at or around the current price.

Hold means just that; hold what you have. Don’t buy, or sell, shares.

Sell means the original reasons for buying the stock no longer apply, and I recommend exiting the position.

Sell a Half means it’s time to take partial profits. Sell half (or whatever portion feels right to you) to lock in a gain, and hold on to the rest until another ratings change is issued.

Disclosure: Rich Howe owns shares in BBXIA, PX, MEDXF, LSYN, IDT, DMLP, and NXDT. Rich will only buy shares after he has shared his recommendation with Cabot Micro-Cap Insider members and will follow his rating guidelines.

The next Cabot Micro-Cap Insider issue will be published on June 8, 2022.

Analyst Bio

Rich Howe

Rich is a trained economist and Chartered Financial Analyst (CFA). He has researched and invested in stocks for more than 20 years and has become a recognized expert in micro-cap stock investing. He started his career at investment advisory firm Eaton Vance where he covered a wide range of sectors including software and internet, financials, and health care.

Following his time at Eaton Vance, Rich joined the Citi Private Bank Private Equity Research team and led the creation of a private equity and real estate fund-of-fund that raised over $300 million in capital commitments from sophisticated high net worth individuals and institutions.

Rich left Citi to launch Stock Spin-off Investing, a research service focused on tracking and identifying the most promising stock spin-offs and special situations.

His recommendations have consistently outperformed the market.