Today, I’m recommending a company that provides the “picks and shovels” to the massive Alzheimer’s market.

Other key points:

- •High insider ownership (30% of the company).•45%+ revenue growth this year.•Secular winner trading at P/E of 33x.

All the details are inside this month’s Issue. Enjoy!

New Recommendation

Secular Winners

I tend to be sensitive to valuations. While I’ve definitely morphed over time from a strict “value” investor to more of a “growth at a reasonable price” investor, I do believe that the price you pay matters.

You can invest in the best secular winners in the stock market, but if you pay too high a price, there is a real risk you will lose your shirt.

Take Microsoft (MSFT) as an example. In January 2000, it traded at an EV/sales multiple of 28x. If you had bought the stock in January 2000, it would have taken you 16 years to break even!

Or take Zoom (ZM) last year, trading at over 100x sales. Zoom is down 83% from its all-time high.

Valuation matters.

The main reason why I love investing in micro-caps is because its possible to invest in real growth companies that are benefitting from secular tailwinds at reasonable valuations.

The company that I’m recommending today is a perfect example.

It provides the “picks and shovels” to the massive Alzheimer’s market. It is growing revenue at a 20%+ clip yet trades at only 33x earnings (not revenue!).

An opportunity like this would not exist in the large-cap market.

With that, with that, let’s dive into my latest idea, Cogstate (COGZF).

New Recommendation

Cogstate: “Picks and Shovels” Play for Coming Alzheimer’s Boom

Company: Cogstate

Ticker: COGZF

Price: 1.57

Market Cap: $272 million

Price Target: 2.70

Upside: 72%

Recommendation: Buy under 1.80

Recommendation Type: Rocket

Executive Summary

Cogstate (COGZF) is a profitable, rapidly growing, Australian company that is the market leader in computerized cognition testing. The biggest use case is Alzheimer’s Disease which is a massive and growing market. Cogstate is benefiting from a boom in Alzheimer’s R&D spending which is driving 20%+ revenue growth. Longer term, Cogstate’s direct-to-consumer Alzheimer’s test could accelerate growth even further. Despite a terrific outlook, Cogstate trades at just 33x current earnings. Looking out a few years, this stock could easily be a double or more.

Company Overview

Background

Cogstate is the leading company focused on computerized cognitive tests. The tests are used in clinical trials to assess clinical endpoints.

The tests are used in a variety of diseases but the largest opportunity right now and for the foreseeable future is in Alzheimer’s Disease.

Cogstate has been working on testing for brain health assessments for a long time. Over 20 years! And they are the leading company in the space. The company has worked with the top 10 pharmaceutical companies globally, been used in over 2,000 academic and clinical research trials and administered more than 2 million tests.

Cogstate’s computerized tests are highly automated, easy to use, sensitive to change and accepted by global regulators. They can be used in any country and have been carefully vetted to eliminate any cultural biases (most questions are yes/no).

As noted above, Cogstate’s tests can be used to assess brain health of patients with a variety of indications, but the largest opportunity right now is in Alzheimer’s Disease.

Why use Cogstate’s tests? Because it’s a scalable solution. A neurologist will do a great job assessing cognition. But a Cogstate test is an excellent solution if a pharmaceutical company is trying to run a trial with thousands of patients and doesn’t’ have enough neurologists. Further, the tests allow nurse practitioners and general physicians to assess cognition in a consistent way.

Alzheimer’s is the 6th most common cause of death in the United States according to the CDC. An estimated 5.8 million people in the United States have Alzheimer’s and related dementias. Worldwide, ~55 million people have the disease. Unfortunately, this problem is only going to get bigger as the world’s population aged 60+ will double to 2.1 billion by 2050.

Despite Alzheimer’s widespread incidence, there are few treatment options available to patients. However, in June 2021, Biogen’s Aduhelm, the first disease-modifying drug, was approved by the FDA. Unfortunately, the approval was marred by controversy as Biogen met inappropriately with FDA officials. As such, reimbursement and uptake of Aduhelm has been very slow.

Nonetheless, the approval has increased optimism for disease-modifying Alzheimer’s drugs and has spurred research and development to discover other therapies.

As a result, Cogstate is growing rapidly and profitable.

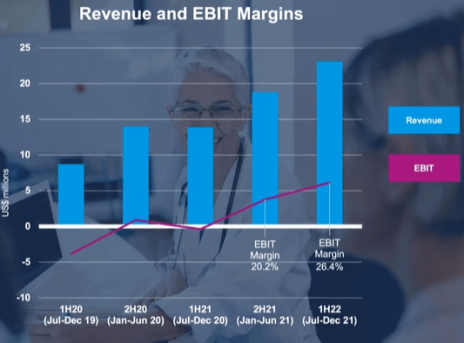

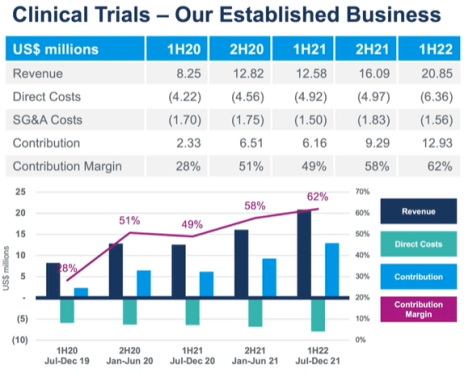

The company is growing rapidly and generated $42 million of revenue and $10 million of EBIT in calendar year 2021.

Currently, 90% of revenue comes from clinical trials, but Cogstate’s partner Eisai is in the process of rolling out a direct-to-consumer cognition test which could be a massive windfall for Cogstate (it gets $2 to $3 per test).

Business Outlook

Given the flurry of clinical trials focused on Alzheimer’s, Cogstate’s solution is in high demand by pharmaceutical companies. Cogstate’s customer base includes 69 pharma and biotech companies over the past 18 months.

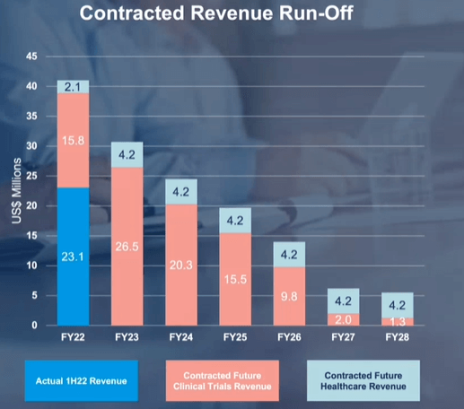

As of 12/31/2021, Cogstate has a $133 million revenue backlog versus calendar year 2022 revenue of $42 million. Given Cogstate’s large backlog, it has a high degree of visibility into its revenue in future years as shown below by the backlog by year.

As shown above, Cogstate has already booked over $30 million (~75% of fiscal year 2022) of revenue for fiscal year 2023.

Further, the backlog has grown by 78% over the past year.

As discussed above, the big driver of the growth has been the clinical trials business. In the first half of fiscal 2022, the clinical trials business grew at 63%.

The clinical trials business will continue to grow at a healthy (20%+) clip in 2023 and beyond due to increased research and development in the Alzheimer’s market.

However, the most exciting part of the growth story is the opportunity to go directly to consumers with a cognitive test.

Cogstate has partnered with Eisai to market the product. Sales are minimal currently, but the margins are high.

Cogstate receives an estimated $2 to $3 per test. Given that the global incidence of Alzheimer’s is ~55 million and growing, it could result in a $50 million market opportunity for the company. In addition, there could be an even bigger market for Alzheimer’s screening. There are currently over a billion people worldwide who are over 60 years old. A standard annual Alzheimer’s screening could quickly become a standard of care once the test becomes widely available. Management has noted that it is hopeful that the direct-to-consumer test can be as big if not bigger than the current clinical business.

Insider Ownership

As Cabot Micro-Cap Insider subscribers know, insider ownership is high on my checklist and is critical when investing in micro-caps.

Insiders, the board of directors, and employees own over 30% of shares outstanding. This ensures that we are well aligned.

Valuation and Price Target

This profitable, secular grower trades at just 33x earnings. I expect that revenue will grow at 20%+ for the foreseeable future and earnings will grow at 25%+ during the same time period.

Assuming Cogstate can eventually trade at 30x my 2025 net income estimate of $22MM, the stock will be worth $2.70, considerably higher than where it currently trades.

There is also the possibility that revenue grows by a factor of 10 due to the proliferation of the direct-to-consumer Alzheimer’s test. In this case, the stock would be a multi-bagger.

My official rating is Buy under 1.80.

As is always the case with micro-caps, use limits as volume is quite low.

Risks

Boom and bust cycle of Alzheimer’s

- If Alzheimer’s therapies are not successful, it would negatively impact uptake of Cogstate. Nonetheless, the Alzheimer’s market is such a large and attractive market for pharma and biotech that I expect considerable focus on the therapeutic category, even in the face of setbacks.

Competition

- While Cogstate is the market leader, another company could design a test that takes share from Cogstate. Given Cogstate has fine-tuned its cognition test over a period of 20 years and gained the trust of the pharma/biotech industry as well as regulators, I’m not overly worried about competition.

Updates, Watch List and Ratings

Recommendation Updates

Changes This Week

None

Updates

Aptevo (APVO) continues to perform poorly. It recently filed an 8-K disclosing that it is at risk of being delisted from the NASDAQ exchange because its stockholder’s equity balance of $1.2MM is below the minimum threshold of $2.5MM. The company could easily meet this threshold by raising equity although it would be dilutive. The stock continues to look incredibly cheap, but the entire biotech market is in a bear market. What could get the stock going again? It’s tough to say with certainty, but Aptevo will report additional data from its ongoing trials this year, and any positive news will move the stock upwards. Aptevo has cash on its balance sheet of $46MM which is enough for the next 12 months. Original Write-up. Buy under 15.00

Atento S.A. (ATTO) reported earnings in late March. Revenue increased 5% but EBITDA declined by 7%. Results missed consensus expectations, but the miss was due to a cyber hack which had been previously disclosed and resolved. Nonetheless, the investment thesis is intact. To summarize, the company is trading at a massive discount to peers and will likely be sold in the near term (the company has hired Goldman Sachs to review strategic alternatives, according to Bloomberg). Another positive is the Brazilian Real has appreciated recently and that will be a tailwind for the company. Original Write-up. Buy under 35.00

BBX Capital (BBXIA) reported earnings in March. They were excellent. Book value per share now stands at $20.79, up over a dollar since last quarter. The aggressive buybacks are really paying off. Since the spin-off, shares outstanding have declined by 16%. The company has a market cap of $162MM. Meanwhile it has net cash + notes receivable of $113MM ($6.96 per share). In 2021 it generated $29MM in free cash flow and that is set to continue given the real estate market is booming in Florida. My new price target is $12.50 (60% of book value). Original Write-up. Buy under 11.00

Cipher Pharma (CPHRF) reported earnings in March. The results were great. On the year, revenue was up 1% to $21.9MM. SG&A decreased 18.3% to $5.1MM and this drove a dramatic increase in EBITDA, which increased 46% to $11.8MM. The company bought back ~5% of shares during the year. The company has no debt and $20.5MM ($0.79 per share) of cash on its balance sheet. Meanwhile the company continues to move its pipeline forward and evaluate accretive acquisition opportunities. Original Write-up. Buy under 2.00

Crossroads Systems (CRSS) reported results recently. PPP has ended, but Crossroads continues to process the forgiveness of loans. In addition, the company continues to focus on funding impact loans across the country. Book value currently sits at $11.68, slightly below the current stock price. The management team and board of directors have a track record of creating shareholder value (company paid a special dividend of $40/per share in 2021 due to windfalls from the PPP program). As such, I think the current valuation looks attractive. Original Write-up. Buy under 15.00

Dorchester Minerals LP (DMLP) continues to look very attractive. The company is benefitting from soaring commodity prices due to the geopolitical conflict in Ukraine. Dorchester will pay out all windfall profits to shareholders. The company paid out its latest dividend of $0.639 per unit on February 10. On an annualized basis, Dorchester is yielding 9.9%. The stock continues to look attractive. Original Write-up. Buy under 25.00

Epsilon Energy (EPSN) recently reported full-year results. Epsilon had an incredibly year. Revenue grew 73% due to soaring natural gas prices. Adjusted EBITDA grew 53%. The company produced tremendous free cash flow and currently has $27.1MM of cash (18% of its market cap) and no debt. The company recently committed to paying a quarterly dividend of $0.0625 per share starting on March 31. This works out to a 4.0% dividend yield. In addition, the company approved a share repurchase authorization to buy 1.1MM shares at an average price of no more than $6.76 per share. Original Write-up. Buy under 6.00

Esquire Financial Holdings (ESQ) had no news this week. The company reported a great quarter in January. For the year, Esquire generated $2.26 of EPS, up 37% from last year. Asset quality remains high as the company’s allowance for bad loans is just 1.7% of total loans. Esquire dominates its niche, the liquidation industry. Due to its specialty and expertise, it has been able to grow very well, and I expect that growth to continue. Importantly, the company’s investment in digital marketing and sales is paying off as digital accounted for half of commercial loan originations in 2021. This expertise will enable Esquire to grow beyond its current New York and New Jersey focus. Despite strong historical growth (~20% per year), the stock trades at ~10x forward earnings. Looking out a couple of years, Esquire should be trading significantly higher. Original Write-up. Buy under 35.00

IDT Corporation (IDT) reported earnings in early March. The headline number didn’t look great, but the investment case remains on track. Revenue was down slightly year over year, but IDT’s two key segments, NRS and net2phone, generated excellent results. NRS revenue grew 104% to $10.6MM while net2phone subscription revenue increased 32.5% to $12.5MM. IDT announced its goal is to spin net2phone off before the end of its fiscal year (July 31 year-end). The investment case remains on track and my price target is 55 based on an updated sum-of-the-parts analysis. Original Write-up. Buy under 45.00

Liberated Syndication (LSYN) recently announced that it sold 1.1MM shares to insiders including Camac Partners at a price of $3.75. The proceeds are being used to pay for a milestone payment due to AdvertiseCast. I was initially a little annoyed that capital was raised given that Libsyn has a strong net cash balance sheet. However, I was able to speak to the company’s CEO last week and got some additional perspective on the equity raise. Essentially, it’s important for Libsyn to have a very strong balance sheet so that advertising partners have confidence in working with the company. The CEO also implied that they are very close to restating their financials which will be a major positive for the stock. I’m bullish on the stock and expect 2022 to be a good year. Original Write-up. Buy under 5.00

Medexus Pharma (MEDXF) recently announced that it has acquired exclusive rights to sell Gleolan in the United States. Medexus estimates that this is a $14MM USD opportunity. Medexus currently sells Gleolan in Canada and is very familiar with the product. This is a big positive as it increases the company’s revenue run rate by ~16%. In February, Medexus posted their Q3 earnings results, and reported sales of $21.3MM, beating consensus of $18.8MM. They also posted positive EBITDA of $1.9MM, which was expected to be negative $1.6MM. Revenue was $17.9MM last quarter. So sequential improvement of 18% is excellent from my perspective. Looks like IXINITY is getting back on track (Medexus noted IXINITY drove the sequential improvement). Key things to note from the earnings call: The company received a $2MM order for IXINITY late in the quarter so it was a little higher than expected. Next quarter might be a little lower revenue but should be breakeven EBITDA. But remember, the company is carrying costs for Treo so excluding that spend, the company would be profitable. I continue to believe that the risk/reward for Medexus looks attractive heading into the second half of the year. Original Write-up. Buy under 3.50

NexPoint Diversified REIT (NXDT) filed its proxy statement in late March and disclosed that “the Conversion process is nearly complete.” This is a major positive as it will enable many new shareholders to invest in the stock (most professional investors don’t invest in closed end funds). The company also recently announced that it made a major realization on its MGM investment. The company disclosed that it received $45MM in cash due to Amazon’s acquisition of MGM. However, what is more interesting is the company disclosed that it expects to receive an additional $81MM from indirect investments in MGM. I spoke to the company and the indirect investments are attributed to the company’s CLO holdings. I believe the CLOs are heavily discounted due to liquidity. As such, once they are realized, NAV should increase. Given the positive news, I’m increasing my buy limit to 16.00. Original Write-Up. Buy under 16.00

P10 Holdings (PX) reported excellent year-end results in early March. Revenue increased 123% y/y. Adjusted EBITDA increased 162% y/y to $83MM. P10 Holdings has equity stakes in six private equity-focused strategies: 1) RCP Advisors, 2) TrueBridge Capital Partners, 3) Enhanced Capital, 4) Five Points Capital, 5) Hark Capital, and 6) Bonaccord Capital Partners. These managers have strong track records which will enable them to continue to raise additional assets under management. Higher assets under management will drive continued revenue and earnings growth. P10 is currently trading at 15x 2022 adjusted EBITDA which is a very reasonable valuation for such a stable business with strong organic growth potential. Original Write-up. Buy under 15.00

Truxton (TRUX) reported a great quarter in January and announced a $1 per share special dividend (which was paid on March 31) and $5MM share repurchase authorization. For the full year, EPS increased 29% to $5.02. Meanwhile, the stock trades at just 14.3x earnings. Loan quality remains excellent as the company wrote off just $2k in loan losses. Allowance for loan losses remains very low at 0.9% of all loans. I expect strong performance to continue in the future and anticipate significant upside in the years ahead. Original Write-up. Buy under 75.00

Zedge Inc. (ZDGE) reported a great quarter in March with 32% revenue growth. Revenue came in at $6.9MM, beating consensus of $6.0MM. EBITDA of $3.4MM grew 16% and beat consensus expectations of $3.1MM. EPS of $0.16 beat consensus expectations of $0.12. The only downside is that management didn’t increase revenue growth guidance which was maintained at 25% to 30%. The management team is very conservative, and guidance looks conservative given revenue grew 60% in Q1 and 32% in Q2. The investment case remains on track. Original Write-up. Buy under 6.00

Watch List

BNCCORP (BNCC) is a cheap bank that is returning all excess cash to shareholders via special dividends. The bank has benefitted from the mortgage refinancing boom which is fading given rising interest rates. Nonetheless, the company earned $0.92 in EPS in the most recent quarter or $3.68 on an annualized basis. The company’s policy is to dividend out all excess earnings. As such, the company could pay out all its earnings this year in a special dividend which would translate to an ~11% yield. The stock looks attractive.

Currency Exchange International Corp. (CURN) is a Canadian company that continues to look attractive. Its core business is a foreign money exchange business that depends on tourism so it’s a reopening play and should continue to recover (it’s still trading well below pre-Covid highs). At the same time, it has a fast-growing software business that is a hidden asset and undervalued. Downside appears limited given cash on its balance sheet, but upside is considerable given the cyclical recovery of its base business and impressive software growth.

Fortitude Gold (FTCO) continues to look attractive. It is a Nevada-based gold producer that is generating tremendous cash flow from its Isabella Pearl mine. The mine only has three more years of remaining life, but the company is aggressively looking to develop an adjacent property. It also pays a nice dividend.

Recommendation RATINGS

| Stock | Price Bought | Date Bought | Price on 4/12/22 | Profit | Rating |

| Aptevo Therapeutics (APVO) | 32.01 | 3/10/21 | 4.89 | -85% | Buy under 15.00 |

| Atento SA (ATTO) | 21.57 | 8/24/21 | 26.06 | 21% | Buy under 35.00 |

| BBX Capital (BBXIA) | 3.17 | 10/5/20 | 9.80 | 209% | Buy under 11.00 |

| Cipher Pharma (CPHRF) | 1.80 | 9/8/21 | 1.92 | 7% | Buy under 2.00 |

| Crossroad Systems (CRSS) | 14.38 | 2/9/22 | 12.20 | -15% | Buy under 15.00 |

| Dorchester Minerals LP (DMLP)* | 10.45 | 10/14/20 | 25.79 | 147% | Buy under 25.00 |

| Epsilon Energy (EPSN) | 5.00 | 8/11/21 | 6.13 | 23% | Buy under 6.00 |

| Esquire Financial Holdings (ESQ) | 34.10 | 11/10/21 | 33.48 | -2% | Buy under 35.00 |

| IDT Corporation (IDT) | 19.37 | 2/10/21 | 31.78 | 64% | Buy under 45.00 |

| Liberated Syndication (LSYN) | 3.06 | 6/10/20 | 3.75 | 23% | Buy under 5.00 |

| Medexus Pharma (MEDXF) | 1.78 | 5/13/20 | 2.53 | 42% | Buy under 3.50 |

| NexPoint Diversified Real Estate Trust (NXDT) | 14.15 | 1/12/22 | 15.96 | 13% | Buy under 16.00 |

| P10 Holdings (PX)** | 2.98 | 4/28/20 | 11.39 | 282% | Buy under 15.00 |

| Truxton Corp (TRUX) | 69.50 | 12/8/21 | 73.49 | 7% | Buy under 75.00 |

| Zedge (ZDGE) | 5.77 | 3/9/22 | 5.51 | -4% | Buy under 6.00 |

* Adjusted for reverse split

Buy means accumulate shares at or around the current price.

Hold means just that; hold what you have. Don’t buy, or sell, shares.

Sell means the original reasons for buying the stock no longer apply, and I recommend exiting the position.

Sell a Half means it’s time to take partial profits. Sell half (or whatever portion feels right to you) to lock in a gain, and hold on to the rest until another ratings change is issued.

Disclosure: Rich Howe owns shares in BBXIA, PX, MEDXF, LSYN, IDT, DMLP, and NXDT. Rich will only buy shares after he has shared his recommendation with Cabot Micro-Cap Insider members and will follow his rating guidelines.

The next Cabot Micro-Cap Insider issue will be published on May 11, 2022.