Weekly Earnings Commentary

All is well in Quant Trader land. Our two positions are currently in great shape with the potential to take some decent profits off the table. We still have 39 days left until the April 21, 2023, expiration cycle, so there is a good chance that we take both of our open trades off the table for profits and look to immediately sell more premium, especially with the recent pop in implied volatility.

If you have any questions, please do not hesitate to email me at andy@cabotwealth.com.

Current Portfolio

Open Trades | |||||||

| Open Date | Ticker | Strategy | Trade | Open Price | Current Price | Current Probability | Delta |

| 2/23/2023 | SPY | Iron Condor | April 21, 2023 435/430 - 350/345 | $0.80 | $0.55 | 97.29% - 85.56% | 0.01 |

| 3/6/2023 | DIA | Bear Call | April 21, 2023 350/355 | $0.85 | $0.17 | 95.30% | -0.02 |

| Open Date | Closed Date | Ticker | Strategy | Trade | Open Price | Closing Price | Return |

| 6/2/2022 | 6/13/2022 | SPY | Bear Call Spread | July 15, 2022 440/445 | $0.70 | $0.05 | 14.94% |

| 6/8/2022 | 6/17/2022 | XOP | Bear Call Spread | July 15, 2022 190/195 | $0.70 | $0.04 | 15.21% |

| 6/22/2022 | 7/13/2022 | SPY | Bear Call Spread | July 29, 2022 405/410 | $0.75 | $0.35 | 8.70% |

| 6/30/2022 | 7/25/2022 | IWM | Iron Condor | August 19, 2022 195/200 - 145/140 | $0.70 | $0.34 | 7.76% |

| 7/8/2022 | 7/28/2022 | GLD | Bull Put Spread | August 19, 2022 155/150 | $0.60 | $0.16 | 9.65% |

| 7/14/2022 | 8/11/2022 | SPY | Iron Condor | August 19, 2022 417/412 - 335/330 | $0.70 | $4.10 | -68.00% |

| 8/1/2022 | 8/29/2022 | SPY | Bear Call Spread | September 16, 2022 439/444 | $0.70 | $0.07 | 14.42% |

| 8/11/2022 | 8/29/2022 | DIA | Bear Call Spread | September 23, 2022 350/325 | $0.75 | $0.08 | 15.47% |

| 8/11/2022 | 9/8/2022 | IWM | Iron Condor | September 23, 2022 220/215 - 173/168 | $0.77 | $0.57 | 4.17% |

| 9/7/2022 | 9/9/2022 | QQQ | Bull Put Spread | October 21, 2022 260/255 | $0.62 | $0.30 | 6.84% |

| 9/9/2022 | 9/15/2022 | SPY | Bear Call Spread | October 21, 2022 430/435 | $0.75 | $0.25 | 11.11% |

| 9/13/2022 | 10/17/2022 | IWM | Iron Condor | October 21, 2022 208/203 - 163/158 | $0.77 | $0.30 | 10.40% |

| 10/3/2022 | 10/25/2022 | SPY | Bull Put Spread | November 18, 2022 325/320 | $0.54 | $0.09 | 9.89% |

| 10/4/2022 | 11/2/2022 | IWM | Iron Condor | November 18, 2022 198/203 - 143/138 | $0.64 | $0.32 | 6.84% |

| 10/6/2022 | 11/2/2022 | SPY | Bear Call Spread | November 18, 2022 412/416 | $0.43 | $0.28 | 3.90% |

| 11/16/2022 | 11/28/2022 | IWM | Iron Condor | December 16, 2022 205/200 - 162/157 | $0.75 | $0.24 | 11.36% |

| 11/10/2022 | 12/6/2022 | SPY | Bear Call Spread | December 16, 2022 420/425 | $0.65 | $0.14 | 11.36% |

| 12/1/2022 | 12/6/2022 | SPY | Bear Call Spread | January 20, 2023 435/440 | $0.67 | $0.18 | 10.86% |

| 12/13/2022 | 12/15/2022 | SPY | Bear Call Spread | January 20, 2023 430/435 | $0.54 | $0.17 | 7.99% |

| 12/7/2023 | 1/6/2023 | IWM | Iron Condor | January 20, 2023 202/198 - 160/156 | $0.70 | $0.06 | 19.00% |

| 1/4/2023 | 2/1/2023 | IWM | Iron Condor | February 17, 2023 200/195 - 154/149 | $0.65 | $2.00 | -27.00% |

| 1/6/2023 | 2/2/2023 | SPY | Bear Call Spread | February 17, 2023 415/420 | $0.60 | $2.50 | -38.00% |

| 2/2/2023 | 2/15/2023 | SPY | Bear Call Spread | March 17, 2023 440/445 | $0.63 | $0.15 | 10.62% |

| 2/10/2023 | 2/22/2023 | DIA | Bear Call Spread | March 31, 2023 355/360 | $0.70 | $0.17 | 11.86% |

| 2/2/2023 | 3/1/2023 | IWM | Iron Condor | March 17, 2023 175/180 - 215/220 | $0.72 | $0.51 | 4.38% |

| 93.73% | |||||||

| 131.87% | |||||||

Volatility Talk

We’ve spent most of 2023 bouncing between support (18) and overhead resistance (23). That is until last week when the VIX finally pushed through 23 and closed the week out at 24.80. However, on Friday the investor’s fear gauge hit a high of roughly 29 before pulling back to close out the week just under 25.

This week should be a doozy with several key data points due to release. I wouldn’t be surprised to see another test of 29 before we see a reprieve and potential pullback in the VIX. One thing is certain: The return of IV should give us ample opportunities to sell premium over the next week or so.

Weekly High-Probability Mean Reversion Indicator

Below is my watch list of ETFs and stocks with the most liquid options headed into the week of March 13, 2023.

Here are the various levels I use to determine if an ETF is in an oversold or overbought state.

| Very Overbought | greater than or equal to 80.1 |

| Overbought | 60.1 to 80.0 |

| Neutral | 40.1 to 60 |

| Oversold | 20.1 to 40.0 |

| Very Oversold | less than or equal to 20.0 |

Each week I also include the current implied volatility (IV) and IV Rank. I look for an IV rank above 40, preferably higher.

ETF Watch List – Trade Ideas

| Ticker Symbol | IV | IV Rank | HPMR Oversold - Overbought | |

| ARK Innovation ETF | ARKK | 62.2 | 28.9 | 26.2 |

| Proshares Bitcoin ETF | BITO | 62.0 | 10.8 | 13.6 |

| SPDR Dow Jones | DIA | 22.5 | 33.2 | 23.4 |

| iShares MSCI Emerging Markets | EEM | 23.6 | 37.7 | 27.9 |

| iShares MSCI EAFE | EFA | 21.7 | 45 | 32.9 |

| iShares MSCI Mexico ETF | EWW | 27.1 | 25 | 37.4 |

| iShares MSCI Brazil | EWZ | 35.8 | 27.9 | 37.9 |

| iShares China Large-Cap | FXI | 35.6 | 24.5 | 25.6 |

| Vaneck Gold Miners | GDX | 38.7 | 17.7 | 40.5 |

| SPDR Gold | GLD | 16.0 | 21.3 | 66.4 |

| iShares High-Yield | HYG | 15.0 | 37.8 | 33.4 |

| iShares Russell 2000 | IWM | 30.4 | 44.8 | 16.2 |

| SPDR Regional Bank | KRE | 46.3 | 110.8 | 6.6 |

| Vaneck Oil Services | OIH | 44.8 | 27.3 | 26.4 |

| Invesco Nasdaq 100 | QQQ | 29.1 | 27.9 | 32.9 |

| iShares Silver Trust | SLV | 30.4 | 25.8 | 41.7 |

| Vaneck Semiconductor | SMH | 36.9 | 26 | 41 |

| SPDR S&P 500 | SPY | 25.2 | 35.6 | 24.6 |

| iShares 20+ Treasury Bond | TLT | 22.1 | 36.4 | 72.8 |

| United States Oil Fund | USO | 37.4 | 16 | 45.7 |

| Proshares Ultra VIX Short | UVXY | 136.0 | 51.3 | 73.3 |

| CBOE Market Volatility Index | VIX | 108.2 | 119.5 | 75.7 |

| Barclays S&P 500 VIX ETN | VXX | 107.5 | 50.8 | 74.1 |

| SPDR Biotech | XLB | 27.0 | 50.7 | 25.8 |

| SPDR Energy Select | XLE | 33.3 | 31 | 29 |

| SPDR Financials | XLF | 33.8 | 67.8 | 11.9 |

| SPDR Utilities | XLU | 22.7 | 37.5 | 34 |

| SPDR S&P Oil & Gas Explorer | XOP | 43.2 | 30.8 | 29.9 |

| SPDR Retail | XRT | 36.2 | 27.4 | 21.5 |

Stock Watch List – Trade Ideas

| Ticker Symbol | IV | IV Rank | HPMR Oversold - Overbought | |

| Apple | AAPL | 32.3 | 31.1 | 43.9 |

| Bank of America | BAC | 44.7 | 79.3 | 10 |

| Bristol-Myers Squibb | BMY | 26.1 | 57.1 | 10.9 |

| Citigroup | C | 41.2 | 50.9 | 23.9 |

| Caterpillar | CAT | 35.2 | 44.3 | 25 |

| Comcast | CMCSA | 33.7 | 31.2 | 20.5 |

| Costco | COST | 29.1 | 18.9 | 29.3 |

| Cisco Systems | CSCO | 26.8 | 19.5 | 43.6 |

| Chevron | CVX | 30.3 | 24.7 | 31.4 |

| Disney | DIS | 36.7 | 20.6 | 17.2 |

| Duke Energy | DUK | 23.2 | 24.2 | 34.8 |

| Fedex | FDX | 41.9 | 45.5 | 34.9 |

| Gilead Sciences | GILD | 32.7 | 72.8 | 34.4 |

| General Motors | GM | 41.4 | 31 | 22.6 |

| Intel | INTC | 40.8 | 33.7 | 64.5 |

| Johnson & Johnson | JNJ | 21.8 | 53.1 | 29 |

| JP Morgan | JPM | 37.8 | 61.7 | 34 |

| Coca-Cola | KO | 20.3 | 31.5 | 39.5 |

| Altria Group | MO | 24.1 | 30.4 | 46.1 |

| Merck | MRK | 24.7 | 54.4 | 45.1 |

| Morgan Stanley | MS | 36.2 | 47.9 | 16 |

| Microsoft | MSFT | 33.4 | 37.8 | 36.4 |

| Nextera Energy | NEE | 31.8 | 32.6 | 45.1 |

| Nvidia | NVDA | 55.7 | 26.5 | 48.3 |

| Pfizer | PFE | 27.5 | 21.2 | 19.5 |

| Paypal | PYPL | 46.1 | 18.1 | 35.4 |

| Starbucks | SBUX | 29.8 | 25.3 | 26.1 |

| AT&T | T | 27.8 | 38.7 | 29.1 |

| Verizon | VZ | 29.1 | 49.6 | 15.9 |

| Walgreens Boots Alliance | WBA | 37.6 | 44.7 | 24.4 |

| Wells Fargo | WFC | 44.6 | 67.2 | 17.4 |

| Walmart | WMT | 23.4 | 27.5 | 21.6 |

| Exxon Mobil | XOM | 32.1 | 23.6 | 28.5 |

Weekly Trade Discussion: Open Positions

*Portfolio updated every Monday

Iron Condor: SPY April 21, 2023, 435/430 calls – 350/345 puts

Original trade published on 2-23-2023 (click to see original alert)

Background: At the time of the trade, SPY was trading for 397.25. We sold the April 21, 2023, SPY 435/430 – 350/345 iron condor for $0.80. The expected range was 373 to 422.

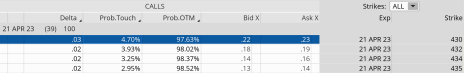

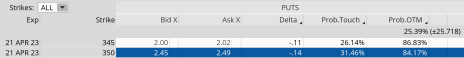

Current Thoughts: SPY is currently trading for 385.91 and our iron condor is worth $0.55. Our probability of success stands at 97.63% on the call side and 84.17% on the put side. We will need to watch the put side a bit more carefully going forward, but we still have 35 points of cushion to the downside and if we see a pop in price early in the week, we should have an opportunity to take off our iron condor for a decent profit.

Call Side:

Put Side:

Bear Call: DIA April 21, 2023, 350/355 calls

Original trade published on 3-6-2023 (click to see original alert)

Background: At the time of the trade, DIA was trading for 335.70. We sold the April 21, 2023, SPY 350/355 bear call for $0.85. The expected range was 323 to 348.

Current Thoughts: DIA is currently trading for 385.91 and our bear call spread is worth $0.17. Our probability of success stands at 95.93%. We should have a good opportunity to take off our bear call spread for a healthy profit this week.

Call Side:

As always, if you have any questions, please feel free to email me at andy@cabotwealth.com.

The next Cabot Options Institute – Quant Trader issue will be published on

March 20, 2023.