Cabot Options Institute Quant Trader – Alert (SPY)

SPDR S&P 500 ETF (SPY)

With the SPDR S&P 500 ETF (SPY) trading for 397.25, I want to place a short-term iron condor going out 57 days. As always, my intent is to take off the trade well before the April 21, 2023, expiration date.

IV: 21.4%

IV Rank: 8.9

Expected Move (Range): The expected move (range) for the April 21, 2023, expiration cycle is from 373 to 422.

Call Side:

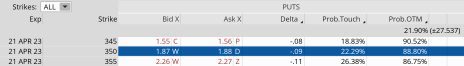

Put Side:

The Trade

Simultaneously:

- Sell to Open SPY April 21, 2023, 430 call strike

- Buy to Open SPY April 21, 2023, 435 call strike

- Sell to Open SPY April 21, 2023, 350 put strike

- Buy to Open SPY April 21, 2023, 345 put strike … for a total of $0.80. (As always, the price of the spread can vary from the time of the alert, so please adjust accordingly if you wish to take on a position.)

*Our margin of error is roughly 8.2% to the upside and more than 11.9% to the downside over the next 57 days.

Delta of spread: -0.03

Probability of Profit: 90.13% (upside) – 88.80% (downside)

Probability of Touch: 19.36% (call side) – 22.29% (put side)

Total net credit: $0.80

Total risk per spread: $420

Max return: 19.0%

Risk Management

Since we know how much we stand to make and lose prior to order entry we can precisely define our position size on every trade we place. Position size is the most important factor when managing risk, so keeping each trade at a reasonable level (I use 1% to 5% per trade, smaller accounts tend to use a higher percentage, closer to 10%) allows not only the Law of Large Numbers to work in your favor … it also allows you to sleep well at night.

I tend to set a stop-loss that sits 1 to 2 times my original credit. Since I’m selling the 435/430 – 350/345 iron condor for roughly $0.80, if my iron condor reaches $1.60 to $2.40, I will exit the trade. As always, I will keep you updated on the status of the position as it progresses and send any necessary updates.