Weekly Commentary

We allowed our PFE calls to expire worthless at expiration last Friday, locked in some decent premium and plan to sell more call premium early this week. Expect to see a trade alert either today or tomorrow.

We also allowed our DKNG puts to carry through expiration and as a result, per our income wheel approach, we were assigned shares of DKNG. Now that we are in the covered call phase of the income wheel approach in DKNG, like PFE, we plan to sell calls against our newly acquired shares today or tomorrow.

Additionally, I intend on introducing a new position in WFC, or another fairly low-priced big bank stock, by selling puts early this week. My hope is we get a short-term pullback before entering a new position.

As I stated last week, and I think it bears repeating one more time since we have a lot of new members on board, the Income Trader service is oftentimes viewed as the tortoise approach. Among many investors today, the slow and steady “tortoise” approach just isn’t sexy. But really, who cares? I certainly don’t, I’m just a nerdy options trader who prefers to sell options with every opportunity, so “sexy” isn’t really in my vocabulary. I care about returns… and more specifically, long-term returns. Returns that offer not only steady growth but sound risk mitigation. And that’s what Income Trader and our income wheel approach offer during both bullish and bearish markets.

Given the conservative approach, returns continue to be exceptional, and if we do indeed see bullish times ahead, it should be of no surprise that returns are even better.

Current Positions

| Open Date | Ticker | Stock Price (open) | Stock Price (current) | Strategy | Trade | Open Price | Current Price | Position Delta |

| Income Wheel Portfolio - Open Trades | ||||||||

| 11/13/2023 | GDX | $27.26 | $31.81 | Covered Call | January 19, 2023 29 Call | $0.62 | $3.00 | 0.1 |

| 11/20/2023 | BITO | $18.81 | $19.27 | Selling Puts | December 22, 2023 16.5 Put | $0.50 | $0.23 | 0.14 |

| 12/5/2023 | XLU | $62.91 | $63.53 | Selling Puts | January 19, 2024 61 Put | $0.80 | $0.76 | 0.3 |

| 11/27/2023 | KO | $58.36 | $58.61 | Selling Puts | January 19, 2024 57.5 Put | $0.76 | $0.74 | 0.35 |

| Open Date | Close Date | Ticker | Strategy | Trade | Open Price | Closed Price | Profit | Return |

| Income Wheel Portfolio - Closed Trades | ||||||||

| 6/2/2022 | 7/8/2022 | PFE | Short Put | July 8, 2022 50 Put | $0.65 | $0.00 | $0.65 | 1.30% |

| 6/10/2022 | 7/15/2022 | GDX | Short Put | July 15, 2022 29 Put | $0.66 | Assigned at $29 | ($2.75) | -9.48% |

| 6/10/2022 | 7/15/2022 | BITO | Short Put | July 15, 2022 16 Put | $0.82 | Assigned at $16 | ($2.09) | -13.10% |

| 6/22/2022 | 7/21/2022 | WFC | Short Put | July 29, 2022 35 Put | $0.80 | $0.02 | $0.78 | 2.23% |

| 6/30/2022 | 8/10/2022 | KO | Short Put | August 19, 2022 57.5 Put | $0.70 | $0.03 | $0.67 | 1.20% |

| 7/21/2022 | 8/10/2022 | WFC | Short Put | August 19, 2022 39 Put | $0.46 | $0.04 | $0.42 | 1.08% |

| 7/18/2022 | 8/17/2022 | BITO | Covered Call | August 19, 2022 16 Call | $0.50 | $0.03 | $0.47 | 3.59% |

| 7/18/2022 | 8/17/2022 | GDX | Covered Call | August 19, 2022 28 Call | $0.63 | $0.05 | $0.57 | 2.22% |

| 7/11/2022 | 8/23/2022 | PFE | Short Put | August 19, 2022 50 Put | $1.00 | Assigned at $50 | $0.21 | 0.43% |

| 7/26/2022 | 8/17/2022 | JPM | Short Put | September 16, 2022 100 Put | $1.22 | $0.16 | $1.06 | 1.10% |

| 8/17/2022 | 9/7/2022 | BITO | Covered Call | September 23, 2022 16.5 Call | $0.55 | $0.03 | $0.52 | 4.00% |

| 8/17/2022 | 9/7/2022 | GDX | Covered Call | September 23, 2022 28 Call | $0.59 | $0.07 | $0.52 | 2.03% |

| 8/23/2022 | 9/23/2022 | PFE | Covered Call | October 21, 2022 50 Call | $1.50 | $0.09 | $1.41 | 2.82% |

| 8/10/2022 | 9/23/2022 | KO | Short Put | September 23, 2022 60 Put | $0.62 | Assigned at $60 | ($0.78) | -1.30% |

| 8/10/2022 | 9/23/2022 | WFC | Short Put | September 23, 2022 41 Put | $0.61 | Assigned at $41 | $0.02 | 0.05% |

| 9/7/2022 | 10/17/2022 | BITO | Covered Call | October 21, 2022 14 Call | $0.40 | $0.03 | $0.37 | 2.60% |

| 9/7/2022 | 10/17/2022 | GDX | Covered Call | October 21, 2022 26 Call | $0.70 | $0.04 | $0.66 | 2.50% |

| 9/26/2022 | 10/21/2022 | WFC | Covered Call | October 21, 2022 41 Call | $1.30 | Called away at $41 | $1.89 | 4.67% |

| 9/26/2022 | 10/21/2022 | KO | Covered Call | October 21, 2022 60 Call | $0.70 | $0.00 | $0.70 | 1.20% |

| 9/23/2022 | 1028/2022 | PFE | Covered Call | October 28, 2022 47 Call | $0.56 | Called away at $47 | $3.49 | 7.43% |

| 10/17/2022 | 11/17/2022 | BITO | Covered Call | November 25, 2022 13.5 Call | $0.38 | $0.03 | $0.35 | 2.60% |

| 10/25/2022 | 11/17/2022 | WFC | Short Put | November 25, 2022 43 Put | $0.96 | $0.07 | $0.89 | 2.00% |

| 10/17/2022 | 11/25/2022 | GDX | Covered Call | November 25, 2022 26 Call | $0.58 | Called away at $26 | $1.09 | 3.87% |

| 10/25/2022 | 11/25/2022 | KO | Covered Call | November 25, 2022 60 Call | $0.80 | Called away at $60 | $2.20 | 3.75% |

| 11/3/2022 | 12/8/2022 | PFE | Short Put | December 16, 2022 45 Put | $1.08 | $0.02 | $1.06 | 2.36% |

| 11/17/2022 | 12/19/2022 | BITO | Covered Call | December 30, 2022 12 Call | $0.45 | $0.04 | $0.41 | 3.42% |

| 11/17/2022 | 12/30/2022 | WFC | Short Put | December 30, 2022 44 Put | $1.02 | Assigned at $44 | ($1.37) | -3.11% |

| 11/29/2023 | 1/9/2023 | GDX | Short Put | January 20, 2023 26 Put | $0.87 | $0.02 | $0.85 | 3.27% |

| 12/8/2022 | 1/13/2023 | PFE | Short Put | January 13, 2023 49 Put | $0.62 | Assigned at $49 | ($0.53) | -1.08% |

| 12/19/2022 | 1/20/2023 | BITO | Covered Call | January 20, 2023 11.5 Call | $0.30 | Called away at $11.5 | $1.49 | 14.70% |

| 11/29/2022 | 1/20/2023 | KO | Short Put | January 20, 2023 60 Put | $0.84 | $0.00 | $0.84 | 1.40% |

| 1/5/2023 | 2/17/2023 | WFC | Covered Call | February 17, 2023 45 Call | $0.84 | Called away at $45 | $4.23 | 10.17% |

| 1/9/2023 | 2/17/2023 | GDX | Short Put | February 17, 2023 29 Put | $0.54 | Assigned at $29 | ($0.05) | -0.10% |

| 1/23/2023 | 2/17/2023 | KO | Short Put | February 17, 2023 59 Put | $0.62 | $0.00 | $0.62 | 1.05% |

| 1/23/2023 | 2/17/2023 | BITO | Short Put | February 17, 2023 13.5 Put | $0.52 | $0.00 | $0.52 | 3.85% |

| 1/20/2023 | 3/1/2023 | PFE | Covered Call | March 3, 2023 46 Call | $1.00 | $0.02 | $0.98 | 2.18% |

| 2/22/2023 | 3/23/2023 | BITO | Short Put | March 31, 2023 31 Put | $0.50 | $0.05 | $0.45 | 3.46% |

| 2/22/2023 | 3/29/2023 | KO | Short Put | March 31, 2023 59 Put | $0.86 | $0.02 | $0.84 | 1.42% |

| 3/1/2023 | 3/29/2023 | PFE | Covered Call | April 6, 2023 42 Call | $0.65 | $0.05 | $0.60 | 1.43% |

| 2/21/2023 | 3/31/2023 | GDX | Covered Call | March 31, 2023 29.5 Call | $0.75 | Called away at $29.5 | $1.84 | 6.48% |

| 2/23/2023 | 3/31/2023 | WFC | Short Put | March 31, 2023 43 Put | $0.53 | Assigned at $43 | ($4.87) | -11.32% |

| 3/29/2023 | 4/28/2023 | KO | Short Put | May 19, 2023 60 Puts | $0.76 | $0.08 | $0.68 | 1.13% |

| 3/29/2023 | 4/28/2023 | PFE | Covered Call | May 19, 2023 42.5 Call | $0.53 | $0.05 | $0.48 | 1.23% |

| 4/4/2023 | 5/8/2023 | GDX | Short Put | May 19, 2023 32 Put | $0.78 | $0.70 | $0.71 | 2.22% |

| 3/23/2023 | 5/18/2023 | BITO | Short Put | May 19, 2023 15 Put | $1.10 | $0.03 | $1.07 | 7.13% |

| 4/4/2023 | 5/24/2023 | WFC | Covered Call | May 19, 2023 40 Call | $0.55 | Called away at $40 | $3.94 | 10.76% |

| 4/28/2023 | 6/16/2023 | PFE | Covered Call | June 16, 2023 40 Call | $0.63 | Called away at $40 | $1.71 | 4.40% |

| 3/29/2023 | 6/16/2023 | KO | Short Put | June 16, 2023 62.5 Put | $0.70 | Assigned at $62.5 | ($0.13) | -0.21% |

| 5/8/2023 | 6/16/2023 | GDX | Short Put | June 16, 2023 34 Put | $0.91 | Assigned at $34 | ($1.70) | -5.00% |

| 5/18/2023 | 6/30/2023 | BITO | Short Put | June 30, 2023 14 Put | $0.45 | $0.01 | $0.44 | 3.14% |

| 5/24/2023 | 7/6/2023 | WFC | Short put | July 21, 2023 37.5 Put | $1.01 | $0.09 | $0.92 | 2.54% |

| 6/30/2023 | 7/24/2023 | DKNG | Short Put | August 18, 2023 22.5 Put | $0.63 | $0.09 | $0.54 | 2.40% |

| 7/6/2023 | 7/24/2023 | WFC | Short Put | August 25, 2023 40 Put | $0.76 | $0.12 | $0.64 | 1.60% |

| 6/21/2023 | 8/18/2023 | PFE | Short Put | August 18, 2023 37.5 Put | $0.64 | Assigned at $37.5 | ($0.24) | -0.64% |

| 6/21/2023 | 8/18/2023 | GDX | Covered Call | August 18, 2023 33 Call | $0.52 | $0.00 | $0.52 | 1.60% |

| 6/21/2023 | 8/18/2023 | KO | Covered Call | August 18, 2023 62.5 Call | $0.85 | $0.00 | $0.85 | 1.40% |

| 6/30/2023 | 8/18/2023 | BITO | Short Put | August 18, 2023 15 Put | $0.78 | Assigned at $15 | ($0.78) | -5.20% |

| 7/24/2023 | 9/14/2023 | DKNG | Short Put | September 15, 2023 28 Put | $1.36 | $0.02 | $1.34 | 4.79% |

| 8/21/2023 | 9/14/2023 | PFE | Covered Call | September 29, 2023 38 Call | $0.78 | $0.02 | $0.76 | 2.00% |

| 8/21/2023 | 9/14/2023 | KO | Covered Call | September 29, 2023 61 Call | $0.78 | $0.03 | $0.75 | 1.23% |

| 7/24/2023 | 9/15/2023 | WFC | Short Put | September 15, 2023 45 Put | $0.85 | Assigned at $45 | ($1.20) | -2.67% |

| 8/21/2023 | 9/29/2023 | BITO | CoveredCall | September 29, 2023 14 Call | $0.48 | $0.00 | $0.48 | 3.58% |

| 9/14/2023 | 10/13/2023 | PFE | CoveredCall | October 20, 2023 35 Call | $0.58 | $0.04 | $0.54 | 1.47% |

| 9/14/2023 | 10/13/2023 | KO | CoveredCall | October 27, 2023 59 Call | $0.95 | $0.03 | $0.92 | 1.49% |

| 9/14/2023 | 10/20/2023 | DKNG | Short Put | October 20, 2023 30 Put | $0.98 | Assigned at $30 | ($1.95) | -6.50% |

| 8/21/2023 | 10/20/2023 | GDX | Covered Call | October 20, 2023 29 Call | $0.86 | $0.00 | $0.86 | 3.11% |

| 9/18/2023 | 10/20/2023 | WFC | Covered Call | October 20, 2023 44.5 Call | $0.89 | $0.00 | $0.89 | 2.05% |

| 10/13/2023 | 11/9/2023 | PFE | Covered Call | November 24, 2023 34 Call | $0.62 | $0.03 | $0.59 | 1.80% |

| 10/23/2023 | 11/13/2023 | GDX | Covered Call | December 1, 2023 31.5 Call | $0.58 | $0.04 | $0.54 | 1.80% |

| 10/23/2023 | 11/17/2023 | DKNG | Covered Call | November 17, 2023 32 Call | $0.87 | Called away at $32 | $2.87 | 9.57% |

| 10/2/2023 | 11/17/2023 | BITO | Covered Call | November 17, 2023 15 Call | $0.47 | Called away at $15 | $0.47 | 3.13% |

| 10/13/2023 | 11/24/2023 | KO | Covered Call | November 24, 2023 55 Call | $0.75 | Called away at $55 | ($6.75) | -10.80% |

| 10/23/2023 | 12/1/2023 | WFC | Covered Call | December 1, 2023 41 Call | $0.87 | Called away at $41 | ($3.13) | -6.95% |

| 10/25/2023 | 12/5/2023 | XLU | Short Put | December 15, 2023 56 Put | $0.80 | $0.02 | $0.78 | 1.39% |

| 11/9/2023 | 12/15/2023 | PFE | Covered Call | December 15, 2023 31 Call | $0.62 | $0.00 | $0.62 | 2.08% |

| 11/20/2023 | 12/15/2023 | DKNG | Selling Puts | December 15, 2023 36 Put | $0.65 | Assigned at $36 | $0.00 | 0.00% |

Weekly High-Probability Mean Reversion Indicator

Below is my watch list of ETFs and stocks with the most liquid options headed into the week of December 18, 2023.

Here are the various levels I use to determine if an ETF is in an oversold or overbought state.

| Very Overbought | a reading greater than or equal to 80.0 |

| Overbought | greater than or equal to 60.0 |

| Neutral | between 40 to 60 |

| Oversold | less than or equal to 40.0 |

| Very Oversold | less than or equal to 20.0. |

Each week I also include the current implied volatility (IV) and IV Rank. I look for an IV rank above 40, preferably higher.

ETF Watchlist – Weekly Trade Ideas

| Exchange Traded Fund | Ticker Symbol | IV | IV Rank | HPMR Oversold - Overbought |

| ARK Innovation ETF | ARKK | 41.1 | 29.5 | 71.4 |

| Proshares Bitcoin ETF | BITO | 77.5 | 53.3 | 54.4 |

| SPDR Dow Jones | DIA | 10.8 | 4.8 | 87.7 |

| iShares MSCI Emerging Markets | EEM | 18.1 | 17.8 | 65.3 |

| iShares MSCI EAFE | EFA | 12.1 | 8.2 | 67.7 |

| iShares MSCI Mexico ETF | EWW | 20.9 | 24.9 | 86.4 |

| iShares MSCI Brazil | EWZ | 31.6 | 13.3 | 61.1 |

| iShares China Large-Cap | FXI | 30.2 | 23.1 | 40.66 |

| Vaneck Gold Miners | GDX | 31.1 | 33.5 | 59.2 |

| SPDR Gold | GLD | 13.7 | 26.6 | 51.5 |

| iShares High-Yield | HYG | 6.9 | 12.7 | 76.1 |

| iShares Russell 2000 | IWM | 21.3 | 31.3 | 80.4 |

| SPDR Regional Bank | KRE | 31.8 | 19.1 | 79.4 |

| Vaneck Oil Services | OIH | 28.7 | 11.2 | 59.1 |

| Invesco Nasdaq 100 | QQQ | 15.8 | 0.9 | 84.3 |

| iShares Silver Trust | SLV | 26.5 | 25.6 | 50.8 |

| Vaneck Semiconductor | SMH | 23.7 | 14.3 | 86.2 |

| SPDR S&P 500 | SPY | 12.2 | 3.2 | 74.6 |

| iShares 20+ Treasury Bond | TLT | 17.8 | 30.8 | 82.6 |

| United States Oil Fund | USO | 36.9 | 42.1 | 48.6 |

| Proshares Ultra VIX Short | UVXY | 94.8 | 13.1 | 32.3 |

| CBOE Market Volatility Index | VIX | 87.5 | 47.3 | 38.8 |

| Barclays S&P 500 VIX ETN | VXX | 64.8 | 13.1 | 33.2 |

| SPDR Biotech | XLB | 13.8 | 47.3 | 79.5 |

| SPDR Energy Select | XLE | 21.0 | 16.3 | 58.7 |

| SPDR Financials | XLF | 14.8 | 7.5 | 79.6 |

| SPDR Utilities | XLU | 17.8 | 8 | 52.1 |

| SPDR S&P Oil & Gas Explorer | XOP | 26.4 | 3 | 57.8 |

| SPDR Retail | XRT | 24.3 | 28.8 | 75.1 |

Stock Watchlist – Weekly Trade Ideas

| Stock - Income Trader | Ticker Symbol | IV | IV Rank | HPMR Oversold - Overbought |

| Apple | AAPL | 17.8 | 0.9 | 69 |

| Bank of America | BAC | 29.5 | 22.6 | 82.4 |

| Bristol-Myers Squibb | BMY | 25.8 | 73.7 | 53.7 |

| Citigroup | C | 29.5 | 19.3 | 73.4 |

| Caterpillar | CAT | 22.8 | 9.3 | 94.5 |

| Comcast | CMCSA | 27.9 | 22.6 | 74.9 |

| Costco | COST | 18.4 | 25.1 | 82.6 |

| Cisco Systems | CSCO | 17.1 | 7.5 | 67.2 |

| Chevron | CVX | 21.8 | 18.8 | 70.4 |

| Disney | DIS | 24.3 | 13.7 | 58.1 |

| Duke Energy | DUK | 15.2 | 4.7 | 67.2 |

| Fedex | FDX | 29.5 | 32.7 | 91.6 |

| Gilead Sciences | GILD | 29.8 | 21.1 | 55.9 |

| General Motors | GM | 30.1 | 11.6 | 79.5 |

| Intel | INTC | 33.5 | 16.7 | 74.3 |

| Johnson & Johnson | JNJ | 16.9 | 35.0 | 50.2 |

| JP Morgan | JPM | 20.5 | 12.3 | 91.6 |

| Coca-Cola | KO | 15.5 | 22.6 | 45.8 |

| Altria Group | MO | 16.6 | 16.5 | 52 |

| Merck | MRK | 19.4 | 14.0 | 54.5 |

| Morgan Stanley | MS | 24.0 | 12.9 | 90.7 |

| Microsoft | MSFT | 20.5 | 5.5 | 47.8 |

| Nextera Energy | NEE | 27.0 | 36.9 | 63.7 |

| Nvidia | NVDA | 35.7 | 7.1 | 64.9 |

| Pfizer | PFE | 26.5 | 46.2 | 25.1 |

| Paypal | PYPL | 35.8 | 23.5 | 65.9 |

| Starbucks | SBUX | 19.6 | 17.1 | 33.4 |

| AT&T | T | 24.8 | 30.2 | 47.6 |

| Verizon | VZ | 21.7 | 24.2 | 44.8 |

| Walgreens Boots Alliance | WBA | 55.7 | 90.6 | 86.9 |

| Wells Fargo | WFC | 27.1 | 13.2 | 90.3 |

| Walmart | WMT | 17.5 | 25.4 | 43.7 |

| Exxon Mobil | XOM | 23.6 | 17.2 | 51.1 |

Weekly Trade Discussion: Open Positions

Income Wheel Portfolio: Open Positions

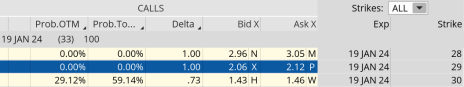

Covered Calls: GDX January 19, 2024, 29 Calls

Original trade published on 11-13-2023 (click here to see original alert)

Current Comments: We sold the January 19, 2024, 29 calls for $0.62. At the time of the alert, GDX was trading for 27.26.

Now, with GDX trading for 30.95, the price of the 29 calls sits at $2.10. There are 33 days left in the January 19, 2024, expiration cycle. We are still early in the trade so there isn’t much to do at the moment other than to allow the price of GDX to vacillate. As it stands, GDX is above its short strike of 29. If GDX closes above its call strike of 29, we will lock in the premium sold and any capital gains on the stock.

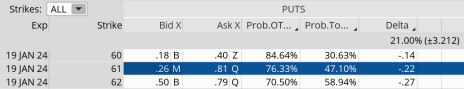

Selling Puts: XLU January 19, 2024, 61 Puts

Original trade published on 12-5-2023 (click here to see original alert)

Current Comments: We sold the January 19, 2024, 61 puts for $0.80. At the time of the alert, XLU was trading for 62.91.

Now, with XLU trading for 63.97, the probability of closing at expiration out of the money stands at 76.33%, and the price of the 61 puts sits at roughly $0.53. There are 33 days left in the January 19, 2024, expiration cycle. Not much to say at the moment, other than… so far, so good.

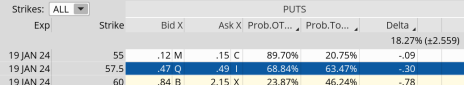

Selling Puts: KO January 19, 2024, 57.5 Puts

Original trade published on 11-27-2023 (click here to see original alert)

Current Comments: We sold the January 19, 2023, 57.5 puts for $0.76. At the time of the alert, KO was trading for 58.36.

Now, with KO trading for 58.60, the probability of closing at expiration out of the money stands at 68.84%, and the price of the 57.5 puts sits at roughly $0.48. There are 33 days left in the January 19, 2024, expiration cycle. There isn’t much to do at the moment other than to allow time decay to work its magic.

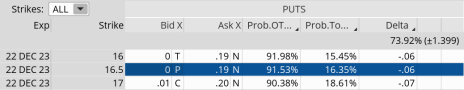

Selling Puts: BITO December 22, 2023, 16.5 Puts

Original trade published on 11-20-2023 (click here to see original alert)

Current Comments: We sold the December 22, 2023, 16.5 puts for $0.50. At the time of the alert, BITO was trading for 18.81.

Now, with BITO trading for 20.89, the probability of closing at expiration out of the money stands at 91.53%, and the price of the 16.5 puts sits at roughly $0.10. There are 5 days left in the December 22, 2023, expiration cycle. So far, our trade is in great shape. I plan to buy back our puts early next week, lock in profits and immediately sell more put premium.

As always, if you have any questions, please do not hesitate to email me at andy@cabotwealth.com.

The next Cabot Options Institute – Income Trader issue will be

published on December 26, 2023.