Cabot Options Institute Income Trader: Alert (GDX)

Gold Miners ETF (GDX)

Since we introduced our GDX position back in early June 2022, we’ve managed to bring in 14.97% worth of premium and capital gains by using our simple income wheel approach. Comparatively, the stock is down 11.1% over the same time frame – once again proving the power of taking the patient, disciplined and conservative approach of the income wheel options strategy.

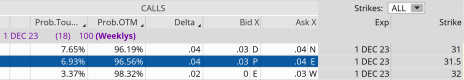

Today I want to hopefully build upon those returns, so I want to buy back our GDX December 1, 2023, 31 calls and immediately sell more call premium. We’ve managed to collect almost every penny of premium from our December calls and, with 18 days left until expiration, it seems counterproductive to continue to hold the position. So, let’s buy our 31.5 calls back, lock in that premium and immediately sell more options premium in GDX.

GDX is currently trading for 27.26.

Here is the trade (we are not selling naked calls; you must own at least 100 shares of GDX before placing the trade):

Buy to Close GDX December 1, 2023, 31.5 (covered) call for $0.04 (adjust accordingly, prices may vary from time of alert).

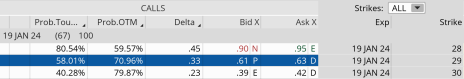

Sell to Open GDX January 19, 2023, 29 (covered) call for $0.62 (adjust accordingly, prices may vary from time of alert).

Delta of short call: 0.33

Probability of Profit: 70.96%

Probability of Touch: 58.01%

Total net credit: $0.62

Max return (cash-secured): 2.3%

Risk Management

We use GDX as part of our Income Wheel Portfolio, so if GDX closes above our call strike at expiration, our shares will be called away and, in most cases, we will reap the capital benefits of the stock increase, plus the premium acquired. Until that point, we will repeatedly sell calls on GDX.