Cabot Options Institute Income Trader: Alert (XLU)

SPDR Utilities ETF (XLU)

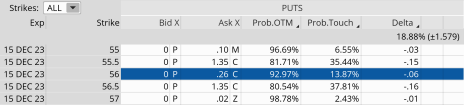

There is little to no value left in our XLU December 15, 2023, 56 puts. As a result, I’m going to buy them back, lock in profits and immediately sell more premium. I’ll be doing the same in a few other positions as we move throughout the week.

XLU is currently trading for 62.91.

Here is the trade:

Buy to close XLU December 15, 2023, 56 put for $0.02. (As always, prices will vary, please adjust accordingly.)

Once that occurs (or if you are new to the position):

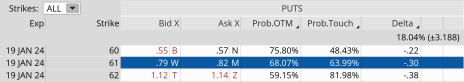

Sell to Open XLU January 19, 2024, 61 put for $0.80. (As always, prices will vary, please adjust accordingly.)

Delta of short call: 0.30

Probability of Closing Out-of-the-Money: 68.07%

Probability of Touch: 63.99%

Total net credit: $0.80

Max return (cash-secured): 1.3%

Risk Management

We will use XLU as part of our Income Wheel Portfolio, so if XLU closes below our put strike at expiration, we will be assigned shares of XLU (per the guidelines of the strategy). Until that point, we will repeatedly sell puts on XLU. Of course, any necessary trade alerts/updates will follow.