I love Twitter. The social media platform, not the stock.

While it’s easy to get lost “doom scrolling” on Twitter, I find it to be an incredibly helpful investment tool.

Two terrific charts showed up in my feed this week.

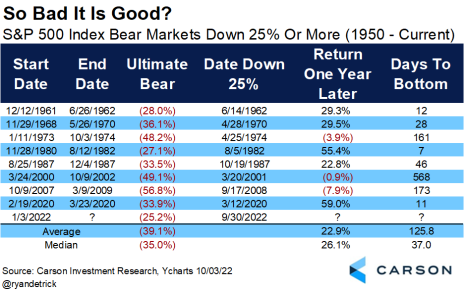

This first was from Ryan Detrick of Carson.

The bear market hit a total drawdown of 25% last week. Nothing fun about that. But if you zoom out and look at prior 25%+ bear market drawdowns, you notice something positive.

Looking out 12 months after the bear market hits the 25% threshold, the market is up 22.9% on average. See the chart below.

The bad news is that markets usually don’t bottom at a 25% drawdown. On average, once the S&P 500 has fallen by 25% it ultimately bottoms down 39.1%.

But if you can take the long view, there’s reason to be encouraged.

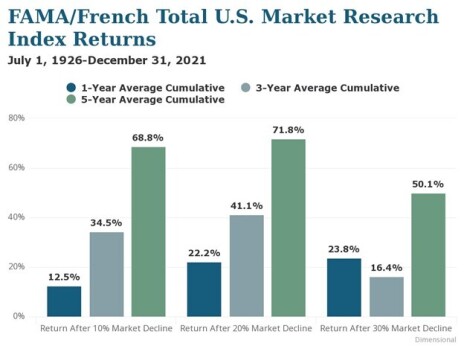

Here’s another encouraging chart.

To summarize, once the market declines by 20%, the forward returns look attractive:

- 1-year average: +22.2%

- 3-year average: +41.1%

- 5-year average: +71.8%

What is even more encouraging to me is that I’m personally seeing many compelling individual stocks with positive fundamentals and draconian valuations.

Next week, I will share my top idea. Stay tuned!

This week, we had a few updates that I want to highlight:

This week, we had two updates that I wanted to highlight (full updates below):

- NexPoint Diversified (NXDT) saw some more insider buying.

- Cogstate (COGZF) got a lift when Esai and Biogen announced positive results for its Phase 3 Alzheimer’s Trial.

- Increased my buy limit for Cipher Pharma (CHPRF) given positive developments and cheap valuation.

The next issue of Cabot Micro-Cap Insider will be published on Wednesday, October 12. As always, if you have any questions, please email me at rich@cabotwealth.com.

Changes This Week

Increase Buy Limit for CPHRF to Buy under 2.50

Updates

Aptevo (APVO) had no news this week. On September 19, 2022, the company announced that the FDA has approved the company and its partner, Alligator Bioscience, to proceed with a new investigational drug ALG.APV-527 to treat multiple solid tumors. This isn’t major news but shows that the company has several promising shots on goal. Aptevo reported quarterly results on August 11. The company continues to report positive results from its key drug, APVO436. Further, it has additional drugs that are progressing well. Aptevo renegotiated its royalty agreement with Pfizer which allows Aptevo to recognize a gain and regain compliance with Nasdaq’s shareholder equity listing requirement. This is a positive. Currently, Aptevo has $25MM of net cash on its balance sheet and projects that it has enough liquidity to continue to operate for 12 more months without raising capital. This biotech bear market is no fun, but Aptevo continues to be an asymmetric bet. Original Write-up. Buy under 7.50

Atento S.A. (ATTO) had no news this week. It announced on September 7 that it has reached an extension on its lockup agreement with its largest shareholders (who represent 71% of shares outstanding) for 12 months. This is meaningful as it shows the largest shareholders of the company have conviction in the stock and believe it’s undervalued. On August 3, Atento reported another weak quarter. Management lowered revenue guidance to flat versus consensus of +4% growth and previous guidance of “mid-single-digit” growth. EBITDA margin guidance has been reduced to 12% (at the midpoint) from 13.5%. While the quarter and guidance cuts were disappointing, the stock is incredibly cheap and is not at risk of defaulting on its debt (no maturities until 2025). Thus, it makes sense to stick with the stock. Original Write-up. Buy under 10.00

Cipher Pharma (CPHRF) announced on September 22 that it has approved a share repurchase authorization to buy back 1.4MM shares (10% of float, 6% of shares outstanding). This is a positive. The company reported strong results on August 11. Revenue declined 8% driven primarily by lower Absorica sales (as expected); however, adjusted EBITDA grew sequentially to $3.6MM. The company’s cash balance stands at $24.2MM, ~50% of its market cap. This limits downside risk. Further, the company continues to generate significant free cash flow and buy back shares. Finally, the company had positive pipeline developments with two compounds (MOB-015 for nail fungus and Piclidenoson for psoriasis). Both drugs are progressing in phase III trials. Given positive developments, I’m raising my price target to 3.50 and buy limit to 2.50. Original Write-up. Buy under 2.50

Cogstate Ltd (COGZF) got a lift when Esai and Biogen announced positive results for its Phase 3 Alzheimer’s Trial. This is massively positive news as it will drive more Alzheimer’s trials (and revenue for Cogstate). Ultimately, Cogstate’s revenue potential this year and beyond will be determined by key Alzheimer’s drug read-outs which are expected this year and next year: 1) Lecanemab from Eisai (phase 3 data: already announced and positive), 2) Gantenerumab from Roche (Phase 3 data expected in Q4 2022), and 3) Donanemab from Eli Lilly (phase 3 data in mid-2023). The Cogstate thesis remains on track. Original Write-up. Buy under 1.80

Copper Property Trust (CPPTL) had no news this week. It announced on September 12 that it has sold 7 of its properties for $65MM. The blended cap rate of the transactions was 7.3%. The trust, on an aggregate basis, is trading at a ~10% cap rate (the higher the cheaper). Proceeds will be paid out next month as well as net rental income. The trust remains attractive. The current yield is 10%. And the trust has no debt, so our downside is protected. Original Write-up. Buy under 14.00

Crossroads Impact Corp. (CRSS) reported earnings on September 13. The quarter was relatively uneventful as the business is in transition from processing PPP loans to focusing on growing its loan portfolio. To that end, the business recently announced a $180MM equity infusion in July and has since added a $150MM credit line. The company is well capitalized and will be growing strongly going forward. Further, delinquencies remain very low. Original Write-up. Buy under 15.00

Currency Exchange International (CURN) reported earnings on September 13. They looked great! Revenue increased 139% to $21MM, beating consensus expectations by $5MM. This was truly a massive beat. Revenue in the fiscal third quarter was 67% higher than 2019 FQ3 (pre-pandemic). The company’s Payments business grew revenue 65% to $3.6MM. Year to date, Currency Exchange has generated EPS of $1.15 or $1.53 on an annualized basis. As such, the stock is trading at just 9x earnings. The investment case remains on track. Original Write-up. Buy under 16.00

Epsilon Energy (EPSN) had no news this week. The company announced strong results on August 11. Epsilon continues to benefit from high natural gas prices. Revenue increased 46% sequentially, driven by 68% higher natural gas prices. Revenue should continue to soar as long as natural gas prices remain elevated and Epsilon is mostly unhedged. During the quarter, the company generated $5.9MM of free cash flow, or $23.4MM on an annualized basis. The stock looks attractive given its $31MM of net cash and strong earnings power. Original Write-up. Buy under 8.00

Esquire Financial Holdings (ESQ) had no news this week. The company reported earnings in July. Results were excellent. Revenue grew 23% y/y while EPS grew 37%. Credit metrics look very strong as the company has an allowance-to-loans ratio of 1.2%. The company has a long runway for growth, as articulated by CEO Andrew Sagliocca: “There is tremendous growth potential in both our national platforms due to the limited number of participants and the fragmented approach to finance and technology in both markets.” Despite its strong outlook, the stock trades at just 14x earnings. Original Write-up. Buy under 35.00

IDT Corporation (IDT) had no news this week but will report earnings later this week. The company last reported quarterly results on June 2. At a high level, the quarter didn’t look great. Revenue decreased 12% y/y which was driven by a 17% decline in traditional communications revenue. This segment benefitted from the boom in paid calling during the pandemic, but that surge is normalizing. Most importantly, IDT’s high-growth segments continue to grow well. National Retail Solutions (NRS), IDT’s payment terminal business, grew 102% y/y. Net2phone, IDT’s other highly valuable subsidiary, grew recurring revenue by 42%. Further, IDT expects subsidiary growth to contribute to consolidated profitability in the second half of this year. While the spin-off of net2phone has been temporarily delayed, we know that it and NRS will ultimately be monetized. The investment case remains on track and my price target is 55 based on an updated sum-of-the-parts analysis. Original Write-up. Buy under 45.00

Kistos PLC (KIST: GB) reported first-half 2022 results on September 7. They looked great. The company reported revenue growth of 745% and EBITDA growth of 768%. It generated free cash flow of £93MM or $186MM annualized. As such, Kistos is currently trading at 1x current EBITDA and 2.5x current free cash flow. The only downside is that the EU is considering instituting a windfall profit tax on energy companies. While this would be a negative, I think it’s partially reflected in Kistos’ valuation. Further, Kistos generated $89MM of EBITDA in 2021. Thus, it’s trading at just 5.1x “normalized” EBITDA, not a demanding valuation. I continue to see at least 100% upside ahead. Original Write-up Buy under 7.50

Liberated Syndication (LSYN) has had no news recently. I had a chance to speak to the CEO in June. He said the team is working through re-filing its financials, and he expects to “go public” again by the end of September (this proved optimistic). Instead of just “turning on” trading, he would like to raise a little capital and also pick up coverage from some sell-side analysts. He noted the advertising business is growing very well and that the podcast hosting business is growing again. It had experienced limited growth last year given free hosting competition, but business has picked back up. While Libsyn has been a frustrating stock, I think (and hope!) our patience will be rewarded. Unfortunately, the market volatility may have delayed Libsyn’s IPO further, but ultimately, I’m highly confident the business will go public again. Since you can’t actually buy the stock until then, I rate it a Hold for those who already own it. Original Write-up. Hold

Medexus Pharma (MEDXF) hosted a conference call on September 21 which I thought was encouraging. The company discussed the latest news related to treosulfan’s indefinite delay. The main takeaways were: 1) The FDA is engaged with medac and has requested additional data/analysis 2) The FDA’s primary concern is in the study’s primary endpoint, event-free survival. Defining an event is subjective, which has led to additional questions. Overall survival (not subjective) is the secondary endpoint. 3) Business is booming. Medexus will report a record quarter for revenue and EBITDA. 4) The company is working on refinancing its convertible debentures. 5) Without Treo expenses, EBITDA margins would be ~20%. If you assume a 20% EBITDA margin (backing out Treo expenses), the business is trading at an EV/EBITDA multiple of 3x, very cheap for a profitable and growing business. Original Write-up. Buy under 3.50

NexPoint (NXDT) reported consistent insider buying last week by CEO, James Dondero. While rising interest rates will definitely impact REIT valuations, I remain confident that NXDT is trading well below fair value. The company had its shareholder update call on August 10, during which they provided significant detail into the assets that make up NAV. Management spent a lot of time discussing how they are confident that they can close the gap to NAV. Unfortunately, no comments were made on an increase to the dividend or whether the company will start buying back stock. Both of these would be significant catalysts for NXDT shares. Last month, we saw more insider buying by CEO James Dondero. The thesis remains on track, and I see ~50% upside in the next 12 months. Original Write-Up. Buy under 17.00

P10 Holdings (PX) had no news this week. It announced a meaningful acquisition in August. The company is acquiring Western Technology Investment, a market leader in venture debt. The acquisition will add $12.5MM of additional EBITDA to P10. It appears that P10 is paying ~12x EBITDA for the acquisition, a cheap but not dirt-cheap price. This acquisition will add to P10’s growth potential. P10 is currently trading at 15x 2022 adjusted EBITDA which is a very reasonable valuation for such a stable business with strong organic growth potential. The investment case remains on track. Original Write-up. Buy under 15.00

RediShred (RDCPD) had no news this week. It last reported earnings on August 26. Results were excellent! Revenue grew 68% to $14.6MM CAD while EBITDA grew 73% to $4.5MM CAD. While acquisitions are helping, organic growth is very strong (+40% y/y). The continues to look incredibly cheap at a 5.1x EV/EBITDA multiple and 7.4x price to free cash flow multiple. I continue to see 100% upside over the next 12 months and significantly more upside looking out a few years. Original Write-up. Buy under 3.50

Richardson Electronics (RELL) was my September recommendation. The company is a rapidly growing micro-cap that is benefiting from many “green” initiatives (electric trains, wind turbines, etc.). Despite strong growth expectations and a pristine balance sheet ($40MM of net cash), the stock trades at just 10x next year’s earnings. Insider ownership is high, and I see ~75% upside over the next couple of years. Original Write-up. Buy under 17.00

Truxton (TRUX) reported a great quarter in July. Despite a volatile market, pre-provision net revenue grew 9% sequentially and 30% y/y. EPS grew 16% y/y. Credit metrics remain strong. The bank has $0 in non-performing loans and $0 in net charge-offs. During the quarter, the company repurchased 22,000 shares for an average price of $70.05. The Truxton investment case remains on track. The bank will continue to grow loans and earnings prudently while returning excess cash to shareholders through dividends and share buybacks. The stock is trading at just 14x annualized earnings. This isn’t the most exciting stock, but it’s a slow and steady winner. Original Write-up. Buy under 75.00

Zedge, Inc. (ZDGE) announced on August 16 that it has authorized a 1.5MM share repurchase (10% of shares outstanding). This is a positive as it conveys management’s conviction in Zedge’s fundamentals and cheap valuation. The stock remains very cheap, trading at 3.4x EBITDA. Original Write-up. Buy under 6.00

| Stock | Price Bought | Date Bought | Price on 10/05/22 | Profit | Rating |

| Aptevo Therapeutics (APVO) | 32.01 | 3/10/21 | 3.01 | -91% | Buy under 7.50 |

| Atento SA (ATTO) | 21.57 | 4/14/21 | 4.22 | -80% | Buy under 10.00 |

| Cipher Pharma (CPHRF) | 1.80 | 10/11/21 | 2.40 | 33% | Buy under 2.50 |

| Cogstate Ltd (COGZF) | 1.70 | 4/13/22 | 1.32 | -22% | Buy under 1.80 |

| Copper Property Trust (CPPTL) | 12.93 | 8/11/22 | 13.75 | 6% | Buy under 14.00 |

| Crossroad Systems (CRSS) | 14.10 | 2/9/22 | 10.75 | -24% | Buy under 15.00 |

| Currency Exchange (CURN) | 14.10 | 05/11/22 | 13.66 | -3% | Buy under 16.00 |

| Epsilon Energy (EPSN) | 5.00 | 8/11/21 | 6.63 | 33% | Buy under 8.00 |

| Esquire Financial Holdings (ESQ) | 34.11 | 10/10/21 | 38.31 | 12% | Buy under 35.00 |

| IDT Corporation (IDT) | 19.37 | 2/10/21 | 26.54 | 37% | Buy under 45.00 |

| Kistos PLC (KIST) | 4.79 | 7/13/22 | 5.10 | 6% | Buy under 7.50 |

| Liberated Syndication (LSYN) | 3.06 | 6/10/20 | 3.75 | 23% | Hold |

| Medexus Pharma (MEDXF) | 1.78 | 5/13/20 | 0.73 | -59% | Buy under 3.50 |

| NexPoint Diversified Real Estate Trust (NXDT) | 14.15 | 1/12/22 | 13.14 | -7% | Buy under 17.00 |

| P10 Holdings (PX)** | 2.98 | 4/28/20 | 11.05 | 271% | Buy under 15.00 |

| RediShred (RDCPF) | 3.30 | 6/8/22 | 2.97 | -10% | Buy under 3.50 |

| Richardson Electronics (RELL) | 15.83 | 9/14/22 | 15.27 | --% | Buy under 17.00 |

| Truxton Corp (TRUX)* | 72.25 | 12/8/21 | 64.00 | -10% | Buy under 75.00 |

| Zedge (ZDGE) | 5.73 | 3/9/22 | 2.53 | -56% | Buy under 6.00 |

Buy means accumulate shares at or around the current price.

Hold means just that; hold what you have. Don’t buy, or sell, shares.

Sell means the original reasons for buying the stock no longer apply, and I recommend exiting the position.

Sell a Half means it’s time to take partial profits. Sell half (or whatever portion feels right to you) to lock in a gain and hold on to the rest until another ratings change is issued.

Disclosure: Rich Howe owns shares in KIST:GB, LSYN, MEDXF, PX, IDT, APVO, NXDT, COGZF, and RDCPD. Rich will only buy shares after he has shared his recommendation with Cabot Micro-Cap Insider members.