After quite a strong rip higher the first half of August, U.S. markets have pulled back sharply.

The S&P 500 touched its 200-day moving average last week and then immediately started to retreat.

Retail investor sentiment has started to creep up but it still feels to me that sentiment among professional investors remains quite low.

I mentioned this shortly after we entered the bear market, but I wanted to flag it again.

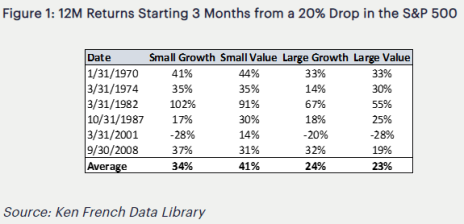

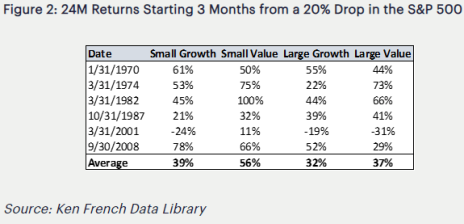

In March 2020, Verdad published some great research about crisis investing.

Their conclusions were quite encouraging. In short, if you invest 3 months after the S&P 500 drops 20%, the 12-month and 24-month returns look terrific for all stocks.

While I’m not trying to time the market, I think we could see a situation where we see some volatility through the end of August and into September, but it ends up being a great buying opportunity.

This would be consistent with Verdad’s research findings (the 20% drawdown threshold to signal a “bear market” was passed in June).

In terms of our recommendations, I have a couple updates that I wanted to flag (full updates below):

- Cipher Pharma (CPHRF) reported positive quarterly results.

- Cogstate Ltd (COGZF) will report full-year earnings and issue guidance next week.

- Kistos PLC (GB:KIST) has been performing very well. Given skyrocketing natural gas prices in Europe, I’m raising my buy limit to 7.50.

The next issue of Cabot Micro-Cap Insider will be published on Wednesday, September 14. As always, if you have any questions, please email me at rich@cabotwealth.com.

Changes This Week

Increased buy limit in Kistos PLC (KIST: GB) to Buy under 7.50

Updates

Aptevo (APVO) reported quarterly results on August 11. The company continues to report positive results from its key drug, APVO436. Further, it has additional drugs that are progressing well. Aptevo renegotiated its royalty agreement with Pfizer which allows Aptevo to recognize a gain and regain compliance with Nasdaq’s shareholder equity listing requirement. This is a positive. Currently Aptevo has $25MM of net cash on its balance sheet and projects that it has enough liquidity to continue to operate for 12 more months without raising capital. This biotech bear market is no fun, but Aptevo continues to be an asymmetric bet. Original Write-up. Buy under 7.50

Atento S.A. (ATTO) reported another weak quarter on August 3. Management lowered revenue guidance to flat versus consensus of +4% growth and previous guidance of “mid-single-digit” growth. EBITDA margin guidance has been reduced to 12% (at the midpoint) from 13.5%. While this quarter and guidance cut was disappointing, the stock is incredibly cheap and is not at risk of defaulting on its debt (no maturities until 2025). Thus, it makes sense to stick with the stock. Original Write-up. Buy under 10.00

Cipher Pharma (CPHRF) reported strong results on August 11. Revenue declined 8% driven primarily by lower Absorica sales (as expected); however, adjusted EBITDA grew sequentially to $3.6MM. The company’s cash balance stands at $24.2MM, 51% of its market cap. This limits downside risk. Further, the company continues to generate significant free cash flow and buy back shares. Finally, the company had positive pipeline developments with two compounds (MOB-015 for nail fungus and Piclidenoson for psoriasis). Both drugs are progressing in phase III trials. Original Write-up. Buy under 2.00

Cogstate Ltd (COGZF) reported preliminary fiscal year results in July (it will report full results next week). In total, revenue increased 38% to $45MM driven by continued strong Alzheimer’s trial revenue. EBIT came in at $10.5MM, up over 200% y/y. The company executed $82.5MM of new clinical trial sales contracts, up 74% from the prior year. The one slight negative was Q4 2022 revenue was negative, impacted by slower-than-expected patient enrollment in a key Alzheimer’s trial that delayed revenue recognition. Contracted revenue increased 72% on a y/y basis. The backlog did decrease slightly q/q due to 1) manufacturing problems for a drug and 2) enrollment issues. Nevertheless, the long-term outlook for Cogstate looks excellent given key Alzheimer’s drugs will read out towards the end of this year and into next year. If these data read-outs are positive, it’s going to result in even more spending on clinical trials as pharma companies try to further understand their drugs and get additional data. Further, a positive read-out would increase optimism for Cogstate’s healthcare (DTC testing) business. All things considered, the thesis remains on track. Original Write-up. Buy under 1.80

Copper Property Trust (CPPLT) is an attractive special situation. It is a liquidating trust that will pay out all proceeds as its assets are sold over a period of five years. The proceeds should generate a 50% return over its current price. But the kicker is that this trust pays yield while we wait. The current yield is 10%. And the trust has no debt so our downside is protected. Copper Property CTL Pass Through Trust represents an attractive, low-risk idea. Original Write-up. Buy under 14.00

Crossroads Impact Corp. (CRSS)had no news this week. On July 11, the company announced that P10 Holdings (PX), another CMCI recommendation, is investing $180MM of equity capital (through one of its investment funds) at $10.76 a share with the ability to commit an additional $310MM of equity capital at the same price. This will enable Crossroads to really ramp up its ESG lending ability and grow earnings. It will also enable Crossroads to scale up and eventually explore an uplisting to a major exchange. Original Write-up. Buy under 15.00

Currency Exchange International (CURN) reported earnings on June 14. Results were strong but not strong enough, as the stock has sold (it has since recovered). Revenue increased 109% y/y to $13.3MM. Net operating income increased to $2.9MM, up from a loss of $600,000 last year. Both Banknotes (+103%) and Payments (+127%) grew very strongly. Importantly, management noted that it expects a strong summer travel season which should drive (my opinion) record results. The stock continues to look very cheap. Original Write-up. Buy under 16.00

Epsilon Energy (EPSN) announced strong results last week as the company continues to benefit from high natural gas prices. Revenue increased 46% sequentially driven by 68% higher natural gas prices. Revenue should continue to soar as long as natural gas prices remain elevated and Epsilon is mostly unhedged. During the quarter, the company generated $5.9MM of free cash flow, or $23.4MM on an annualized basis. The stock looks attractive given its $31MM of net cash and strong earnings power. Original Write-up. Buy under 8.00

Esquire Financial Holdings (ESQ) reported earnings on July 25. Results were excellent. Revenue grew 23% y/y while EPS grew 37%. Credit metrics look very strong as the company has an allowance-to-loans ratio of 1.2%. The company has a long runway for growth, as articulated by CEO Andrew Sagliocca: “There is tremendous growth potential in both our national platforms due to the limited number of participants and the fragmented approach to finance and technology in both markets.” Despite its strong outlook, the stock trades at just 14x earnings. Original Write-up. Buy under 35.00

IDT Corporation (IDT) had no news this week. The company reported quarterly results on June 2. At a high level, the quarter didn’t look great. Revenue decreased 12% y/y which was driven by a 17% decline in traditional communications revenue. This segment benefitted from the boom in paid calling during the pandemic, but that surge is normalizing. Most importantly, IDT’s high-growth segments continue to grow well. National Retail Solutions (NRS), IDT’s payment terminal business, grew 102% y/y. Net2phone, IDT’s other highly valuable subsidiary, grew recurring revenue by 42%. Further, IDT expects subsidiary growth to contribute to consolidated profitability in the second half of this year. While the spin-off of net2phone has been temporarily delayed, we know that it and NRS will ultimately be monetized. The investment case remains on track and my price target is 55 based on an updated sum-of-the-parts analysis. Original Write-up. Buy under 45.00

Kistos PLC (KIST: GB) had no news this week but it is generating significant earnings given soaring natural gas prices in Europe. As such, I’m increasing my buy limit to Buy under 7.50. Kistos is taking advantage of a booming natural gas market in Europe yet only trades at 1x current free cash flow. It has very little debt. The management team is excellent, and they own ~20% of the company, ensuring that we are well aligned. I see at least 100% upside ahead. Original Write-up Buy under 7.50

Liberated Syndication (LSYN) has had no news recently. However, I had a chance to speak to the CEO in June. He said the team is working through re-filing its financials, and he expects to “go public” again by the end of September. Instead of just “turning on” trading, he would like to raise a little capital and also pick up coverage from some sell-side analysts. He noted the advertising business is growing very well and that the podcast hosting business is growing again. It had experienced limited growth last year given free hosting competition, but business has picked back up. While Libsyn has been a frustrating stock, I think (and hope!) our patience will be rewarded by the end of September. Since you can’t actually buy the stock until then, I rate it a Hold for those who already own it. Original Write-up. Hold

Medexus Pharma (MEDXF) reported earnings on August 9. They were excellent. Revenue in the quarter increased 33% y/y to $23MM. Sales drivers were IXINITY and Gleolan sales in the U.S. Adjusted EBITDA was $1.9MM. A huge positive was Medexus announced that it has amended its agreement with Medac to extend the payment date for regulatory milestones triggered by an FDA approval to October 2023, which therefore allows Medexus to launch and begin commercialization well before these license payments must be paid. This is a major positive. Recently, Medac provided the FDA with the information that it requested for its Treosulfan review. We will find out within a month whether the FDA deems the re-submission complete. If it does, the FDA will decide on Treosulfan’s approval within six months. Approval would be a huge catalyst for Medexus as its revenue potential would double. I continue to think the risk/reward profile of Medexus is asymmetric to the upside. Original Write-up. Buy under 3.50

NexPoint (NXDT) finally had its shareholder update call on August 10, in which they provided significant detail into the assets that make up NAV. Management spent a lot of time discussing how they are confident that they can close the gap to NAV. Unfortunately, no comments were made on an increase to the dividend or whether the company will start buying back stock. Both of these would be significant catalysts for NXDT shares. Last month, we saw more insider buying by CEO James Dondero. The thesis remains on track, and I see ~50% upside in the next 12 months. Original Write-Up. Buy under 17.00

P10 Holdings (PX) reported another great quarter in May. Revenue increased 32% to $43.3MM while adjusted EBITDA increased 31% to $22.5MM. Assets under management increased 34% to $17.6BN. Higher assets under management will drive continued revenue and earnings growth. The company also announced a $20MM share repurchase. P10 is currently trading at 15x 2022 adjusted EBITDA which is a very reasonable valuation for such a stable business with strong organic growth potential. Original Write-up. Buy under 15.00

RediShred (RDCPF) had no news this week. It’s a Canada-based, leading document destruction services company. Insiders own more than 30% of the company. It has grown revenue at a 31% CAGR and EBITDA at an 80% CAGR over the past 10 years through organic and inorganic growth. Future growth is poised to continue, yet the stock trades at just 5x forward EBITDA. I see 100% upside over the next 12 months and significantly more upside looking out a few years. Original Write-up. Buy under 0.70

Truxton (TRUX) reported a great quarter in July. Despite a volatile market, pre-provision net revenue grew 9% sequentially 30% y/y. EPS grew 16% y/y. Credit metrics remain strong. The bank has $0 in non-performing loans and $0 in net charge-offs. During the quarter, the company repurchased 22,000 shares for an average price of $70.05. The Truxton investment case remains on track. The bank will continue to grow loans and earnings prudently while returning excess cash to shareholders through dividends and share buybacks. The stock is trading at just 14x annualized earnings. This isn’t the most exciting stock, but it’s a slow and steady winner. Original Write-up. Buy under 75.00

Zedge, Inc. (ZDGE) announced last week that it has authorized a 1.5MM share repurchase authorization (10% of shares outstanding). This is a positive as it conveys management’s conviction in Zedge’s fundamental and cheap valuation. The stock remains very cheap, trading at 3.4x EBITDA. Original Write-up. Buy under 6.00

| Stock | Price Bought | Date Bought | Price on 8/23/22 | Profit | Rating |

| Aptevo Therapeutics (APVO) | 32.01 | 3/10/21 | 3.56 | -89% | Buy under 7.50 |

| Atento SA (ATTO) | 21.57 | 4/14/21 | 5.44 | -75% | Buy under 10.00 |

| Cipher Pharma (CPHRF) | 1.80 | 10/11/21 | 1.95 | 8% | Buy under 2.00 |

| Cogstate Ltd (COGZF) | 1.70 | 4/13/22 | 1.13 | -34% | Buy under 1.80 |

| Copper Property Trust (CPPTL) | 12.93 | 8/11/22 | 13.16 | 2% | Buy under 14.00 |

| Crossroad Systems (CRSS) | 14.10 | 2/9/22 | 12.25 | -13% | Buy under 15.00 |

| Currency Exchange (CURN) | 14.10 | 05/11/22 | 13.88 | -2% | Buy under 16.00 |

| Epsilon Energy (EPSN) | 5.00 | 8/11/21 | 7.50 | 50% | Buy under 8.00 |

| Esquire Financial Holdings (ESQ) | 34.11 | 10/10/21 | 39.20 | 15% | Buy under 35.00 |

| IDT Corporation (IDT) | 19.37 | 2/10/21 | 25.94 | 34% | Buy under 45.00 |

| Kistos PLC (KIST) | 3.06 | 7/13/22 | 6.24 | 104% | Buy under 7.50 |

| Liberated Syndication (LSYN) | 3.06 | 6/10/20 | 3.75 | 23% | Hold |

| Medexus Pharma (MEDXF) | 1.78 | 5/13/20 | 2.10 | 18% | Buy under 3.50 |

| NexPoint Diversified Real Estate Trust (NXDT) | 14.15 | 1/12/22 | 16.07 | 14% | Buy under 17.00 |

| P10 Holdings (PX)** | 2.98 | 4/28/20 | 12.68 | 326% | Buy under 15.00 |

| RediShred (RDCPF) | 0.66 | 6/8/22 | 0.55 | -17% | Buy under .70 |

| Truxton Corp (TRUX)* | 72.25 | 12/8/21 | 68.49 | -4% | Buy under 75.00 |

| Zedge (ZDGE) | 5.73 | 3/9/22 | 2.90 | -49% | Buy under 6.00 |

*Includes dividends received

Buy means accumulate shares at or around the current price.

Hold means just that; hold what you have. Don’t buy, or sell, shares.

Sell means the original reasons for buying the stock no longer apply, and I recommend exiting the position.

Sell a Half means it’s time to take partial profits. Sell half (or whatever portion feels right to you) to lock in a gain and hold on to the rest until another ratings change is issued.

Disclosure: Rich Howe owns shares in KIST:GB, LSYN, MEDXF, PX, IDT, APVO, and NXDT. Rich will only buy shares after he has shared his recommendation with Cabot Micro-Cap Insider members.