Dividends offer a way for investors to receive steady income during rocky market periods, much like what we have experienced in 2022. They also provide a nice hedge against inflation, especially when they grow over time. Unfortunately, most dividend-paying stocks pay a quarterly dividend which, at least in my mind, isn’t truly consistent.

But what if we could create a portfolio that takes some of the safest dividend-paying stocks and ramp up the income stream from quarterly to monthly – a monthly dividend of sorts?

Well, look no further than the power of options. Options offer a great way to essentially create your own dividend on a monthly, if not weekly, basis—depending on the expiration cycles you choose.

[text_ad use_post='262604']

But options also help to overcome a huge obstacle for those wishing to invest in dividend-paying stocks. The capital required for one stock, let alone a group of diversified stocks, can be excessive.

So let’s say you forgo the dividends in the stocks (maybe due to a lack of capital) and instead decide you would like to use an options strategy for income using the same stocks.

Let’s take a look at a few examples.

Create Your Own Dividend in McDonald’s (MCD)

It would take roughly $50,000 to make $1,000 in annual dividend income. McDonald’s (MCD) pays a 2.16% yield.

However, as an option trader, we know that there are far more efficient ways to make two to three times that amount while taking on far less risk in the way of capital costs.

For instance, let’s take a look at a poor man’s covered call. It’s one of the most efficient options strategies for making consistent income while simultaneously limiting risk through the reduction of capital costs.

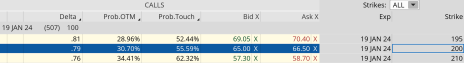

When taking a look at the LEAPS for McDonald’s going out 507 days, we could purchase the January 19, 2024 200 calls for roughly $66.00, or $6,600 per LEAPS contract.

So let’s see how much we could make if we purchased just one LEAPS contract, equivalent to 100 shares of MCD stock for $6,600, far less than the roughly $50,000 needed to make the $1,000 in annual dividend income.

Let’s see how much we could make by selling a call against 1 LEAPS contract, as my preference would be to diversify income among a basket of stocks instead of spending all of your allocation on one stock.

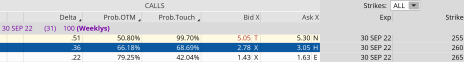

After looking at the September 30, 2022, expiration cycle (31 days left until expiration) it’s clear that we can sell calls at the 260 strike for a minimum of $2.90 per contract.

Basically, we can make approximately $290 per contract every 31 days by selling a call slightly out-of-the money in MCD.

So, with an investment of $6,600, all things being equal we can make roughly $290 every 31 days. That’s a 4.4% return on capital.

And rather than making $1,000 annually with an investment in MCD stock of just over $50k, we can realistically bring in over $3,480, if not more, in premium on an annual basis with an initial investment of $6,600. It’s a pretty easy choice.

But just think if we used the power of diversification.

Other Stocks to Create Monthly Dividends

Altria (MO): A LEAPS contract, with a 0.80 delta, would cost roughly $10.50, or $1,050. We could reasonably sell $0.65, or $65, every 30 to 45 days for an annual premium of roughly $650.

Verizon (VZ): A LEAPS contract, with a 0.80 delta, would cost roughly $11.50, or $1,150. We could reasonably sell $0.60, or $60, every 30 to 45 days for an annual premium of roughly $600.

Walgreens Boots Alliance (WBA): A LEAPS contract, with a 0.80 delta, would cost roughly $11.60, or $1,160. We could reasonably sell $0.55, or $55, every 30 to 45 days for an annual premium of roughly $550.

United Parcel Service (UPS): A LEAPS contract, with a 0.80 delta, would cost roughly $57.00, or $5,700. We could reasonably sell $3.30, or $330, every 30 to 45 days for an annual premium of roughly $3,300.

Starbucks (SBUX): A LEAPS contract, with a 0.80 delta, would cost roughly $29.00, or $2,900. We could reasonably sell $1.40, or $140, every 30 to 45 days for an annual premium of roughly $1,400.

If we tallied the initial cost of buying the one LEAPS contract in the five aforementioned stocks, it would total $11,960. Just from the purchase of one LEAPS contract in each of these stocks we earn could an annual “dividend” income from our options of roughly $6,500. That’s over half the initial cost of our LEAPS for an annual return of 54.3% in just premium, and the main reason why you should consider mixing in a few different options strategies into your overall investment approach.

If this is an approach that interests you please check out my Fundamentals service. I offer five different portfolios within the service, each offering a unique approach to the market.

[text_ad]