Weekly Commentary

Not much to say this week. The plan remains simple. I continue to focus on balancing out the overall deltas of our current positions by adding a trade, most likely a bull put spread. I’ll be concentrating on sector ETFs and individual stocks as the major indices continue to see low levels of volatility.

As always, if you have any questions, please do not hesitate to email me at andy@cabotwealth.com.

Current Portfolio

Open Trades | |||||||

| Open Date | Ticker | Strategy | Trade | Open Price | Current Price | Current Probability | Delta |

| 1/16/2024 | SPY | Iron Condor | March 15, 2024 510/505 - 440/435 | $0.66 | $1.57 | 68.65% - 94.88% | -0.11 |

| 1/23/2024 | QQQ | Bear Call | March 1, 2024 445/450 | $0.60 | $0.87 | 79.91% | -0.07 |

| Open Date | Closed Date | Ticker | Strategy | Trade | Open Price | Closing Price | Return |

| 6/2/2022 | 6/13/2022 | SPY | Bear Call Spread | July 15, 2022 440/445 | $0.70 | $0.05 | 14.94% |

| 6/8/2022 | 6/17/2022 | XOP | Bear Call Spread | July 15, 2022 190/195 | $0.70 | $0.04 | 15.21% |

| 6/22/2022 | 7/13/2022 | SPY | Bear Call Spread | July 29, 2022 405/410 | $0.75 | $0.35 | 8.70% |

| 6/30/2022 | 7/25/2022 | IWM | Iron Condor | August 19, 2022 195/200 - 145/140 | $0.70 | $0.34 | 7.76% |

| 7/8/2022 | 7/28/2022 | GLD | Bull Put Spread | August 19, 2022 155/150 | $0.60 | $0.16 | 9.65% |

| 7/14/2022 | 8/11/2022 | SPY | Iron Condor | August 19, 2022 417/412 - 335/330 | $0.70 | $4.10 | -68.00% |

| 8/1/2022 | 8/29/2022 | SPY | Bear Call Spread | September 16, 2022 439/444 | $0.70 | $0.07 | 14.42% |

| 8/11/2022 | 8/29/2022 | DIA | Bear Call Spread | September 23, 2022 350/325 | $0.75 | $0.08 | 15.47% |

| 8/11/2022 | 9/8/2022 | IWM | Iron Condor | September 23, 2022 220/215 - 173/168 | $0.77 | $0.57 | 4.17% |

| 9/7/2022 | 9/9/2022 | QQQ | Bull Put Spread | October 21, 2022 260/255 | $0.62 | $0.30 | 6.84% |

| 9/9/2022 | 9/15/2022 | SPY | Bear Call Spread | October 21, 2022 430/435 | $0.75 | $0.25 | 11.11% |

| 9/13/2022 | 10/17/2022 | IWM | Iron Condor | October 21, 2022 208/203 - 163/158 | $0.77 | $0.30 | 10.40% |

| 10/3/2022 | 10/25/2022 | SPY | Bull Put Spread | November 18, 2022 325/320 | $0.54 | $0.09 | 9.89% |

| 10/4/2022 | 11/2/2022 | IWM | Iron Condor | November 18, 2022 198/203 - 143/138 | $0.64 | $0.32 | 6.84% |

| 10/6/2022 | 11/2/2022 | SPY | Bear Call Spread | November 18, 2022 412/416 | $0.43 | $0.28 | 3.90% |

| 11/16/2022 | 11/28/2022 | IWM | Iron Condor | December 16, 2022 205/200 - 162/157 | $0.75 | $0.24 | 11.36% |

| 11/10/2022 | 12/6/2022 | SPY | Bear Call Spread | December 16, 2022 420/425 | $0.65 | $0.14 | 11.36% |

| 12/1/2022 | 12/6/2022 | SPY | Bear Call Spread | January 20, 2023 435/440 | $0.67 | $0.18 | 10.86% |

| 12/13/2022 | 12/15/2022 | SPY | Bear Call Spread | January 20, 2023 430/435 | $0.54 | $0.17 | 7.99% |

| 12/7/2023 | 1/6/2023 | IWM | Iron Condor | January 20, 2023 202/198 - 160/156 | $0.70 | $0.06 | 19.00% |

| 1/4/2023 | 2/1/2023 | IWM | Iron Condor | February 17, 2023 200/195 - 154/149 | $0.65 | $2.00 | -27.00% |

| 1/6/2023 | 2/2/2023 | SPY | Bear Call Spread | February 17, 2023 415/420 | $0.60 | $2.50 | -38.00% |

| 2/2/2023 | 2/15/2023 | SPY | Bear Call Spread | March 17, 2023 440/445 | $0.63 | $0.15 | 10.62% |

| 2/10/2023 | 2/22/2023 | DIA | Bear Call Spread | March 31, 2023 355/360 | $0.70 | $0.17 | 11.86% |

| 2/2/2023 | 3/1/2023 | IWM | Iron Condor | March 17, 2023 175/180 - 215/220 | $0.72 | $0.51 | 4.38% |

| 3/6/2023 | 3/13/2023 | DIA | Bear Call Spread | April 21, 2023 350/355 | $0.85 | $0.17 | 15.74% |

| 2/23/2023 | 3/28/2023 | SPY | Iron Condor | April 21, 2023 435/430 - 350/345 | $0.80 | $0.15 | 14.94% |

| 3/23/2023 | 4/11/2023 | DIA | Bear Call Spread | April 21, 2023 338/443 | $0.62 | $2.05 | -28.60% |

| 3/23/2023 | 4/19/2023 | IWM | Iron Condor | May 19, 2023 196/191 - 147/142 | $0.83 | $0.23 | 13.64% |

| 4/12/2023 | 4/21/2023 | DIA | Bear Call Spread | May 19, 2023 350/355 | $0.82 | $0.44 | 8.23% |

| 4/21/2023 | 5/2/2023 | SPY | Iron Condor | June 16, 2023 440/435 - 365/360 | $0.95 | $0.63 | 6.84% |

| 4/24/2023 | 5/10/2023 | DIA | Bear Call Spread | June 16, 2023 354/359 | $0.72 | $0.22 | 11.11% |

| 5/5/2023 | 5/24/023 | SPY | Bear Call Spread | June 16, 2023 430/435 | $0.72 | $0.35 | 7.99% |

| 6/15/2023 | 6/22/2023 | SPY | Bear Call Spread | August 18, 2023 465/470 | $0.70 | $0.24 | 10.13% |

| 5/26/2023 | 6/23/2023 | IWM | Iron Condor | July 21, 2023 191/196 - 156/151 | $0.79 | $0.50 | 6.15% |

| 5/31/2023 | 7/12/2023 | QQQ | Bear Call Spread | July 21, 2023 375/380 | $0.60 | $1.80 | -31.60% |

| 6/30/2023 | 8/7/2023 | SPY | Bear Call Spread | August 18, 2023 462/466 | $0.52 | $0.23 | 7.82% |

| 8/4/2023 | 8/11/2023 | SPY | Bear Call Spread | September 15, 2023 470/475 | $0.65 | $0.20 | 9.90% |

| 8/17/2023 | 9/13/2023 | SPY | Iron Condor | October 20, 2023 475/470 - 390/385 | $0.72 | $0.25 | 10.38% |

| 9/6/2023 | 10/11/2023 | IWM | Iron Condor | October 20, 2023 204/199 - 169/164 | $0.62 | $0.19 | 9.41% |

| * 9/29/2023 | 10/27/2023 | SPY | Bear Call Spread | November 17, 2023 452/457 | $0.74 | $0.03 | 16.60% |

| *10/6/2023 | 11/3/2023 | SPY | Bull Put Spread | November 17, 2023 408/403 | $0.58 | $0.03 | 12.36% |

| * 10/27/2023 | 11/3/2023 | SPY | Bear Call Spread | November 17, 2023 430/435 | $0.58 | $3.50 | -33.20% |

| 10/31/2023 | 11/14/2023 | SPY | Iron Condor | December 15, 2023 450/445 - 380/375 | $0.77 | $3.00 | -44.60% |

| 11/6/2023 | 12/8/2023 | SPY | Bear Call Spread | December 15, 2023 456/461 | $0.58 | $3.08 | -50.00% |

| 12/1/2023 | 1/10/2024 | SPY | Bear Call Spread | January 19, 2024 475/480 | $0.75 | $2.75 | -40.00% |

| 26.97% | |||||||

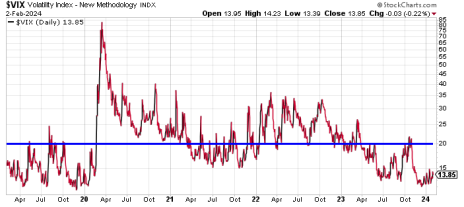

Volatility Talk

Volatility picked up again last week, but still sits in “complacency” territory. What was interesting was the “fear gauge” didn’t push lower during the sharp rally to end the week. Typically, we would see the VIX significantly lower during such a rally, but that didn’t happen. In fact, the VIX held steady throughout the rally … a sign this rally could be nearing a short-term point of exhaustion.

As I stated over the past few weeks, I do think implied volatility will increase going forward. In fact, we could be seeing some of the lowest levels of volatility for 2024. Since 1992, there have only been four years where the VIX has not pushed above 20. The long-term average, according to the CBOE, is 20. As I’ve stated over the past few issues, I’m still looking at a variety of different volatility plays to take advantage of a potential pop in implied volatility over the next three to six months.

Weekly High-Probability Mean Reversion Indicator

Below is my watch list of ETFs and stocks with the most liquid options headed into the week of February 5, 2024.

Here are the various levels I use to determine if an ETF is in an oversold or overbought state.

| Very Overbought | a reading greater than or equal to 80.0 |

| Overbought | greater than or equal to 60.0 |

| Neutral | between 40 to 60 |

| Oversold | less than or equal to 40.0 |

| Very Oversold | less than or equal to 20.0. |

Each week I also include the current implied volatility (IV) and IV Rank. I look for an IV rank above 40, preferably higher.

ETF Watch List – Trade Ideas

| Exchange Traded Fund | Ticker Symbol | IV | IV Rank | HPMR Oversold - Overbought |

| ARK Innovation ETF | ARKK | 37.8 | 22.1 | 48.6 |

| ProShares Bitcoin ETF | BITO | 58.6 | 30.5 | 49 |

| SPDR Dow Jones | DIA | 12.0 | 13.4 | 71.9 |

| iShares MSCI Emerging Markets | EEM | 15.7 | 13.5 | 48.8 |

| iShares MSCI EAFE | EFA | 15.3 | 19.8 | 54.6 |

| iShares MSCI Mexico ETF | EWW | 23.5 | 41.6 | 71.8 |

| iShares MSCI Brazil | EWZ | 24.1 | 31.8 | 37.5 |

| iShares China Large-Cap | FXI | 32.2 | 50.8 | 32.6 |

| VanEck Gold Miners | GDX | 32.6 | 33 | 44.7 |

| SPDR Gold | GLD | 12.4 | 16.9 | 52.2 |

| iShares High-Yield | HYG | 8.2 | 22.2 | 40.8 |

| iShares Russell 2000 | IWM | 23.1 | 41.2 | 46.9 |

| SPDR Regional Bank | KRE | 33.8 | 22.8 | 28.5 |

| VanEck Oil Services | OIH | 29.7 | 12.3 | 30.2 |

| Invesco Nasdaq 100 | QQQ | 17.7 | 14.8 | 65.7 |

| iShares Silver Trust | SLV | 23.4 | 5.4 | 43.5 |

| VanEck Semiconductor | SMH | 27.4 | 37.3 | 66.7 |

| SPDR S&P 500 | SPY | 13.7 | 13.5 | 69.8 |

| iShares 20+ Treasury Bond | TLT | 16.7 | 24.9 | 53.1 |

| United States Oil Fund | USO | 33.6 | 38.4 | 33.4 |

| ProShares Ultra VIX Short | UVXY | 96.3 | 28.9 | 51.9 |

| CBOE Market Volatility Index | VIX | 84.2 | 47.2 | 55.3 |

| Barclays S&P 500 VIX ETN | VXX | 66.8 | 20.8 | 53.6 |

| SPDR Biotech | XLB | 14.2 | 10.1 | 52.2 |

| SPDR Energy Select | XLE | 21.2 | 7.7 | 55.7 |

| SPDR Financials | XLF | 15.3 | 7.6 | 69 |

| SPDR Utilities | XLU | 19.3 | 23.6 | 46.5 |

| SPDR S&P Oil & Gas Explorer | XOP | 27.0 | 10.8 | 40.1 |

| SPDR Retail | XRT | 25.6 | 0.2 | 59.6 |

Stock Watch List – Trade Ideas

| Stock - Quant Trader | Ticker Symbol | IV | IV Rank | HPMR Oversold - Overbought |

| Apple | AAPL | 22.0 | 28.8 | 37.8 |

| Bank of America | BAC | 26.0 | 14.1 | 51 |

| Bristol-Myers Squibb | BMY | 23.9 | 55.4 | 25.3 |

| Citigroup | C | 25.8 | 10.8 | 63.5 |

| Caterpillar | CAT | 32.3 | 56.6 | 78.9 |

| Comcast | CMCSA | 22.0 | 13.6 | 48.8 |

| Costco | COST | 20.1 | 33.6 | 74.5 |

| Cisco Systems | CSCO | 27.4 | 61.6 | 33 |

| Chevron | CVX | 21.5 | 18.3 | 71 |

| Disney | DIS | 33.9 | 71.5 | 67.2 |

| Duke Energy | DUK | 19.4 | 25.0 | 49.2 |

| FedEx | FDX | 21.0 | 7.8 | 34 |

| Gilead Sciences | GILD | 29.1 | 58.7 | 23 |

| General Motors | GM | 29.2 | 7.5 | 83.3 |

| Intel | INTC | 34.4 | 17.9 | 25.9 |

| Johnson & Johnson | JNJ | 16.0 | 27.6 | 22.9 |

| JPMorgan | JPM | 18.5 | 7.2 | 64.2 |

| Coca-Cola | KO | 16.9 | 36.3 | 60.7 |

| Altria Group | MO | 17.2 | 16.9 | 61.5 |

| Merck | MRK | 16.7 | 0.1 | 86.3 |

| Morgan Stanley | MS | 22.9 | 11.0 | 46.3 |

| Microsoft | MSFT | 20.1 | 3.9 | 68.7 |

| NextEra Energy | NEE | 28.9 | 44.0 | 42.9 |

| Nvidia | NVDA | 49.2 | 44.9 | 84.8 |

| Pfizer | PFE | 25.0 | 38.5 | 25.9 |

| PayPal | PYPL | 49.2 | 70.3 | 50.7 |

| Starbucks | SBUX | 19.7 | 19.7 | 47.2 |

| AT&T | T | 21.7 | 15.3 | 67.7 |

| Verizon | VZ | 20.3 | 16.3 | 62.4 |

| Walgreens Boots Alliance | WBA | 38.5 | 45 | 43.2 |

| Wells Fargo | WFC | 25.5 | 10.2 | 47.4 |

| Walmart | WMT | 23.3 | 65.7 | 82.6 |

| Exxon Mobil | XOM | 22.5 | 13.8 | 54.5 |

Weekly Trade Discussion: Open Positions

*Portfolio updated every Monday

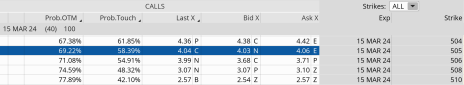

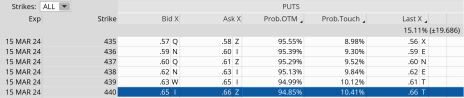

Iron Condor: SPY March 15, 2024, 510/505 – 440/435

Original trade published on 1-16-2024 (click to see original alert)

Background: At the time of the trade, SPY was trading for roughly 474. We sold the March 15, 2024, SPY 510/505 – 440/435 iron condor for $0.66. The expected range or move was 455 to 494. The probability of success at the time of the trade was 91.07% on the call side and 86.77% on the put side.

Current Thoughts: The SPY now it sits at 494.35. Admittedly, we are still early in the trade, but the probability sits at a somewhat precarious 69.22% on the call side and 94.82% on the put side. While there isn’t anything to do at the moment, a continued push to the upside and we will need to make an adjustment to our position.

Call Side:

Put Side:

Bear Call: QQQ March 1, 2024, 445/450

Original trade published on 1-23-2024 (click to see original alert)

Background: At the time of the trade, QQQ was trading for roughly 422.16. We sold the March 1, 2024, QQQ 445/450 iron condor for $0.60. The expected range or move was 405 to 440. The probability of success at the time of the trade was 85.41% on the call side.

Current Thoughts: QQQ now sits slightly higher at 429.01. Our probability sits comfortably at 80.17% on the call side. There are 26 days left until our position is due to expire. If we see a move to the downside over the next week or so, we should be able to take off our trade for a nice return. Until then, there isn’t much to do at the moment other than to allow time decay to work its magic.

Call Side:

As always, if you have any questions, please feel free to email me at andy@cabotwealth.com.

The next Cabot Options Institute – Quant Trader issue will be

published on February 12, 2024.

Copyright © 2024. All rights reserved. Copying or electronic transmission of this information without permission is a violation of copyright law. For the protection of our subscribers, copyright violations will result in immediate termination of all subscriptions without refund. Disclosures: Cabot Wealth Network exists to serve you, our readers. We derive 100% of our revenue, or close to it, from selling subscriptions to our publications. Neither Cabot Wealth Network nor our employees are compensated in any way by the companies whose stocks we recommend or providers of associated financial services. Employees of Cabot Wealth Network may own some of the stocks recommended by our advisory services. Disclaimer: Sources of information are believed to be reliable but they are not guaranteed to be complete or error-free. Recommendations, opinions or suggestions are given with the understanding that subscribers acting on information assume all risks involved. Buy/Sell Recommendations: are made in regular issues, updates, or alerts by email and on the private subscriber website. Subscribers agree to adhere to all terms and conditions which can be found on CabotWealth.com and are subject to change. Violations will result in termination of all subscriptions without refund in addition to any civil and criminal penalties available under the law.