Stocks continued to rally this week in what has been one hell of a move for the market. SPY is up almost 12% in just 27 days. Annualized, that’s more than a 150% return for the world’s largest stock market index. Realistic? Nah, but it certainly shows just how sharp this rally has been over the past month.

A few weeks ago, almost every index pushed into a short-term overbought state due to the rally. And over the two weeks that followed almost every market and sector index continued that push into an extreme overbought state. Obviously, this didn’t bode well for our SPY iron condor, but hey, we know we are going to take a loss from time to time and in most cases, they are far less. But it’s the transition periods from low to high volatility and vice versa where most options strategies struggle.

Cabot Options Institute – Quant Trader Issue: August 12, 2022

Stocks continued to rally this week in what has been one hell of a move for the market. SPY is up almost 12% in just 27 days. Annualized, that’s more than a 150% return for the world’s largest stock market index. Realistic? Nah, but it certainly shows just how sharp this rally has been over the past month.

A few weeks ago, almost every index pushed into a short-term overbought state due to the rally. And over the two weeks that followed almost every market and sector index continued that push into an extreme overbought state. Obviously, this didn’t bode well for our SPY iron condor, but hey, we know we are going to take a loss from time to time and in most cases, they are far less. But it’s the transition periods from low to high volatility and vice versa where most options strategies struggle. That’s why it’s good to have a diversified approach to options using bull, bear and neutral strategies simultaneously. Thankfully, we kept our positions small (only two open positions at the time), remained cautious and didn’t load up on positions trying to fade the move.

Moreover, we were able to take some early profits for a few of our August positions that could have led to further losses had we held on.

But we move on. Losses are a guarantee when trading. And they are a good reminder to those that don’t abide by strict position-sizing guidelines. Moreover, while we took a larger loss than usual, we were far from a 100% loss, which with our approach (and really any approach) is a no-no and can always be avoided. Remember, anyone, and I mean anyone, can make profits…it’s those that have a disciplined risk-management system in place that stick around for true long-term success.

Current Portfolio

| Open Date | Ticker | Strategy | Trade | Open Price | Current Price | Current Probability | Delta |

| 8/1/2022 | SPY | Bear Call | September 16, 2022 439/444 | $0.70 | $0.73 | 85.60% | -5 |

| 8/11/2022 | DIA | Bear Call | September 23, 2022 350/355 | $0.75 | $0.75 | 82.67% | -7 |

| 8/11/2022 | IWM | Iron Condor | September 23, 2022 220/215 - 173/168 | $0.77 | $0.77 | 88.09% - 88.06% | -5 |

| Closed Trades | |||||||

| Open Date | Closed Date | Ticker | Strategy | Trade | Open Price | Closing Price | Return |

| 6/2/2022 | 6/13/2022 | SPY | Bear Call Spread | July 15, 2022 440/445 | $0.70 | $0.05 | 14.94% |

| 6/8/2022 | 6/17/2022 | XOP | Bear Call Spread | July 15, 2022 190/195 | $0.70 | $0.04 | 15.21% |

| 6/22/2022 | 7/13/2022 | SPY | Bear Call Spread | July 29, 2022 405/410 | $0.75 | $0.35 | 8.70% |

| 6/30/2022 | 7/25/2022 | IWM | Iron Condor | August 19, 2022 195/200 - 145/140 | $0.70 | $0.34 | 7.76% |

| 7/8/2022 | 7/28/2022 | GLD | Bull Put Spread | August 19, 2022 155/150 | $0.60 | $0.16 | 9.65% |

| 7/14/2022 | 8/11/2022 | SPY | Iron Condor | August 19, 2022 417/412 - 335/330 | $0.70 | $4.10 | -68.00% |

Volatility Talk

The volatility index, otherwise known as the fear index, pushed below 20 for the first time in months this week. We are seeing some really oversold readings in the VIX over numerous time frames which typically means the market is due for a pullback. That certainly didn’t occur this week as anticipated, but I would be surprised if we didn’t see at least a short-term pullback next week. And when you couple the oversold reading in the VIX with two back-to-back upside gaps on Wednesday and Thursday (the second closed Thursday) and my guess (and that’s all it is) is that Wednesday’s gap in SPY should close. Once we see a closure, again, it’s anyone guess as to the direction of the next move. But gaps act as magnets in the big indices like SPY and again, when we couple this with an extreme oversold reading in the VIX, well, that’s as good as it gets for a potential short-term pullback.

Weekly High Probability Mean Reversion Indicator

Below is my watch list of ETFs and stocks with the most liquid options headed into the week of August 15, 2022.

Here are the various levels I use to determine if an ETF is in an oversold or overbought state.

| Very Overbought | greater than or equal to 80.1 |

| Overbought | 60.1 to 80.0 |

| Neutral | 40.1 to 60 |

| Oversold | 20.1 to 40.0 |

| Very Oversold | less than or equal to 20.0 |

Each week I also include the current implied volatility (IV) and IV Rank. I look for an IV rank above 40, preferably higher.

ETF Watch List- Trade Ideas

| Ticker Symbol | IV | IV Rank | HPMR Oversold - Overbought | |

| ARK Innovation ETF | ARKK | 55.8 | 45.6 | 56.7 |

| ProShares Bitcoin ETF | BITO | 77 | 19.2 | 61.7 |

| SPDR Dow Jones | DIA | 15.9 | 12.1 | 76.6 |

| iShares MSCI Emerging Markets | EEM | 20 | 18.4 | 70.4 |

| iShares MSCI EAFE | EFA | 21.7 | 25.4 | 68.4 |

| iShares MSCI Mexico ETF | EWW | 23.7 | 15.1 | 70.4 |

| iShares MSCI Brazil | EWZ | 35.8 | 52.4 | 73.8 |

| iShares China Large-Cap | FXI | 30.1 | 14.2 | 43.6 |

| VanEck Gold Miners | GDX | 39.5 | 57.1 | 54.1 |

| SPDR Gold | GLD | 16.1 | 7.9 | 60.7 |

| iShares High-Yield | HYG | 13.2 | 39.6 | 58.2 |

| iShares Russell 2000 | IWM | 24.4 | 35.3 | 78.7 |

| SPDR Regional Bank | KRE | 30.4 | 9.8 | 83.2 |

| VanEck Oil Services | OIH | 49 | 26.6 | 65.9 |

| Invesco Nasdaq 100 | QQQ | 25.8 | 44 | 65.8 |

| iShares Silver Trust | SLV | 29.1 | 13.2 | 55.9 |

| VanEck Semiconductor | SMH | 34.3 | 40.3 | 56.5 |

| SPDR S&P 500 | SPY | 21.3 | 32.9 | 75.8 |

| iShares 20+ Treasury Bond | TLT | 18.5 | 33.6 | 34.6 |

| United States Oil Fund | USO | 42.3 | 24.2 | 59.4 |

| ProShares Ultra VIX Short | UVXY | 108.2 | 13.5 | 23.4 |

| CBOE Market Volatility Index | VIX | 95.1 | 7.5 | 34.5 |

| Barclays S&P 500 VIX ETN | VXX | 58.6 | 14.1 | 50.8 |

| SPDR Biotech | XLB | 22.3 | 35.3 | 77.9 |

| SPDR Energy Select | XLE | 47.1 | 32.6 | 68.2 |

| SPDR Financials | XLF | 21.5 | 21.9 | 81.6 |

| SPDR Utilities | XLU | 23.6 | 28.6 | 84.5 |

| SPDR S&P Oil & Gas Explorer | XOP | 46.9 | 20.8 | 70.6 |

| SPDR Retail | XRT | 34.5 | 48 | 71.1 |

Stock Watch List- Trade Ideas

| Ticker Symbol | IV | IV Rank | HPMR Oversold - Overbought | |

| Apple | AAPL | 26.3 | 11 | 75.6 |

| Bank of America | BAC | 29.9 | 23.1 | 76.9 |

| Bristol-Myers Squibb | BMY | 24.3 | 28.5 | 57.6 |

| Citigroup | C | 29.9 | 19.7 | 75.5 |

| Caterpillar | CAT | 29.2 | 26.3 | 69.8 |

| Comcast | CMCSA | 29 | 21.2 | 53.1 |

| Costco | COST | 25.7 | 25.5 | 45.6 |

| Cisco Systems | CSCO | 33.5 | 45.9 | 65.6 |

| Chevron | CVX | 32.3 | 35.2 | 67.4 |

| Disney | DIS | 41.2 | 18.9 | 81.3 |

| Duke Energy | DUK | 20.3 | 26.3 | 46.7 |

| Fedex | FDX | 30.5 | 26.3 | 47.6 |

| Gilead Sciences | GILD | 23.4 | 6.8 | 59.6 |

| General Motors | GM | 40.5 | 30.8 | 68.6 |

| Intel | INTC | 31.6 | 33.9 | 40.3 |

| Johnson & Johnson | JNJ | 19 | 38.7 | 22.2 |

| JP Morgan | JPM | 26 | 22.7 | 72.1 |

| Coca-Cola | KO | 20.7 | 30.1 | 48.5 |

| Altria Group | MO | 29 | 39.6 | 80 |

| Merck | MRK | 23.1 | 36.7 | 47.9 |

| Morgan Stanley | MS | 27.2 | 14.3 | 88.5 |

| Microsoft | MSFT | 25.6 | 19.7 | 67.6 |

| NextEra Energy | NEE | 27.4 | 35 | 80.7 |

| Nvidia | NVDA | 54.7 | 35.6 | 50.4 |

| Pfizer | PFE | 25.6 | 21.5 | 24.4 |

| PayPal | PYPL | 45.8 | 32.6 | 74.8 |

| Starbucks | SBUX | 28.5 | 41.5 | 67.4 |

| AT&T | T | 23.5 | 25.1 | 29.9 |

| Verizon | VZ | 20.7 | 34.7 | 35.6 |

| Walgreens Boots Alliance | WBA | 25.6 | 5.8 | 67 |

| Wells Fargo | WFC | 29.8 | 4.8 | 69.9 |

| Walmart | WMT | 28.4 | 56.1 | 54.9 |

| Exxon Mobil | XOM | 35 | 31.7 | 62.1 |

Weekly Trade Discussion: Open Positions

Iron Condor: IWM September 23, 2022, 220/215 calls – 173/168 puts

Original trade published on 8-11-2022 (click to see original alert)

Background: At the time of the trade IWM was trading for 197.66. We sold the September 23, 2022, IWM 220/215 – 173/168 iron condor spread for $0.77 with an 88.09% (upside) to 88.06% (downside) probability of success. The probability of touch was 24.01% (upside) to 23.41% (downside). The expected range was 186 to 209.

Current Thoughts: We just added the trade so there isn’t much to discuss at the moment.

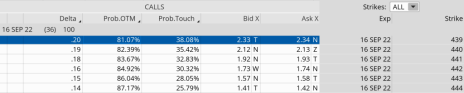

Bear Call: SPY September 16, 2022, 439/444 calls

Original trade published on 8-1-2022 (click to see original alert)

Background: With SPY reaching a short-term overbought reading and pushing even deeper into overbought territory, I decided to add a bear call spread in SPY. SPY was trading for 412.41 at the time and we were able to sell a September 16, 2022, 439/444 bear call spread for $0.70. The probability of success at the time of the trade was 85.63% and the probability of touch was 28.98%.

Current Thoughts: Not much has changed since we entered the trade just four days ago. SPY continues to hover in overbought territory after a huge rally in July. As expected, our probability of success is right around the same as when we entered the trade, and so is the price. So now we just play the waiting game for either a reprieve to occur or time decay to erode our position, or both.

Call Side:

Next Live Analyst Briefing with Q&A

Our next live, subscriber-exclusive webinar is scheduled for Wednesday, August 17, 2022, at 12 p.m. ET. As always, I will be discussing the options market, giving a detailed look at open positions, strategies used, will look at a few potential trades on the trading platform and follow up with live questions and answers. I hope to see you all there! Register here.

The next Cabot Options Institute – Quant Trader issue will be published on August 19, 2022.

About the Analyst

Andy Crowder

Andy Crowder is a professional options trader, researcher and Chief Analyst of Cabot Options Institute. Formerly with Oppenheimer & Co. in New York, Andy has leveraged his investment experience to develop his statistically based options trading strategy which applies probability theory to option valuations in order to execute risk-controlled trades. This proprietary strategy has been refined through two decades of research and real-world experience and has been featured in the Wall Street Journal, Seeking Alpha, and numerous other financial publications. Andy has helped thousands of option traders learn and implement his meticulous rules-driven options trading strategies through highly attended conferences, one-on-one coaching, webinars, and his work as a financial columnist. He currently resides in Bolton Valley, Vermont and when he’s not trading, teaching and writing about options, he enjoys spending time with his wife and two daughters, backcountry skiing, biking, running and enjoying all things outdoors.