Well, I think it’s about time to rip the Band-Aid off and close our August 19, 2022 SPY iron condor. As we talked about last week, the move in SPY has been a historic one since we added our position back on July 14. At the time SPY was trading for 375.87. Now, only 27 days later, the world’s largest stock index trades 11.7% higher at 420. Not too shabby for the bulls.

And while this has been great for my SPY poor man’s covered calls in my Fundamentals advisory, it’s not ideal for an iron condor. We did give ourselves a 9.6% cushion to the upside when we initiated the trade, but the sharp, short-term rally was just too much.

We did give it a chance when SPY hit an extreme overbought state, but overbought has just become, well, more overbought. In almost every case, I would have just gotten out around the $2.10 area, but the short-term overbought state had hit an extreme and typically we see a short-term reprieve shortly after. Obviously, that did not occur this time around. It’s these types of anomalies, or statistical outliers, that lead to losses and this trade was no different.

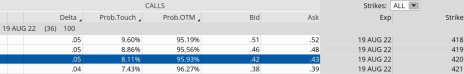

Just look at the image below. There was only an 8.11% chance that SPY would hit 420 and that was over a 36-day period. Again, SPY hit 420 in 27 days.

The statistical outliers are also when our largest losses occur. Thankfully they are few and far between as we don’t often see SPY move 11.7% in just 27 days. So, we take our lumps here and move on, hopefully reminding ourselves why position size is so important to long-term success. Thankfully we’ve built a nice cushion in the few short months we’ve been trading. I will talk more about the trade, current positions, future trades and the August expiration cycle in general in our upcoming webinar. Register here.

In addition to our closing trade today I want to add several more trades for the September expiration cycle. Stay tuned for another alert today as we enter several new trades.

To exit this one, you need to…

Simultaneously:

- Buy to close SPY August 19, 2022, 412 call strike

Sell to close SPY August 19, 2022, 417 call strike - Buy to close SPY August 19, 2022, 335 put strike

Sell to close SPY August 19, 2022, 330 put strike…for a total of $4.10. (As always, the price of the spread can vary from the time of the alert, so please adjust accordingly if you wish to exit the position.)