We are up to three positions in the Income Trader service. As I’ve stated in the past, my goal is to have 5 to 10 ongoing positions in both the Income Trades Portfolio and the Income Wheel Portfolio. That being said, I want to ramp up at a measured pace, especially given this market. So, expect to see 2-3 trades added each week over the next several weeks.

Cabot Options Institute – Income Trader Issue: June 10, 2022

We are up to three positions in the Income Trader service. As I’ve stated in the past, my goal is to have 5 to 10 ongoing positions in both the Income Trades Portfolio and the Income Wheel Portfolio. That being said, I want to ramp up at a measured pace, especially given this market. So, expect to see 2-3 trades added each week over the next several weeks.

As always, if you have any questions please feel free to email me at andy@cabotwealth.com. Also, as a reminder, we have our first live analyst briefing with Q&A next week where we will discuss all things Income Trader. We will go over our positions, take some time on the platform to look at other potential trades and answer any of your questions. I’m looking forward to it! The event is scheduled for Thursday, June 16, 2022 at 1 p.m. ET. Register here.

Current Positions

| Open Date | Ticker | Stock Price (open) | Stock Price (close) | Strategy | Trade | Open Price | Current Price | Current Probability | Delta |

| Income Wheel Portfolio | |||||||||

| 6/3/22 | PFE | $53.10 | $53.49 | Sell Put | 7/8/22 50 Put | $0.65 | $0.65 | 73.28% | 0.24 |

| 6/10/22 | GDX | $30.76 | $30.76 | Sell Put | 7/15/22 29 Put | $0.66 | $0.66 | 67.54% | 0.28 |

| Income Trades Portfolio | |||||||||

| 6/10/22 | BITO | $18.19 | $18.19 | Sell Put | 7/15/22 16 Put | $0.82 | $0.82 | 64.65% | 0.26 |

Below is my watch list of ETFs and stocks with the most liquid options for the week of June 13, 2022.

Here are the various levels I use to determine if an ETF is in an oversold or overbought state.

| Very Overbought | greater than or equal to 80.1 |

| Overbought | 60.1 to 80.0 |

| Neutral | 40.1 to 60 |

| Oversold | 20.1 to 40.0 |

| Very Oversold | less than or equal to 20.0 |

I also include the current implied volatility (IV) and IV Rank. I look for an IV rank above 40, preferably higher.

ETF Watchlist

| Ticker Symbol | IV | IV Rank | HPMR Oversold - Overbought | |

| ARK Innovation ETF | ARKK | 81.3 | 68.9 | 47.2 |

| Proshares Bitcoin ETF | BITO | 87.2 | 42.2 | 45.5 |

| iShares MSCI Emerging Markets | EEM | 24.2 | 25.4 | 39.8 |

| iShares MSCI EAFE | EFA | 21.5 | 38 | 42.3 |

| iShares MSCI Brazil | EWZ | 27.9 | 42 | 21.1 |

| iShares MSCI Mexico ETF | EWW | 39.2 | 54.4 | 27.4 |

| iShares China Large-Cap | FXI | 37.8 | 39.8 | 57.8 |

| Vaneck Gold Miners | GDX | 38.3 | 44.6 | 34.1 |

| SPDR Gold | GLD | 16.7 | 16.2 | 47 |

| iShares High-Yield | HYG | 13.7 | 70.8 | 32.9 |

| SPDR Regional Bank | KRE | 29.8 | 27 | 45.7 |

| iShares Silver Trust | SLV | 29.7 | 18.3 | 40.7 |

| iShares 20+ Treasury Bond | TLT | 21.5 | 53.1 | 37.9 |

| United States Oil Fund | USO | 46.8 | 31.4 | 43.6 |

| Proshares Ultra VIX Short | UVXY | 122.7 | 0.6 | 50.5 |

| Barclays S&P 500 VIX ETN | VXX | 89.5 | 9.3 | 54.4 |

| SPDR Biotech | XLB | 24.1 | 60.3 | 40.8 |

| SPDR Energy Select | XLE | 37.4 | 42.9 | 35.4 |

| SPDR Financials | XLF | 28.1 | 29.4 | 31.8 |

| SPDR Utilities | XLU | 21.0 | 72.2 | 72.3 |

| SPDR Retail | XRT | 46.9 | 67.9 | 49.7 |

Stock Watchlist

| Ticker Symbol | IV | IV Rank | HPMR Oversold - Overbought | |

| Bank of America | BAC | 34.7 | 45 | 27.9 |

| Bristol-Myers | BMY | 25.8 | 26 | 49.5 |

| Citigroup | C | 35.2 | 49.9 | 34.1 |

| Costco | COST | 34.9 | 46.1 | 52.6 |

| Cisco Systems | CSCO | 27.4 | 29.1 | 36.2 |

| CVS Health | CVS | 28.9 | 45.1 | 28.5 |

| Dow Inc. | DOW | 32.0 | 21.5 | 29.3 |

| Duke Energy | DUK | 22.6 | 50.4 | 28.1 |

| Ford | F | 47.3 | 25.1 | 45.4 |

| Gilead Sciences | GILD | 28.8 | 8.2 | 25.9 |

| General Motors | GM | 44.5 | 47.1 | 39.8 |

| Intel | INTC | 33.3 | 47.9 | 24.6 |

| Johnson & Johnson | JNJ | 23.0 | 42.6 | 31.1 |

| Coca-Cola | KO | 8.5 | 64.6 | 33.7 |

| Altria Group | MO | 25.4 | 60.1 | 17.9 |

| Merck | MRK | 32.1 | 44.5 | 25.9 |

| Marvell Tech. | MRVL | 34.7 | 26.9 | 42.7 |

| Morgan Stanley | MS | 15.6 | 53.2 | 34.3 |

| Micron | MU | 29.6 | 38.3 | 31.9 |

| Oracle | ORCL | 40.9 | 70.7 | 35.7 |

| Pfizer | PFE | 34.0 | 46.1 | 38.3 |

| Paypal | PYPL | 62.4 | 60.7 | 47.1 |

| Starbucks | SBUX | 35.2 | 56.9 | 61.3 |

| AT&T | T | 25.9 | 41.7 | 47.6 |

| Verizon | VZ | 26.8 | 49.9 | 51.2 |

| Walgreens Boots Alliance | WBA | 34.1 | 59.3 | 31.7 |

| Wells Fargo | WFC | 35.2 | 41.3 | 31.5 |

| Walmart | WMT | 25.4 | 41.6 | 26.9 |

| Exxon-Mobil | XOM | 34.6 | 38.8 | 69 |

Weekly Trade Discussion: Open Positions

Income Wheel Portfolio Open Positions

Selling Put: PFE July 8, 2022 50 Puts

Original trade published on 6-3-2022 (click to see original alert)

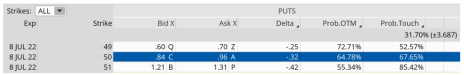

Current Comments: At the time of the trade PFE was trading for 53.10. Our probability of success on the trade was 73.28% and the probability of touch was 51.35%.

PFE is now trading slightly lower at 51.78 and as expected, our probability of success subsequently moved lower to 64.78%.

No worries, as I plan to wheel PFE. If I’m assigned shares at the 50 strike, I’ll gladly sell calls until my shares are eventually called away and then I’ll repeat the wheel process all over again. As I’ve said before, my goal is to have at least 5 to 10 positions in both the Income Wheel Portfolio and the Income Trades Portfolio.

Call Side

Selling Put: GDX July 15, 2022 29 Puts

Original trade published on 6-10-2022 (click here to see original alert)

Nothing new to report at the moment as we just added the trade today.

Income Trades Portfolio Open Positions

Selling Put: BITO July 15, 2022 16 Puts

Original trade published on 6-10-2022 (click here to see original alert)

Nothing new to report at the moment as we just added the trade today.

Next Live Analyst Briefing with Q&A

Our first live analyst briefing with Q&A is scheduled for Thursday, June 16, 2022 at 1 p.m. ET. I will be discussing the options market, have a detailed look at open positions, go over strategies used, and do a follow-up with live questions. But I also want to take some time to go through the ins and outs of the service and what to expect going forward, so I’ll probably go a little longer than usual, possibly upwards of 45 minutes to an hour, potentially longer if we have lots of questions…and I hope we do. Register here.

The next Cabot Options Institute – Income Trader issue will be published on June 17, 2022.

About the Analyst

Andy Crowder

Andy Crowder is a professional options trader, researcher and Chief Analyst of Cabot Options Institute. Formerly with Oppenheimer & Co. in New York, Andy has leveraged his investment experience to develop his statistically based options trading strategy which applies probability theory to option valuations in order to execute risk-controlled trades. This proprietary strategy has been refined through two decades of research and real-world experience and has been featured in the Wall Street Journal, Seeking Alpha, and numerous other financial publications. Andy has helped thousands of option traders learn and implement his meticulous rules-driven options trading strategies through highly attended conferences, one-on-one coaching, webinars, and his work as a financial columnist. He currently resides in Bolton Valley, Vermont and when he’s not trading, teaching and writing about options, he enjoys spending time with his wife and two daughters, backcountry skiing, biking, running and enjoying all things outdoors.