I want to dip my toes into at least one position this week, with the intent of adding several more next week. My goal is to have a rotation of five to ten positions in both the Income Trades Portfolio and Income Wheel Portfolio.

In today’s trade alert, I want to start out by selling some puts with the intent of eventually wheeling into the position.

The mechanics are simple.

- Sell Cash-Secured Puts on a stock until you are assigned shares (100 shares for every put sold)

- Sell Covered Calls on the assigned stock until the shares are called away

- Repeat the Process!

All this being said, you can simply just sell puts without the need to wheel into the position. Some of you don’t want to own stock and I get it … which is why we also have an Income Trades Portfolio that is just trades, with no intent of holding stock.

Anyway …

I’m not going with anything too crazy here. I want to choose highly liquid market stalwarts to sell premium against over the long term. These are typically lower-beta stocks with an average implied volatility.

Pfizer (PFE)

IV: 44.0%

IV Rank: 59.1

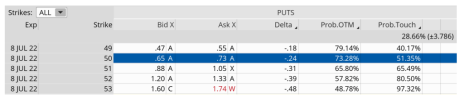

Expected Move (Range): The expected move (range) for the July 8, 2022, expiration cycle is from 50 to 56.5.

With PFE trading for 53.10 I want to sell puts going out 35 days. My intent is to take off the trade well before the July 8, 2022, expiration date.

The Trade

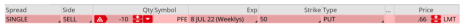

Sell to open PFE July 8, 2022, 50 put strike for a total of $0.65 or higher (As always, the price of spread will vary, please adjust accordingly.)

Delta of spread: -0.24

Probability of Profit: 73.28%

Probability of Touch: 51.35

Total net credit: $0.65

Max return (cash-secured): 1.3%

Risk Management

I will be using PFE as part of the conservative side of our Income Wheel Portfolio, so if PFE closes below on expiration we will be issued shares at the 50 strike and begin the process of selling calls against it. Until that point, we will continue to sell puts on PFE. Of course, any necessary trade alerts/updates will follow.

If you have any questions, please do not hesitate to email me at andy@cabotwealth.com.