Weekly Commentary

Expiration is upon us, and three of our six positions are due to expire this week.

I plan to buy back our calls in WFC, as they are essentially worthless, lock in some profits and immediately sell more call premium.

As for our GDX covered call position, the current probability is basically 50%, so we are in coin toss territory. I’ll update my thoughts on the position, with any necessary alerts, as the week progresses.

And to wrap it up, DKNG is currently trading below our DKNG 30 puts. If DKNG closes below the 30 put strike at expiration, no worries, we will simply be put shares (100 shares per put contract sold) of DKNG and immediately begin to sell calls against our newly acquired shares.

Current Positions

| Open Date | Ticker | Stock Price (open) | Stock Price (current) | Strategy | Trade | Open Price | Current Price | Delta |

| Income Wheel Portfolio - Open Trades | ||||||||

| 9/14/2023 | DKNG | $31.40 | $28.44 | Short Put | October 20, 2023 30 Put | $0.98 | $1.74 | 0.77 |

| 10/13/2023 | PFE | $32.40 | $32.11 | Covered Call | November 24, 2023 34 Call | $0.62 | $0.53 | 0.24 |

| 8/21/2023 | GDX | $27.61 | $28.95 | Covered Call | October 20, 2023 29 Call | $0.86 | $0.53 | 0.51 |

| 10/13/2023 | KO | $53.23 | $52.89 | Covered Call | November 24, 2023 55 Call | $0.75 | $0.70 | 0.3 |

| 9/18/2023 | WFC | $43.44 | $40.96 | Covered Call | October 20, 2023 44.5 Call | $0.89 | $0.04 | 0.05 |

| 10/2/2023 | BITO | $14.24 | $13.62 | Covered Call | November 17, 2023 15 Call | $0.47 | $0.20 | 0.22 |

| Open Date | Close Date | Ticker | Strategy | Trade | Open Price | Closed Price | Profit | Return |

| Income Wheel Portfolio - Closed Trades | ||||||||

| 6/3/2022 | 7/8/2022 | PFE | Short Put | July 8, 2022 50 Put | $0.65 | $0.00 | $0.65 | 1.30% |

| 6/10/2022 | 7/15/2022 | GDX | Short Put | July 15, 2022 29 Put | $0.66 | Assigned at $29 | ($2.75) | -9.48% |

| 6/10/2022 | 7/15/2022 | BITO | Short Put | July 15, 2022 16 Put | $0.82 | Assigned at $16 | ($2.09) | -13.10% |

| 6/22/2022 | 7/21/2022 | WFC | Short Put | July 29, 2022 35 Put | $0.80 | $0.02 | $0.78 | 2.23% |

| 6/30/2022 | 8/10/2022 | KO | Short Put | August 19, 2022 57.5 Put | $0.70 | $0.03 | $0.67 | 1.20% |

| 7/21/2022 | 8/10/2022 | WFC | Short Put | August 19, 2022 39 Put | $0.46 | $0.04 | $0.42 | 1.08% |

| 7/18/2022 | 8/17/2022 | BITO | Covered Call | August 19, 2022 16 Call | $0.50 | $0.03 | $0.47 | 3.59% |

| 7/18/2022 | 8/17/2022 | GDX | Covered Call | August 19, 2022 28 Call | $0.63 | $0.05 | $0.57 | 2.22% |

| 7/11/2022 | 8/23/2022 | PFE | Short Put | August 19, 2022 50 Put | $1.00 | Assigned at $50 | $0.21 | 0.43% |

| 7/26/2022 | 8/17/2022 | JPM | Short Put | September 16, 2022 100 Put | $1.22 | $0.16 | $1.06 | 1.10% |

| 8/17/2022 | 9/7/2022 | BITO | Covered Call | September 23, 2022 16.5 Call | $0.55 | $0.03 | $0.52 | 4.00% |

| 8/17/2022 | 9/7/2022 | GDX | Covered Call | September 23, 2022 28 Call | $0.59 | $0.07 | $0.52 | 2.03% |

| 8/23/2022 | 9/23/2022 | PFE | Covered Call | October 21, 2022 50 Call | $1.50 | $0.09 | $1.41 | 2.82% |

| 8/10/2022 | 9/23/2022 | KO | Short Put | September 23, 2022 60 Put | $0.62 | Assigned at $60 | ($0.78) | -1.30% |

| 8/10/2022 | 9/23/2022 | WFC | Short Put | September 23, 2022 41 Put | $0.61 | Assigned at $41 | $0.02 | 0.05% |

| 9/7/2022 | 10/17/2022 | BITO | Covered Call | October 21, 2022 14 Call | $0.40 | $0.03 | $0.37 | 2.60% |

| 9/7/2022 | 10/17/2022 | GDX | Covered Call | October 21, 2022 26 Call | $0.70 | $0.04 | $0.66 | 2.50% |

| 9/26/2022 | 10/21/2022 | WFC | Covered Call | October 21, 2022 41 Call | $1.30 | Called away at $41 | $1.89 | 4.67% |

| 9/26/2022 | 10/21/2022 | KO | Covered Call | October 21, 2022 60 Call | $0.70 | $0.00 | $0.70 | 1.20% |

| 9/23/2022 | 1028/2022 | PFE | Covered Call | October 28, 2022 47 Call | $0.56 | Called away at $47 | $3.49 | 7.43% |

| 10/17/2022 | 11/17/2022 | BITO | Covered Call | November 25, 2022 13.5 Call | $0.38 | $0.03 | $0.35 | 2.60% |

| 10/25/2022 | 11/17/2022 | WFC | Short Put | November 25, 2022 43 Put | $0.96 | $0.07 | $0.89 | 2.00% |

| 10/17/2022 | 11/25/2022 | GDX | Covered Call | November 25, 2022 26 Call | $0.58 | Called away at $26 | $1.09 | 3.87% |

| 10/25/2022 | 11/25/2022 | KO | Covered Call | November 25, 2022 60 Call | $0.80 | Called away at $60 | $2.20 | 3.75% |

| 11/3/2022 | 12/8/2022 | PFE | Short Put | December 16, 2022 45 Put | $1.08 | $0.02 | $1.06 | 2.36% |

| 11/17/2022 | 12/19/2022 | BITO | Covered Call | December 30, 2022 12 Call | $0.45 | $0.04 | $0.41 | 3.42% |

| 11/17/2022 | 12/30/2022 | WFC | Short Put | December 30, 2022 44 Put | $1.02 | Assigned at $44 | ($1.37) | -3.11% |

| 11/29/2023 | 1/9/2023 | GDX | Short Put | January 20, 2023 26 Put | $0.87 | $0.02 | $0.85 | 3.27% |

| 12/8/2022 | 1/13/2023 | PFE | Short Put | January 13, 2023 49 Put | $0.62 | Assigned at $49 | ($0.53) | -1.08% |

| 12/19/2022 | 1/20/2023 | BITO | Covered Call | January 20, 2023 11.5 Call | $0.30 | Called away at $11.5 | $1.49 | 14.70% |

| 11/29/2022 | 1/20/2023 | KO | Short Put | January 20, 2023 60 Put | $0.84 | $0.00 | $0.84 | 1.40% |

| 1/5/2023 | 2/17/2023 | WFC | Covered Call | February 17, 2023 45 Call | $0.84 | Called away at $45 | $4.23 | 10.17% |

| 1/9/2023 | 2/17/2023 | GDX | Short Put | February 17, 2023 29 Put | $0.54 | Assigned at $29 | ($0.05) | -0.10% |

| 1/23/2023 | 2/17/2023 | KO | Short Put | February 17, 2023 59 Put | $0.62 | $0.00 | $0.62 | 1.05% |

| 1/23/2023 | 2/17/2023 | BITO | Short Put | February 17, 2023 13.5 Put | $0.52 | $0.00 | $0.52 | 3.85% |

| 1/20/2023 | 3/1/2023 | PFE | Covered Call | March 3, 2023 46 Call | $1.00 | $0.02 | $0.98 | 2.18% |

| 2/22/2023 | 3/23/2023 | BITO | Short Put | March 31, 2023 31 Put | $0.50 | $0.05 | $0.45 | 3.46% |

| 2/22/2023 | 3/29/2023 | KO | Short Put | March 31, 2023 59 Put | $0.86 | $0.02 | $0.84 | 1.42% |

| 3/1/2023 | 3/29/2023 | PFE | Covered Call | April 6, 2023 42 Call | $0.65 | $0.05 | $0.60 | 1.43% |

| 2/21/2023 | 3/31/2023 | GDX | Covered Call | March 31, 2023 29.5 Call | $0.75 | Called away at $29.5 | $1.84 | 6.48% |

| 2/23/2023 | 3/31/2023 | WFC | Short Put | March 31, 2023 43 Put | $0.53 | Assigned at $43 | ($4.87) | -11.32% |

| 3/29/2023 | 4/28/2023 | KO | Short Put | May 19, 2023 60 Puts | $0.76 | $0.08 | $0.68 | 1.13% |

| 3/29/2023 | 4/28/2023 | PFE | Covered Call | May 19, 2023 42.5 Call | $0.53 | $0.05 | $0.48 | 1.23% |

| 4/4/2023 | 5/8/2023 | GDX | Short Put | May 19, 2023 32 Put | $0.78 | $0.70 | $0.71 | 2.22% |

| 3/23/2023 | 5/18/2023 | BITO | Short Put | May 19, 2023 15 Put | $1.10 | $0.03 | $1.07 | 7.13% |

| 4/4/2023 | 5/24/2023 | WFC | Covered Call | May 19, 2023 40 Call | $0.55 | Called away at $40 | $3.94 | 10.76% |

| 4/28/2023 | 6/16/2023 | PFE | Covered Call | June 16, 2023 40 Call | $0.63 | Called away at $40 | $1.71 | 4.40% |

| 3/29/2023 | 6/16/2023 | KO | Short Put | June 16, 2023 62.5 Put | $0.70 | Assigned at $62.5 | ($0.13) | -0.21% |

| 5/8/2023 | 6/16/2023 | GDX | Short Put | June 16, 2023 34 Put | $0.91 | Assigned at $34 | ($1.70) | -5.00% |

| 5/18/2023 | 6/30/2023 | BITO | Short Put | June 30, 2023 14 Put | $0.45 | $0.01 | $0.44 | 3.14% |

| 5/24/2023 | 7/6/2023 | WFC | Short put | July 21, 2023 37.5 Put | $1.01 | $0.09 | $0.92 | 2.54% |

| 6/30/2023 | 7/24/2023 | DKNG | Short Put | August 18, 2023 22.5 Put | $0.63 | $0.09 | $0.54 | 2.40% |

| 7/6/2023 | 7/24/2023 | WFC | Short Put | August 25, 2023 40 Put | $0.76 | $0.12 | $0.64 | 1.60% |

| 6/21/2023 | 8/18/2023 | PFE | Short Put | August 18, 2023 37.5 Put | $0.64 | Assigned at $37.5 | ($0.24) | -0.64% |

| 6/21/2023 | 8/18/2023 | GDX | Covered Call | August 18, 2023 33 Call | $0.52 | $0.00 | $0.52 | 1.60% |

| 6/21/2023 | 8/18/2023 | KO | Covered Call | August 18, 2023 62.5 Call | $0.85 | $0.00 | $0.85 | 1.40% |

| 6/30/2023 | 8/18/2023 | BITO | Short Put | August 18, 2023 15 Put | $0.78 | Assigned at $15 | ($0.78) | -5.20% |

| 7/24/2023 | 9/14/2023 | DKNG | Short Put | September 15, 2023 28 Put | $1.36 | $0.02 | $1.34 | 4.79% |

| 8/21/2023 | 9/14/2023 | PFE | Covered Call | September 29, 2023 38 Call | $0.78 | $0.02 | $0.76 | 2.00% |

| 8/21/2023 | 9/14/2023 | KO | Covered Call | September 29, 2023 61 Call | $0.78 | $0.03 | $0.75 | 1.23% |

| 7/24/2023 | 9/15/2023 | WFC | Short Put | September 15, 2023 45 Put | $0.85 | Assigned at $45 | ($1.20) | -2.67% |

| 8/21/2023 | 9/29/2023 | BITO | CoveredCall | September 29, 2023 14 Call | $0.48 | $0.00 | $0.48 | 3.58% |

| 9/14/2023 | 10/13/2023 | PFE | CoveredCall | October 20, 2023 35 Call | $0.58 | $0.04 | $0.54 | 1.47% |

| 9/14/2023 | 10/13/2023 | KO | CoveredCall | October 27, 2023 59 Call | $0.95 | $0.03 | $0.92 | 1.49% |

| 108.76% | ||||||||

ETF Watchlist – Weekly Trade Ideas

| Exchange Traded Fund | Ticker Symbol | IV | IV Rank | HPMR Oversold - Overbought |

| ARK Innovation ETF | ARKK | 41.9 | 22.7 | 31.5 |

| Proshares Bitcoin ETF | BITO | 40.8 | 5.8 | 41.2 |

| SPDR Dow Jones | DIA | 15.8 | 32 | 51.5 |

| iShares MSCI Emerging Markets | EEM | 19.6 | 25.5 | 47.1 |

| iShares MSCI EAFE | EFA | 18.1 | 36.3 | 42.5 |

| iShares MSCI Mexico ETF | EWW | 29.0 | 66.7 | 35.4 |

| iShares MSCI Brazil | EWZ | 31.0 | 12.1 | 50.2 |

| iShares China Large-Cap | FXI | 30.2 | 17.1 | 49.9 |

| Vaneck Gold Miners | GDX | 35.6 | 35.5 | 68.9 |

| SPDR Gold | GLD | 14.7 | 68.6 | 76.2 |

| iShares High-Yield | HYG | 10.4 | 23.9 | 36.8 |

| iShares Russell 2000 | IWM | 23.0 | 38.8 | 30.2 |

| SPDR Regional Bank | KRE | 37.6 | 22.1 | 35.8 |

| Vaneck Oil Services | OIH | 37.7 | 30.4 | 58.1 |

| Invesco Nasdaq 100 | QQQ | 23.2 | 29.2 | 50.9 |

| iShares Silver Trust | SLV | 30.8 | 49 | 64.9 |

| Vaneck Semiconductor | SMH | 31.3 | 29.5 | 52.2 |

| SPDR S&P 500 | SPY | 18.4 | 36 | 49.3 |

| iShares 20+ Treasury Bond | TLT | 25.3 | 56.2 | 50.4 |

| United States Oil Fund | USO | 38.1 | 66.5 | 58.6 |

| Proshares Ultra VIX Short | UVXY | 116.4 | 80.6 | 66.3 |

| CBOE Market Volatility Index | VIX | 102.1 | 57.4 | 67.1 |

| Barclays S&P 500 VIX ETN | VXX | 80.0 | 78.3 | 39.7 |

| SPDR Biotech | XLB | 20.9 | 24.6 | 39.7 |

| SPDR Energy Select | XLE | 27.9 | 31.8 | 58.1 |

| SPDR Financials | XLF | 21.9 | 29.8 | 48.9 |

| SPDR Utilities | XLU | 25.1 | 49.9 | 53.5 |

| SPDR S&P Oil & Gas Explorer | XOP | 34.6 | 28.7 | 64.9 |

| SPDR Retail | XRT | 25.7 | 27.4 | 36.9 |

Stock Watchlist – Weekly Trade Ideas

| Stock - Income Trader | Ticker Symbol | IV | IV Rank | HPMR Oversold - Overbought |

| Apple | AAPL | 29.1 | 37.2 | 59.4 |

| Bank of America | BAC | 38.8 | 42.8 | 45.8 |

| Bristol-Myers Squibb | BMY | 25.3 | 60.6 | 32.6 |

| Citigroup | C | 36.8 | 23.5 | 60.6 |

| Caterpillar | CAT | 36.9 | 69.8 | 42.4 |

| Comcast | CMCSA | 29.4 | 33.2 | 42.3 |

| Costco | COST | 22.7 | 26.8 | 56.3 |

| Cisco Systems | CSCO | 19.8 | 28.6 | 47.5 |

| Chevron | CVX | 26.8 | 36.2 | 47.6 |

| Disney | DIS | 35.0 | 41.2 | 64.3 |

| Duke Energy | DUK | 28.7 | 65.1 | 50.4 |

| Fedex | FDX | 26.7 | 25.3 | 16.2 |

| Gilead Sciences | GILD | 31.2 | 63.9 | 75.3 |

| General Motors | GM | 44.6 | 49.6 | 25.5 |

| Intel | INTC | 45.6 | 54.4 | 47.4 |

| Johnson & Johnson | JNJ | 22.0 | 76.1 | 43.3 |

| JP Morgan | JPM | 28.4 | 23.9 | 67.7 |

| Coca-Cola | KO | 25.9 | 67.1 | 31.1 |

| Altria Group | MO | 23.7 | 48.2 | 58.1 |

| Merck | MRK | 24.9 | 65.8 | 49.7 |

| Morgan Stanley | MS | 33.8 | 48.2 | 26.2 |

| Microsoft | MSFT | 31.5 | 65.8 | 55.6 |

| Nextera Energy | NEE | 43.4 | 96.6 | 49.1 |

| Nvidia | NVDA | 42.1 | 13.7 | 53.4 |

| Pfizer | PFE | 32.7 | 88.6 | 25.9 |

| Paypal | PYPL | 54.1 | 48.1 | 27.4 |

| Starbucks | SBUX | 34.8 | 59.1 | 40.8 |

| AT&T | T | 33 | 62.1 | 35.6 |

| Verizon | VZ | 31.4 | 70.6 | 28.4 |

| Walgreens Boots Alliance | WBA | 50.3 | 57.8 | 60.4 |

| Wells Fargo | WFC | 38.1 | 23.9 | 64.9 |

| Walmart | WMT | 22.2 | 35.1 | 53.6 |

| Exxon Mobil | XOM | 29.8 | 42.1 | 45.2 |

Weekly Trade Discussion: Open Positions

Income Wheel Portfolio: Open Positions

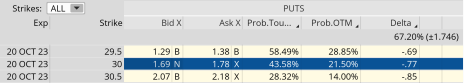

Selling Puts: DKNG October 20, 2023, 30 Puts

Original trade published on 9-14-2023 (click here to see original alert)

Current Comments: We sold the October 20, 2023, 30 puts for $0.98. At the time of the alert, DKNG was trading for 31.04.

Now, with DKNG trading for 28.55, the probability of success stands at 21.50%, and the price of the 30 puts sits at $1.74. There are still 5 days left in the October 20, 2023 expiration cycle. If DKNG closes below the 30 put strike at expiration, no worries, we will simply be put shares (100 shares per put contract sold) of DKNG and immediately begin to sell calls against our newly acquired shares.

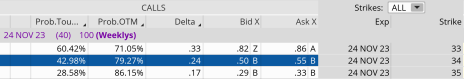

Covered Calls: PFE November 24, 2023, 34 Calls

Original trade published on 10-13-2023 (click here to see original alert)

Current Comments: We sold the November 24, 2023, 34 calls for $0.62. At the time of the alert, PFE was trading for 32.40. We are extremely early in the trade so there is not much to discuss at the moment.

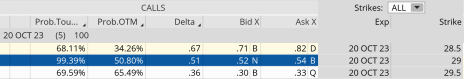

Covered Calls: GDX October 20, 2023, 29 Calls

Original trade published on 8-21-2023 (click here to see original alert)

Current Comments: We sold the October 20, 2023, 29 calls for $0.86. At the time of the alert, GDX was trading for 27.61.

Now, with GDX trading for 28.95, the probability of success stands at 50.80%, and the price of the 29 calls sits at $0.53. There are 5 days left in the October 20, 2023 expiration cycle. If GDX closes above our short call strike of 29 at expiration in five days, no worries, our shares will be called away, we in turn lock in profits and immediately look for an opportunity to sell more puts on GDX early next week.

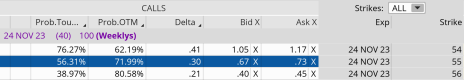

Covered Calls: KO November 24, 2023, 55 Calls

Original trade published on 10-13-2023 (click here to see original alert)

Current Comments: We sold the November 24, 2023, 55 calls for $0.75. At the time of the alert, KO was trading for 53.23. We are extremely early in the trade so there is not much to discuss at the moment.

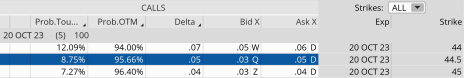

Covered Calls: WFC October 20, 2023, 44.5 Calls

Original trade published on 9-18-2023 (click here to see original alert)

Current Comments: We sold the October 20, 2023, 44.5 calls for $0.89. At the time of the alert, WFC was trading for 43.44.

Now, with WFC trading for 40.96, the probability of success stands at 95.66%, and the price of the 44.5 calls sits at $0.05. There are 5 days left in the October 20, 2023, expiration cycle. I plan to buy back our calls early this week, lock in profits and immediately sell more call premium.

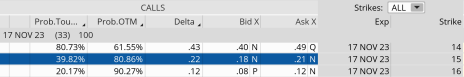

Covered Calls: BITO November 17, 2023, 15 Calls

Original trade published on 10-2-2023 (click here to see original alert)

Current Comments: We sold the November 17, 2023, 15 calls for $0.47. At the time of the alert, BITO was trading for 14.24.

Now, with BITO trading for 13.62, the probability of success stands at 80.86%, and the price of the 15 calls sits at $0.20. There are 33 days left in the November 17, 2023 expiration cycle, so there isn’t much to do at the moment other than to be patient and allow time decay to work its magic. If the price of our calls dips below $0.10, I’ll most likely buy them back, lock in some profits and immediately sell more calls.

As always, if you have any questions, please do not hesitate to email me at andy@cabotwealth.com.

The next Cabot Options Institute – Income Trader issue will be

published on October 23, 2023.