Cabot Options Institute Income Trader: Alert (DKNG, PFE, KO)

DraftKings (DKNG)

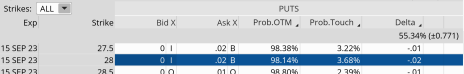

DKNG continues to trend higher, so we are going to buy back our September puts, lock in profits and immediately sell more puts for the October expiration cycle.

DKNG is currently trading for 31.40.

Here is the trade:

Buy to Close DKNG September 15, 2023, 28 put for $0.02. (As always, prices will vary, please adjust accordingly.)

Sell to Open DKNG October 20, 2023, 30 put for $0.98. (As always, prices will vary, please adjust accordingly.)

Delta of short call: 0.33

Probability of Profit: 62.26%

Probability of Touch: 73.99%

Total net credit: $0.98

Max return (cash-secured): 3.3%

Risk Management

We will use DKNG as part of our Income Wheel Portfolio, so if DKNG closes below our put strike at expiration, we will be assigned shares of DKNG (per the guidelines of the strategy). Until that point, we will repeatedly sell puts on DKNG. Of course, any necessary trade alerts/updates will follow.

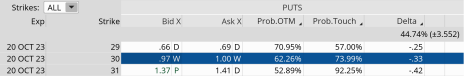

Pfizer (PFE)

As part of the Income Wheel approach, we allowed our PFE puts to expire in the money at the last expiration cycle. As a result, we were issued shares at our chosen put strike of 37.5.

Today, as our Income Wheel strategy states, we are going to buy back our current calls, lock in some profits and immediately sell more calls against our shares in PFE.

We are not selling naked calls, so you need to have at least 100 shares if you wish to enter a new position in PFE. For those of you who are new to Income Trader and wish to follow along with PFE, buying at least 100 shares of PFE for every call contract you wish to sell is required as we are in the covered call phase of the Income Wheel strategy for PFE.

PFE is currently trading for 34.16.

Here is the trade:

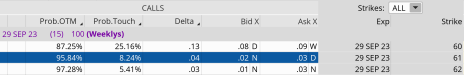

Buy to Close PFE September 29, 2023, 38 (covered) call for $0.02. (Adjust accordingly, prices may vary from time of alert.)

Once that occurs (or if you are new to the trade and own shares of PFE):

Sell to Open PFE October 20, 2023, 35 (covered) call for $0.58 (adjust accordingly, prices may vary from time of alert).

Delta of short call: 0.37

Probability of Profit: 64.95%

Probability of Touch: 71.47%

Total net credit: $0.58

Max return (cash-secured): 1.7%

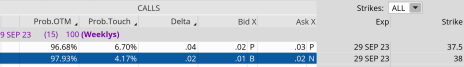

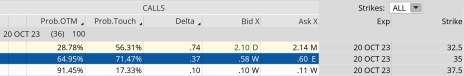

Coca-Cola (KO)

I want to buy back our short calls and immediately sell more call premium. We still have 15 days left until our September 29, 2023, 61 calls are due to expire, and they are essentially worthless. As a result, let’s buy them back, lock in some call premium and sell more calls.

KO is currently trading for 58.47.

Here is the trade (we are not selling naked calls; you must own at least 100 shares of KO before placing the trade):

Buy to Close KO September 29, 2023, 61 (covered) call for $0.03. (Adjust accordingly, prices may vary from time of alert.)

Once that occurs:

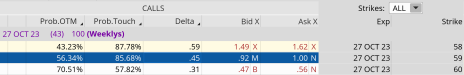

Sell to Open KO October 27, 2023, 59 (covered) call for $0.95. (Adjust accordingly, prices may vary from time of alert.)

Delta of short call: 0.45

Probability of Profit: 56.34%

Probability of Touch: 85.68%

Total net credit: $0.95

Max return (cash-secured): 1.6%

Risk Management

We use KO as part of our Income Wheel Portfolio, so if KO closes above our call strike at expiration, our shares will be called away and, in most cases, we will reap the capital benefits of the stock increase, plus the premium acquired. Until that point, we will repeatedly sell calls on KO.

As always, if you have any questions, please do not hesitate to email me at andy@cabotwealth.com.