Cabot Options Institute Earnings Trader – Alert (MA)

As discussed in our weekly issue and on our weekly call, I will be taking a position in Mastercard (MA) today.

Mastercard is due to announce before the opening bell Thursday.

Iron Condor Earnings Trade in Mastercard (MA)

MA is currently trading for 319.58. Let’s examine an iron condor trade with a high probability of success.

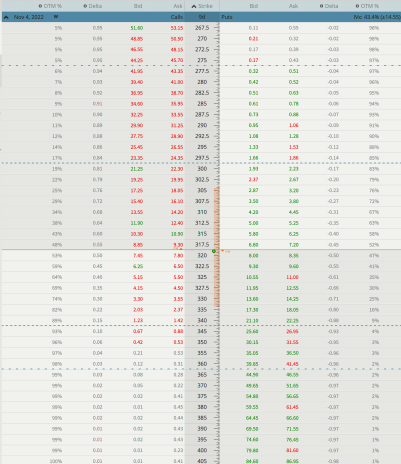

First, let’s take a look at the expected move in MA for the expiration cycle that I’m interested in. Since MA is due to report late in the week, I want to go out at least one additional week, in this case to the November 4th expiration cycle.

The expected move or expected range over the next 9 days can be seen in the pale, orange-colored bar below. The expected move is from 305 to roughly 335, for a range of 30.

Knowing the expected range, I want to place the short call strike and short put strike of my iron condor outside of the expected range, in this case outside of 305 to 335.

This is my preference most of the time when using iron condors.

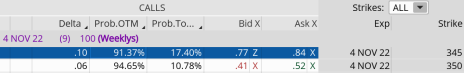

If we look at the call side of MA for the November 4, 2022, expiration, we can see that the 345 call strike offers a 91.37% probability of success. So, I’m going to sell the short call at the 345 call strike and define my risk with the 350 call strike. By choosing the 350 call strike to define my risk, I know that there is less than a 6% chance that I will take a max loss on the trade.

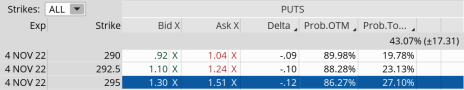

Now let us move to the put side. Same process as the call side. But now we want to find a suitable strike below the low side of our expected move, or 305. The 295 put strike, with an 86.27% probability of success, works. I’m going to define my risk by choosing the 290 put strike with an 89.98% probability of success. This means we have less than an 11% chance of taking a max loss on the downside.

We can create a trade with a nice probability of success if MA stays between our 50-point range, or between the 345 call strike and the 295 put strike. Our probability of success on the trade is 91.37% on the upside and 86.27% on the downside.

I like those odds. The question is, will the premium be enough to make the trade worth the risk? Let’s take a look.

Here is the trade:

Simultaneously:

Sell to open MA November 4, 2022, 345 calls

Buy to open MA November 4, 2022, 350 calls

Sell to open MA November 4, 2022, 295 puts

Buy to open MA November 4, 2022, 290 puts for roughly $0.73 or $73 per iron condor (prices will fluctuate, please adjust accordingly if you wish to enter trade)

Our potential return on the trade: 17.1%

Our margin requirement is $423 per iron condor.

Again, the goal of selling the MA iron condor is to have the underlying stock stay below the 345 call strike and above the 295 put strike immediately after MA earnings are announced.

Here are the parameters for this trade:

- The Probability of Success – 91.37% (call side) and 86.27% (put side)

- The maximum return on the trade is the credit of $0.73, or $73 per iron condor

- Breakeven level: 345.73 – 294.23

- The maximum loss on the trade is $423 per iron condor. Remember, we always adjust if necessary, and always stick to our stop-loss guidelines.

*Also, proper position size is the KEY to long-term success when trading earnings. Keep your size within reason and allow the law of large numbers to do the work. Losses will occur, so manage your position via position size accordingly.