Cabot Options Institute Earnings Trader – Alert (WYNN)

Wynn Resorts (WYNN)

I will be holding our last subscriber-only webinar for this earnings season on Friday at 12 p.m. ET. Click here to sign up. No worries if you can’t make it, we archive everything here at Cabot. You can find all the archived recordings here.

Remember, as is always the case, risk management is the key to long-term success when using high-probability option strategies. It’s the only way to truly allow the law of large numbers to work in your favor. Don’t get greedy and enamored by the quick nature of these trades. Stay disciplined!

Wynn Resorts (WYNN) is due to announce earnings today after the closing bell.

The stock is currently trading for 92.80.

- IV Rank: 23.0

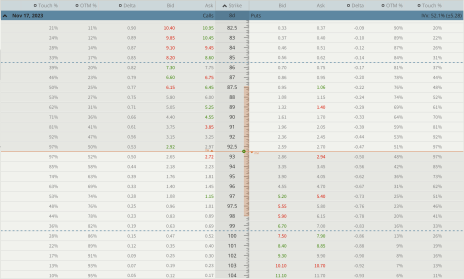

Expected Move for the November 17, 2023, Expiration Cycle: 87.5 to 98

Knowing the expected range, I want to place the short call strike and short put strike of my iron condor outside of the expected range, in this case outside of 87.5 to 98.

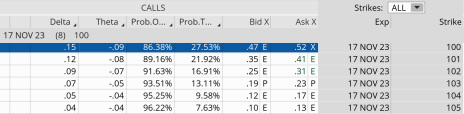

If we look at the call side of WYNN for the November 17, 2023, expiration, we can see that selling the 100 call strike offers an 86.38% probability of success. The 100 call strike sits just above the expected move, or 98.

Now let us move to the put side. Same process as the call side. But now we want to find a suitable strike below the low side of our expected move, or 87.5. The 84 put, with an 86.44% probability of success, works.

We can create a trade with a nice probability of success if WYNN stays within the 16-point range, or between the 100 call strike and the 84 put strike. Our probability of success on the trade is 86.38% on the upside and 86.44% on the downside.

Moreover, we have a 7.8% cushion to the upside and a 9.4% margin of error to the downside.

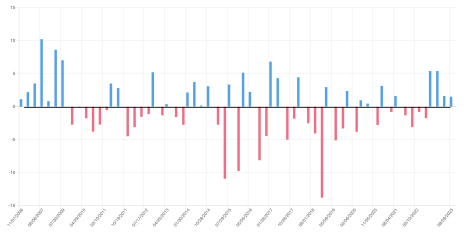

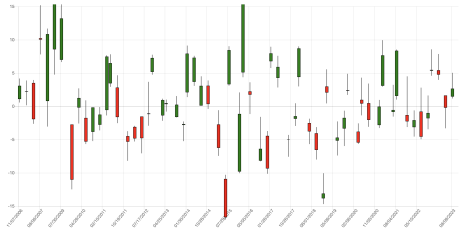

If we look below at the earnings reactions since 11/7/2006, we can see that there have been only a few breaches of 6% to the upside or downside after an earnings announcement.

Net Change – At the Opening Bell

Net Change – At the Closing Bell

If one wanted to make a trade, below are the potential strikes that make the most sense or are at least a starting point for a trade.

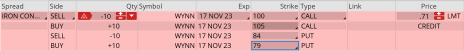

Here is the trade:

Simultaneously:

Sell to open WYNN November 17, 2023, 100 calls

Buy to open WYNN November 17, 2023, 105 calls

Sell to open WYNN November 17, 2023, 84 puts

Buy to open WYNN November 17, 2023, 79 puts for roughly $0.70 or $70 per iron condor.

Our margin requirement would be roughly $430 per iron condor. Again, the goal of selling the WYNN iron condor is to have the underlying stock stay below the 100 call strike and above the 84 put strike immediately after WYNN earnings are announced.

Here are the parameters for this trade:

- The probability of success – 86.38% (call side) and 86.44% (put side)

- The maximum return on the trade is the credit of $0.70, or $70 per iron condor

- Max return: 16.3% (based on $43 margin per iron condor)

- Break-even level: 100.70 – 83.30.

As always, if you have any questions, please do not hesitate to email me at andy@cabotwealth.com.