Cabot Options Institute Earnings Trader – Alert (SBUX)

Starbucks (SBUX)

As discussed in our weekly issue, and on our weekly call, I will be taking a position in Starbucks (SBUX) today. SBUX is due to announce earnings after the closing bell today (November 3). The stock is currently trading for 85.26.

IV Rank: 75.1

Expected Move for the November 11, 2022, Expiration Cycle: 80 to 91

Knowing the expected range, I want to place the short call strike and short put strike of my iron condor outside of the expected range, in this case outside of 80 to 91.

If we look at the call side of SBUX for the November 11, 2022, expiration, we can see that selling the 93 call strike offers an 87.58% probability of success. The 93 call strike sits just above the expected move, or 91. We can define our risk by buying the 98 call, thereby creating a five-strike-wide bear call spread at the 93/98 call strikes.

Now let us move to the put side. Same process as the call side. But now we want to find a suitable strike below the low side of our expected move, or 80. The 76 put, with an 86.36% probability of success, works. Staying with a five-strike-wide spread I can buy the 71 put to define our risk and create a bull put spread at the 76/71 strikes.

We can create a trade with a nice probability of success if SBUX stays within the 17-point range, or between the 93 call strike and the 76 put strike. Our probability of success on the trade is 87.58% on the upside and 86.36% on the downside.

Moreover, we have a 9.08% cushion to the upside and a 10.86% margin of error to the downside…

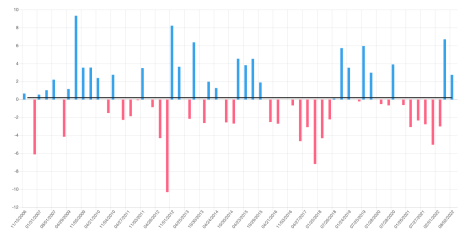

Courtesy of Slope of Hope

Here is the trade:

Simultaneously:

Sell to open SBUX November 11, 2022, 93 calls

Buy to open SBUX November 11, 2022, 98 calls

Sell to open SBUX November 11, 2022, 76 puts

Buy to open SBUX November 11, 2022, 71 puts for roughly $0.67 or $67 per iron condor

Our margin requirement would be $433 per iron condor. Again, the goal of selling the SBUX iron condor is to have the underlying stock stay below the 93 call strike and above the 76 put strike immediately after SBUX earnings are announced.

Here are the parameters for this trade:

- The probability of success – 87.58% (call side) and 86.36% (put side)

- The maximum return on the trade is the credit of $0.67, or $67 per iron condor

- Max return: 15.5%

- Break-even level: 93.67 – 75.33