Visa (V)

Visa (V) is due to announce earnings after the closing bell today.

The stock is currently trading for 271.33.

- IV Rank: 32.5

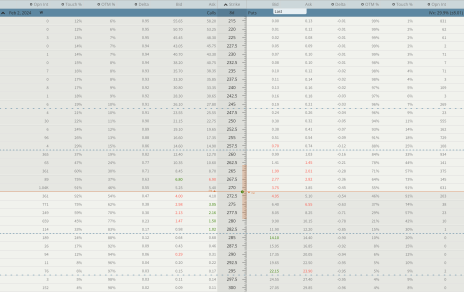

Expected Move for the February 2, 2024, Expiration Cycle: 262 to 280

Knowing the expected range, I want to place the short call strike and short put strike of my iron condor outside of the expected range, in this case outside of 262 to 280.

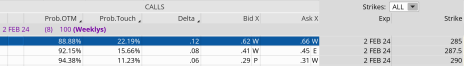

If we look at the call side of V for the February 2, 2024, expiration, we can see that selling the 285 call strike offers an 88.88% probability of success. The call strike sits just above the expected move, or 280.

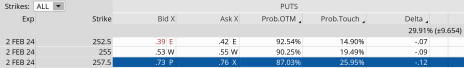

Now let us move to the put side. Same process as the call side. But now we want to find a suitable strike below the low side of our expected move, or 262. The 257.5 put, with an 87.03% probability of success, works.

We can create a trade with a nice probability of success if V stays within the 27.5-point range, or between the 285 call strike and the 257.5 put strike. Our probability of success on the trade is 88.88% on the upside and 87.03% on the downside.

Moreover, we have a 5.2% cushion to the upside and a 5.0% margin of error to the downside.

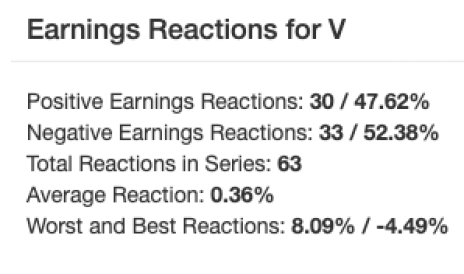

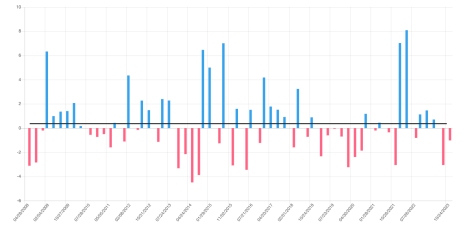

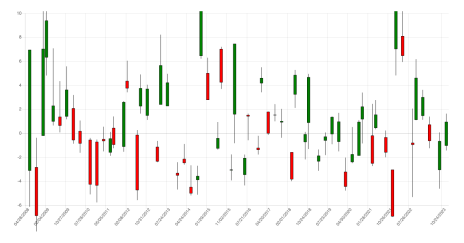

If we look at the earnings reactions since 4/28/2008, we can see that there have only been a few large moves of roughly 5% to the upside and 4% to the downside after an earnings announcement, so the fairly wide margins of error of 5.2% and 5.0% seem appealing … and more importantly, opportunistic.

Quick Stats

Net Change – At the Opening Bell

Full Bar – Closing Bell

If one wanted to make a trade, below are the potential strikes that make the most sense or are at least a starting point for a trade.

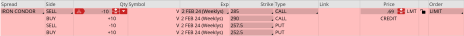

Here is the trade:

Simultaneously:

Sell to open V February 2, 2024, 285 calls

Buy to open V February 2, 2024, 290 calls

Sell to open V February 2, 2024, 257.5 puts

Buy to open V February 2, 2024, 252.5 puts for roughly $0.68 or $68 per iron condor.

Our margin requirement would be roughly $432 per iron condor. Again, the goal of selling the V iron condor is to have the underlying stock stay below the 285 call strike and above the 257.5 put strike immediately after V earnings are announced.

Here are the parameters for this trade:

1. The probability of success – 88.88% (call side) and 87.03% (put side)

2. The maximum return on the trade is the credit of $0.68, or $68 per iron condor

3. Max return: 15.7% (based on $432 margin per iron condor)

4. Break-even level: 285.68 – 256.82.

As always, if you have any questions, please do not hesitate to email me at andy@cabotwealth.com.